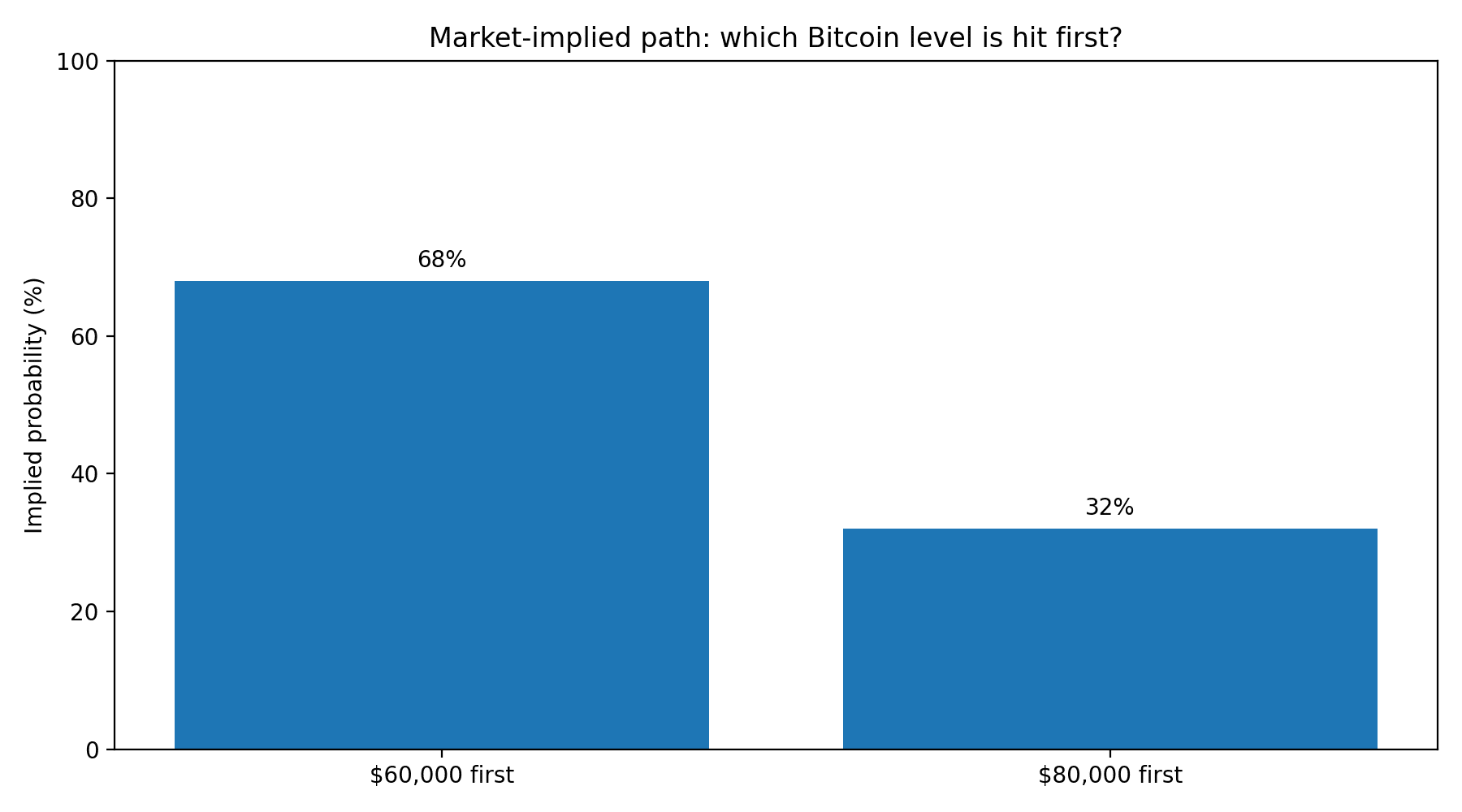

A fresh Bitcoin price prediction is taking shape in the one place that tends to be brutally honest about fear and greed: a live prediction market. Traders there are giving the edge to Bitcoin tagging $60,000 before it reaches $80,000, with odds hovering around 68% and meaningful trading volume behind the bet.

That does not read like a collapse call. It reads like a market that expects a pullback, the kind that happens when a move gets crowded and liquidity thins out. Bitcoin has been trading in the high $60,000s in recent sessions, with reports placing it around $67,000 to $69,700 depending on the day, while macro data has kept rate-cut expectations in check.

