The Bitcoin price prediction 2025 indicates that $BTC could see a year of swings but with good chances to grow. Experts and large investors are keeping a close eye on it, looking at how the recent halving limits supply, the rising interest from institutions, and uncertainty in the global economy. Past patterns, limited availability, and Bitcoin’s role as a reliable asset are all shaping expectations for the rest of 2025.

- What are the Monthly Price Projections for $BTC?

- How Do Experts View Bitcoin’s Year-End Potential?

- Which Factors Are Driving Bitcoin’s Price in 2025?

- What Are Industry Leaders Saying About Bitcoin in 2025?

- How Does Investor Sentiment Affect Bitcoin Price Prediction 2025?

- What Should Traders Consider Before Making Moves?

- Conclusion

- FAQs

- 1. Which month might see a Bitcoin price drop in 2025?

- 2. What is Bitcoin price prediction 2025?

- 3. How does Bitcoin halving affect its price?

- 4. Can global economic changes impact Bitcoin?

- 5. How does investor sentiment influence Bitcoin price prediction 2025 ?

- Glossary

- Sources

What are the Monthly Price Projections for $BTC?

According to Changelly, $BTC is expected to stay mostly steady through August 2025, with prices between $120,348 and $121,859. This means there won’t be big changes for now.

In September, the price might fall a little to an average of $116,524, with lows of $112,158 and highs of $120,889. October could be a bit more unpredictable, ranging from $109,208 to $113,699, and November may drop further between $103,138 and $109,713.

Analysts think prices could go up again in December, with an average of $113,807 and highs around $125,731. These monthly estimates show the usual ups and downs of Bitcoin, influenced by market mood and its limited supply.

How Do Experts View Bitcoin’s Year-End Potential?

A survey by Finder.com with 24 crypto experts gives a positive outlook for Bitcoin at the end of the year. They expect $BTC to be around $145,167, with a possible low of $87,618 and a high of $162,353, showing that its price can go up and down.

Experts like Martin Froehler and Joseph Raczynski say more companies buying Bitcoin and uncertain world events could push the price higher. Some think it could even reach $250,000, but that would only happen in rare, unusual situations.

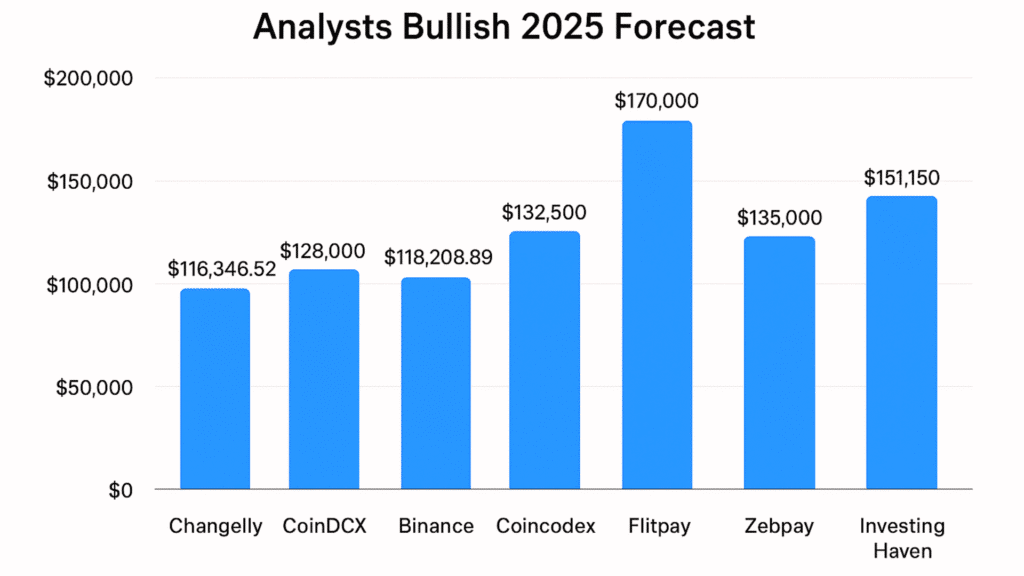

| Analysts | Bullish 2025 Forecast |

| Changelly | $116,346.52 |

| CoinDCX | $128,000 |

| Binance | $118,208.89 |

| Coincodex | $ 132,500 |

| Flitpay | $170k |

| Zebpay | $135,000 |

| Investing Haven | $151,150 |

Which Factors Are Driving Bitcoin’s Price in 2025?

