This article was first published on Deythere.

Bitcoin ETF turbulence has reached a dramatic new level as record trading volume collides with falling prices and rising fear. The latest market action reflects more than routine volatility. It signals a critical emotional turning point for institutional crypto exposure.

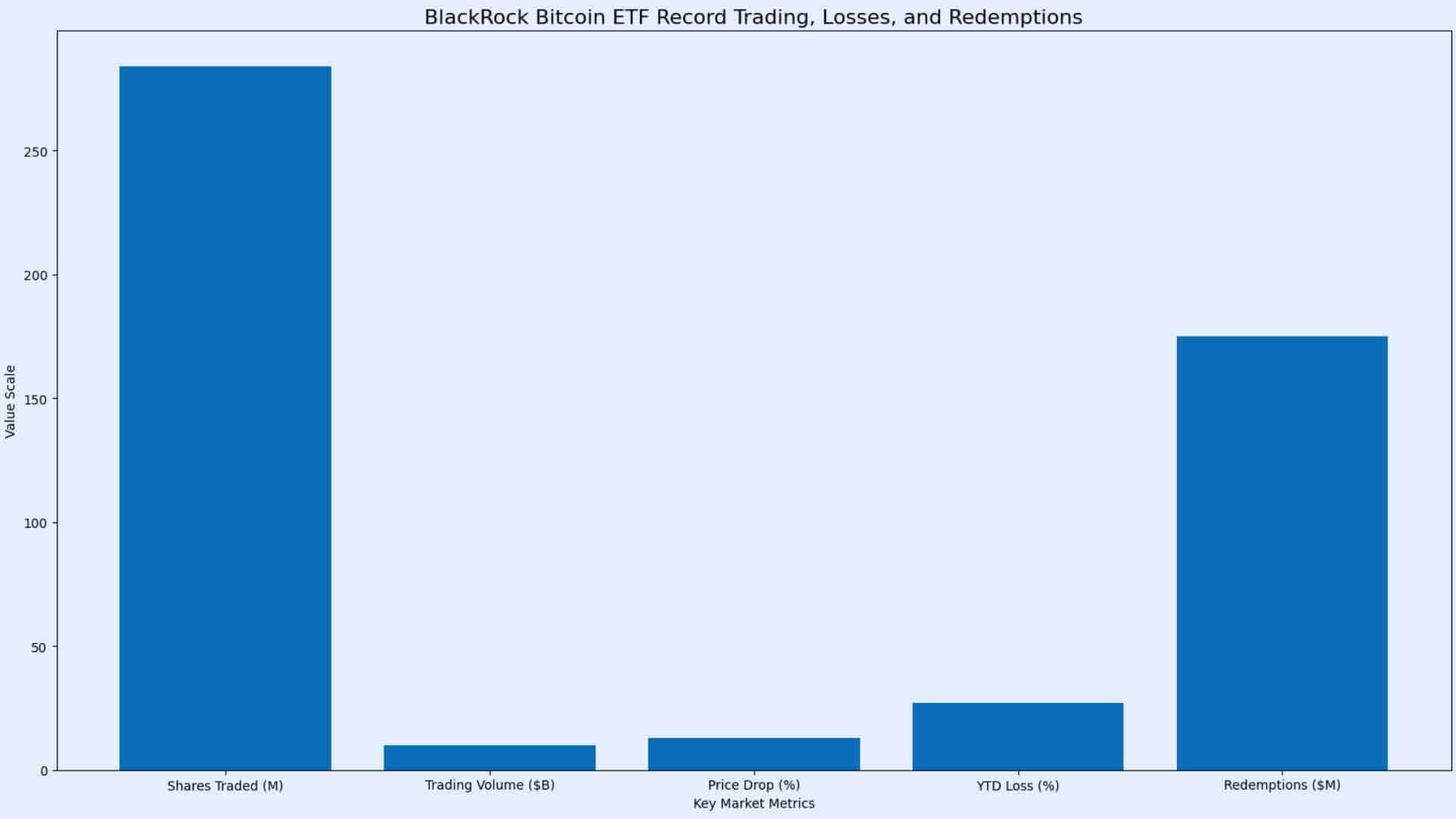

According to the source, the BlackRock Bitcoin ETF recorded more than 284 million traded shares in a single session, exceeding 10 billion dollars in value and crushing its prior record of 169.21 million shares set in November. The surge arrived alongside a sharp decline in price and heavy investor withdrawals, forming a pattern widely linked with capitulation during deep bear phases.

