This article was first published on Deythere.

- What the Whale Moves Mean

- ETFs Tell a Different Story

- Who’s Buying: Why It Matters

- A Market of Two Forces

- Conclusion

- Glossary

- Frequently Asked Questions About Bitcoin Whale Accumulation and Market Activity

- What was the Bitcoin market like on February 6, 2026?

- Does whale accumulation ensure price increases?

- Why are Bitcoin ETFs still bleeding assets?

- What is the significance of Binance SAFU buying Bitcoin?

- Does this Bitcoin whale accumulation signify a bottom in the market?

- References

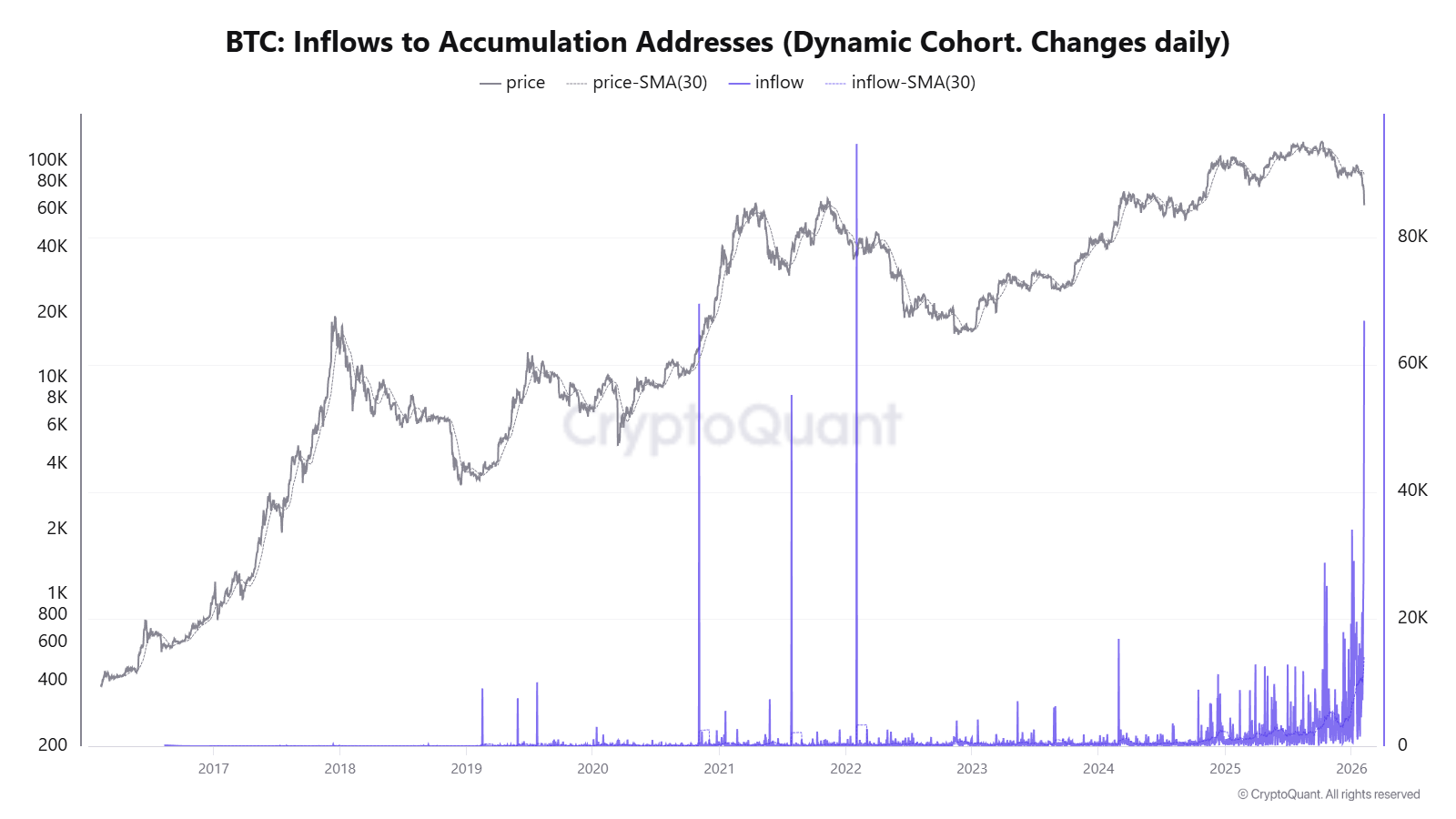

As the price of Bitcoin swung wildly to as low as $60,000 before climbing back to nearly $70,000, a curious pattern emerged on blockchain data. Big Bitcoin holders, often referred to as whales, deposited about 66,940 BTC (worth around $4.7 billion) into addresses with long-term holder characteristics on Feb 6th; the single largest inflow of this on-chain cycle.

Meanwhile, institutional vehicles like U.S. spot Bitcoin exchange-traded funds continued to see outflows. On-chain analytics show strong Bitcoin whale accumulation while retail and institutional flows suggest otherwise.

What the Whale Moves Mean

The morning after Bitcoin’s price briefly fell to about $60,000, on-chain tracker CryptoQuant reported that 66,940 BTC had flowed into accumulation wallets on Feb. 6, the largest single-day movement of large transactions in this cycle.

These addresses are usually owners who do not spend the coins, which means holding for a long time and not short-term trading. This, analysts and market observers have interpreted to mean big holders “buying the dip” or repositioning for longer horizons, an attitude generally adopted when markets hit deep correction zones and smart money takes over.

