This article was first published on Deythere.

- Bitcoin Price Plummet: What Happened and When

- Geopolitical Stress and Tariff Concerns Sink Markets

- Tech Sector News Adds to the Sell-Off

- Market Impact: Liquidations and Volatility

- Conclusion

- Glossary

- Frequently Asked Questions About Recent Bitcoin Price Drop

- Why did Bitcoin drop to $81,000?

- What does $1.7 billion in liquidations mean?

- How many traders were affected?

- What were the impacts on other cryptocurrencies?

- Does geopolitics have any impact on crypto markets?

- References

Bitcoin price has just tumbled to about $81,000, its lowest point in over nine months triggering more than $1.7 billion worth of liquidations across cryptocurrency markets. This rapid-fire dip is a consequence of global geopolitical tension, tariff threats from the United States, disappointing tech earnings and general risk-off felt among global traders.

Bitcoin Price Plummet: What Happened and When

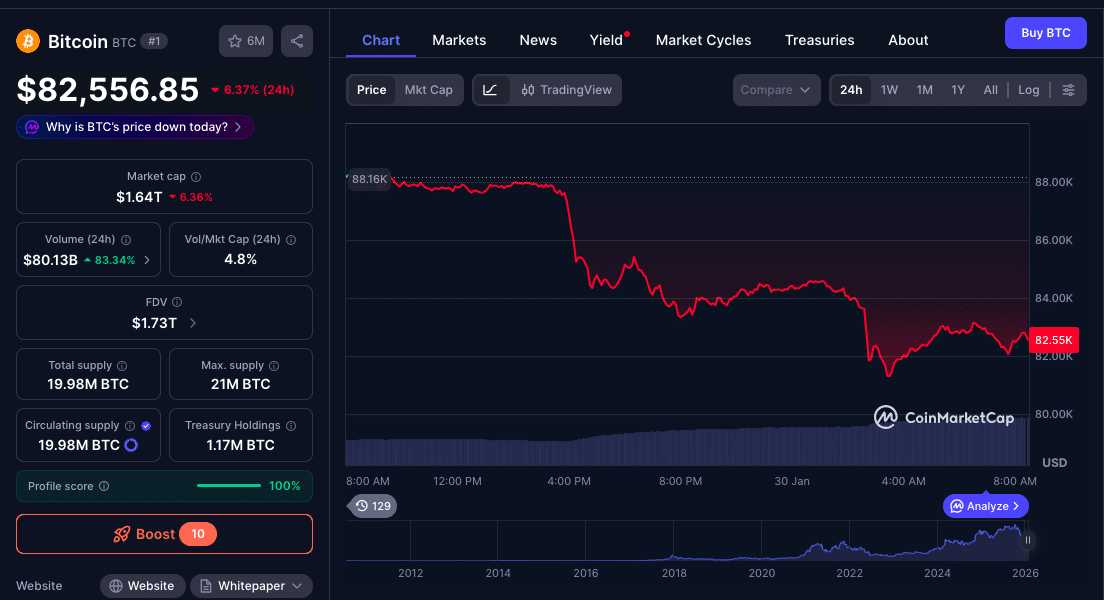

Bitcoin fell to a low of around $81,058 in early trading on 30th January 2026 and according to market data, its lowest point since April 2025.

The sharp decline left Bitcoin’s price about 35 percent below the record high it hit in October 2025 of nearly $126,000. CoinGlass revealed that in the last 24 hours, approximately 270K traders were liquidated, as total market liquidations amounted to about $1.68 billion. Roughly 93% of the losses were on leveraged long positions, mostly in Bitcoin and Ethereum.

Liquidation happens when leveraged positions are not able to maintain the minimum margin requirement, forcing exchanges to close those positions automatically.

The magnitude of the forced unwinds in this episode shows just how heavily leveraged markets were positioned for a further move higher before prices turned lower.

At the time of writing, Bitcoin trades at $82,586.45

Geopolitical Stress and Tariff Concerns Sink Markets

Volatile geopolitics was part of the reason the Bitcoin price dropped, particularly tensions involving the United States and Iran.

