This article was first published on Deythere.

- The Ideal Setup: ABCD and Demand Zone

- Macro and Institutional Catalysts Supporting This

- Bitcoin Price Predictions: What Analysts are Seeing Now

- Bull, Base, and Bear Scenarios

- What To Watch Next

- Conclusion

- Glossary

- Frequently Asked Questions About Bitcoin Price Predictions

- What is the “Bitcoin for America Act”?

- Why is $74,500-$83,800 key?

- Where does Metaplanet fit within the Bitcoin framework?

- What are the downside (bear case) risks?

- How likely is an 86K point?

- References

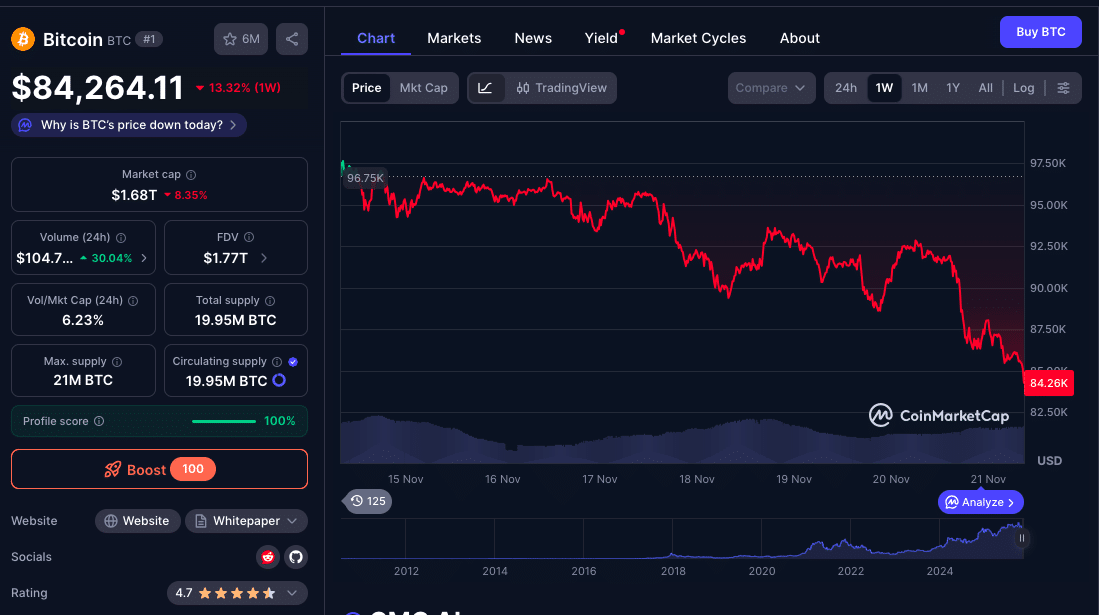

Market analysis is showing that $BTC is close to hitting the critical demand area between $74.5k and $83.8k where buyers have previously taken over from sellers.

Meantime, a larger ABCD pattern seems to be nearing completion with some expectations for a rally toward $86k.

This technical setup is coming on with a series of powerfulheadlines. A bill in the U.S. Congress that would let people pay federal taxes with Bitcoin; the market for European crypto ETPs appears to be taking off; and Metaplanet, one of the world’s leading corporate treasury firms, has raised $135 million to buy more $BTC.

All of these boil down to a closely-watched Bitcoin price prediction, one that could help as crucial pointers through the rest of 2025.

The Ideal Setup: ABCD and Demand Zone

The current Bitcoin price prediction is also heavily based on an impending demand zone that sits between $74,500 and $83,800.

This zone lines up with a 0.618 retracement of the 2025 uptrend, and has been cited as an important area to observe, according to some analysts.

Recent reports suggest $BTC’s breach of this ascending trendline and the presence of a classic three-black-crows candlestick formation on the daily chart invites further selling pressure.

In the meantime, momentum indicators such as the RSI have hit the mid-20s, a point at which one would expect a rally to start, although there hasn’t been an obvious bullish divergence formed.

In the event of completion with a final push at ABCD, the next logical is around $86,000 in which the market would expect a strong rejection to turn things back towards higher valuations.

A significant push above that may open the door for a possible rally towards $97,500 or even $111,300 where old resistance zones are located.

Macro and Institutional Catalysts Supporting This

Apart from technicals, the big macro and institutional developments are reinforcing the Bitcoin price prediction.

Congressman Warren Davidson just introduced the Bitcoin for America Act, which recommended a U.S. citizen pay their federal taxes in $BTC.

The bill also recommends setting up a Strategic Bitcoin Reserve, a government-held long-term cold storage treasury of Bitcoins.

Such a proposal has the potential to significantly increase the long-term demand and institutional legitimacy of $BTC.

