This article was first published on Deythere.

Bitcoin whales do not need headlines to move markets. Their actions alone can change sentiment. On December 25, that quiet influence returned when large Bitcoin transfers reached centralized exchanges. The surprise was not the movement itself. It was the calm response that followed.

In the second half of December, on-chain data flagged multiple high-value transfers tied to long-inactive wallets and institutional custodians. On-chain tracking data shows one institutional wallet transferred more than 2,200 Bitcoin to a U.S. exchange, while a separate wallet dormant for nearly eight years moved 400 Bitcoin to an offshore platform. Together, the transfers exceeded $230 million at prevailing market rates.

When Bitcoin Whales Move but Markets Stay Still

Historically, exchange inflows from Bitcoin whales tend to trigger caution. Large deposits often precede selling, or at least raise the risk of it. Academic research on crypto liquidity patterns shows that heavy inflows into exchanges can suppress short-term momentum even when broader trends remain intact.

This time, the BTC price held steady near the mid-$87,000 range. That stability puzzled traders. Market observers noted that there was no sudden spike in spot selling following the transfers. Instead, buyers absorbed available supply, keeping price action contained. Market data suggested the inflows did not immediately translate into spot selling, limiting downside pressure despite the size of the transfers.

Data from a public market tracker confirms Bitcoin traded within a narrow band during the session, reflecting balance rather than fear.

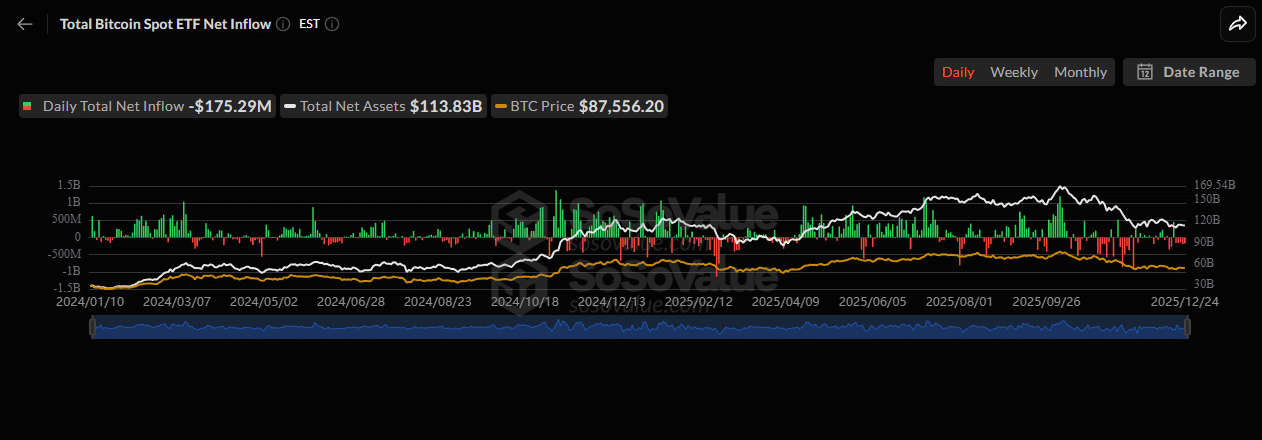

ETF Outflows Add Pressure Without Triggering Panic

While whales drew attention, another signal added weight beneath the surface. U.S. spot Bitcoin exchange-traded funds recorded five consecutive days of net outflows. Persistent redemptions often reflect institutional caution, especially during low-liquidity holiday periods.

Despite that backdrop, the BTC price avoided a breakdown. Analysts who study ETF flows note that outflows do not always imply bearish conviction. In many cases, they reflect portfolio rebalancing or year-end risk trimming rather than directional bets.

Aggregate ETF flow data shows institutions reduced exposure without accelerating downside momentum.

