This article was first published on Deythere.

- Bitcoin Back to Top of List of World’s Biggest Payment Methods

- Stablecoins and Operational Usage Expand

- Altcoins and Payment Network Diversification

- Global Distribution of Crypto Payments Activity

- Conclusion

- Glossary

- Frequently Asked Questions About Crypto Payments in 2025

- What does the 22.1 percent share mean for crypto payments?

- How many payments were made globally using Bitcoin in 2025?

- Why did USDC surpass USDT in payments?

- Do companies need stablecoins for payments?

- What other cryptos increased in usage for payment in 2025?

- References

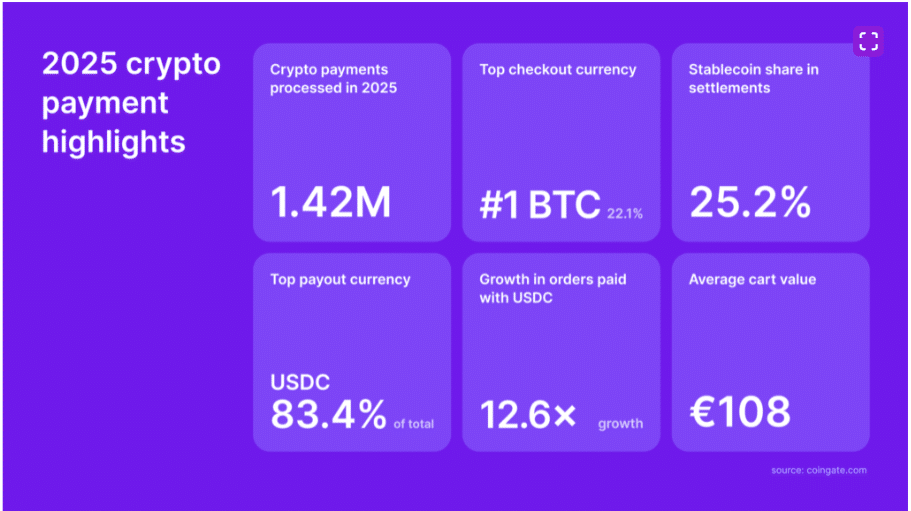

Crypto payments have blossomed into a worldwide business financial tool, according to the latest CoinGate annual payments data. Bitcoin regained the title of most-utilized cryptocurrency for payments, accounting for 22.1% of all transactions on the platform.

This represents both consumer and corporate spend with crypto, and a further level of business adoption for settlement, treasury management, cross-border payouts and even operational capital.

Bitcoin Back to Top of List of World’s Biggest Payment Methods

The latest CoinGate report reveals that in 2025, Bitcoin again became the top cryptocurrency of choice for payments, accounting for up to 22.1 percent of all transactions.

This is a reversal from 2024, when Tether’s USDT had the largest share of crypto payment use. More than 1.42 million crypto payment transactions were handled by CoinGate in 2025, about one order every 22 seconds, bringing the platform’s lifetime total to over 7 million.

Almost 11.3 percent of Bitcoin payments occurred through the low-fee Lightning channels, while the rest were routed on-chain.

Bitcoin’s control of crypto payments is not only limited to small value checkouts. On-chain data clearly reveals that Bitcoin is scaling and being used for higher-value transactions such as travel bookings, tech services,as well as cross-border money transfers.

Stablecoins and Operational Usage Expand

Although Bitcoin moved back to the top, stablecoins continued to drive the vision of a crypto payments future. Nearly 30 percent of total crypto payments were made in stablecoins, though the composition changed during the year.

USDT’s dominance fell as regulatory pressure broke out under frameworks such as the EU’s Markets in Crypto-Assets (MiCA), pushing some merchants to begin winding down its acceptance.

USDC however came out in its place as the dominant stablecoin with USDC payment order volume increasing nearly thirteen times what it was in 2024.

CoinGate data also indicates that settlement habits are beginning to change, with more merchants electing to hold crypto settlements instead of immediately converting them into fiat.

The share of transactions settled in stablecoins increased to 25.2%, and overall crypto settlements increased from 27% in 2024 to 37.5% in 2025.

Altcoins and Payment Network Diversification

Beyond Bitcoin and stablecoins, growth in crypto payments was also noticeable for other cryptocurrencies. Litecoin remained the 3rd most popular cryptocurrency for payments, accounting for 14.4 percent of transactions according to CoinGate, briefly climbing to 2nd place during the summer months.

Litecoin is still commonly accepted as well as used by consumers and merchants alike due to the low fees and quick confirmation,s making it practical for consumers as well.

Tron’s TRX and Ethereum’s ETH on native token payment shares rose as well. For the year, TRX payment share increased from 9.1% to 11.5% and ETH increased from 8.9% to approximately 10.6%.

On the network side of things, Tron and Ethereum ranked among the largest chains by usage.

Layer 2 networks like Polygon, Arbitrum and Base gained more widespread use as well, offering faster and cheaper settlement options.

These chains helped push higher through0ut and also the diversity of the crypto payments in 2025.

Global Distribution of Crypto Payments Activity

The United States was the top country by transaction volume on CoinGate, with about 24.4% of overall processed payments. Germany and the Netherlands were the other top markets.

Fast-growing markets such as Nigeria stayed active on the list, indicating widespread adoption of digital payments around the world.

The global and growing relevance of digital assets in world trade is massive. Businesses on different continents have started to look at crypto as a payment option, and even more so, as a cross-border settlement and treasury tool that allows money to be moved quickly without relying on traditional banking intermediaries.

Conclusion

Crypto payments matured in 2025, and Bitcoin reclaimed the top spot as the most used crypto payment asset with a 22.1% share, outperforming stablecoins and other alts in terms of global transactional activity.

Data suggests that digital assets are no longer just used at the point of sale but also for settlement, treasury management, payouts and operational capital across continents.

With the roles of stablecoins changing and network usage extending to Bitcoin, Litecoin, Tron, and Layer 2 solutions, crypto payments adoption is in for a wholesome ride.

Glossary

Crypto payments: the use of digital currencies as a means of transaction and business financial processes.

Lightning Network: a layer-2 protocol for Bitcoin which uses payment channels to facilitate quicker low costs transactions off the main blockchain.

Stablecoin: A type of cryptocurrency whose value is pegged to a fiat currency or exchange-traded commodity and used to make payments or store value.

Settlement: The completion of a transaction, and in turn the transfer and recording of value on the blockchain or ledger.

Frequently Asked Questions About Crypto Payments in 2025

What does the 22.1 percent share mean for crypto payments?

It means that in 2025, Bitcoin represented 22.1 percent of processed transactions on CoinGate and was the most popular cryptocurrency used in transaction flows.

How many payments were made globally using Bitcoin in 2025?

CoinGate processed approximately 1.42 million crypto payments in 2025.

Why did USDC surpass USDT in payments?

Some regulatory updates, and compliance with MiCA requirements played a role in the fact that many merchants phased out USDT, while USDC gained its popularity really quickly due to business acceptance as well.

Do companies need stablecoins for payments?

Yes, stablecoins were almost 30 percent of crypto payments, and they became much more widely used for settlements and payouts.

What other cryptos increased in usage for payment in 2025?

Litecoin, TRX and ETH also gained payment share in 2025

References