El Salvador has introduced a new Investment Banking Law, sparking renewed institutional interest and boosting market optimism. The legislation, passed on August 7, allows licensed banks to hold Bitcoin and operate in multiple currencies. This shift strengthens the nation’s bid to become a regional hub, and Bitcoin price prediction now points to continued gains.

New Law Reshapes Banking Rules

The Investment Banking Law separates investment banks from commercial lenders, granting broader powers for digital asset holdings. Under this framework, institutions can deal in legal tender, foreign currencies, and cryptocurrencies, including Bitcoin. However, they may only serve “sophisticated investors” with at least $250,000 in investable assets.

Authorities have set a minimum capital requirement of $50 million for these banks to secure licenses. This ensures participants have significant resources for large-scale operations. The regulation also opens pathways for tokenized bonds, stablecoin services, and crypto-backed project financing.

Juan Carlos Reyes, president of the Commission of Digital Assets, confirmed that banks could operate entirely as Bitcoin-focused entities. He emphasized that this could diversify funding channels for infrastructure and innovation, and foreign capital inflows are expected to increase as a result.

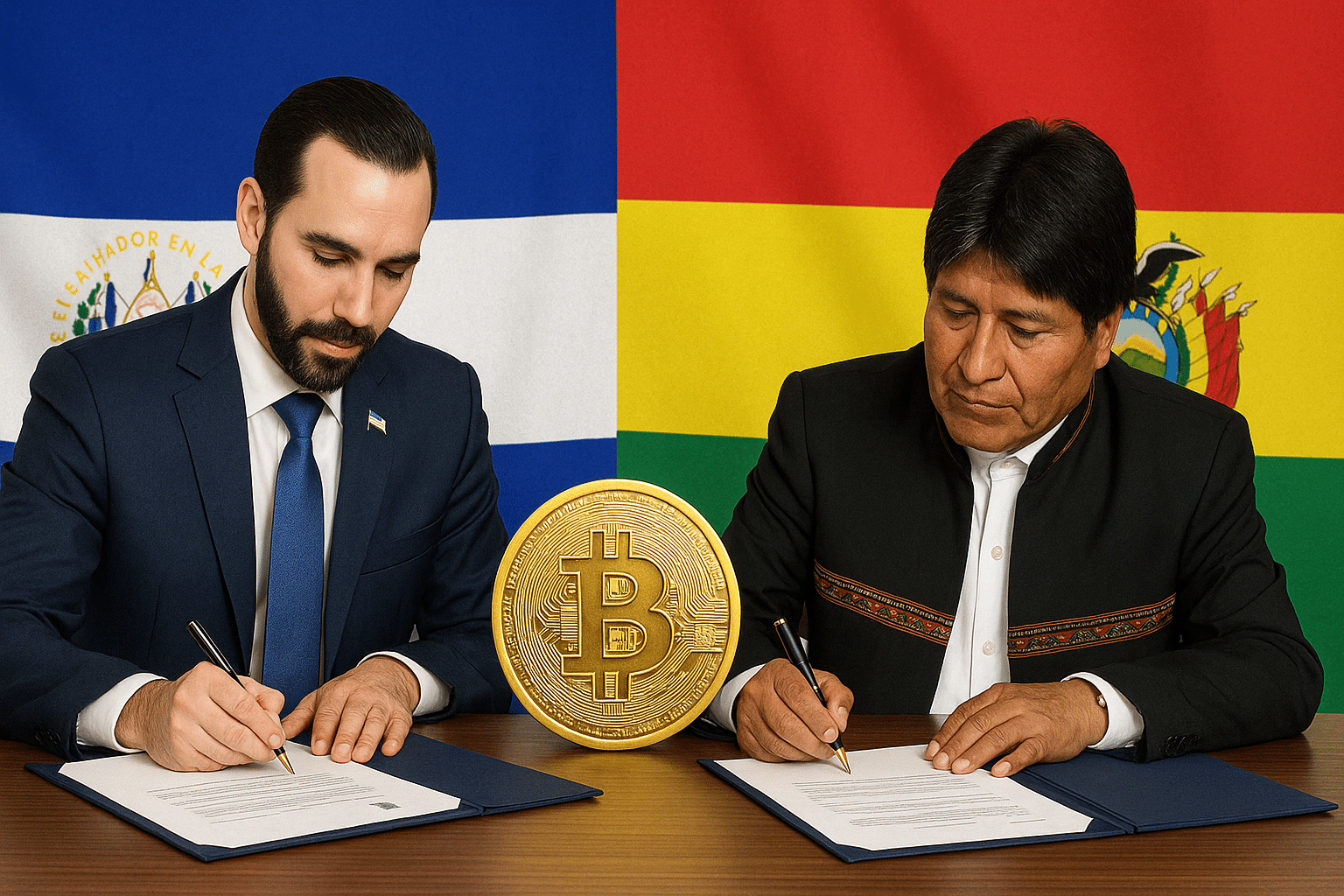

El Salvador, Bolivia Sign Cryptocurrency Adoption Deal

President Nayib Bukele met with Bilal Bin Saqib, Pakistan’s state minister of crypto and blockchain, to explore nation-level adoption strategies. The meeting covered mining policies, energy cooperation, and cross-border investment opportunities. Officials believe such partnerships will enhance El Salvador’s standing in the global digital asset market.

On July 30, Bolivia’s central bank signed a memorandum with El Salvador’s regulators to promote cryptocurrency adoption. The agreement comes amid Bolivia’s dollar shortage, which has increased reliance on dollar-backed stablecoins. According to Tether CEO Paolo Ardoino, demand for stablecoins in Bolivia is skyrocketing.

These moves signal El Salvador’s broader aim to position itself in global financial networks. By combining domestic reforms with international alliances, it is strengthening its role in regulated crypto markets. This approach may also expand Bitcoin’s liquidity channels.

Market Signals and Bitcoin Price Prediction

Bitcoin price is trading at $118,059 after a 0.28% daily gain, breaking out from a bullish flag pattern. This is after weeks of consolidations along an uptrend line. The 50-day SMA at 113,732 is regarded as one of the primary dynamic supports.

