This article was first published on Deythere.

- Bitcoin Price Dips Below Important Psychological Level

- Market And Macroeconomic Forces Pressuring BTC

- Price Levels and Market Signals at Present

- Technical and Institutional Dynamics in Operation

- Conclusion

- Glossary

- Frequently Asked Questions About Bitcoin Price Crash

- Why did the price of Bitcoin slide toward $70,000?

- Has Bitcoin price ever been this low before?

- Why does it matter for traders?

- Are institutions selling Bitcoin?

- What might happen next?

- References

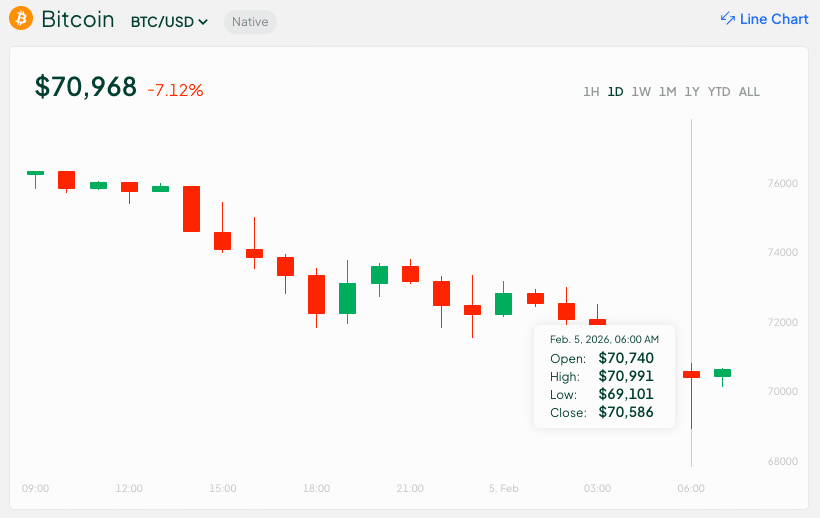

Bitcoin price fell below the psychologically important $70,000 level during Asian trading on Thursday in a new downswing of crypto sell-off. $BTC hit a low of $69,101 on the Bitstamp exchange, with prices on major exchanges like Coinbase trading slightly above $70,000.

This is in effect to the wider decline that has taken out almost half the value from Bitcoin since late 2025, as well as the volatile conditions across digital asset markets in early February 2026.

Analysts have flagged thin liquidity as well as macro pressure from global equities and ETF outflows for being behind the continued slide.

Bitcoin Price Dips Below Important Psychological Level

Bitcoin price on the Bitstamp exchange fell briefly below the $70,000 level during Asian hours, a notable level that is expected to attract strong trading attention from institutional and retail traders.

Coinbase and other leading platforms recorded prices close to this level, all showing simultaneous selling pressure. The discount on Bitstamp was possibly amplified based on greater selling pressure on the exchange, according to market commentary.

The entire market has been tough as well. BTC’s global average price, tracked by price aggregators, reached all-time high above $126,000 in October 2025 but has trended lower ever since with convincing breaks below critical support levels at $80,000 and $75,000.

Market And Macroeconomic Forces Pressuring BTC

A number of forces have combined to drive Bitcoin price down. The financial markets have been under pressure, characterized by the sell-offs in global technology shares which has also caught up risk assets such as cryptocurrencies.

Bitcoin fell by almost 8 percent on Thursday, amid dwindling liquidity and a wider selloff in global stock markets.

Liquidity conditions in crypto markets are tighter than the norm, and when sell-offs kick, it tends to amplify declines.

Across the board, the crypto market experienced a large capital erosion, with reports indicating close to $500 billion wiped out in just days because digital assets uniformly fell.

Macroeconomic factors like the prospects of tighter monetary policy and changing expectations surrounding central bank leadership in the U.S. also dampened risk appetite that fed into Bitcoin’s decline.

Price Levels and Market Signals at Present

Bitcoin has been trading at around the mid $70,000 level with intraday swings putting it beneath $70,000 before modest relief rally attempts.

According to recent data, Bitcoin touched lows around $70,129.6 and recorded trading levels around $70,427 on some exchanges, on CMC, BTC recorded a low of $70,034.54, its lowest reading since November 2024.

This price action extends Bitcoin into regions unseen for more than 15 months, which further emphasizes the importance of $70,000 as psychological support.

Prediction markets have also caught up to the increased volatility. According to the latest data, markets like Polymarket show a strong likelihood that Bitcoin will trade below $70,000 in February.

Technical and Institutional Dynamics in Operation

Technical analysis suggests that the break of key supports has led to more forced selling, especially in derivative markets.

According to data from analytics platforms, there have been hundreds of millions of dollars in leveraged positions that were liquidated as prices crashed through crucial levels.

This can increase the speed of downside moves, as stop-loss orders are automatically triggered.

Institutional flows have been a factor too. Spot Bitcoin exchange-traded funds have faced net outflows, pointing to falling interest from traditional investors in the wake of price weakness.

According to analysts, a break below $70,000 for Bitcoin may indicate that the market is becoming unstable on a larger timeframe and could open the gates to additional selling pressure from institutions that use said level as one of their important support levels when making capital allocation-based decisions.

Conclusion

The 2026 Bitcoin price crash has entered a harsh phase with the world’s biggest cryptocurrency dropping below $70,000 during morning trading on some exchanges based on fresh pressure from liquidity restrictions, institutional outflows and global market turmoil.

This is the weakest level seen for $BTC since over a year ago, and it draws focus to the difficulties crypto markets must contend with in risk-off conditions.

With the price now testing key psychological and technical support, traders and institutions stand on guard waiting to see if Bitcoin can settle down or if more downside is forthcoming.

Glossary

Derivatives liquidation: a forced closing of leveraged positions when the price of fundamental assets moves sharply against them, and it tends to accelerate prices declines.

Spot Bitcoin ETF outflows: signify institutional investment products seeing net capital outflow, which may act as a drag on demand for the underlying asset.

Psychological Support Level: refers to price points, where traders commonly place buy orders, often based on round figures like $70,000 for Bitcoin.

Frequently Asked Questions About Bitcoin Price Crash

Why did the price of Bitcoin slide toward $70,000?

The fall to less than $70,000 for Bitcoin was due to poor liquidity and a negatively-inclined global market off-risk with selling pressure in exchanges especially during the Asian trading period.

Has Bitcoin price ever been this low before?

Yes, this is the lowest level since late 2024, it is an ongoing drop from a peak above $126,000 in late 2025.

Why does it matter for traders?

Breaking through psychological supports such as $70,000 may indicate rising bearish sentiment and could lead to forced liquidations in the derivatives markets.

Are institutions selling Bitcoin?

There are some signs in the data that institutional products such as spot bitcoin ETFs have experienced outflows, and this may put pressure on prices.

What might happen next?

There are still a lot of unknowns in the open market and traders are eagerly watching to see if support levels will hold or go back down to lower territories in the weeks ahead.