This article was first published on Deythere.

- What happened when Bitcoin failed to hold above $97,000?

- What does the Bitcoin funding rate reveal about trader confidence?

- Why are retail traders largely absent from the market?

- How does broader market behavior influence Bitcoin sentiment?

- What role do macro and geopolitical risks play?

- Can institutional demand compensate for weak retail participation?

- Conclusion

- Glossary

- Frequently Asked Questions About Bitcoin Funding Rate

Bitcoin funding rate data shaped Bitcoin’s recent price movement, as the rally weakened near the $97,000 level. Funding trends showed that traders were using less leverage at a time when upward price momentum began to slow.

Based on derivatives activity and market data, the pause in funding levels happened alongside lower participation from retail traders. This development shows that price gains alone were insufficient to attract strong speculative interest during the latest recovery attempt.

What happened when Bitcoin failed to hold above $97,000?

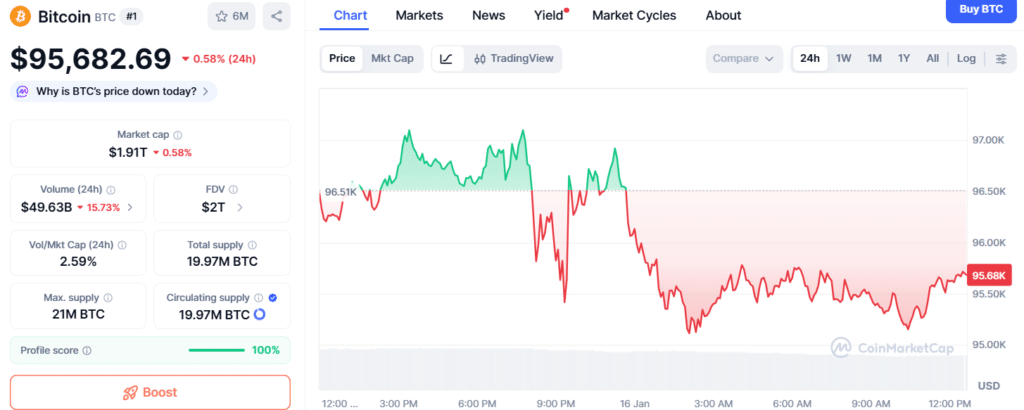

Bitcoin failed to stay near the $97,900 level and moved lower, which weakened short-term market confidence as the Bitcoin funding rate remained subdued. This pullback followed an 8% rally over three days that wiped out $465 million in short Bitcoin futures positions, showing how quickly leveraged trades were cleared.

After the decline, Bitcoin stabilized around $95,500 on Thursday and is currently trading around $95,679.37. Despite this stabilization, the inability to hold above $97,000 kept traders cautious. The price action suggested that upward attempts were facing resistance rather than attracting fresh momentum.

What does the Bitcoin funding rate reveal about trader confidence?

The Bitcoin funding rate represents the cost traders pay to maintain leveraged long or short positions in perpetual futures contracts. Under normal and neutral market conditions, this rate typically ranges between 8% and 12%, helping to compensate for the cost of capital tied up in these positions.

When the rate falls below this range, it generally signals a reduced appetite for leveraged bullish exposure among traders. In the current market setup, the Bitcoin funding rate stood at 4% on Thursday, which pointed to restrained demand for long positions despite recent price gains and suggested hesitation rather than aggressive or confident positioning.

Why are retail traders largely absent from the market?

Retail traders generally prefer perpetual futures because these contracts closely follow spot prices, unlike monthly Bitcoin contracts traded on the CME. However, the low Bitcoin funding rate indicated that these traders were not actively using leverage despite recent price movement.

Web search metrics further reinforced this trend, pointing to weak retail participation across the market. Google Trends data placed global search interest for crypto at 27 out of 100, close to the 12-month low of 22. This reduced level of attention highlighted the lack of enthusiasm, even as Bitcoin tried to stage a recovery.

