Updated on 22nd October, 2025

Key Takeaways

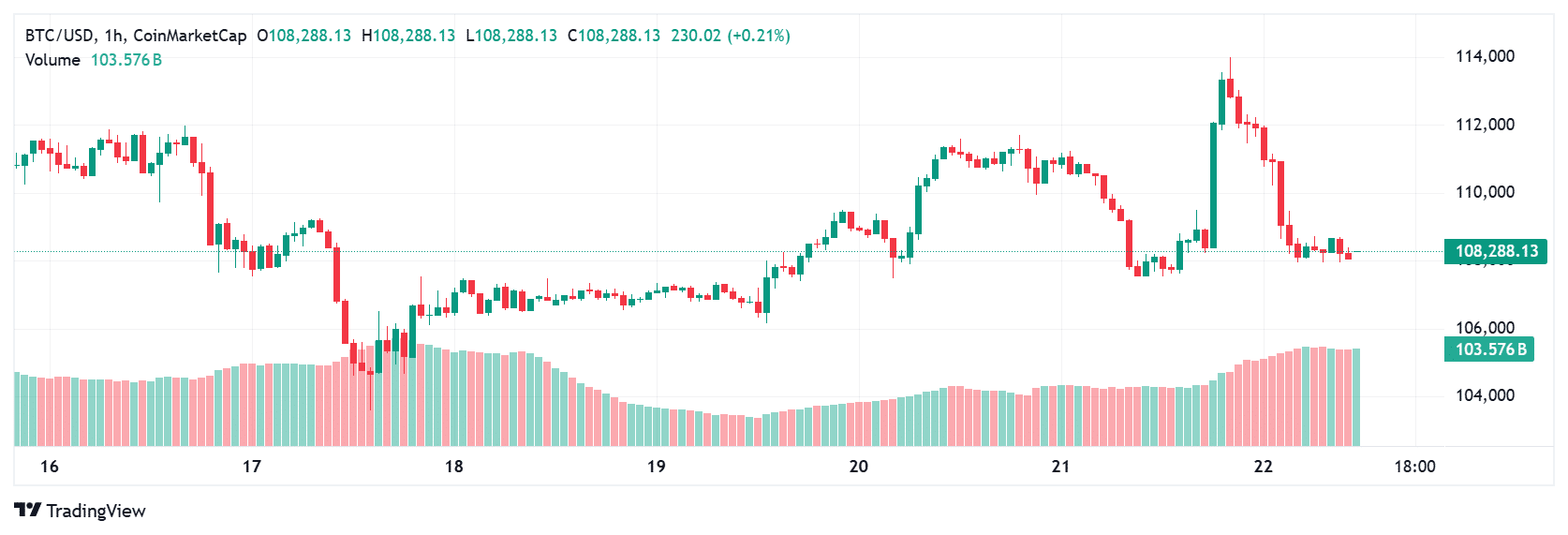

• Bitcoin touched 114K driven by strong futures demand and macro optimism before retreating to 108K as selling pressure increased

• Analysts say the U.S.–Australia minerals deal boosted global risk appetite and helped fuel the initial Bitcoin rally before profit-taking returned

Bitcoin showed signs of strength early in the week as the price briefly pushed to 114,000 dollars before reversing back to 108,000 dollars. The move ignited debate among traders. Was the Bitcoin rally a genuine trend continuation, or just a liquidity-driven spike triggered by macro headlines and aggressive futures positioning

The price action arrived at the same time the United States and Australia announced a major strategic deal focused on critical minerals and rare earth elements. The agreement, valued at nearly 8.5 billion dollars, aims to secure supply chains for essential industrial metals outside of China. The news also boosted commodity markets and risk sentiment. Investors reacted positively as the deal signaled deepening Western economic cooperation.

Market commentators say the same global optimism spilled into crypto. Bitcoin tends to follow macro liquidity flows, and the market interpreted the deal as a sign of geopolitical and economic stability. That narrative helped ignite a Bitcoin rally from 110K before price was sharply rejected at 114K resistance.

Futures Markets Fuel Bitcoin Rally but Set Up Pullback

Open interest in Bitcoin futures jumped past 32 billion dollars, indicating higher leverage entering the market. Rising open interest is often seen during a Bitcoin rally because it shows traders are taking new positions. Funding rates rose modestly, showing longs dominated the market. The build-up of leverage helped fuel upward momentum.

However, high leverage also increases liquidation risk. Once price lost steam at 114K, late long entries were wiped out, sending price back to 108K support.

Macro strategist Lyn Alden commented on X that liquidity still drives Bitcoin’s direction more than headlines. She said, “Market structure matters more than narrative. Liquidity cycles shape crypto moves, whether tied to geopolitics or not.” Her view suggests that while news like the U.S.–Australia deal can trigger sentiment, technical factors decide follow-through.

Spot market flows also played a role. Exchange inflows increased near 114K as whales moved coins to trading platforms, signaling intent to sell and lock profits from the Bitcoin rally. That supply surge capped price and drove the pullback.

Bitcoin Rally Rejected at Resistance: Price Prediction Outlook

Bitcoin Rally Faces Key Resistance at 114K

The failed breakout at 114K created a clear liquidity barrier. Trading volume thinned once sellers stepped in, and price retreated in a controlled decline rather than a crash. That is a common pattern during a cooling Bitcoin rally.

The Relative Strength Index sits near 57, which keeps Bitcoin out of overbought territory. MACD momentum remains positive on the daily chart. Price currently tests the 20 day moving average near 108,500 dollars. If that level holds, buyers may attempt another push to 112K. A break above 114K would invalidate the short-term bearish bias and reopen upside levels at 118K and 120K.

If price weakens further, traders see likely downside targets at 105K and 102K. A drop below 100K would signal broader sentiment deterioration, though that scenario is not dominant yet.

Popular crypto trader Scott Melker noted on X,

“Structure still intact unless 105K breaks. Higher time frames remain bullish. Healthy corrections are part of every Bitcoin rally.”

His view matches technical signals that long term momentum remains positive despite short term volatility.

Summing Up

The latest Bitcoin rally to 114K was triggered by a mix of macro optimism and futures leverage. The U.S.–Australia trade announcement improved global investor confidence, and rising open interest strengthened the move.

However, overhead resistance and profit-taking stopped the rally in its tracks. Analysts say Bitcoin needs strong volume to reclaim 114K. Until then, price will likely range between 108K and 114K.

Bitcoin still holds a long-term bullish structure, but traders must watch liquidity zones closely. If global risk appetite continues rising, momentum could return. If macro pressure increases, another retest of 105K support is possible.

Frequently Asked Questions

Why did Bitcoin fall from 114K to 108K

Price rejected major resistance, and rising exchange inflows signaled profit-taking from large wallets.

Did the U.S.–Australia deal affect Bitcoin

Yes. It briefly improved global risk sentiment, boosting commodities and indirectly helping the Bitcoin rally.

Is the Bitcoin rally over

No. Price still holds key support, and long term bullish structure remains valid above 105K.

What level must Bitcoin break to turn bullish again

A close above 114K with volume is needed for continuation toward 118K and higher.

Glossary

Open Interest

The total number of active futures contracts. Rising open interest signals increased trading activity.

Market Liquidity

The depth of buy and sell orders. Higher liquidity reduces volatility risk during a Bitcoin rally.

Funding Rate

Fee paid between futures traders to maintain contract balance. Positive rates show buying pressure.

Resistance Level

A price zone where sellers overpower buyers and often reverse a rally.