Bitcoin is facing renewed volatility as analysts warn of a potential reset that could send prices tumbling to $82K, despite its recent strong performance above the $100K mark. A sharp correction driven by macro events, liquidation cascades, and weakening on-chain fundamentals has many traders rethinking their short-term strategies.

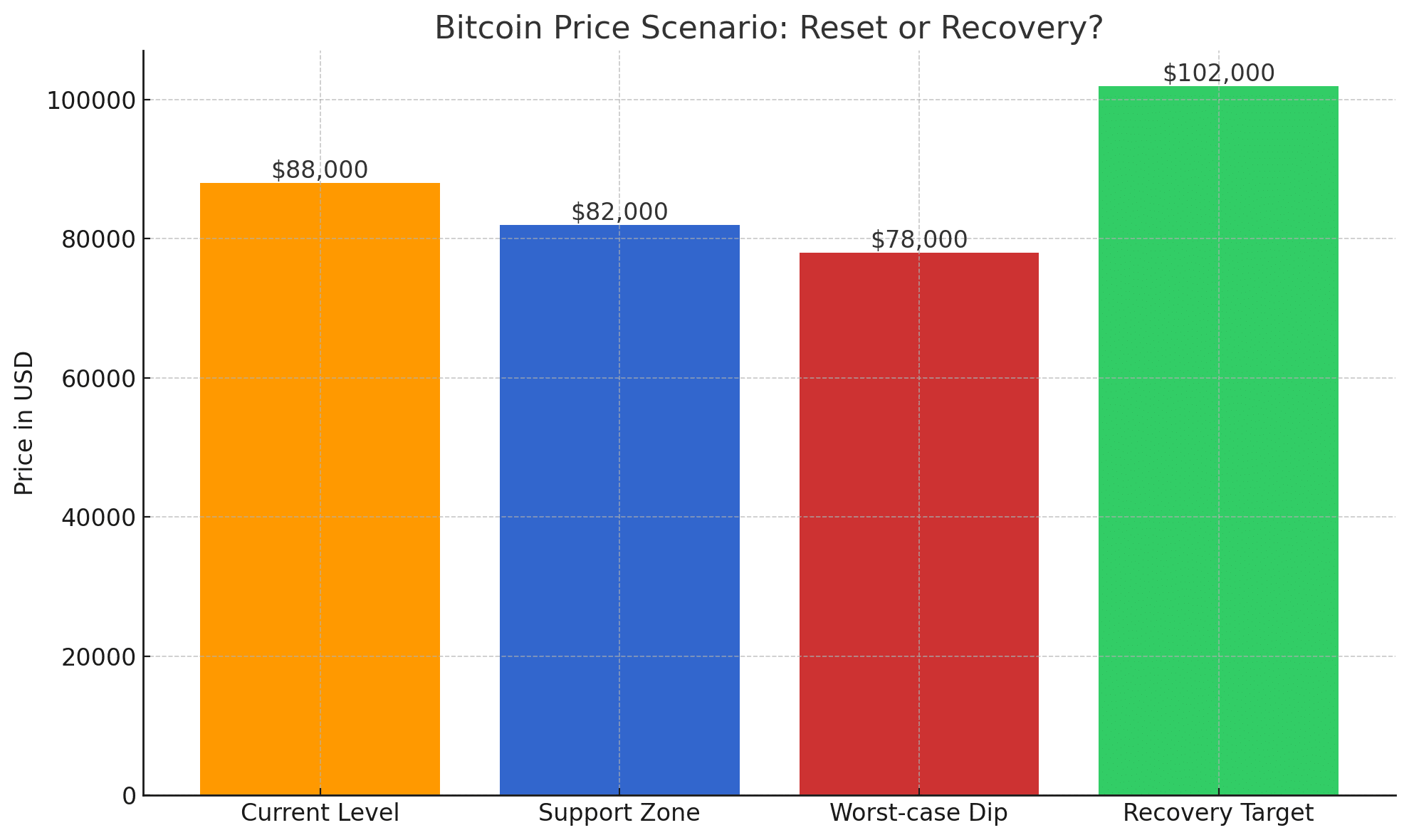

As of this writing, Bitcoin is trading around $88K, down nearly 9% from its recent peak of $102.5K. While some view this as a healthy correction, others are bracing for a steeper drop toward the $82K zone, a level historically tied to major market resets.

