This article was first published on Deythere.

BitMine Immersion Technologies has just announced a massive accumulation of Ethereum (ETH). The company is now perhaps the largest publicly disclosed $ETH holder outside of mining operations.

This is a big moment in the Bitmine Ethereum accumulation narrative as the firm bought around $250m of $ETH in one day, bringing its total to over 3.3m tokens, roughly 2.7% of all circulating $ETH.

According to chairman Tom Lee, “this price dislocation represents an attractive risk/reward.”

The Details

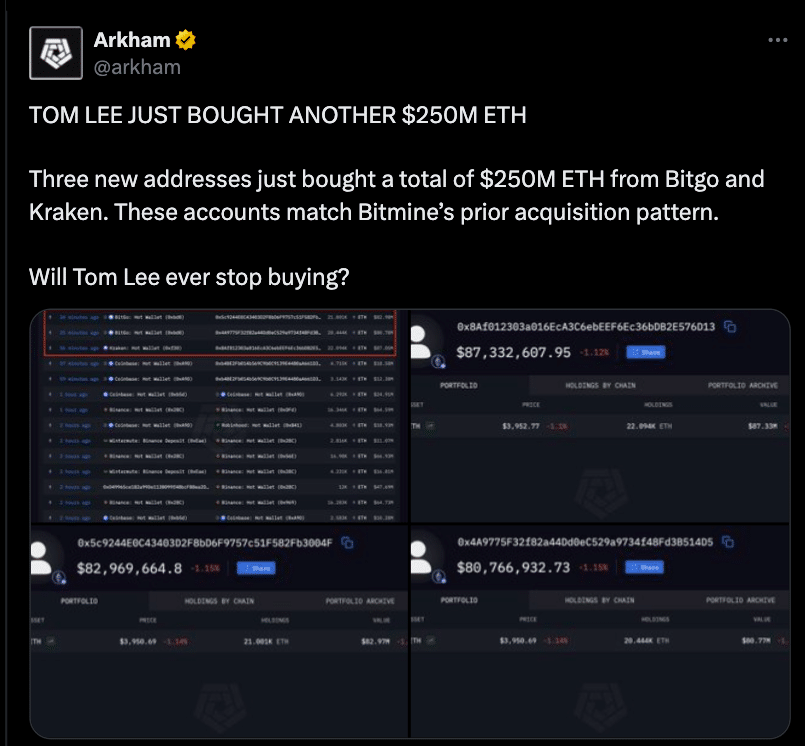

The recent BitMine Ethereum accumulation came in multiple tranches: according to Arkham Intelligence, the company bought $ETH from exchanges like BitGo and Kraken during the market dip after a big deleveraging event.

The press release says $ETH was trading at $3,900 but BitMine added 203,826 tokens over a 7 day span, taking its total holdings to 3.24m ETH and a crypto + cash + “moonshots” portfolio of $13.4bn.

Lee said:

“Open interest for ETH sits at the same levels as seen on June 30th of this year, ETH was $2,500, given the expected Supercycle for Ethereum, this price dislocation represents an attractive risk/reward.”

By accumulating at this scale, BitMine is saying Ethereum is core to its strategy going forward.

Institutional Accumulation Trend

Experts say this Bitmine Ethereum accumulation falls in line with a trend of institutional investors increasing their exposure to Ethereum. Research shows multiple treasury companies now hold over 5m ETH collectively, representing about 4.75% of supply.

BitMine’s goal of securing 5% of supply is ambitious but also shows growing conviction among professional investors in the long-term value of the asset.

The Bitmine Ethereum accumulation of this magnitude means Ethereum is being bought by firms positioning for multi-year upside.

Lee also said many digital-asset treasury firms are trading below net-asset value, which he calls the “DAT bubble”. But BitMine’s strategy is clear; accumulate at scale now for future upside.

Market Response and Signal to Others

Market has reacted immediately. BitMine’s stock (BMNR) went up 7-8% in the US markets after the announcement, showing investor recognition and institutional attention. More broadly, this public accumulation is a signal to other firms and retail participants that Ethereum might be entering an accumulation phase.

Since accumulation at this scale reduces the supply, especially when tokens are moved to long-term holding, it can impact the market.

So this Bitmine Ethereum accumulation may encourage others to watch and follow, and tighten the supply further.

What to Watch

Going forward, will other treasury firms follow BitMine’s lead? Collective accumulation is a stronger signal. Will the market see $ETH flowing into exchange wallets or long-term custody? Will derivatives open interest and funding rates increase?

Finally, will BitMine and peers make any public comments or filings that will give transparency into their aggregate holdings over time? All of this ties back to how this Bitmine Ethereum accumulation news plays out into market impact.

Conclusion

BitMine’s large scale ETH accumulation shows the level of institutional conviction now entering Ethereum. BitMine’s 3.3 million ETH purchase (2.7% of supply) as a treasury asset.

The timing, after a market dip and low derivatives open interest, suggests this is a strategic accumulation and not a momentum chase. As the market digests this, the question is will big holders accumulation lead to more positioning across the ecosystem?

Glossary

Accumulation: Buying an asset continuously or in large quantities, often for long-term and not for short-term trading.

Digital-Asset Treasury (DAT): A company that holds cryptocurrency on its balance sheet as an asset and investment strategy.

Open Interest: The total number of outstanding derivatives (futures, options) that have not been settled, used as a measure of market positioning.

Supercycle: A long period of growth or dominance of an asset, often driven by structural changes and not cyclical behaviour.

Price Dislocation: When an asset’s price is not aligned with its value or fundamentals, often seen as an opportunity by buyers.

Staking Yield: The return earned by locking cryptocurrency tokens in a proof-of-stake network for validating transactions, part of long term incentives.

Frequently Asked Questions About Bitmine Ethereum Accumulation

Why is BitMine Ethereum accumulation this big?

They now hold over 3.3 million ETH; about 2.7 % of supply, with a goal of 5 %. It shows institutional accumulation and the belief in Ethereum’s future.

What’s the “Supercycle” Tom Lee is talking about?

Lee thinks Ethereum is entering a period of structural dominance; driven by staking, institutional adoption and the transition to proof-of-stake rather than a normal cycle.

Will the market rally now?

Not necessarily. Accumulation can tighten supply and set the foundation for growth but market dynamics, liquidity and macro factors still play a big role. This is a strong signal not a guarantee.

What to watch now?

Other firms increase ETH holdings, changes in exchange wallet supply, derivatives open interest in ETH and how market pricing adjusts as accumulation becomes public.