Bitcoin markets saw renewed excitement as the Bitfinex whale reemerged, aggressively purchasing BTC using a TWAP strategy. Blockstream CEO Adam Back confirmed the whale bought around 300 BTC daily over the last 48 hours. This return of the Bitfinex whale comes amid low exchange supply and heightened institutional interest.

- Whale Activity Reignites Speculation

- Adam Back Signals Institutional Strength

- Bitfinex Whale Behavior Raises Market Questions

- FAQs

- 1. Who is the Bitfinex whale?

- 2. What is TWAP buying?

- 3. Why is whale accumulation important?

- 4. What did Adam Back say about this activity?

- 5. How could this impact the market?

- Glossary of Key Terms

Whale Activity Reignites Speculation

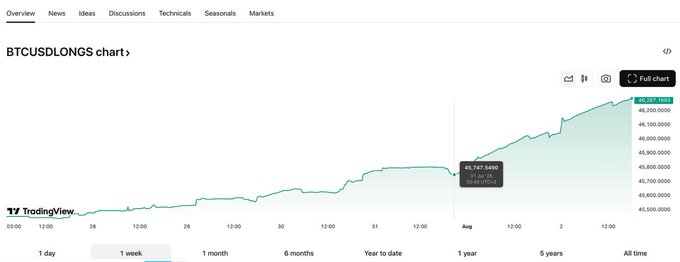

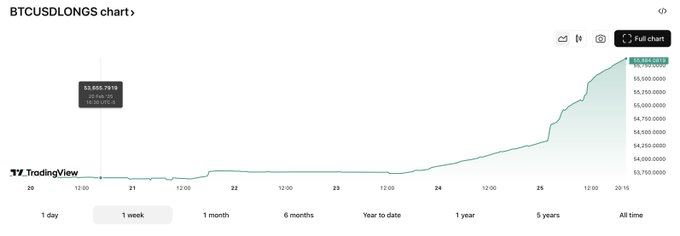

The Bitfinex whale has historically influenced price action during both bullish and bearish phases through strategic accumulation and distribution. Back also highlighted the size of the activity, saying that 300 BTC/day amounts to 400 BTC per second throughout the day. He commented further that in the past cycles, this whale upped its purchases to 1000 BTC on daily basis.

Although an accumulation of whales usually comes before positive moves, there are still traders who feel cautious as history indicates sellers during market rallies. One commenter noted, “That’s not a good thing, as Bitfinex whales buy downtrends and sell uptrends.” Such feeling is used to explain the continued discussion on whether this activity contributes to or limits the price increase.

The whale, however, is currently moving at a pace that is likely an indication that it is looking to suck up supply during these volatile times. That will serve to cushion against the downside as long as the activity persists in the days to come. Lots of people are looking now to see whether accumulation is to go on.

Adam Back Signals Institutional Strength

Adam Back’s remarks have a certain weight as the author was one of the first to pioneer cryptography and the development of Bitcoin. He invented Hashcash, the proof-of-work used in the initial Bitcoin whitepaper. Since he is the CEO of Blockstream, his comments tend to create a mood in institutions regarding Bitcoin.

Back’s confirmation of this whale’s buying indicates renewed confidence from deep-pocketed market participants. His framing of the whale’s $400-per-second pace underscores the scale involved. That volume could apply sustained upward pressure on Bitcoin’s market structure.

This activity follows Back’s long-standing view that smart money accumulates when sentiment turns negative. He suggested that continued whale buying could trigger broader price responses. Yet he stopped short of predicting a specific outcome.

Bitfinex Whale Behavior Raises Market Questions

The Bitfinex whale’s reappearance coincides with Arthur Hayes‘ warning of a global liquidity crunch, adding complexity to the current market picture. Hayes adjusted his positions, anticipating a BTC test of $100,000. Whether this outlook aligns with whale behavior remains unclear.

The whale’s methodical TWAP buying is counter to what is seen in the retail panic of late and the hesitancy of the institutions. Supply of BTC on exchanges near multi-year lows, mega spot accumulation, will tighten availability. If this is to be sustained, it may lay the conditions for a longer-term squeeze.

Yet, traders remain aware that whales shift strategies quickly. Some whales provide short-term support, but later sell into strength, as seen during prior market cycles. Therefore, analysts suggest monitoring for any deviation from the current buying trend.

For more crypto news or price predictions, visit our platform.

Summary

The Bitfinex whale has resumed large-scale Bitcoin accumulation, buying 300 BTC daily using TWAP strategies. Confirmed by Adam Back, this activity could signal renewed institutional strength as supply tightens across exchanges. Though traders remain cautious of potential future selling, the whale’s sustained interest may support Bitcoin’s price amid ongoing volatility.

FAQs

1. Who is the Bitfinex whale?

The Bitfinex whale is an anonymous large-scale Bitcoin trader linked to Bitfinex, known for making strategic BTC purchases or sales.

2. What is TWAP buying?

TWAP (Time-Weighted Average Price) buying spreads purchases evenly over time to minimize price impact and detectability.

3. Why is whale accumulation important?

Whale accumulation absorbs supply, potentially lifting price or providing support during market declines if sustained over time.

4. What did Adam Back say about this activity?

Adam Back highlighted that the whale is buying 300 BTC daily and has historically scaled that up during key phases.

5. How could this impact the market?

If accumulation continues, it could tighten available supply and support price, but sudden selling may cause volatility.

Glossary of Key Terms

- Bitfinex whale: A major unidentified trader using the Bitfinex exchange for large Bitcoin transactions.

- TWAP: The Time-Weighted Average Price, which is an algorithm that trades with the intent of spreading orders out across time.

- Adam Back: Leaf Blockstream CEO, cryptographer and developer of Hashcash, the equivalent of proof-of-work in Bitcoin.

- Supply squeeze: An aspect of a market with a high demand level and a low supply level, which may raise the asset price.

- PoW: A consensus layer that depends on the expenditure of a computational resource in order to validate transactions.

- Smart money: The money of the institutional investors or savvy traders.

References: