This article was first published on Deythere.

Bitcoin has been under intense pressure this year, with a renewed drop in its price provoking discussions among market strategists and bearish warnings about more economic stress.

Mike McGlone of Bloomberg Intelligence speaking publicly said his belief is that Bitcoin’s recent decline is the result of increased financial instability, and went as far to even predict that BTC could be on its way back down towards $10K in the event of a recession setting in within the United States.

Other analysts remain cautious about such an extreme outcome, which they dismiss as a small possibility without some major systemic event.

Mike McGlone’s Bitcoin Recession-Linked Bitcoin Forecast

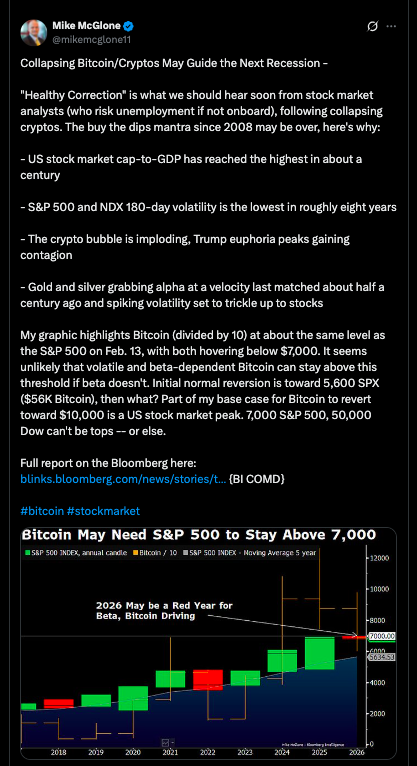

Bloomberg Intelligence senior macro strategist Mike McGlone has linked Bitcoin’s downward moves to bigger signs of financial stress, suggesting that patterns in the crypto market could be creating weakness in the economy. Bitcoin had plummeted along with other risk assets, its price falling significantly below October 2025 highs as of mid-February 2026.

The traditional “buy-the-dip” attitude that had supported BTC during previous drawdowns has seemingly eroded, according to McGlone, a change he suggests means increasing fragility across risk markets more broadly.

McGlone pointed to valuations of the U.S. stock market near record high levels compared with GDP, along with abnormally low volatility in benchmark indexes, as conditions that usually have preceded a correction.

He also described the “crypto bubble” as “imploding,” adding that “Trump euphoria” has peaked and is contributing to contagion across markets.

On social media, he wrote that the collapsing cryptos could be “a signal of broader financial stress and recession risk”, explaining that if equities face a deeper collapse, BTC could easily follow suit as correlations generally tighten during risk-off times.

Using McGlone logic, if wide equity markets top and then offer a hard correction, Bitcoin could see a proportionate decline toward the $10,000 level.

This is a very large pullback from recent pricing, but his perspective places it as a potential reversion to mean behavior under high stress.

Market Background: Volatility, Stocks, Risk Appetite

The current macro background shows equities plying near record capitalization highs relative to GDP, a condition likely to elevate risk in both asset classes, according to McGlone. Then there are indicators that the 180-day volatility in the S&P 500 and Nasdaq 100 have compressed.

It is a rare occurrence that generally comes before complacency just before such compression transitions to correction. McGlone’s commentary draws a bigger connection between these conditions and BTC’s relationship with market beta, in other words, Bitcoin’s tendency to amplify broader-market moves both upward and downward.

In recent days, gold and silver have also picked up strength, with McGlone noting precious metals “grabbing alpha” from the volatility, often associated with capital moving toward perceived safe havens.

This rotation could mean more of a flight from risk assets like Bitcoin and into safer stores of value, helping to support his idea about rising Bitcoin recession risk and speculative stress.

Opposing View: Analysts Who Don’t Believe in Bitcoin’s Downside Potential

Not everyone in the industry shares the dire nature of McGlone’s outlook. Jason Fernandes, a market analyst and co-founder of AdLunam, contradicted that any breakdown to $10,000 would necessitate “a true systemic event” like a massive credit shock, intense liquidity crunch or disorderly collapse in the equity markets, scenarios he thinks unlikely without broader financial calamity.

Fernandes described the idea of a straight path to $10,000 as based on “false equivalence and single-path bias,” stressing that markets can adjust through time, rotation, or inflation erosion without this kind of collapse.

His stance remains on the fact that although Bitcoin has correlated more closely with equities in drawdowns, it doesn’t necessarily result to a symmetric crash or Bitcoin recession. Instead, market correction can occur in steps, which can result in consolidations or mild reset rather than a terminal crash.

February 2026 Bitcoin Price Moves and Indicators

As at the time of writing, Bitcoin sits around the $68,000 range after dropping to almost $60,000. This is a long drawn correction phase from its peak in October 2025 at over $126,000. ETF flows have been seeing outflows in recent weeks, meaning some investor headwind but not a whole abandonment of exposure to BTC.

Analysts also note that macro volatility and slumping risk appetite have occurred alongside BTC’s underperformance when compared to other assets such as gold. Bitcoin’s mining difficulty experienced one of its largest declines since 2021, suggesting reduced market participation and heightened caution among miners during price drawdowns.

On-chain data collectors note that BTC being moved to exchanges which is typically a sign that sell pressure is imminent, has spiked at some levels. These tendencies influence more general investor sentiment indicators that provide inputs for macro strategist models relating BTC returns to systemic risk perceptions.

Conclusion

The question of whether Bitcoin could hit $10,000 is an intense matter and a profound query about the relationship between crypto markets and broader financial systems. Mike McGlone’s Bitcoin recession-related prediction reveals how the current macro conditions may fuel a price reversion in times of extreme stress.

Counters to such a claim however, sees a much less likely path as long as there is no big systemic event. What is evident is that Bitcoin as of this February remains more closely linked with macro sentiment, and there are readings coming through in its price action which offer insight into the general level of risk appetite seen across global markets.

Glossary

Macro volatility: Fluctuation in global market indicators, with reference to equities, bonds and commodities; frequently an outcome of risk appetite.

Market beta: A measure of how much an asset moves with broader movements in the market; Bitcoin is often considered high-beta.

Risk assets: financial instruments whose value is determined by sentiment on the part of investors (e.g., stocks, cryptos).

ETF flows: Direction of capital within or out of exchange-traded funds, signaling investor faith or aversion.

Frequently Asked Questions About Bitcoin Recession

What is the warning of a Bitcoin recession about?

Analyst Mike McGlone recently pointed out that Bitcoin price is trading in a similar way to the S&P 500 during the 2008 financial crisis, and could suffer a similar fate as it drops from an equilibrium range.

Why did McGlone associate BTC with recession risk?

He cites stretched stock valuations to GDP and previously low equity volume, which he implies suggest risk assets may enter new depths, which tends be negative for Bitcoin.

Is a fall to $10,000 likely?

Other analysts say that such a drastic decline would necessitate systemic shock, not just average market adjustments, and therefore is still a low-probability scenario.

What macro trends are affecting Bitcoin’s movement at the moment?

Investor sentiment, ETF flows, performance of the traditional equities market and broad risk appetite are listed as factors driving Bitcoin’s price in 2026.

Is this to say Bitcoin is a recession indicator?

Although Bitcoin may act as an indicator of risk appetite, it’s still an open question among economists and market strategists as to whether it correctly predicts recessions.