How does broader market behavior influence Bitcoin sentiment?

Traditional financial markets showed signs of stability, with the Nasdaq trading just 1.6% below its all-time high after TSMC reported a 35% rise in quarterly earnings. Despite this supportive backdrop, Bitcoin’s price remained about 25% below its $126,219 all-time high, which reinforced views of relative underperformance.

At the same time, investor attention appeared to shift toward assets showing stronger short-term momentum, including silver, which climbed 28% in two weeks. This contrast further reduced the urgency among retail traders to move back into Bitcoin positions.

| Metric | Current Value |

|---|---|

| BTC Funding Rate | 4% |

| BTC Price | $95,679 |

| Short Liquidations | $465M (3 days) |

| Google Trends “crypto” | 27/100 |

| BTC vs ATH | 25% below $126,219 |

| Silver Performance | +28% (2 weeks) |

| Spot ETF Assets | $120B+ |

| Corporate BTC Holdings | $105B (MicroStrategy model) |

What role do macro and geopolitical risks play?

Socio-political uncertainty added another layer of caution for market participants, influencing sentiment alongside signals from the Bitcoin funding rate. Concerns about the independence of the US Federal Reserve emerged after the Justice Department launched a criminal inquiry into cost overruns linked to the Fed’s building renovation.

With Fed Chair Jerome Powell’s term set to end in April, traders have already begun to factor in potential policy shifts in 2026. Geopolitical tensions also weighed on confidence.

The threat of retaliation against Iran, which produces more than 3 million barrels of oil and controls a major global tanker route, increased uncertainty across markets. Taken together, these risks strengthened fears that Bitcoin could remain vulnerable during periods of broader economic stress.

Can institutional demand compensate for weak retail participation?

While retail interest remains muted, institutional demand has continued to grow and is increasingly seen as a supportive element in Bitcoin’s market structure, with some viewing it as a factor that could contribute to a move toward $100,000. The Bitcoin spot ETF market has surpassed $120 billion in assets, reflecting sustained allocation from large investors.

In parallel, public companies following the Strategy (MSTR US) treasury model have accumulated more than $105 billion in Bitcoin. This steady accumulation has increased the importance of institutional flows. Even as the Bitcoin funding rate remains low, these purchases have helped stabilize price action near current levels.

Conclusion

Bitcoin funding rate trends indicate a market driven by caution rather than excess, with price action reflecting restraint instead of aggressive positioning. Retail traders remain largely on the sidelines, leverage demand is limited, and uncertainty continues to shape behavior across the market.

At the same time, institutional accumulation provides structural support that could influence longer-term direction, including the possibility of a sustained move toward $100,000. As long as the Bitcoin funding rate stays subdued, rapid upside moves may remain difficult.

However, the presence of continued institutional buying suggests that any future rally would likely be built on firmer ground rather than short-term speculative pressure.

Glossary

Bitcoin Funding Rate: Fee traders pay to keep long or short Bitcoin futures open.

Perpetual Futures: Futures contracts with no expiry that track Bitcoin’s price.

Bitcoin ETF: A fund letting investors buy Bitcoin exposure without holding it.

Spot Price: The current price to buy or sell Bitcoin instantly.

Retail Traders: Individual investors trading with their own money.

Frequently Asked Questions About Bitcoin Funding Rate

Why is the Bitcoin funding rate low right now?

The funding rate is low because traders are not using much leverage or taking big risks.

Why are retail traders staying out of Bitcoin?

Retail traders are staying out because price gains have not been strong enough to attract them.

How did Bitcoin react after failing to hold $97,000?

Bitcoin dropped below $97,000 and then stabilized near $95,500.

What happened to leveraged traders during the recent rally?

About $465 million in short positions were wiped out during the three-day price rally.

How are ETFs affecting Bitcoin’s price?

Bitcoin ETFs are helping support the price by bringing in institutional money.