However, the blockchain movement alone does not prove fresh buying. Some of the transfers might be internal reshuffling by funds or custody transfers that appear to be an accumulation but not necessarily a new demand.

Still, the size and particular timing of this move is drawing attention.

ETFs Tell a Different Story

While on-chain Bitcoin whale accumulation was unfolding, the regulated investment products took very different paths. Several flow trackers such as SoSoValue and CoinShares have been showing continued net outflows in Bitcoin ETFs since the start of February.

On Feb 3, U.S.-listed Bitcoin spot ETFs lost about $272 million from the products, including funds such as Fidelity’s FBTC, with some sessions seeing minor inflows into altcoin-linked products like XRP and Solana ETFs.

This separated routes where coins flow into accumulation addresses while institutional vehicles offload positions, exposes the market’s two-pronged chronicles. On the one hand, large holders seem confident enough to move supply into cold wallets. And on the other hand, traditional investment products continue to have funds drained away.

This could mean more generalized institutional risk aversion, or it might mean profit-taking after the late-2025 price run.

Market action across exchange platforms further confirms that Bitcoin exchange reserves have also been dropping; a metric typically associated with supply tightness when users withdraw coins from exchanges to private or cold storage. But this measure can also be a function of internal treasury management rather than new spot purchasing.

Who’s Buying: Why It Matters

Two groups particularly stood out in Bitcoin whale accumulation activity throughout this drawdown.

One of the firms was Strategy (formerly MicroStrategy), the publicly traded company famous for its large Bitcoin treasury. According to SEC filings, Strategy added 1,142 BTC between February 2 and February 8 when it spent around $90 million at average prices near $78,800 per coin for a total position of 714,644 BTC.

These buys are small in comparison to the firm’s overall holdings, but their significance is that they took place during times of market distress and show that allocation to Bitcoin continues.

The other was Binance’s SAFU fund, which is the user protection reserve of the exchange. In early February, SAFU grew its Bitcoin holdings by more than 4,225 BTC (roughly $300 million) to over 10,000 BTC.

Unlike speculative purchasing, SAFU’s movements are based on a risk management approach where reserves are rebalanced to maintain a target level of crypto collateral to protect users.

This type of buying can provide some steady support under stress, which isn’t like direct trader demand.

A Market of Two Forces

Bitcoin had plunged to as low as $60,000, which is the lowest level since the late 2022 FTX collapse, and then bounced back toward the $70k zone. U.S. spot Bitcoin ETFs continue to show negative flows across multiple days even as some altcoin ETF products saw small inflows, indicating capital rotation within crypto rather than an outright return of buying pressure.

Total digital asset investment products saw outflows slow to around $187 million in the latest week, CoinShares data showed, which could mean a possible slowdown in selling pressure but overall net redemptions. Bitcoin was the main source of negative sentiment, with inflows elsewhere including into XRP.

This tug-of-war where whales stack coins off exchanges while ETFs bleed capital is controlling market slump.

Some traders see the ongoing Bitcoin whale accumulation as an indication that the sell-off may have brought in long-term buyers. Others cite the continued outflows from regulated products as a sign that institutional demand remains cautious.

Conclusion

The market behavior of Bitcoin during the first week of February 2026 is one of conflicting opposites. On-chain, Bitcoin whale accumulation data shows that large holders are making big moves putting almost $4.7B in long term wallets, mostly interpreted as buying the dip.

Meanwhile, regulated products declined yet again as Bitcoin ETFs, in particular, were still losing assets, suggesting an ongoing risk-off attitude from institutional investors.

This divided market shows that the price and supply dynamics of Bitcoin are no longer heading in one direction. Even as capital generally seems to be on the way to the exits, larger holders do seem willing to increase exposure.

Glossary

Bitcoin whale: Individuals or wallets that own large amounts of Bitcoin that they can move markets if they make big transactions.

Accumulator address: A wallet pattern that displays coins coming in but no outgoing transactions (possibly individuals holding on to their Bitcoin for the long-term).

Cold storage: Storing crypto offline where it’s not connected to an exchange or online networks, making it less likely to sell.

ETF outflows: Net withdrawals from exchange-traded funds, which can be indicative of waning institutional or retail investment interest.

SAFU fund: Binance’s Secure Asset Fund for Users, established to cover their users in case of violent market conditions.

Frequently Asked Questions About Bitcoin Whale Accumulation and Market Activity

What was the Bitcoin market like on February 6, 2026?

On Feb. 6, there were more than 66,940 BTC that flowed into long-term holding wallets according to on-chain data, this is one of the largest single day Bitcoin whale accumulations this cycle.

Does whale accumulation ensure price increases?

Not necessarily. Significant inflows to accumulation wallets usually indicate confidence, but they can also indicate a reshuffle in custody rather than fresh buying. The market context matters.

Why are Bitcoin ETFs still bleeding assets?

Bitcoin spot ETFs experienced continued outflows, as some institution and retail players sought to reduce exposure and volatility even while whales accumulated on-chain.

What is the significance of Binance SAFU buying Bitcoin?

The additional holdings of Bitcoin by SAFU are for the sake of sales activities and price-insensitive demand, not for speculative trading, so it can provide some support during market stress.

Does this Bitcoin whale accumulation signify a bottom in the market?

Although the big whale activity could be a bottoming signal, analysts note that ongoing flows and price action need to continue before calling any type of reversal in the trend.