Bitcoin’s wild ride seems to be calming and that may be exactly what qualifies it now as a mature asset class. The cryptocurrency world has always been synonymous with wild swings and chaos. However, Bitcoin volatility is maturing before the eyes of investors and traders, with its 30-day volatility slumping to levels not seen in almost half a decade.

- Calm in the Storm: Volatility Hits Historic Low

- Bitcoin vs Tech Stocks: A Surprising Comparison

- The Numbers Behind the Trend

- What’s Behind the Stability? Institutions are Stepping In

- Patterns of the Past: Precursor to Breakouts

- Why Maturity Matters to Investors

- Conclusion

- FAQs

- What does Bitcoin volatility maturity mean?

- Why is volatility so much lower now?

- Does low volatility mean lower returns?

- How does Bitcoin compare with traditional assets today?

- Glossary

Calm in the Storm: Volatility Hits Historic Low

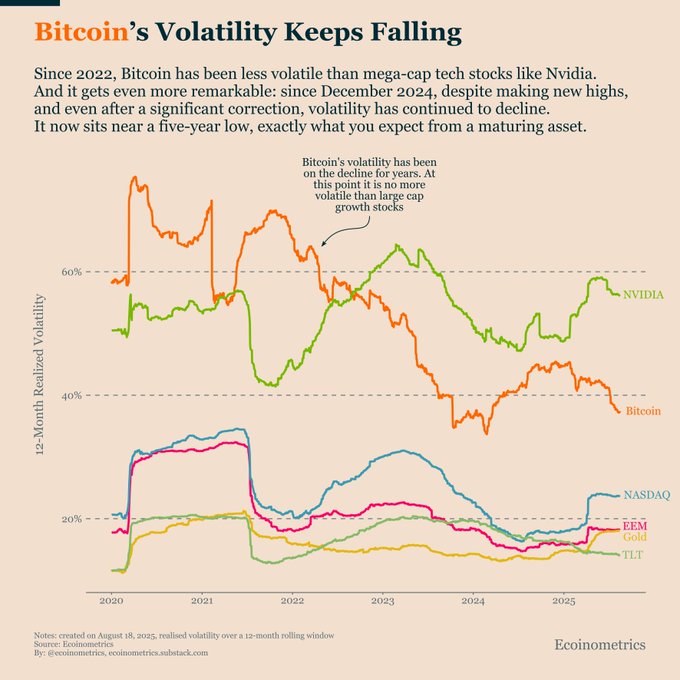

New data from Ecoinometrics shows Bitcoin’s 30 day volatility is in the bottom of its 5 year history; a far cry from the wild swings in previous years.

This trend is remarkable. Even as Bitcoin surges to new all time highs, the pace of price movement is much more measured than previous cycles. Institutional players are saying this is a sign of growing confidence and depth in the market.

Bitcoin vs Tech Stocks: A Surprising Comparison

Once the poster child for volatility Bitcoin is now more stable than blue-chip tech stocks. Reports show over the last few months it’s been less volatile than Nvidia, PayPal and AMD.

Further evidence of this trend, data from Fidelity shows Bitcoin’s realized volatility is now lower than Netflix, putting it in the same league as traditional equities.

The Numbers Behind the Trend

For traders and risk managers, these numbers matter. Realized volatility, a measure of actual past price movement, has dropped into single digits. Glassnode shows Bitcoin’s 1 week realized volatility is 23.4% near a historic low not seen in the last 4 years.

The 30 day implied volatility, used to price options, is also low. Sources note that when this metric drops below 500, it often leads to big price moves either up or down, within the next month.

What’s Behind the Stability? Institutions are Stepping In

Several factors are at play behind the calming of Bitcoin’s price action. The growing adoption of US spot Bitcoin ETFs has brought in steady flows from institutions, providing liquidity and reducing wild swings.

Corporate treasuries and pension funds are also adding Bitcoin to their portfolios. As more capital comes in with long-term horizons, the noise from retail trading dies down.

Patterns of the Past: Precursor to Breakouts

History shows that low volatility precedes big moves. Research from sources finds that when 30 day volatility goes below certain levels, Bitcoin often follows with $10,000+ price moves.

Ecoinometrics visual heatmaps show a shift from red chaos to blue calm; an inflection point where the market is getting its act together.

Why Maturity Matters to Investors

For individual investors and institutional managers, this means easier integration into traditional portfolios, more predictable risk models and better alignment with long term financial goals. As Fidelity says, this is what happened to gold when it went from a speculative asset to a store of value.

Conclusion

Based on the latest research, Bitcoin volatility matures with a market profile of steady movement, institutional depth and tighter alignment with traditional assets.

As it drops, now rivaling mega-cap tech stocks; it is becoming an investible, interest-bearing asset not just speculative. This calm behavior prepares it for more long-term adoption and potentially solid growth.

For in-depth analysis and the latest trends in the crypto space, our team offers expert content regularly.

Summary

A record of volatility unwinds as Bitcoin volatility matures. Recent data shows 30-day realized volatility at its lowest in nearly 5 years. Remarkably, price swings are now gentler than many major tech stocks. Institutional trends, spot ETFs, and corporate treasuries have solidified liquidity and reduced speculative bursts.

FAQs

What does Bitcoin volatility maturity mean?

It means the price moves less and more like a mature asset.

Why is volatility so much lower now?

Institutional investment via ETFs, corporate holdings and deeper liquidity are dampening retail-driven moves.

Does low volatility mean lower returns?

Not necessarily. Low volatility often compresses price action before big breakouts, $BTC has historically gone up after low-vol periods.

How does Bitcoin compare with traditional assets today?

Recent data shows it’s now comparable; or less volatile; with mega-cap stocks like Nvidia and Netflix, and less volatile than almost all S&P 500 components.

Glossary

Realized volatility: Historical measure of how much the price has actually varied.

Implied volatility: Forward looking volatility from options pricing that reflects future expected movement.

30 day realized volatility: Volatility over the last 30 days. Used to measure short term risk.

ETF (Exchange-Traded Fund): A regulated investment vehicle that gives you exposure to Bitcoin and institutional liquidity.