This article was first published on Deythere.

- BlackRock BUIDL Fund Hits DeFi via UniswapX

- What the Integration Means for Institutional Participation

- Represented vs. Distributed Assets

- Market Reaction and the Price of UNI

- Conclusion

- Glossary

- Frequently Asked Questions About BlackRock BUIDL and UniSwap Integration

- What is the significance of BUIDL trading on UniswapX?

- Who can trade BUIDL at UniswapX?

- Does BlackRock endorse UNI tokens?

- Why did UNI’s price jump?

- References

BlackRock has now brought its USD Institutional Digital Liquidity Fund (BUIDL) to the UniswapX platform. Announced on February 11, 2026, the step enables specifically approved investors to convert BUIDL shares into dollar-pegged stablecoin USDC onchain through an RFQ model, combining compliance features with decentralized settlement.

It’s one of the clearest steps towards DeFi integration by an institution and points to a new place for decentralized protocols in global finance.

BlackRock BUIDL Fund Hits DeFi via UniswapX

The BlackRock BUIDL fund is a tokenized version of the firm’s USD Institutional Digital Liquidity Fund, which has around $2.2 billion assets under management. It now makes its way onto public DEX UniswapX for the first time through the partnership with tokenization platform Securitize.

Qualified investors who have whitelisted via Securitize are now able to make swaps between BlackRock BUIDL and USDC on a 24/7 basis, settled to the blockchain through smart contracts.

The integration uses an RFQ model, on which approved market makers, such as Flowdesk, Tokka Labs and Wintermute, provide competing quotes that settle atomically through the UniswapX smart contract system.

BlackRock’s global head of digital assets, Robert Mitchnick, described the integration as “a notable step in the convergence of tokenized assets with decentralized finance.”

Meanwhile Hayden Adams, founder and CEO of Uniswap Labs, said the partnership enhances liquidity and efficiency by giving buyers and sellers access to reliable execution and 24/7 settlement.

What the Integration Means for Institutional Participation

The deal forges a long-sought connection between traditional financial products and the decentralized world. Until now, decentralized exchanges (DEXes) such as Uniswap have primarily served retail and open liquidity pools for trading without permission.

But the UniswapX RFQ system adds a layer of compliance, meaning only institutional, whitelisted individuals can interact with BlackRock BUIDL on chain, even though everything gets settled in a decentralized fashion.

While Uniswap smart contracts offer execution and settlement rails free of central custody, the need for KYC and accredited investor status matches that imposed on regulated financial products.

This permissioned DeFi model means DeFi primitives can now accommodate institutional flows while meeting legal standards. In doing so, it demonstrates that this form of decentralization can happily coexist with compliance but not necessarily with open or permissionless access.

