A quiet but profound shift is taking place inside boardrooms and fund houses across the world. What began as a simple question, “Should we hold Bitcoin?”, has now expanded into a more complex debate: Ether vs Bitcoin Treasuries.

- Bitcoin’s Fortress Model Still Holds Ground

- Ethereum: Yield, Utility, and Innovation

- Institutional Rotation and the New Allocation Mindset

- Why Yield Changes the Game

- Treasury Behavior Reflects Market Maturity

- Data Snapshot: Treasury Holdings 2025

- The Strategic Divide: Store vs Stream

- Expert Insights and Forward View

- Conclusion

- Frequently Asked Questions about Ether vs Bitcoin Treasuries

The contrast between the two assets has never been sharper. Bitcoin remains the benchmark for scarcity and digital permanence. Ethereum, on the other hand, has matured into a productive asset capable of generating real yield.

For corporate treasurers and institutional allocators, the conversation is no longer about choosing one over the other. It’s about deciding which mix best fits the strategy: long-term preservation, yield optimization, or on-chain participation.

Bitcoin’s Fortress Model Still Holds Ground

For more than a decade, Bitcoin has been the undisputed reserve of the crypto world. Its fixed supply of 21 million coins gives it the kind of mathematical scarcity that central banks could only dream of.

Institutional holdings now represent roughly 4 percent of Bitcoin’s total supply, translating to about 848,000 BTC valued at around $105 billion. This figure includes corporate treasuries, public companies, and ETF reserves.

To traditional institutions, Bitcoin offers something beautifully simple: no yield, no governance risks, no moving parts. It’s a store of value that sits outside inflationary systems.

An asset manager recently summarized it on X: “Bitcoin is not just digital gold. It’s the first asset you can verify in real time, with no counterparty.”

That clarity makes it the anchor of digital balance sheets. Even as new contenders rise, Bitcoin remains the default expression of trust in decentralized money.

Ethereum: Yield, Utility, and Innovation

Ethereum’s path could not be more different. Its rise in the Ether vs Bitcoin Treasuries debate stems from its flexibility. Since the network’s shift to proof-of-stake, ETH has evolved from a purely speculative asset into a productive one.

Today, treasuries can stake ETH and earn between 3–5 percent annually while maintaining exposure to price movements. That simple difference changes everything.

Unlike Bitcoin, Ethereum is not merely held, it’s used. Treasuries that allocate to ETH often deploy capital into DeFi protocols, tokenized assets, or staking validators, turning idle reserves into active positions.

“Ethereum gives treasuries the ability to work their balance sheets,” said a senior analyst at a digital asset fund in Singapore. “It’s not just about price appreciation. It’s about programmable yield.”

That “yield narrative” has drawn attention from both public firms and ETFs. Ethereum-linked investment products accounted for over half of institutional inflows in Q3 2025, marking a significant milestone in capital rotation.

Institutional Rotation and the New Allocation Mindset

The past year has seen a gradual but visible migration of treasury capital toward Ethereum. While Bitcoin ETFs remain the most liquid entry point for institutions, the demand for ETH-based exposure has accelerated.

Fund flow data suggests that many corporate treasuries are adopting blended portfolios, holding Bitcoin for defensive purposes and Ethereum for active yield management.

In essence, Ether vs Bitcoin Treasuries is becoming less of a competition and more of a calibration exercise. The mix depends on what each treasury values most: permanence or participation.

A European fintech executive recently described it succinctly: “Bitcoin is my vault. Ethereum is my vehicle.”

That sentiment captures the new institutional mood. Treasury management is no longer static; it’s dynamic, yield-aware, and blockchain-integrated.

Why Yield Changes the Game

The introduction of staking returns gives Ethereum an advantage that Bitcoin cannot match organically. A company that holds ETH is not just hedging against inflation, it’s earning.

Treasury departments that used to park billions in near-zero-yield money markets now see Ethereum as a productive alternative. By integrating staking through regulated custodians, firms can collect steady on-chain income while keeping compliance intact.

The implications are significant. That extra 3–5 percent annualized yield can lift overall reserve efficiency by 30–50 basis points on large capital pools. Over multiple quarters, this becomes a measurable performance edge.

However, yield comes with risk. Validators can face slashing, network upgrades introduce uncertainty, and DeFi exposure demands technical literacy. Bitcoin’s simplicity remains its shield in this regard.