Meanwhile, a publicly traded company in Tokyo called Metaplanet is seeking to raise $135 million directly into Class B perpetual preferred shares in order to increase its Bitcoin treasury.

The company currently has 30,823 BTC (according to recent filings) and tapped a $100 million loan secured by $BTC for further accumulation.

These actions not only indicate a culture of bullish price bets but also structural commitment to Bitcoin as a core treasury asset an important demand accelerator if it holds.

Bitcoin Price Predictions: What Analysts are Seeing Now

Here’s a table of current Bitcoin price prediction estimates based on recent technicals and macro analysis:

| Scenario | Price Target / Range |

|---|---|

| Upside Target | $86,000 |

| Bullish Stretch Range | $97,500 – $111,300 |

| Current Trading Range | $75,000 – $90,000 |

| Key Demand Zone | $74,500 – $83,800 |

| Breakdown Risk Below | $74,500 |

These predictions display diverse, yet largely positive expectations: in the near-term, $86,000 will serve as a technical level, while into the longer stretch we could also contemplate continuous demand and accumulation.

Bull, Base, and Bear Scenarios

In the bull case, If Bitcoin rallies from the current area of demand and hits an ABCD formation, then a move to $86,000 may ignite momentum again.

Added to the Congressional efforts of adopting $BTC for taxes as well as large scale treasury accumulation by firms like Metaplanet, the market may see institutional and macro demand drive $BTC towards $97,500 – $111,300 in time.

In the base case, Bitcoin holds steady between $75,000 and $90,000. The demand area remains in tact but the follow through is weak.

Metaplanet and other institutional players are still racking up, but overall market flows remain neutral. $BTC price trades in a range-bound manner as it consolidates the gains.

In the bear case, demand zone of $74,500-$83,800 gives way conclusively. In the absence of solid buyer protection, $BTC may decline once again and retest lower structural supports.

Macro headwinds like harsh regulation or slowing adoption may suppress demand, and the consolidation or an even deeper correction could drag out longer.

What To Watch Next

Price action in and around the demand zone, particularly if $BTC prints bullish rejection candles near $74,500-$83,800.

The progress of the Bitcoin for America Act. Passage, or a serious momentum, might massively raise long-term demand.

How Metaplanet pulled its capital raise and bought Bitcoin using the $135M share issuance and credit facility.

On-chain data flows; big treasury buys, accumulation by public firms and wallet growth might all signal strength.

Macro themes, such as macro liquidity, inflation and the central bank policies.

If these pullback pieces fit together, the $86,000 Bitcoin price forecast and then possibly beyond is increasingly plausible.

However, if demand zone support is breached, a more bearish view could be taken.

Conclusion

Bitcoin is at a technical point. With an ABCD, tightening demand zone and institutional signals such as a proposed U.S. bill making $BTC legal tender for tax and Metaplanet’s $135M Bitcoin-accumulation raise, a bullish Bitcoin price prediction of a potential move to and above $86K may just be in the works.

Though risks exist, the interplay of technical structure and macro tailwinds implies this time frame could set the course for $BTC through 2026.

Glossary

ABCD: A classic pattern in technical analysis derived from price (A, B, C and D), which is used to inform potential reversal/continuation points.

Demand Zone: A range of prices where there is strong interest in buying shares, this can be seen as a support level.

Strategic Bitcoin Reserve : A potential stash of Bitcoin held by a government or institution in an attempt to store long-term value, rather than trading it on the market.

Corporate Treasury Strategy: When companies hold Bitcoin as a foundational, long-term asset on their balance sheet, and size into the position over time.

RSI: Relative Strength Index, a technical indicator of momentum on a 0-to-100 scale typically used to identify overbought or oversold conditions.

Frequently Asked Questions About Bitcoin Price Predictions

What is the “Bitcoin for America Act”?

Rep. Warren Davidson has introduced the Bitcoin for America Act, which seeks to allow Americans to pay some federal taxes with $BTC. All Bitcoin received would be deposited into a Strategic Bitcoin Reserve.

Why is $74,500-$83,800 key?

This area of demand is consistent with significant buying, Fibonacci retracement levels and pattern-based turning points, providing an important support zone for Bitcoin’s price prediction.

Where does Metaplanet fit within the Bitcoin framework?

Metaplanet is accumulating huge amounts of $BTC. It intends to raise $135 million through preferred shares for more and greater accumulation. The company also arranged for a $100 million loan on the basis of its $BTC holdings.

What are the downside (bear case) risks?

Bitcoin price is likely to extend its decline if the demand zone collapses. Poor adoption, more regulatory hits or the absence of fresh inflows could see it slide into a bigger correction.

How likely is an 86K point?

A point around $86,000 is possible given an ABCD pattern, structure and institutional tailwinds but will require a confluence of factors to occur including on-chain demand and macro momentum.