Record Volume Meets a Sharp Price Breakdown

The newest Bitcoin ETF data reveals how quickly sentiment can reverse under pressure. The BlackRock Bitcoin ETF plunged 13 percent to below 35 dollars, marking its lowest level since October 11, 2024. The drop pushed year to date losses near 27 percent after prices peaked around 71.82 dollars in early October.

Market behavior described in an independent trading analysis shows that extreme volume during falling prices often reflects forced selling rather than calm repositioning. Long-term holders tend to exit positions when fear dominates expectations.

Bitcoin itself slid toward 60,000 dollars during the same session, reinforcing how closely each Bitcoin ETF mirrors movements in the underlying asset. Institutional products rarely escape the gravity of spot price momentum.

Redemptions and Options Markets Reveal Capitulation Signals

Fund flow pressure deepens the warning signs. The BlackRock Bitcoin ETF processed about 175 million dollars in single-day redemptions, representing roughly 40 percent of the 434 million dollars withdrawn across eleven major spot funds. Persistent outflows suggest institutions are choosing liquidity and safety over continued exposure.

Derivatives activity confirms defensive positioning. Longer-dated protective puts traded at premiums more than 25 volatility points above bullish call options. Research discussed in a global derivatives risk study notes that aggressive hedging usually appears near emotional extremes in financial markets.

Such signals often define capitulation, a phase where investors sell at losses after an extended decline. While this stage sometimes precedes stabilization, history shows bear markets can remain painful even after peak fear emerges. Each Bitcoin ETF therefore, acts as both a price tracker and a real-time sentiment gauge.

Why the BlackRock Bitcoin ETF Shapes the Wider Market

The BlackRock Bitcoin ETF is the world’s largest publicly listed spot Bitcoin fund and holds physical coins designed to mirror market price. Because institutions rely on regulated access, stress within this structure carries meaning far beyond a single ticker.

Repeated instability inside a leading Bitcoin ETF could reshape allocation strategies across global portfolios. Financial students observe liquidity stress. Developers track adoption signals. Analysts evaluate whether regulated exposure reduces or amplifies volatility.

For now, the BlackRock Bitcoin ETF serves as a trust barometer. When confidence weakens here, the broader Bitcoin ETF ecosystem often feels the same tremor across markets.

A Possible Bottom or the Start of a Longer Test

Financial history rarely offers instant recovery after panic. Capitulation phases may signal exhaustion in selling pressure, yet confirmation requires time, stability, and renewed inflows. The current Bitcoin ETF turmoil could mark the late stage of a prolonged bear cycle or simply another pause before deeper weakness.

What remains clear is the maturity of institutional crypto participation. Fear, hedging, and rapid withdrawals now unfold inside regulated investment vehicles once viewed as stabilizing forces. The BlackRock Bitcoin ETF therefore illustrates how traditional finance and digital assets now share identical emotional cycles.

Whether this moment becomes a foundation for recovery or another warning sign, the evolving Bitcoin ETF narrative continues to shape global confidence in digital value. Careful analysis and disciplined risk awareness remain essential as markets search for balance.

Conclusion

The latest turmoil in the Bitcoin ETF market reflects more than a routine decline. Record volume, rising redemptions, and strong hedging activity point to deep institutional fear and possible late-stage capitulation. While such moments can precede stabilization, uncertainty still surrounds the path ahead.

The BlackRock Bitcoin ETF now serves as a key signal of how traditional finance is navigating digital assets in times of stress. Careful observation and disciplined risk awareness will shape what comes next.

Glossary of Key Terms

Bitcoin ETF: A regulated exchange-traded fund that tracks Bitcoin’s market price.

Capitulation: Panic-driven selling after prolonged losses.

Redemptions: Investor withdrawals that reduce total fund assets.

Put Option: A contract that gains value when an asset price falls.

FAQs About BlackRock Bitcoin ETF

Why is Bitcoin ETF volume important?

It reveals investor sentiment and shows whether institutions are entering or exiting positions.

Does the BlackRock Bitcoin ETF influence Bitcoin’s price?

It tracks the market price but does not directly control it.

Are large redemptions always bearish?

They signal caution, though markets sometimes stabilize afterward.

Could this indicate a market bottom?

Capitulation can appear near bottoms, but confirmation takes time.