As October 2025 approaches, Bitcoin price prediction in October is being forecasted by analysts. Using long-cycle fractal models, analyst Joao Wedson says $BTC could top out near $140,000 before dropping drastically to $50,000 in 2026. But other analysts argue that a softer decline or even a flip higher remains possible.

Bitcoin’s Fractal Cycle and the October Top

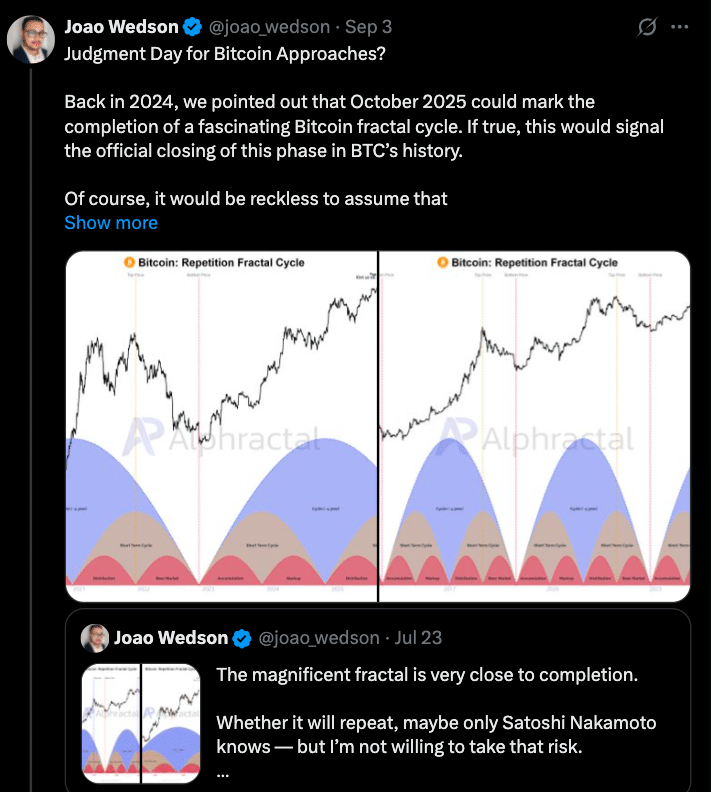

Wedson’s analysis, based on 35-month cycle patterns, points to October 2025 as the top. If true, he says it could be followed by a big drop to $50,000 the following year. Previous cycle models show a big rally near a mid-cycle top before capitulation and Wedson warns not to ignore this.

But this model clashes with the new influence of institutional factors. With ETFs and institutional accumulation changing the game, the old patterns’ reliability remains to be questioned.

Also read: Bitcoin Price Prediction 2025: Can $BTC End the Year Above $170K?

Institutional Flows and ETF Momentum

Institutional demand has changed the Bitcoin path. Since early 2024, spot Bitcoin ETFs have seen over $54 billion in inflows pushing the market to at new highs. BlackRock’s iShares Bitcoin Trust alone has $80 billion in AUM. U.S. Bancorp just relaunched its institutional custody service to cater to this demand .

These changes have brought deeper liquidity and reduced volatility. Some say price corrections may now be shallower, between 26% to 50%, compared to the 70–80% bear drops that followed previous bull runs.

Bull, Base, and Bear Scenarios for Bitcoin’s Path

In the Bull case, Institutional investment pours in way more than current levels, ETFs continue to dominate flows, and macro support holds. Technicals stay strong and momentum takes $BTC above $140K, possibly to new highs, with corrections minimal or none.

In the Base case, $BTC tops out short term between $130K-$150K, possibly in October, and then consolidates. Macro uncertainty and reduced ETF flows temper growth, resulting in a range bound pattern between $100K-$130K into 2026.

In the Bear case, Bitcoin price prediction in October sees $140K, after which $BTC can’t hold support and institutions start to withdraw. Fractal collapse takes prices to $50K. Macro risk and reduced ETF demand can amplify all of that.

Expert Forecasts for Bitcoin Price Prediction in October And Beyond

Here’s how notable viewpoints compare:

| Analyst / Source | Forecast Summary |

| Joao Wedson (Alphractal) | October 2025 could mark a top near $140K, followed by a crash to $50K in 2026. |

| CryptoBullet | $BTC may peak around $150K in October using ‘tick-tock’ fractals. |

| InvestingHaven | Continued ETF and corporate adoption could sustain BTC between $125K–$200K. |

| Bernstein Analysts | Expect rally toward $200K given ETF momentum and institutional adoption. |

| Global X ETF Forecasts | Predict 45% upside, putting $BTC near $200K within 12 months. |

| H.C. Wainwright Analysts | Bullish end-of-year target of $225,000. |

Also read: Bitcoin Price Analysis 2025 and 2026: Will BTC Continue Its Bullish Climb or Face Resistance

Macro Factors and Political Tailwinds

Broader economic forces and politics also weigh in heavily. Tariff tensions and the now deleted Elon Musk’s recession comments are big risks for October and beyond. If equities drop, Bitcoin may mirror the moves and follow.

At the same time, political developments could provide support. Trump’s executive order to create a Strategic Bitcoin Reserve has elevated the asset’s status. This reserve makes $BTC a national financial asset not a speculative token.

However, using cryptocurrency in policy still raises long term questions and debates from critics about stability and investor sentiment.

Conclusion

Based on the latest research, Bitcoin price prediction in October points to either triumph or collapse, leading at the intersection of cycle-based models, institutional momentum, and political influence.

If $BTC stalls at $130K or crashes to $50K, the outcome will lay the grounds for the next cycle.

Stay up to date with expert analysis and price predictions by visiting our crypto news platform.

Summary

Looking at Bitcoin price prediction in October; Analyst Joao Wedson says Bitcoin will hit $140K in October 2025 and then $50K in 2026. Strong ETF inflows and institutional adoption counterbalance the cycle risk, so some are forecasting $200K. Outcomes range from big upside, measured consolidation to crash.

Glossary

Bitcoin October Reckoning – The term for a predicted peak in BTC around October 2025 that may lead to a big correction.

ETF Inflows – Investments into Bitcoin ETFs, often a sign of institutional demand and liquidity shifts.

Fractal Cycle – A pattern in Bitcoin’s price that aligns bull and bear phases over multi-year periods.

Strategic Bitcoin Reserve – A US Treasury managed holding of Bitcoin established by executive order, a government reserve asset.

Macro Tailwinds / Headwinds – External economic conditions (inflation, tariffs, equities) that can impact asset price.

FAQs on Bitcoin Price Prediction in October

Will October be the top?

It lines up with the cycles but institutional demand and macro sentiment can extend or prevent the top.

Why will Bitcoin go to $50K?

If the expected correction meets bearish sentiment and institutional liquidity pullback, the patterns could play out sharply.

What supports the bullish view?

ETF inflows, policy support and Bitcoin being “digital gold” will keep price above $100K.

What should investors do?

Investors are advised to watch ETF flows, support/resistance levels and macro indicators. Don’t make emotional trades, and above all, DYOR.