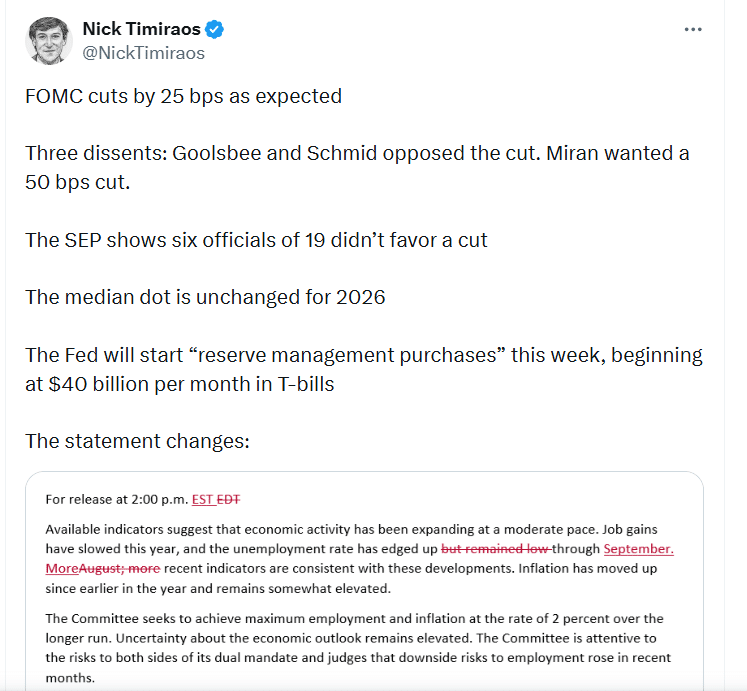

The latest rate decision from the United States central bank arrived at a delicate moment for digital assets. Policymakers lowered the benchmark rate by 25 basis points to a range around 3.50 to 3.75 percent and signaled that the balance between jobs and inflation has become more even. For the crypto market, this looks like a cautious step toward easier policy, not a dramatic shift in direction.

Officials also confirmed plans to keep buying short-term government debt in order to support smooth funding conditions. When safe assets enjoy steady demand, some investors feel more comfortable taking risk in other corners of the market, including Bitcoin, Ethereum and liquid altcoins. The result is a backdrop that feels supportive on paper, but not strong enough to silence macro worries.