Bitcoin price prediction: what the odds are really saying

This Bitcoin price prediction is about the order of destinations, not a final verdict on the cycle. The question is whether sellers can drag price down to a deep, obvious level first, before buyers manage another push toward a big round number above. Markets often behave like a crowded elevator: once everyone is leaning the same way, the smallest jolt can force a shuffle.

If Bitcoin revisits $60,000, it would not be a random number. It is a psychological shelf where long-term holders often look for value, and where short-term traders tend to place clustered bids and stops. The odds imply that traders see a higher probability of that “shakeout” path than a clean climb to $80,000.

The chart signals traders watch first

A serious Bitcoin price prediction usually starts with trend and momentum. Moving averages help frame whether the market is walking uphill or sliding downhill. When price stays above key averages, buyers typically control the tape; when it loses them, rallies can start to look like temporary bounces.

Momentum indicators such as the Relative Strength Index can add texture. A high RSI can signal overheating, while a low RSI can hint at exhaustion, though it is never a standalone buy or sell button. Volume matters as well because price moves on thin participation can fizzle quickly, while moves backed by strong turnover tend to stick. Recent coverage has noted shrinking overall crypto volume during periods of consolidation, which can make sudden drops and rebounds more likely.

On-chain and flows: the quieter signals

A grounded Bitcoin price prediction also checks what holders are doing rather than only what traders are saying. Exchange inflows can suggest sell pressure if coins move onto trading venues, while outflows can hint at accumulation and long-term custody behavior. Wallet activity, realized profit-taking, and the age of coins being spent can all help answer a simple question: is this selling from nervous newcomers or distribution from experienced hands?

Institutional flows matter too, especially in a market that has become increasingly sensitive to spot product demand and broader risk appetite. When macro uncertainty rises, Bitcoin often trades like a high-beta asset, reacting to shifts in liquidity expectations.

Derivatives: where leverage leaves footprints

A practical Bitcoin price prediction has to account for leverage, because leverage turns small moves into forced moves. Open interest shows how much futures risk is stacked in the market, while funding rates reveal whether traders are paying up to stay long or short. When funding runs hot and open interest climbs, the market can become fragile, and a dip can cascade into liquidations that push the price lower than most “reasonable” models would expect.

That is the pathway that makes $60,000 plausible even if the longer trend remains constructive: not a change in belief, but a change in positioning.

A reasonable path: $60,000 first, then the real test

Putting the pieces together, the current setup supports a cautious Bitcoin price prediction that respects both directions. A dip toward $60,000 fits the crowd’s pricing and the way leverage unwinds, while a later move toward $80,000 would likely require steadier participation, improving macro clarity, and momentum that can hold above key technical levels. The market has already shown it can swing hard around the $60,000 area, rebounding sharply after brief visits near that zone.

Conclusion

In this Bitcoin price prediction, the headline is not panic, it is sequencing. Traders are leaning toward a messy route that tests conviction near $60,000 before optimism earns its way back toward $80,000, and the next leg will likely be decided by momentum, real volume, and how much leverage remains in the system.

Frequently Asked Questions (FAQs)

What does this Bitcoin price prediction suggest for the next move?

This Bitcoin price prediction suggests the market sees a higher chance of Bitcoin touching $60,000 before it can reach $80,000, which is a short-term caution signal rather than a long-term ceiling.

Are prediction-market odds reliable?

They can be useful as a real-time sentiment gauge because money is at risk, but odds change quickly and can be wrong, especially during headline-driven volatility.

Which indicator matters most right now?

Trend plus positioning tends to matter most: whether price holds key moving averages, and whether leverage, funding, and open interest are building conditions for a squeeze.

Glossary of key terms

Relative Strength Index (RSI): A momentum indicator that helps estimate whether an asset is overbought or oversold based on recent price changes.

Moving average: A smoothed price line used to judge trend direction and potential support or resistance zones.

Open interest: The total number of active futures contracts, often used to assess how much leverage is in the market.

Funding rate: A periodic payment between long and short futures traders that signals which side is paying to hold positions.

Exchange inflows and outflows: On-chain tracking of coins moving into or out of exchanges, used to infer potential selling or accumulation behavior.

Disclaimer

This article is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer to buy or sell any asset.

Sources