As a market strategist at a U.S. bank noted, “Ethereum’s yield is attractive, but it introduces an operational layer that corporate finance desks aren’t used to managing.”

Treasury Behavior Reflects Market Maturity

In early 2025, a mid-cap mining company made headlines after shifting its reserves from Bitcoin to Ethereum, citing greater liquidity access and on-chain utility. Its stock price soared 3,000 percent within a week, driven by investor excitement over the shift.

The case underlined how narratives drive valuation in this space. Ethereum’s integration into DeFi and tokenization makes it a natural asset for treasuries aligned with fintech, payments, or Web3 infrastructure.

Meanwhile, Bitcoin continues to dominate among legacy corporates and financial institutions that prioritize security, liquidity, and auditability.

As the two ecosystems mature, their respective treasury roles are becoming complementary rather than competitive.

Data Snapshot: Treasury Holdings 2025

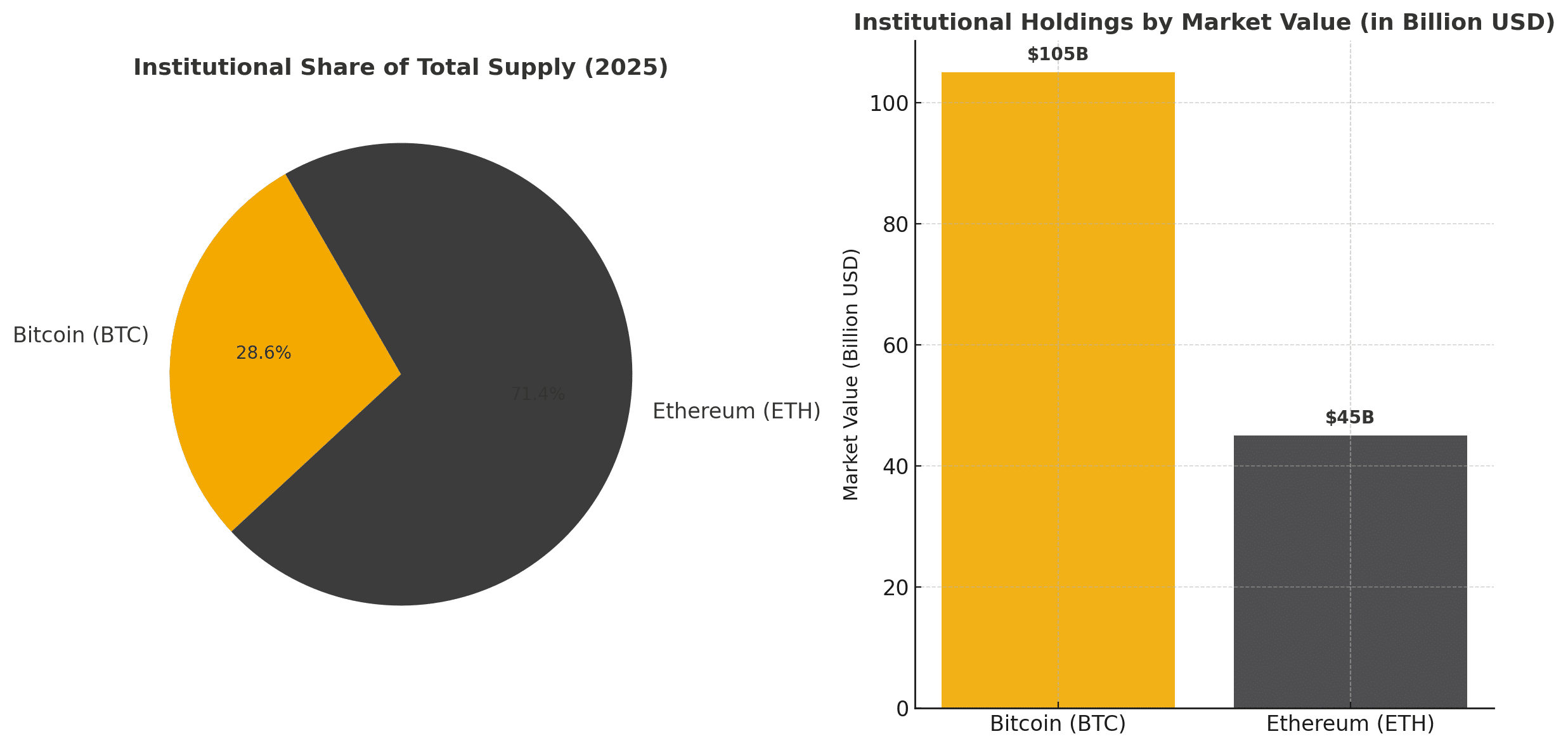

Bitcoin Treasuries: 848,000 BTC (≈4% of total supply), worth about $105 billion.