Bitcoin and Ethereum swing on the headline

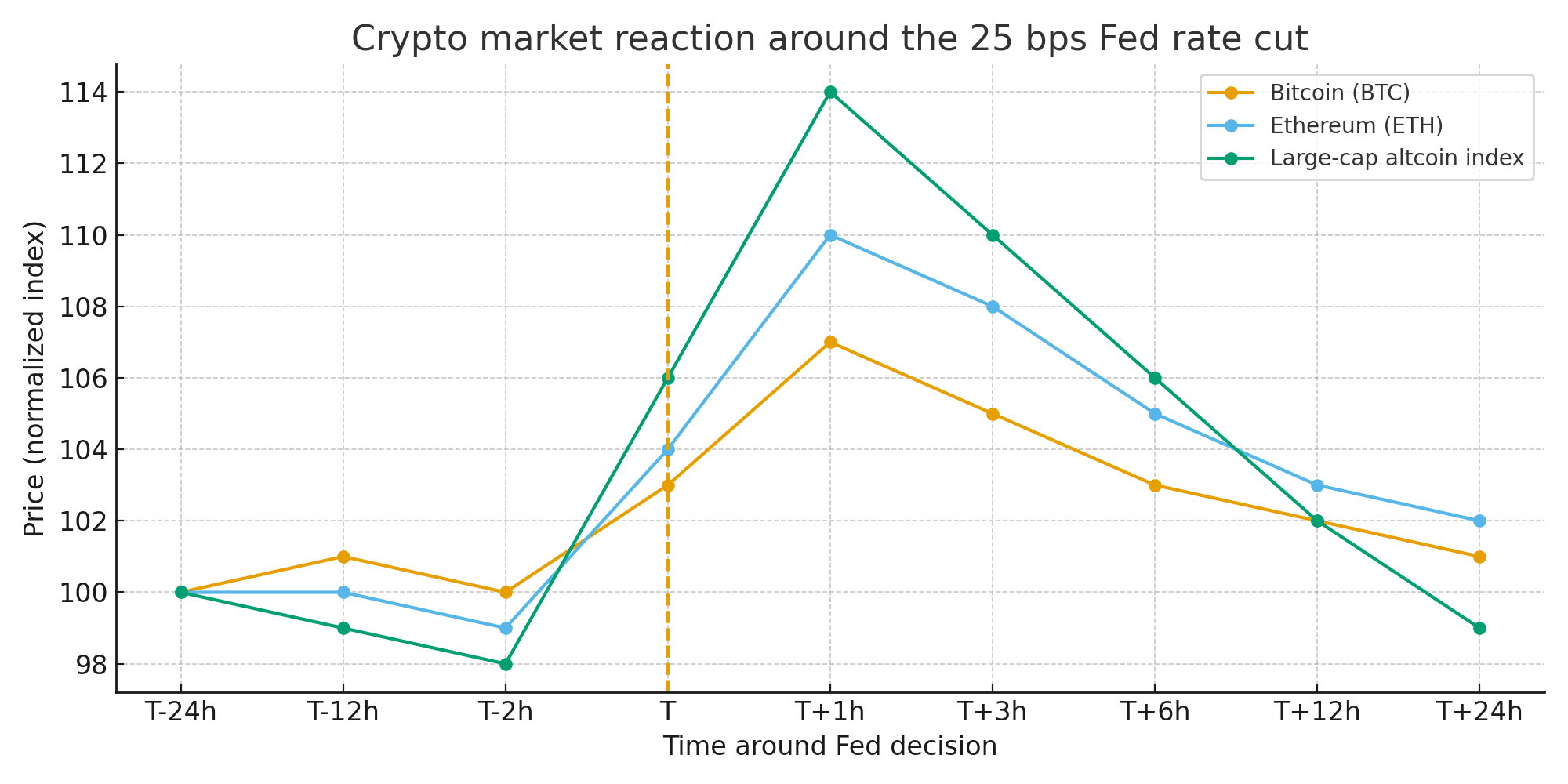

Prices reacted almost instantly as Bitcoin jumped by more than 2 percent within minutes of the announcement and briefly moved above the 93,000 dollar mark. Ethereum followed higher, and a cluster of large cap altcoins recorded strong hourly gains as traders tried to get ahead of a possible wave of new liquidity and lower borrowing costs.

The enthusiasm faded once the statement and press conference were fully absorbed. By the next trading session, Bitcoin hovered closer to 90,000 dollars, and Ethereum slipped back toward the low 3,000 dollar band. Many high-beta tokens surrendered most of their early gains. The message was clear. The market liked the idea of lower rates, but it still worried about slower growth, heavy public debt and stubborn inflation pressures into 2026.

Key crypto indicators in focus after the cut

After the first spike, traders shift attention to the core indicators that tend to drive crypto in a macro-heavy environment. Price remains the primary signal, especially the behavior around well-known support and resistance levels. Volume adds context. A fast jump followed by quiet trading suggests that short term speculators dominated the move rather than long term buyers who build positions over weeks and months.

Derivatives and on chain data complete the picture. Open interest in futures and the direction of funding rates show how much leverage is still in the system and whether it leans long or short. On chain, analysts watch Bitcoin dominance, stablecoin supply and the behavior of long term holders. Rising dominance and growing stablecoin balances usually point to cautious but constructive conditions, while falling dominance and weak stablecoin growth hint at more fragile sentiment and a market that can be pushed around by relatively small flows.

What this means for the road to 2026

For participants who think beyond one meeting, the lesson is straightforward. Digital assets now sit at the heart of the global risk complex. If incoming data allow a slow path of further cuts and bond yields drift lower, the environment for Bitcoin and major altcoins may gradually improve and leave room for fresh attempts at all time highs. If growth slips too far or inflation forces policy back to a tighter stance, prices could remain stuck in a wide, volatile range rather than moving into a clear new trend.

Frequently Asked Questions

Why did Bitcoin react so quickly to the rate cut?

Bitcoin trades around the clock and is very sensitive to changes in the cost of money. When the policy rate moves, both algorithms and human traders adjust positions almost immediately, which leads to rapid price swings.

Is this small cut a clear positive for crypto?

It offers modest support rather than a guarantee of higher prices. Lower rates and extra liquidity can help risk assets, but the long term impact still depends on growth, inflation and investor demand for digital assets.

Which indicators should traders follow now?

Key signals include Bitcoin price levels, overall market dominance, spot and derivatives volumes, futures funding rates, stablecoin flows and the actions of long term holders. Together, these indicators show whether the market is adding or reducing risk.

Glossary of key terms

Federal funds rate

The main short term interest rate targeted by the United States central bank. It influences borrowing costs across the economy.

Basis points (bps)

A unit used to describe interest rate changes. One basis point equals 0.01 percent, so 25 basis points equal 0.25 percent.

Liquidity

The ease with which assets can be bought or sold without moving the price too much. Higher liquidity usually supports more stable markets.

Treasury bills (T bills)

Short term government debt securities. When the central bank buys T bills, it injects cash into the financial system.

Volatility

The degree of price swings in an asset over time. High volatility means large and frequent price moves, both up and down.

Unemployment rate

The share of the labor force that is without a job but actively looking for work. It is a key indicator of economic health and influences rate decisions.