Bitwise Sui ETF has officially been filed with the US Securities and Exchange Commission, marking a major step into the fast-growing crypto ETF market. The filing, submitted on Thursday, Dec 18, 2025, shows Bitwise’s plan to provide investors with a regulated way to access the $SUI token.

The $SUI token is the native cryptocurrency of the Sui Network and is currently trading at $1.39, offering new opportunities for secure and compliant crypto investment. This filing positions Bitwise alongside competitors Canary Capital and 21Shares, both of which have submitted spot SUI ETF filings earlier this year.

The SEC review deadline for 21Shares’ application is next month, keeping investors and the market focused on the regulator’s upcoming decisions.

What Does the Bitwise Sui ETF Represent?

The Bitwise Sui ETF is designed to track the spot price of $SUI, giving investors a way to gain exposure without holding the token directly. $SUI powers the Sui Network, a Layer 1 blockchain launched in mid-2023, and is currently the 31st largest cryptocurrency with a market capitalization of around $4.98 billion.

The filing, publicly available on the SEC’s EDGAR database, states that Coinbase Custody will serve as the fund’s custodian. Bitwise has not yet assigned a ticker symbol for the Bitwise Sui ETF, which will be announced once it receives approval.

Why Is This ETF Important for Investors?

A Bitwise Sui ETF would make it easier and safer for people to invest in $SUI by offering a regulated option instead of managing the digital asset themselves. Market analysts say spot ETFs often increase demand for the assets they track.

One senior crypto analyst noted that exchange-traded funds tied to newer tokens like $SUI can help bring wider attention and participation to the market. By launching a regulated product, Bitwise could make it easier for both everyday investors and large institutions to gain exposure to $SUI through familiar investment channels.

How Does Bitwise Compare with Other Market Players?

Bitwise has entered the race to launch the first U.S. spot SUI ETF. Earlier, Canary Capital and 21Shares also applied for approval in March and April 2025. The SEC recently gave the green light to 21Shares for a 2x leveraged SUI ETF, which could open the door for more spot SUI ETFs in the future.

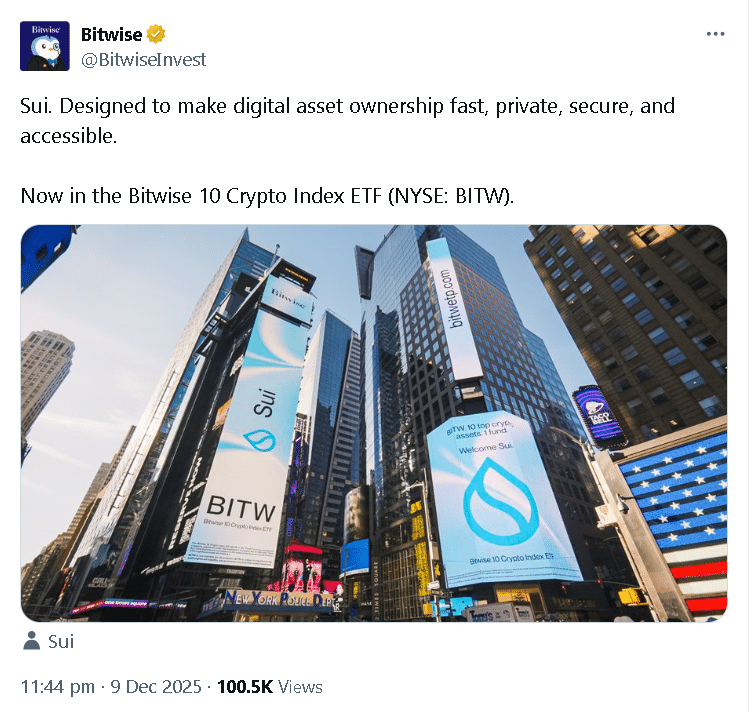

Earlier this month, Bitwise added SUI to its Bitwise 10 Crypto Index ETF, which trades on the New York Stock Exchange under the ticker BITW. In a post on X, the company said the Sui Network focuses on speed, privacy, security, and ease of use. The decision shows Bitwise views the project as a long-term part of the market.

What Are Experts Saying About Bitwise’s Move?

Bitwise researcher Ryan Rasmussen discussed the firm’s expansion plans on the Bankless podcast, saying the pace of growth is expected to pick up sharply from here. He said more than 100 crypto ETF products could enter the market in 2026 as issuers compete for position.

People in the industry say a Bitwise Sui ETF could become a reference point for institutional investors looking for regulated access to a Layer 1 blockchain with a market value of about $4.98 billion.

How Could the Bitwise Sui ETF Impact the Crypto Market?

The Bitwise Sui ETF would give $SUI exposure through a regulated structure. That setup places the token in front of investors who have so far stayed out of the crypto market.

The SEC has recently adopted generic listing standards for crypto ETFs. The change lowers the procedural barrier for products like Bitwise’s fund to move toward U.S. listings.

Conclusion

Bitwise Sui ETF filing marks a notable development for the U.S. crypto market. The product would give investors regulated access to $SUI and adds to Bitwise’s growing lineup of crypto exchange-traded funds. SUI’s market cap is close to $5 billion, which puts it among the larger crypto assets already trading today.

A spot ETF would put the token into a familiar investment wrapper used across U.S. markets. The SEC review is still ongoing, and there is no clear signal yet on which application moves first. For Bitwise, the Bitwise Sui ETF would be another addition to its existing list of crypto ETFs.

Glossary

Bitwise Sui ETF: A fund that tracks SUI’s price and lets investors access crypto safely.

SUI Token: The main cryptocurrency of the Sui Network blockchain.

Coinbase Custody: A secure service that stores crypto for investors and funds.

Canary Capital & 21Shares: Firms also applying for spot SUI ETFs in the U.S.

Sui Network: A fast, secure blockchain launched in 2023 for digital assets.

Frequently Asked Questions About Bitwise Sui ETF

Who filed for the Bitwise Sui ETF?

Bitwise, a crypto asset management company, filed for the Sui ETF with the US Securities and Exchange Commission.

Why is this ETF important for investors?

This ETF is important because it lets investors gain exposure to the SUI token in a regulated and safer way without handling crypto directly.

Do investors need to own SUI to invest in the ETF?

No, investors do not need to own the SUI token because the ETF provides price exposure without direct ownership.

Who will store the ETF’s crypto assets?

Coinbase Custody will store and protect the ETF’s crypto assets using regulated and secure custody services.

Are other companies filing SUI ETFs too?

Yes, other firms like Canary Capital and 21Shares have also filed applications to launch spot SUI ETFs.