This article was first published on Deythere.

- BTC Stash Moves for the First Time in 13 Years Plus

- Bitcoin Price Action at Time of Reactivation

- Historical Perspective on Whale Reactivation

- Comparison to Other Whale Movement

- Conclusion

- Glossary

- Frequently Asked Questions About Bitcoin Whale Awakening

- What defines a Bitcoin whale reactivation?

- What was the whale value in this instance?

- Does this mean the whale is selling?

- What is the correlation between the price of Bitcoin and reactivation of whales?

- Were other whales active recently?

- References

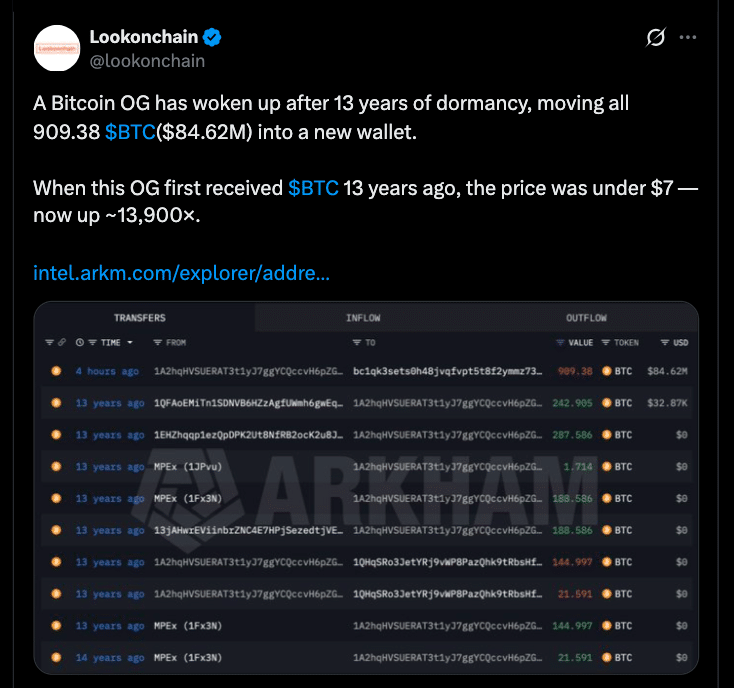

There has been notable whale reawakening as an address that had been inactive for over 13 years moved some 909.38 BTC worth around $84,600,000, to a fresh new wallet.

Tracking the movements with blockchain monitoring service Lookonchain and Whale Alert, they showed these coins were originally purchased when Bitcoin was valued below $7 or so. This swing shows a huge unrealized profit of almost 13,900 times the original cost.

BTC Stash Moves for the First Time in 13 Years Plus

The wallet involved in the Bitcoin whale reactivation had been dormant since early 2013, where it gathered these BTC when the cryptocurrency traded for a fraction of its current price.

On-chain data indicated that the address identified in parts with “1A2hq…ZGZm” moved an entire 909.38 BTC over to a new wallet address labeled bc1qk…sxaeh.

At the time that this Bitcoin was bought, BTC traded below $7, a far cry from today’s price level. The value of the BTC moved, at 2026 prices, was estimated to be about $84 million.

Unlike some past whale transfers, this one has not been sent to an exchange yet, suggesting that the coins are being consolidated into a more secure location rather than deployed or sold. Consolidation trades are common among long-term holders getting set to rebalance portfolios or lock in gains.

Bitcoin Price Action at Time of Reactivation

This Bitcoin whale reawakening occurred when the BTC was trading around $92,000, a strong resistance level for the crypto in early 2026. Following strong end of 2025 rallies, BTC overtook the $97K resistance for a short period before sliding to low $90Ks in line with overall market hesitation due to the latest geopolitical and macroeconomic developments.

The price of Bitcoin still shows a combination of weak signals on the various markets, but maintains strength around the $90k level, which gives some hope that massive on-chain movements can be absorbed by the market without substantial price damage.

This stability is a change from some earlier periods where whale action frequently led to volatility, thus indicating that the markets are maturing with more liquidity.

Historical Perspective on Whale Reactivation

Whale movements that have long lain dormant are a rare but noteworthy event. In previous cycles, large transfers from early addresses, especially those that have not been tapped since the advent of Bitcoin, unfolded as pointers for the market.

For instance, some wallets that had long remained inactive had moved BTC around between 2024 and 2025. These were worth watching because of the effect they had on sentiment as well as technically.

In late 2025, Galaxy Digital facilitated the transaction of a whopping 80,000 BTC position from a very early wallet, which temporarily affected price action along with market dynamics for a short period of time.

In contrast, the 909 BTC transferred in this latest Bitcoin whale reactivation is not as large of a volume but still notable considering how long it had been dormant for.

Comparison to Other Whale Movement

Although no exchange deposits were directly caused by the moving whale, such activity is observed because it depicts early holders returning to the market after holding their stash for a long time in cold storage.

Other large movements have been well-documented in recent months, too, with coordinated buys by big wallets as well as big outflows from exchanges. These indicate that despite some older holders moving coins, the ecosystem of whales is still bullish and participating.

For instance, in mid-December 2025, on-chain data showed wallets holding between 10,000 and 12,000 BTC adding more than 56,000 BTC collectively. This pattern points to long term accumulation rather than distribution.

Conclusion

The Bitcoin whale reactivation involving 909.38 BTC after over 13 years is a helpful addition as Bitcoin continues to grow.

While the coins have not yet been moved to an exchange, given the size of the transfer and how old it is, it still serves as quite a data point for those who watch these markets.

Viewed against Bitcoin’s price maintaining around the $92,000 level and other whale accumulation behavior patterns more widely, what this suggests is that old hands are active but cautious on the chain.

Glossary

Bitcoin whale awakening: An inactive Bitcoin address that has kept a substantial amount of coins (often hundreds or even thousands of BTC) becomes active after many years.

On-chain analytics: The practice of observing blockchain data to keep up with transactions, wallet activity and significant transfers.

Dormant wallet: A cryptocurrency wallet that has not made any transactions in a long time, sometimes years.

Consolidation: Moving from one wallet to another, often liquidating for security or repositioning, not always indicating sale.

Exchange supply: The total amount of a cryptocurrency on exchanges and the liquidity and potential sell pressure that comes with it.

Frequently Asked Questions About Bitcoin Whale Awakening

What defines a Bitcoin whale reactivation?

This is when a dormant wallet with very high BTC balance gets reactivated after many years and then sends the coins to some other address, probably new strategies or investment decisions.

What was the whale value in this instance?

The whale transferred 909.38 BTC, worth approximately $84.6 million, amounting to profit of about 13,900 times the initial purchase price when Bitcoin was less than $7 per coin.

Does this mean the whale is selling?

Not necessarily. Since the BTC has not been deposited to exchanges yet, the movement seems to be just for consolidation, security or construction of the portfolio.

What is the correlation between the price of Bitcoin and reactivation of whales?

Whale reactivations frequently coincide with elevated valuations of dormant holdings, but the effects on price differ when comparing sales to transfers. Bitcoin price has largely maintained near $92,000 during these movements.

Were other whales active recently?

Yes. Extensive blockchain data suggests that large wallets have been acquiring rather than selling Bitcoin in the past few months.

References

CoinDesk

Crypto Briefing

Bingx Exchange

Value The Markets

FX Leaders