The Bitwise Dogecoin ETF could start trading in about 20 days. This is because of a special filing change with the U.S. Securities and Exchange Commission SEC. The move shows that Dogecoin $DOGE is becoming more accepted as a real investment.

- Inside the Bitwise Dogecoin ETF and How It Works

- How Bitwise’s SEC Move Could Fast-Track the Dogecoin ETF?

- Why Is This Important for Dogecoin and Investors?

- What Challenges Could the Bitwise Dogecoin ETF Face?

- How Could This Impact the Broader Crypto Market?

- Conclusion

- Glossary

- Frequently Asked Questions About Bitwise Dogecoin ETF

It also marks progress for cryptocurrencies on regulated exchanges The move by Bitwise shows growing interest in cryptocurrency ETFs. It also points to wider acceptance of meme coins by institutional investors.

Traders see this as a notable development for the crypto market. The Bitwise Dogecoin ETF may influence how investors approach Dogecoin.

Inside the Bitwise Dogecoin ETF and How It Works

The Bitwise Dogecoin ETF is a planned fund that will hold real Dogecoin tokens. It will not use derivatives or other types of contracts. The ETF is made to follow the spot price of $DOGE. It will use the CF Dogecoin Dollar Settlement Price to track its value.

Bitwise’s filing shows that the ETF will keep Dogecoin tokens with Coinbase Custody. Cash assets will be handled by BNY Mellon. The ticker symbol and management fee have not been announced yet.

Eric Balchunas, a Bloomberg ETF analyst, said the ETF would give investors direct access to Dogecoin. It can be bought through a regular brokerage account. This makes it easier for more people to invest in $DOGE. It could also bring more activity to the market.

How Bitwise’s SEC Move Could Fast-Track the Dogecoin ETF?

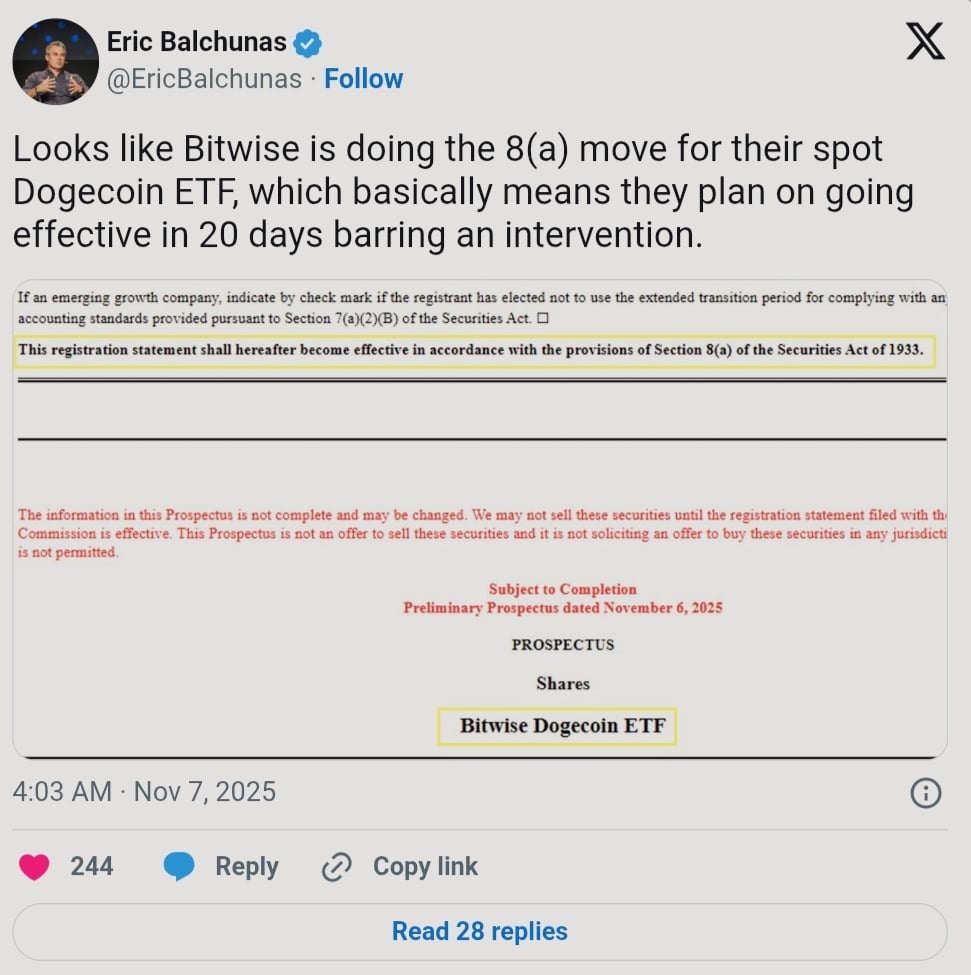

Bitwise recently changed its S-1 registration to remove a delaying amendment. They used Section 8(a) of the Securities Act for this process. This allows the filing to become effective automatically in 20 days. The SEC can still step in to delay it if needed.