A bullish crossover followed on the MACD and thus signaled an increasing momentum. The RSI is already at 5,7, which indicates that it can still rise. A level on the sight of traders to confirm breakout is $117,350.

A sustained close above $123,250 could push Bitcoin toward $127,000, with $130,000 as a medium-term target. Negatively, we see that the values of $113,678 and $110,721 could serve as a rigid accumulation area. Analysts say the Bitcoin price prediction remains bullish if macro factors and institutional demand align.

Summary

The Investment Banking Law of El Salvador gives approved and licensed banks the right to use Bitcoin and act with wider asset classes. The law focuses specifically on advanced investors, and higher capital requirements are established to provide a stable environment. International positioning through regional partnerships, such as the partnerships with Pakistan and Bolivia, is desired.

The Bitcoin price action is bullish, according to the market statistics, and the further target points will be at $127,000 and above, depending on the preserved momentum. Additional gains may be made based on institutional interest and macro supportive trends.

For more crypto news or price predictions, visit our platform.

FAQs

What is the Investment Banking Law of El Salvador?

It will be the law covered by the licensed investment banks to hold Bitcoin and other assets and target sophisticated investors.

Who is a sophisticated investor of the new law?

A minimum of $250,000 investable assets and market knowledge are required of an investor.

How much do you need to start an investment bank as a licensed one?

In order to acquire a license, banks must have a capital of at least 50 million dollars.

What is the performance of Bitcoin following the pass of the law?

Technically, Bitcoin is in a trading position above $118,000, with the following bullish action breaking out of the bullish structure.

What are Bitcoin’s major technical objectives?

Analysts think that there is a possibility that they can reach $127,000 and $130,000 targets with bullish momentum.

Glossary of Key Terms

Bitcoin Price Prediction – The estimation of Bitcoin’s price in the future, taking into account trends and technical analysis.

MACD: A momentum-driven indicator that displays the direction of a trend, as well as the strength of the trend.

RSI: Relative Strength Index- a sign indicating whether the market is overbought or oversold.

SMA: Simple Moving Average is a popular technical indicator that follows the price trend.

Tokenized Bonds: Traditional bonds, which take the form of tokens on a blockchain.