This article was first published on Deythere.

Institutional positioning around publicly listed Bitcoin-reserve firms seems to be changing. Just recently, a veteran short-seller, James Chanos, closed his widely followed hedged trade against MicroStrategy Inc. (ticker MSTR) and long on Bitcoin.

The unwinding of this 11-month position has been seen by market commentators as a potential intercept point for companies that hold BTC on their balance sheets; commonly referred to as bitcoin treasury companies.

Institutional Short Covering Signals

Chanos’s exit of his MSTR/BTC hedged trade stands out because he had been shorting MicroStrategy, a company that’s been aggressively accumulating Bitcoin.

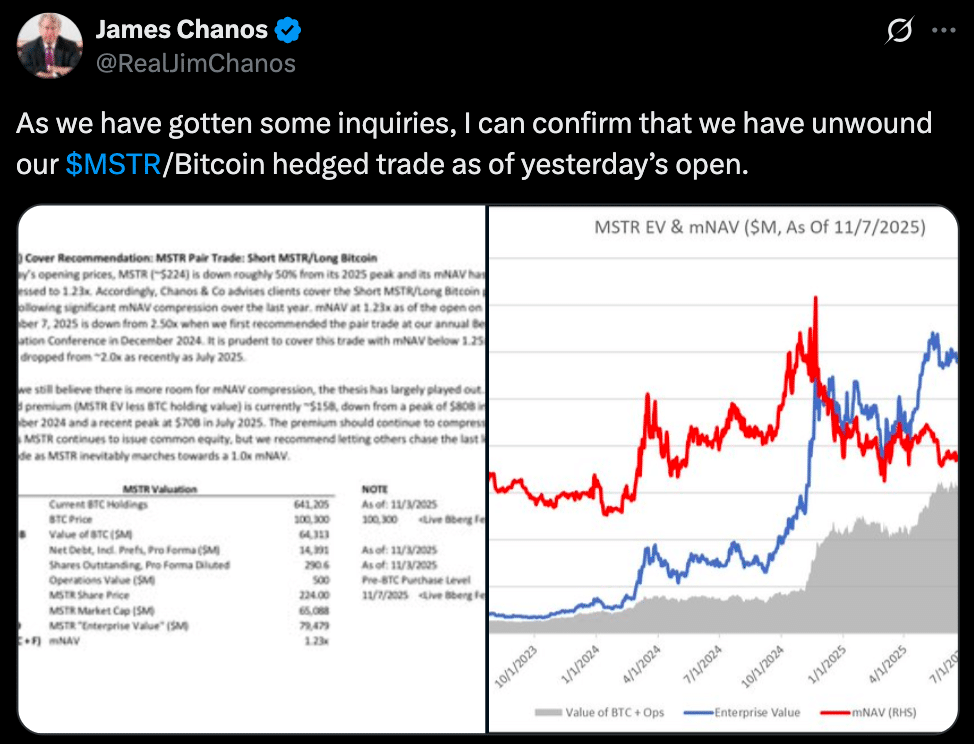

According to news reports, he officially closed his $MSTR/Bitcoin hedged trade after 11 months, marking the end of his high-profile bet against Bitcoin-linked equities and Strategy stock.

He tweeted:

“As we have gotten some inquiries, I can confirm we have unwound our $MSTR/Bitcoin hedged trade as of yesterday’s open.”

Pierre Rochard (CEO of The Bitcoin Bond Company) replied:

“The Bitcoin treasury company bear market is gradually coming to an end.”

The narrative is that when a big short-seller closes a big bet against a sector, it means sentiment has reached a turn around.

The Stress on Bitcoin Treasury Companies

Bitcoin treasury companies have reportedly had a tough 2025. Many of these companies saw their stock prices collapse as premium valuations above net-asset value compressed sharply.

One industry note pointed out that several firms were down significantly from peaks earlier this year and had been heavily shorted.

Notably, MicroStrategy, which holds over 640,000 BTC, was under pressure as debt rose and premium compressed. According to sources, the Strategy has fallen sharply and may have tested support. The tough period for these companies has eroded investor conviction but this may be a turn.

First, it removes a big force that was the headwind, namely a well-known investor shorting the sector. When that contrarian position is closed, markets could reprice.

As Rochard said, “Expect volatility but this is the kind of signal you want to see for a reversal.”

This could impact other institutional players who watch sentiment flows; if a big short closes, some could reassess risk-reward. It also means internal analysis has concluded the downside for Bitcoin treasury companies is getting exhausted.

What This Means for Sentiment

As a result of the current events; the sentiment around Bitcoin treasury companies is shifting from fear to cautious hope. The short-side capitulation by a big name like Chanos may reduce the “max pain” for these companies and some investors may think the worst could be behind them.

However, this is not a guarantee of smooth sailing. Volatility could continue as Rochard said “Expect continued volatility”.

The narrative may be changing from “how far will they fall” to “what needs to happen to rebuild”.

For many market watchers, this may be the start of liquidation to accumulation in the Bitcoin-treasury universe.

Conclusion

Bitcoin treasury companies are at a decision making front. The unwinding of one of the most publicized short trades in the industry by James Chanos against MicroStrategy/BTC is a signal of a shift in sentiment that could be the start of a recovery.

These companies have been overvalued and drawn down in 2025 but the removal of a big short and the emergence of structural investor signals may mean the worst is behind them.

But volatility could continue and a path to sustained recovery will depend on improved treasury practices, renewed institutional participation and positive shifts in valuation metrics.

Glossary

Bitcoin treasury companies: Public firms whose main business is to hold large amounts of Bitcoin (BTC) on their corporate balance sheets, as a strategic reserve asset.

mNAV (market-adjusted net asset value): A valuation metric comparing a company’s market capitalization to the net value of its assets; adjusted for market conditions and debt.

Short seller: An investor who bets on the decline in value of a company’s stock or asset; often by borrowing and then selling the asset with the hope of buying back at a lower price.

Hedged trade: An investment strategy combining offsetting positions (e.g., shorting a stock while having a long exposure elsewhere); to limit net exposure.

Premium/discount to NAV: When a company’s stock trades above (premium) or below (discount) the value of its underlying assets, such as holdings of Bitcoin.

Frequently Asked Questions About Bitcoin Treasury Companies

Why did James Chanos exit his MSTR/BTC short position?

He said on X that his firm had “unwound our $MSTR/Bitcoin hedged trade as of yesterday’s open.” According to reports, the premium that MSTR commanded over its Bitcoin holdings (mNAV multiple) had fallen sharply, reducing the returns from the short trade.

Does this mean Bitcoin treasury companies will automatically rebound?

Not necessarily. While the short-covering is a positive sentiment shift, recovery will depend on several factors, including better operational execution, good macro-crypto tailwinds, and renewed investor confidence. Volatility is still likely.

What firms are Bitcoin treasury companies?

These are companies that accumulate Bitcoin as an asset. One of the most well-known is MicroStrategy Inc., now often referred to as Strategy, which holds hundreds of thousands of BTC.

What are the risks for Bitcoin treasury companies?

Even with improved sentiment, risks remain such as BTC price volatility, leverage or debt at companies, regulatory changes and possible NAV compression if underlying Bitcoin holdings underperform.