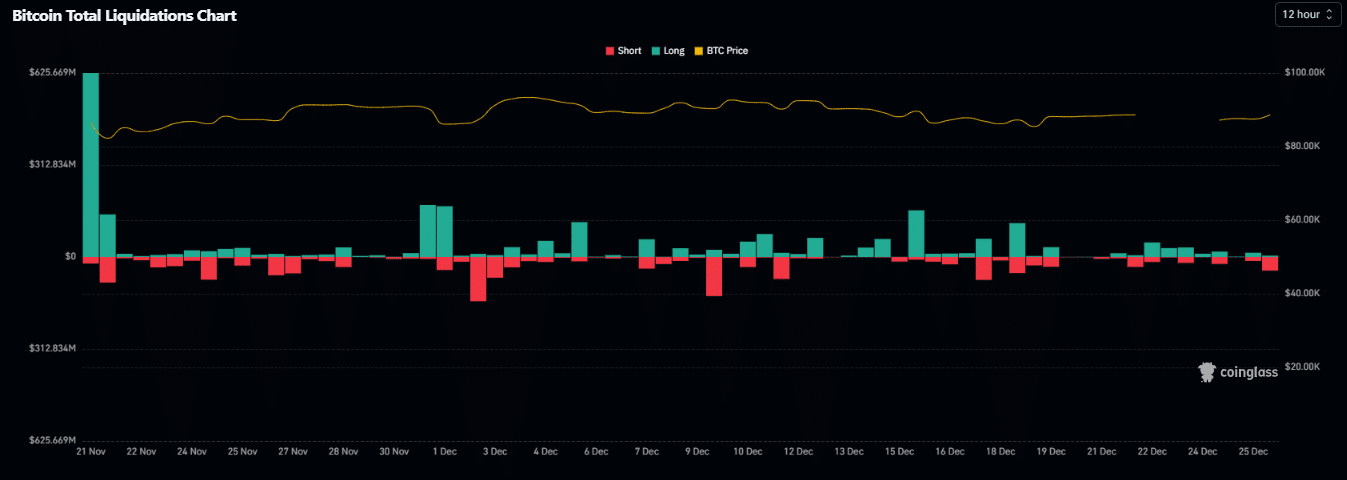

Leverage Pullback Reveals Defensive Positioning

Derivatives markets offered another layer of insight. Open interest across Bitcoin futures declined modestly as the price stalled. The decline in open interest suggested traders were reducing exposure ahead of potential volatility rather than positioning for a sharp breakdown. That shift signaled traders were unwinding leverage rather than building aggressive positions.

Liquidation maps revealed heavy long positioning near $85,900 and sizable short exposure above $88,600. This structure suggested traders believed downside risk remained limited while upside faced resistance. The BTC price reflected that tug-of-war.

Here, Bitcoin whales influenced psychology more than price. Their activity raised awareness, but not alarm.

Why Consolidation Often Comes Before Direction

Since mid-November, Bitcoin has traded in between $86,000–$93,500. Historic studies find increased volatility often preempts powerful moves.

If Selling momentum builds and the price closes below support, momentum can quickly decay. If buyers reclaim the upper boundary, sidelined capital may return. Until then, Bitcoin whales continue to act as silent stress tests for market conviction.

At present, the BTC price sits at the center of that range, reflecting indecision rather than weakness.

Conclusion

Markets often reveal more through restraint than reaction. Bitcoin whales moved significant capital. ETFs leaked demand. Leverage thinned. Yet price held.

This balance suggests confidence has not vanished, but conviction remains fragile. The BTC price now depends less on headlines and more on follow-through. A decisive break will require either renewed institutional demand or a shift in whale behavior. So far, neither has materialized.

Until that catalyst emerges again, Bitcoin’s range-bound behavior reflects balance, not exhaustion, something fundamental lies behind meaninglessness.

Until then, Bitcoin whales remain the quiet force shaping sentiment beneath a steady chart.

Glossary of Key Terms

Bitcoin whales: Holders of large Bitcoin balances capable of influencing short-term market sentiment.

BTC price: It refers to the current market value of Bitcoin across major trading venues.

Exchange inflows: They describe Bitcoin moving from private wallets to exchanges, often monitored for sell pressure.

Open interest: It measures the total value of active derivatives contracts and indicates the level of leverage exposure.

FAQs About Bitcoin Whales

Why do Bitcoin whales’ moving funds matter?

Large transfers can signal potential selling or strategic repositioning.

Did whales sell after depositing Bitcoin?

No confirmed spot selling followed the transfers.

Why did the BTC price remain stable?

Buyers absorbed supply while institutions gradually reduced risk.

What levels matter most now?

Support near $86,000 and resistance around $93,500.