Represented vs. Distributed Assets

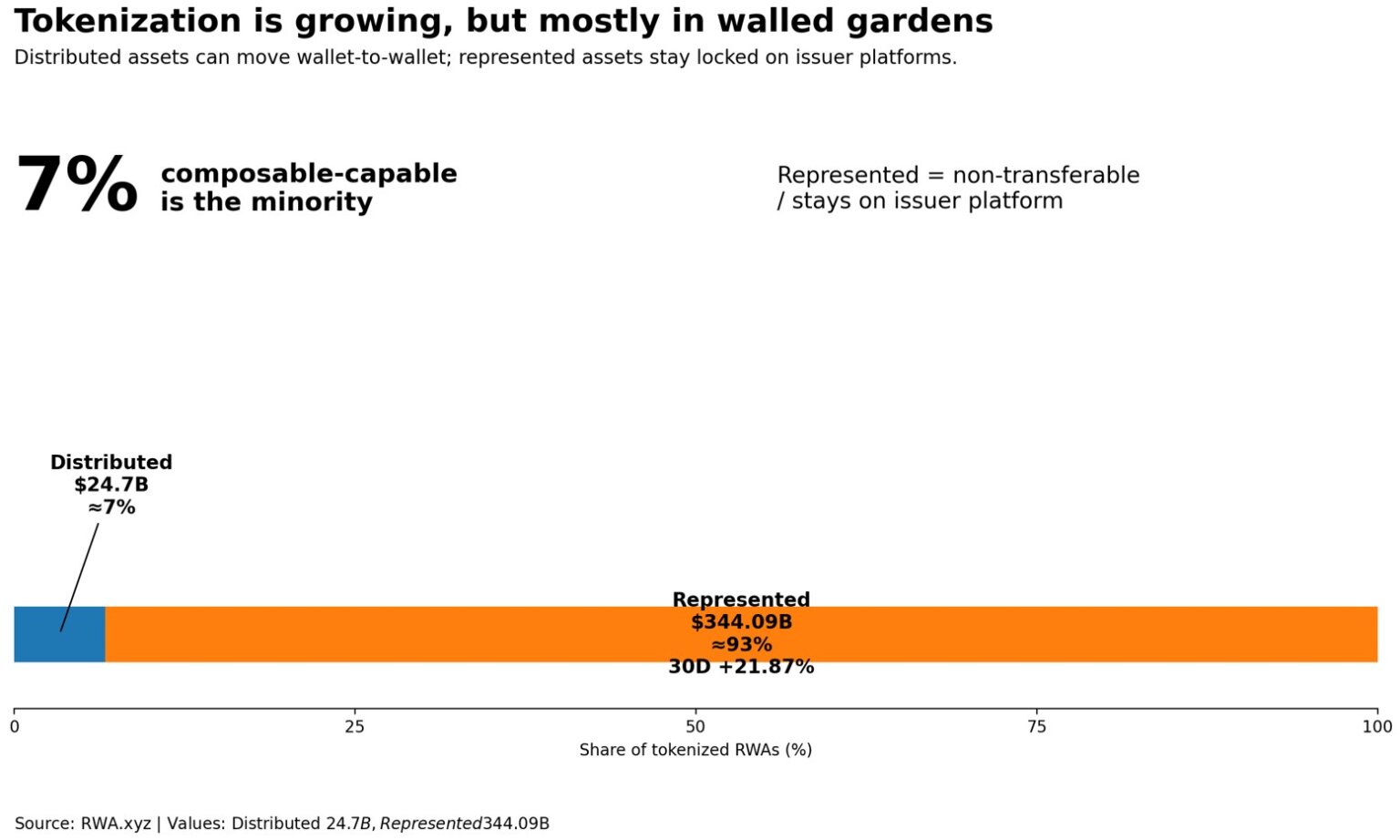

The arrival of BlackRock BUIDL on UniswapX shows the divide in the real-world asset (RWA) tokenization space. According to industry data, the entire total tokenized asset base comprises just a small portion of distributed assets, or those that can be freely transferred wallet-to-wallet, and is hugely dominated by represented assets that don’t leave issuer systems and won’t trade outside them.

The total distributed tokenized assets, including BlackRock BUIDL, are about $24.7 billion while the represented ones amount to over $344 billion, all of which corresponds to almost 93% of the tokenized market.

BlackRock BUIDL is tagged as “distributed,” which indicates holders can take the asset off-chain and settle trades, whereas most tokenized assets are locked within the issuer’s platform. This makes intuitive sense as to why a growing amount of value sits in controlled institutional arrangements, with only a small fraction actually free to be traded on decentralized protocols like UniswapX.

Market Reaction and the Price of UNI

The BlackRock-Uniswap announcement led to some noticeable market motion. The project’s governance token, UNI, shot up around 40 percent after the announcement to briefly touch a high of about $4.57 and then settled lower as larger holders took profits. $UNI price is now back in the $3.32 range.

However, the price reaction aside, it wasn’t as though BlackRock’s declaration was effectively an endorsement of Uniswap’s protocol or UNI token itself. The firm also pointed out that it reserves the right to suspend the arrangement and doesn’t formally endorse or recommend UNI as an investment.

This cautious language bares out the regulatory and operational constraints that large asset managers face when navigating decentralized liquidity markets.

Conclusion

Bringing the BlackRock BUIDL Fund to UniswapX via Securitize is a record moment in decentralized finance. For the very first time, a large traditional asset manager has facilitated onchain trading of a tokenized money-market product in which access to the regulated investor is combined with decentralized settlement.

This is just one example of a larger trend in institutional DeFi integration, where decentralized infrastructure supports traditional financial workflows within regulated contexts.

As the market keeps transforming, this partnership creates a model for tokenized institutional products to tap into DeFi rails safely and compliantly, revolutionizing liquidity and settlement in crypto markets.

Glossary

Institutional DeFi integration: When traditional finance products interoperate with decentralized financing systems in a regulatory compliant manner.

BUIDL: BlackRock’s USD Institutional Digital Liquidity Fund, a tokenized marketing money fund traded on UniswapX.

UniswapX Request-for-Quote (RFQ) Model: the request for quote trading model on UniswapX where whitelisted market makers provide prices and settle trades onchain directly.

Distributed asset: Digitized financial instruments that move freely between wallets (not on the issuer platform).

Represented Asset: Tokenized asset that is recorded onchain but not freely transferable without a controlled environment.

USDC: A popular dollar-pegged stablecoin, which is used for liquidity and as a settlement currency in DeFi.

Frequently Asked Questions About BlackRock BUIDL and UniSwap Integration

What is the significance of BUIDL trading on UniswapX?

It enables institutions to swap regulated tokenized fund with stablecoin on chain and brings together traditional finance and decentralized execution protocols.

Who can trade BUIDL at UniswapX?

Trades can only be done on UniswapX’s RFQ system by investors who have been whitelisted and pre-qualified through Securitize.

Does BlackRock endorse UNI tokens?

No BlackRock said it does not recommend or advise that investors hold UNI tokens and reserves the right to sell all of its investment.

What does this mean for the future of DeFi?

The BlackRock Uniswap integration demonstrates how DeFi could be compatible with institutional trading and settlement demands while meeting the law.

Why did UNI’s price jump?

The news about BlackRock’s integration prompted trading activity and short-term price gains in UNI.