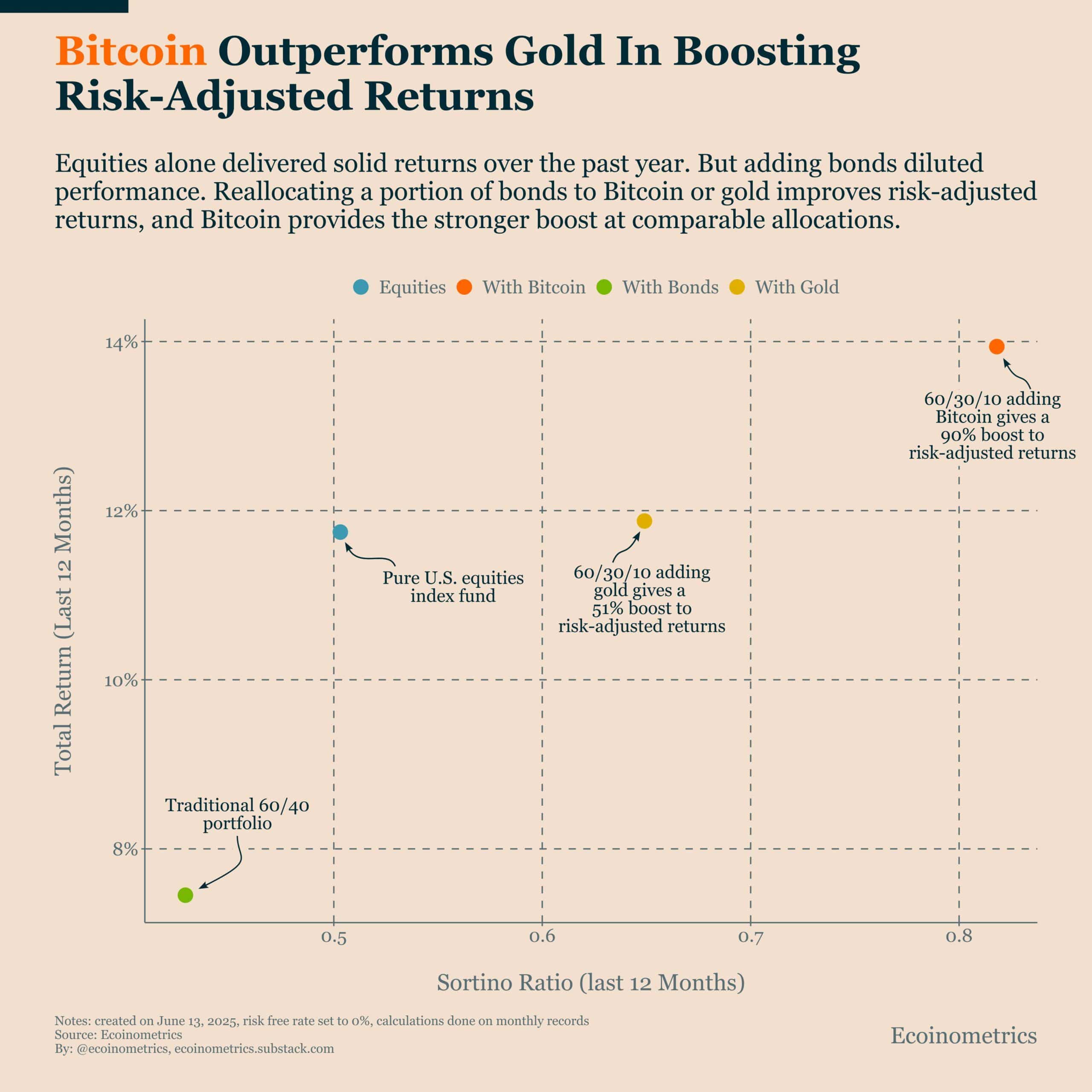

Over the last 12 months, a 60/40 portfolio with 10% Bitcoin allocation returned 90% of the risk-adjusted return compared to 51% for gold. This was reported by data analytics firm Ecoinometrics on June 16th. The traditional 60/40 portfolio; which allocates 60% to equities and 40% to bonds; has been considered a conservative strategy to weather macro volatility.

- Risk-Adjusted Returns: Bitcoin Rewrites the Hedging Script

- Fidelity Backs Bitcoin’s Role in Post-Bond Hedging Framework

- Bitcoin as Network Asset: Volatility That Favors Long-Term Holders

- Institutional Inflows and Deepening Liquidity Support the Thesis

- Conclusion: Bonds are Fading, Bitcoin is Rising

- FAQs

- What is a 60/40 portfolio?

- How does Bitcoin add to a 60/40 portfolio?

- Is Bitcoin less risky now than before?

- How does Bitcoin compare to gold in hedging?

- Are institutional investors buying Bitcoin?

- Glossary

However, considering the persistent inflation, geopolitical fragmentation and bond underperformance, analysts argue that this framework is becoming outdated. The data now shows that reallocating some of the bond sleeve to Bitcoin improves both absolute returns and downside risk metrics.