Balchunas said this is not the normal way ETFs get approved. The process is still fully legal and follows the rules. It lets the 20-day timer run on its own. The SEC would have to take action to stop it.

If everything goes as planned, the Bitwise Dogecoin ETF could start around November 26, 2025. This would be a faster way to enter the market. Investors could access Dogecoin through a regulated ETF sooner than usual. It marks a key step for cryptocurrency in traditional finance.

Why Is This Important for Dogecoin and Investors?

Dogecoin, once considered purely a novelty cryptocurrency. Over time, it has started to gain recognition from big institutions. ETFs like the Bitwise Dogecoin ETF could let more investors access $DOGE.

This includes people using retirement accounts and regular brokerage accounts. Analysts say the Bitwise Dogecoin ETF could make $DOGE easier to buy and sell. It may also make investing in Dogecoin safer for holders. The ETF could remove some barriers for new investors.

A Wall Street strategist said this shows the market is maturing, and Dogecoin is joining that trend. Interest in Dogecoin ETFs has been growing steadily. This follows earlier launches like the REX Osprey DOGE ETF in September 2025.

These launches show there is strong demand for crypto investment products. Investors are paying more attention to $DOGE as a result.

What Challenges Could the Bitwise Dogecoin ETF Face?

Even with the fast timeline, the SEC can still step in during the 20 days. They may review the ETF for safety and compliance. Concerns include market manipulation and protecting investors. The volatility of $DOGE is also a potential challenge.

Regulators may take a careful approach that could slow down the ETF’s approval. The SEC often reviews such filings closely before allowing them. However, past approvals for Bitcoin and Ethereum ETFs give hope for a quick process.

Many in the market expect the Bitwise Dogecoin ETF to move forward smoothly. An institutional trader said that some risks are still present in crypto ETFs. Even so, the overall direction of the market is clear.

Regulated crypto ETFs are becoming more common in finance. Many experts believe they will soon be a normal part of investing.

How Could This Impact the Broader Crypto Market?

The Bitwise Dogecoin ETF could spark new attention toward other digital coins. Many investors might see it as a sign that crypto is becoming more accepted. This confidence could help the market grow further.

More firms may follow with their own ETF plans soon. Bitwise is using the 8(a) process to speed up its ETF approval. This approach could guide how future crypto ETF filings are made.

It shows how traditional finance and digital assets are coming closer together. Many experts see this as a sign of progress for the industry.

Conclusion

The Bitwise Dogecoin ETF marks a new step in crypto investing. It follows all regulatory rules while giving direct access to $DOGE. If it gets approval, more people will be able to invest easily. Both small investors and large institutions could benefit from it.

The Bitwise Dogecoin ETF could become active within 20 days. It may be one of the first meme coin investments available to many investors. Analysts say this shows growing trust in digital assets. They believe it also reflects a more mature and stable crypto market.

The fund marks progress in connecting crypto with regular investing. It shows growing acceptance of digital assets. Investors are eager to see its performance. Many await its launch with interest.

Glossary

NYSE Arca: A major U.S. exchange where ETFs are listed and traded.

Coinbase Custody: A secure service that stores cryptocurrencies safely for big investors.

BNY Mellon: A trusted global bank that manages fund cash and assets.

Section 8(a): A rule allowing ETF filings to become active in 20 days unless stopped.

S-1 Filing: A legal form companies file to launch a new ETF or fund.

Frequently Asked Questions About Bitwise Dogecoin ETF

What is the Bitwise Dogecoin ETF?

The Bitwise Dogecoin ETF is a fund that will hold real Dogecoin tokens and track their actual market price.

When could the Bitwise Dogecoin ETF start trading?

It could start trading in about 20 days, around November 26, 2025.

Who will store the Dogecoin for the ETF?

Coinbase Custody will safely store the Dogecoin tokens for the ETF.

Why is this ETF important for investors?

It allows people to invest in Dogecoin easily through a regular brokerage account which makes it important.

How could this ETF affect Dogecoin’s price?

If approved, it could increase interest and buying activity, possibly lifting DOGE’s price.