The Bitcoin price prediction 2025 is affected by a few key things. The recent halving cut the rewards for miners, which limits how much Bitcoin is available and usually helps the price go up.

Michael Saylor, CEO of MicroStrategy, says this “supply shock” can push prices higher if demand stays the same or grows. More companies and even some countries are buying $BTC.

When big players like hedge funds, businesses, and governments hold it, the market stays steadier and can grow more safely over time.

Global economic changes also affect Bitcoin’s future. Instability in the world, falling currencies, and uncertainty in traditional finance have made investors see $BTC as a safe asset.

Josh Fraser from Origin Protocol says Bitcoin can protect against risks in regular markets, which makes it attractive in uncertain times.

Rules and concerns about the environment could make Bitcoin’s price drop in the short term. New rules and concerns about the environment can make $BTC prices fall for a short time.

Experts think that rules like AML and KYC, and concerns about energy use, could make $BTC prices fall a little. Still, as more people buy and use Bitcoin, its value is expected to rise over time.

What Are Industry Leaders Saying About Bitcoin in 2025?

Experts have different ideas about Bitcoin’s future. Anthony Scaramucci says $BTC might reach $170,000 by the end of 2025 as more people buy and use it.

Tom Lee and Marshall Beard see $150,000 as a realistic target for now, considering ups and downs in the market. Cathie Wood is the most optimistic, saying Bitcoin could hit $1 million in five years if adoption and technology keep growing.

Digital Coin Price expects an average of $210,644 for 2025, with highs of $230,617, because of limited supply and more demand.

Wallet Investor warns that $BTC might fall to $103,675 but could grow long-term. Binance users are confident too, predicting $157,156 in five years, showing trust in Bitcoin’s strength and scarcity.

How Does Investor Sentiment Affect Bitcoin Price Prediction 2025?

How people feel about Bitcoin affects its price a lot. Social trends and online communities can make it go up or down quickly.

Experts say that when people are optimistic and big investors buy, the price can rise even if the economy is uncertain.

There may still be short-term drops, but Bitcoin’s value as a rare asset keeps attracting investors. This mix of changes helps explain the Bitcoin price prediction 2025.

What Should Traders Consider Before Making Moves?

Traders looking at $BTC in 2025 should pay attention to monthly price changes, big investors’ activity, new rules, and the global economy.

Knowing the likely highs and lows can help with decisions, and watching big investors can show where the market is headed. New rules or environmental laws could make $BTC prices fall, so caution is needed.

Experts suggest focusing on the long-term Bitcoin price prediction 2025, understanding that prices will go up and down, but there’s still a good chance to make profits.

Conclusion

The Bitcoin price prediction 2025 shows a year with ups and downs but also big opportunities. Prices could move between $103,000 and $126,000 during the year, while experts expect it might end around $145,000–$170,000.

Some very optimistic predictions even say Bitcoin could go over $200,000 if things go well. Bitcoin’s price changes because there aren’t many coins, more people and companies are using it, the economy affects it, and big investors are buying it. No one can predict exactly, but Bitcoin will stay important and attract attention from everyone.

Summary

The Bitcoin price prediction 2025 shows $BTC will fluctuate, likely ranging from $103,000 to $126,000 most months. Experts expect it could end the year near $145,000–$170,000.

Prices are driven by limited new supply, growing institutional adoption, and global economic factors. Despite small dips, $BTC remains a strong investment and could surpass $200,000 if conditions are favourable.

Stay Ahead in Bitcoin 2025, track price swings, expert forecasts & layer 2 upgrades on our platform

FAQs

1. Which month might see a Bitcoin price drop in 2025?

September and November could see lower prices.

2. What is Bitcoin price prediction 2025?

Experts expect Bitcoin price prediction 2025 around $145,000–$170,000.

3. How does Bitcoin halving affect its price?

It limits supply, which can push prices higher.

4. Can global economic changes impact Bitcoin?

Yes, uncertainty or currency drops can increase demand for $BTC.

5. How does investor sentiment influence Bitcoin price prediction 2025 ?

Positive sentiment and big investor activity can raise prices quickly.

Glossary

Safe-Haven Asset – Investment expected to retain value during market uncertainty.

Regulatory Impact – Influence of laws and policies on Bitcoin’s market value.

Supply Shock – Reduced availability of Bitcoin due to halving or demand increase.

Halving – An Event that cuts Bitcoin mining rewards in half, limiting supply.

Adoption – Growing use of Bitcoin by companies, institutions, or countries.