Risk-Adjusted Returns: Bitcoin Rewrites the Hedging Script

Ecoinometrics compared a pure equities index fund to a 60/40 portfolio and found that the equities fund returned 12% with a 0.55 risk-adjusted ratio. Adding traditional fixed income instruments reduced returns to 8% with a 0.45 risk-adjusted ratio. Gold improved the numbers slightly; 12% return and 0.62 risk adjusted ratio. However, it was Bitcoin that made the biggest difference with 14% return and risk adjusted ratio above 0.80.

The analysis used downside deviation as the risk metric and set the risk free rate to zero. This emphasizes Bitcoin’s ability to add performance without increasing tail risk, a quality often overlooked in the volatility debates. When looking at only downside deviations, Bitcoin’s wild swings become less penalizing, recasting it as a high volatility, high reward asset whose net contribution to a diversified portfolio may be underappreciated.

Fidelity Backs Bitcoin’s Role in Post-Bond Hedging Framework

Institutional voices are saying the same thing. Fidelity Digital Assets researcher Chris Kuiper and Fidelity Investments’ macro director Jurrien Timmer recently discussed the evolution of portfolio construction in a segment of The Value Exchange and how Bitcoin fits into the new financial paradigm.

Kuiper pointed out that investors are facing an economic environment of deglobalization, sticky inflation and rising policy uncertainty, all of which erode the utility of bonds. He noted that nominal bond yields have returned 1-2% over the last decade and inflation adjusted drawdowns have been as deep as 55%.

“Investors can no longer use fixed income to hedge against equity risk the way they used to,” Kuiper said.

Timmer went further, commenting on the 2022 bond selloff,

“Treasuries went from being the port in the storm to bringing the storm.”

He said this reversal of bonds’ role in capital preservation means investors need to find alternative hedges that offer both liquidity and scarcity.

Bitcoin as Network Asset: Volatility That Favors Long-Term Holders

Kuiper framed Bitcoin not just as a speculative store of value but as a network asset whose volatility increasingly works in favor of those who understand its growth curve. He cited Fidelity’s internal modeling that projects a 6× price increase for every 40% growth in network age, linking long-term adoption and infrastructure maturity to exponential price potential.

Timmer extended that logic to a global scale, arguing that the expansion of global money supply will only increase demand for non-sovereign scarce assets. This is a space where Bitcoin, by design, dominates. The fact that it remains disconnected from sovereign monetary policy only strengthens its appeal in an age of capital controls, inflation risk, and fiscal interventions.

Institutional Inflows and Deepening Liquidity Support the Thesis

One of the recurring concerns among conservative investors is Bitcoin’s perceived illiquidity or execution risk. However, Fidelity’s team countered that sentiment, asserting that institutional adoption is expanding, even if not always visible in daily trading flows. Liquidity depth is improving, execution is becoming more seamless, and infrastructure, particularly post-ETF approvals in major economies, is now more robust than at any point in the asset’s history.

This aligns with Ecoinometrics’ findings: not only did Bitcoin dramatically outperform gold in its effect on the risk-adjusted ratio, but it did so using the same 10% reallocation from the bond segment, making it a clean apples-to-apples comparison.

Conclusion: Bonds are Fading, Bitcoin is Rising

There is a growing consensus that bonds are no longer the reliable ballast they once were. While inflation-linked treasuries or emerging-market debt may offer some diversification, their yields remain compressed, and their downside risk has been exposed. Fidelity’s Kuiper and Timmer both concluded that it is time for portfolios to evolve and that Bitcoin should be part of that evolution.

10% of Bitcoin in a 60/40 mix has not only outperformed, but outperformed with a risk-adjusted ratio that beats gold and fixed income. As the utility of bonds continues to fade and inflation persists, Investors re-allocating for the long term are increasingly buying into the idea that Bitcoin can be a part of capital preservation and growth.

FAQs

What is a 60/40 portfolio?

A common investment strategy where 60% is allocated to equities and 40% to bonds, for balanced risk and return.

How does Bitcoin add to a 60/40 portfolio?

Replacing 10% of the bond allocation with Bitcoin increased the portfolio’s risk-adjusted return by over 90% in 12 months, according to Ecoinometrics.

Is Bitcoin less risky now than before?

While still volatile, using downside deviation shows Bitcoin’s risk profile may be more favorable in diversified portfolios than assumed.

How does Bitcoin compare to gold in hedging?

Bitcoin outperformed gold in both total return and risk-adjusted performance in recent studies, even when both were allocated 10%.

Are institutional investors buying Bitcoin?

According to Fidelity researchers, institutional participation is growing, which means deeper liquidity and better trade execution.

Glossary

Risk-Adjusted Return – A measure of performance that accounts for the volatility or downside risk of an investment.

Downside Deviation – A metric that focuses on negative volatility, excluding upside swings from risk assessments.

Network Asset – An asset whose value is driven by user adoption and network growth rather than intrinsic cash flows.

Sharpe Ratio – A standard measure for adjusting returns based on total risk, but some models use only downside deviation.

Gold Hedge – Traditionally used to preserve value during market turmoil or inflation, but now facing competition from digital alternatives.