What Triggered the Bitcoin Correction?

The recent decline was largely sparked by geopolitical tensions, specifically U.S. military strikes in Iran. This macro shock triggered fear across financial markets, resulting in over $127 million in Bitcoin long liquidations within 24 hours. As leveraged positions unwound, cascading sell orders pushed BTC below critical technical support levels.

Simultaneously, Bitcoin’s fall below Glassnode’s +0.5σ MVRV (Market Value to Realized Value) band has raised red flags for analysts. Historically, dips below this band have signaled deeper corrections and market resets. The same pattern was seen in early 2022 and 2020, leading to multi-week downtrends.

Analysts Eye $82K as a Key Reversal Zone

Multiple crypto analysts, including those from AMBCrypto and FinanceMagnates, are now pointing to the $82K to $83K range as a potential support zone if current bearish momentum continues. According to on-chain data, Bitcoin’s Network Value to Transactions (NVT) ratio has spiked over 80%, suggesting price may be outpacing transaction activity, a bearish sign.

Additionally, the stock-to-flow model, which has historically guided BTC’s long-term trajectory, has shown a 12.5% deviation below projected targets, another indication that the market may need to “reset” before resuming its climb.

Institutional Flows and Liquidations Are Adding Pressure

Institutional investors have been a major force behind Bitcoin’s 2025 surge, but recent outflows from BTC ETFs have added pressure to the market. While major firms like BlackRock and Fidelity remain long-term bullish, short-term profit-taking and macro risk hedging have led to temporary selling.

The liquidation data tells a similar story. Overleveraged long positions were the first to be hit when BTC broke below $100K, leading to massive cascading sell-offs that amplified the correction. Exchanges saw more than $250 million in liquidations across futures markets during the dip.

Is $82K a Buying Opportunity or the Start of a Bear Phase?

Not all analysts agree on the severity of the situation. Ki Young Ju, CEO of CryptoQuant, notes that this drawdown may simply be a “bull market correction”, a common occurrence in multi-year cycles. He says the $82K range represents a “high-conviction buy zone”, especially for long-term holders.

Others point out that Bitcoin has repeatedly bounced from similar levels in past cycles. In March 2020 and June 2021, BTC faced similar retracements before making new all-time highs. The upcoming Bitcoin halving in 2026 and growing institutional adoption are major tailwinds.

Key Levels to Watch This Week

$102K: Recently broken MVRV support. If BTC climbs back above, bullish momentum may resume.

$88K to $90K: Current consolidation zone with weak volume.

$82K to $83K: Potential bottom if correction deepens. Strong on-chain support exists here.

$78K to $80K: Worst-case scenario level flagged by Elliott wave analysts.

Conclusion: Stay Alert, Not Afraid

Bitcoin’s short-term outlook remains uncertain as global tensions, ETF flows, and on-chain signals all collide. While a drop to $82K remains a real possibility, the longer-term structure of the bull market is still intact. Smart money may view this as an opportunity to accumulate, not exit.

As always, risk management is essential. Whether you’re a swing trader or a long-term holder, understanding the bigger picture, both on-chain and macro, is your edge in volatile markets.

FAQs

1. Why are analysts predicting a Bitcoin drop to $82K?

Analysts cite liquidation cascades, geopolitical tensions, and weakening on-chain indicators as signals for a potential Bitcoin reset to $82K.

2. Is $82K considered strong support for Bitcoin?

Yes, the $82K–$83K range is viewed by many analysts as a key support zone that may trigger accumulation and rebound activity.

3. Should traders sell now or hold through the volatility?

Many experts suggest using risk management strategies rather than panic selling. Long-term holders may view dips as buying opportunities.

Glossary of Key Terms

Bitcoin Market Reset: A significant correction in BTC price after an extended rally, often viewed as a healthy rebalancing.

MVRV (Market Value to Realized Value): An on-chain metric used to assess if Bitcoin is overvalued or undervalued.

Liquidation Cascade: A series of automatic sell-offs triggered when leveraged traders fail to maintain margin requirements.

Support Zone: A price level at which buying interest is strong enough to prevent further decline.

On-Chain Metrics: Blockchain-based data such as wallet activity, transaction volume, and miner behavior used for market analysis.