Demand was mixed, and as reports circulated that the U.S. sent more military forces to the region, uncertainty increased over potential conflict.

The mood among traders was already cautious when President Donald Trump said

“We have a lot of very big, very powerful ships sailing to Iran right now, and it would be great if we didn’t have to use them”.

Adding to the conflict risk, President Trump also signed an executive order on new tariffs concerning imports from countries involved in oil shipments to Cuba.

This led to an immediate uproar in the financial markets, as policy surprises often bring risk-off across asset categories such as crypto.

Markets caught in the crossfire of geopolitical and trade uncertainty can drive demand for fiat currencies and away from risk-sensitive alternatives such as Bitcoin.

Tech Sector News Adds to the Sell-Off

Meanwhile, disappointing earnings from big technology companies continued to weigh on digital currencies. Jeff Mei, chief operations officer of the BTSE exchange, said there seems to be a correlation to Microsoft’s earnings flop, as the tech giant has seen its stock plunge after weaker, unexpected results and lower growth in its cloud business.

That added to the diminishing confidence in AI and overall tech sector strength, which drew capital out of the risk markets.

Microsoft’s stock recorded its sharpest one-day decline since March 2020 after reporting record spending that weighed on profits, and contributed to market weakness during this critical period.

Investors responded by trimming their positions in speculative assets, which added to the fall of Bitcoin, as well as other risk-assets tied to tech growth stories.

Market Impact: Liquidations and Volatility

Crypto exchange data indicated that the decline in Bitcoin had instant, aggressive chain reactions across the entire market. The widespread sell-off wiped about $200 billion from the overall value of the crypto markets within a short period of time, as leveraged positions were unwound across the board.

Most leveraged traders who held long positions were the hardest hit, as recent data revealed that long exposure made up the majority of the liquidations.

Bitcoin’s drop also pushed Ether to a delicate near-term level as ETH now trades below $2,800 in line with the general risk sentiment.

The forced liquidations and drops in price accelerated the selling further, as algorithm-driven margin calls and short-term trader reactions fed downward momentum.

Conclusion

This recent drop below $81,000 on Bitcoin shows just how quickly macroeconomic and geopolitical issues can affect digital asset markets.

Rising Middle East tensions, unexpected trade policy and disappointing tech earnings came together to result in a risk-off behavior among traders and investors.

The result was a large forced liquidation of leveraged long positions and a steep market value erosion across the entire crypto market.

The market will continue to play out and nothing can be resolved for sure yet.

Glossary

Liquidations: Leveraged positions are automatically closed by exchanges resulting in losses surpassing available margin, often amplifying market moves during volatile price changes.

Leverage: In crypto trading, this involves borrowing capital to increase the size of a position; although it can amplify gains, it also increases the likelihood of liquidation in case prices move against a position.

Geopolitical risk: spans everything from a domestic military conflict or policy action to global political events that can affect the decisions of investors.

Risk-off sentiment: a term that refers to investors moving money out of riskier markets (crypto included) and into perceived safe-havens (bonds or cash) during turbulent times.

Frequently Asked Questions About Recent Bitcoin Price Drop

Why did Bitcoin drop to $81,000?

Geopolitical tensions, new tariff policy signals from the United States and disappointing tech earnings led to market sell-offs, pushing Bitcoin’s price down to near $81,000.

What does $1.7 billion in liquidations mean?

It represents leveraged positions linked to Bitcoin and other digital currencies that were pulled, or liquidated, by exchanges when traders’ losses surpassed their margin, erasing roughly $1.7 billion of notional value.

How many traders were affected?

According to data, approximately 270,000 traders experienced liquidations throughout the recent sell-off, and most of their losses were incurred on long positions.

What were the impacts on other cryptocurrencies?

Other tokens, including Ether, also saw downward pricing pressure and helped fuel the liquidation activity tied with leveraged bets.

Does geopolitics have any impact on crypto markets?

Yes. Investor sentiment can be affected by political tensions, military posturing, and changes in trade policy, and when they become bearish towards risk assets such as Bitcoin, they pull back their capital into safer areas of the market, which leads to price declines.