Ethereum Treasuries: 12.5 million ETH (≈10% of total supply), worth around $45 billion.

While Bitcoin still leads in total dollar value, Ethereum’s institutional penetration relative to its supply is deeper. That metric, percentage of circulating supply held, offers a truer reflection of conviction.

In that sense, Ether vs Bitcoin Treasuries reveals an emerging equilibrium: one asset optimizing for scarcity, the other for productivity.

The Strategic Divide: Store vs Stream

At its core, this debate represents a philosophical divide. Bitcoin is a store of value, an anchor in a world of monetary drift. Ethereum is a stream of value, constantly circulating, compounding, and evolving.

Both matter. For some treasuries, Bitcoin serves as digital ballast, a stable backstop during uncertain times. For others, Ethereum represents adaptive capital, capable of generating returns in both bull and bear cycles.

As tokenized securities, on-chain bonds, and real-world assets expand, Ethereum’s programmable infrastructure becomes increasingly relevant. But as macro conditions tighten, Bitcoin’s predictability will remain a comforting constant.

Ultimately, treasuries are learning what investors already know: the two assets serve different purposes, and together, they create balance.

Expert Insights and Forward View

Financial analysts believe the coming quarters will see a more deliberate approach to treasury diversification. Institutional allocators may adopt a 70–30 split, with Bitcoin anchoring reserves and Ethereum powering yield strategies.

Citigroup recently reaffirmed its $4,500 price target for ETH and maintained a long-term neutral stance on Bitcoin, highlighting the rotational nature of institutional capital.

Fidelity’s digital asset division described it well in a recent report: “Ethereum is behaving more like an equity—yield-bearing, functional, and growth-oriented. Bitcoin remains the pure monetary asset.”

The evolving Ether vs Bitcoin Treasuries balance mirrors broader market behavior: yield-seeking in expansion, consolidation in contraction.

The Coexistence Era

The most likely outcome is coexistence, not dominance. Treasury models in 2026 and beyond will reflect a hybrid philosophy—allocating between the permanence of Bitcoin and the productivity of Ethereum.

As the global economy digitizes, these assets will not only hedge inflation but also generate income, liquidity, and programmable capital flows.

Bitcoin may anchor trust; Ethereum may drive growth. Together, they define the next chapter of corporate finance in the digital age.

Conclusion

The Ether vs Bitcoin Treasuries debate is not a tug of war—it’s a tuning fork for institutional strategy. One frequency resonates with safety, the other with innovation.

Bitcoin’s simplicity will always appeal to conservative treasuries that prize durability. Ethereum’s yield and versatility will continue to attract forward-looking firms that see blockchain not as a hedge, but as a growth engine.

What was once a question of “which is better” has evolved into “which serves the purpose.” The answer, in 2025, is increasingly both.

Frequently Asked Questions about Ether vs Bitcoin Treasuries

1. Why are Ether vs Bitcoin Treasuries a major topic now?

Because institutions are transitioning from speculative exposure to strategic asset management, where yield, liquidity, and risk control matter.

2. Is Ethereum outperforming Bitcoin in treasury adoption?

In relative terms, yes. Ethereum’s share of institutional supply is higher, though Bitcoin still leads in total dollar value.

3. How do Ethereum’s staking yields affect treasury performance?

Staking provides consistent yield, improving cash efficiency while maintaining crypto exposure—something Bitcoin cannot natively offer.

4. Can both assets coexist in the same treasury?

Absolutely. Many institutions now use Bitcoin for long-term stability and Ethereum for yield-based liquidity management.

Glossary of Key Terms

Treasury Allocation:

The strategic holding of digital assets by corporations or funds to optimize balance sheet performance.

Staking Yield:

Reward earned for locking ETH to secure the network, typically between 3–5 percent annually.

Institutional Flows:

Movement of capital from professional investors into specific cryptocurrencies or funds.

DeFi Integration:

Use of decentralized financial tools on Ethereum to manage or grow treasury holdings.

Circulating Supply:

The total number of coins or tokens currently available in the market.