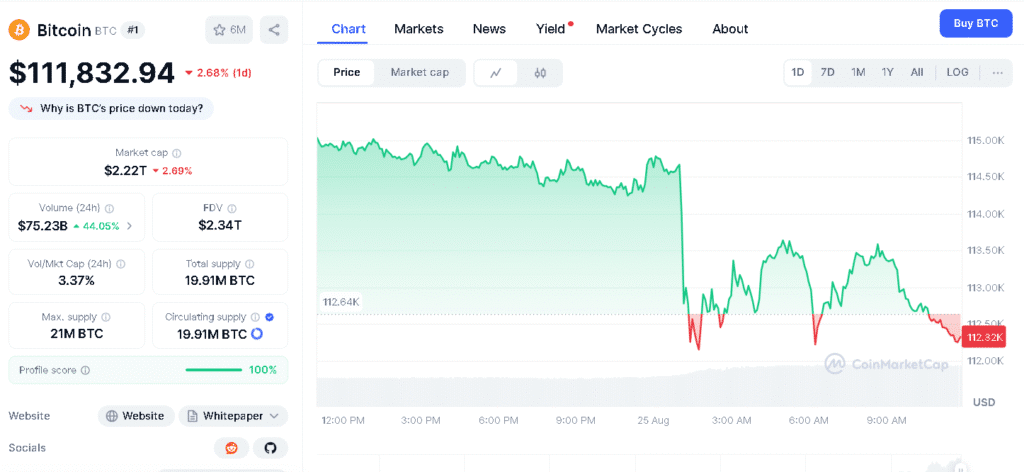

According to sources, the Bitcoin Flash Crash happened when a whale sold 24,000 $BTC, cutting off the gains that came from Fed Chair Jerome Powell’s dovish comments. The big sell pushed $BTC down from $114,666 to $112,546 in under ten minutes, showing how thin the market’s liquidity is.

- What Sparked the Sudden Bitcoin Flash Crash?

- Did Powell’s Speech Lose Its Market Impact?

- How Did Options Traders React?

- What Role Did Ethereum Play Amid the Sell-Off?

- What Are Experts Saying About Market Stability?

- Conclusion

- FAQ on Bitcoin Flash Crash

- 1. What triggered the Bitcoin Flash Crash?

- 2. Where did the whale move the Bitcoin before selling?

- 3. How did options traders react to the flash crash?

- 4. What concerns did experts raise after the crash?

- 5. What is the long-term outlook after the crash?

- Glossary

What Sparked the Sudden Bitcoin Flash Crash?

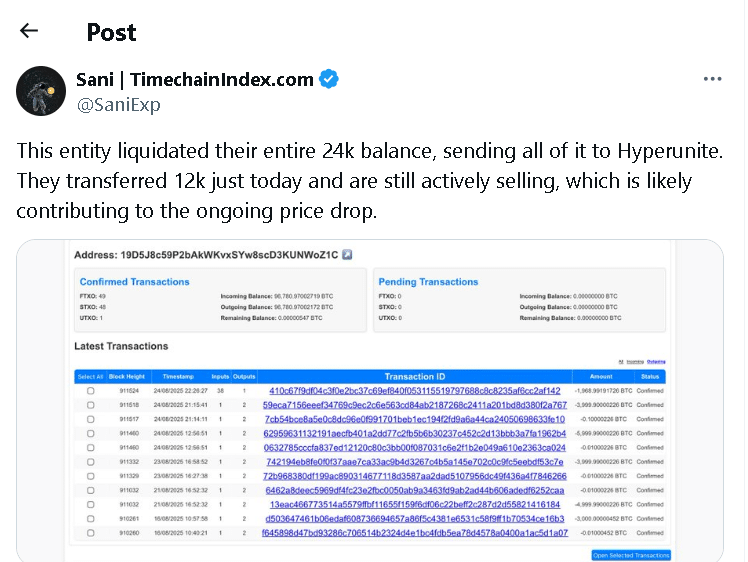

The sharp fall started when the whale moved 24,000 $BTC to Hyperunite and began selling in big amounts. Sani, a researcher at Timechainindex.com, said that half of it was sold on the same day, and more sales were made through linked addresses.

The whale is connected to HTX transactions from six years ago and still holds over 152,000 $BTC. Sani said on X that the size of the sale was too big to ignore. He explained that the whale’s moves shook the market and the liquidity pressure was hurting short-term confidence.

Did Powell’s Speech Lose Its Market Impact?

Powell’s speech at Jackson Hole suggested possible rate cuts, which pushed $BTC close to $116,900. His comments gave investors confidence that tariffs and inflation might not stop policy easing. But the Bitcoin Flash Crash quickly erased those gains.

Traders who thought the dovish stance would take $BTC to new highs were disappointed when the price dropped below $111,000 before climbing back near $112,800.

Analysts said the bigger economic factors are still strong, but sudden whale moves can easily overshadow them in the short term.

| Metrics | Key Values |

| Whale BTC Sold | 24,000 BTC |

| Bitcoin Price Before Crash | ~$114,666 |

| Bitcoin Price During Crash | $112,546 |

| Bitcoin Price Lowest | ~$111,000 |

| Options Market Sentiment | Bearish Jitters |

| Ethereum Price During Event | Above $4,700 to $4,900 |

| Whale BTC Transfer Destination | Hyperunite Exchange |

How Did Options Traders React?

Options market data showed that traders were still cautious. Amberdata said 25-delta risk reversals stayed negative, meaning more people were buying puts for protection than calls for gains. This shows traders are preparing for sudden drops, even though Powell’s comments were supportive.

A derivatives strategist said the Bitcoin Flash Crash shows that big sellers can outweigh positive economic news. They added that hedging costs indicate that fear of price drops is still strong.

What Role Did Ethereum Play Amid the Sell-Off?

$BTC was going up and down, but Ethereum (ETH) briefly went over $4,900 and then settled above $4,700. This shows that some investors are moving their money to networks that are useful in real life.

Experts said Ethereum’s steady performance shows more big investors are looking at platforms for decentralized finance and growth.

Market observers said this was like a stress test, showing that Bitcoin Flash Crash events reveal how risky leveraged positions can be. At the same time, altcoins can offer a safer place for investors looking for stability.

What Are Experts Saying About Market Stability?

The event has renewed calls for more transparency about whale activity. Some traders said big sudden moves show risks in a market that is still developing. Others believe these events are normal corrections and not signs of a long-term trend change.

A senior analyst at Amberdata said Bitcoin Flash Crash events often push out weaker investors. However, long-term factors like institutional adoption and overall economic policies still keep the market optimistic.

Conclusion

Based on the latest research, the Bitcoin Flash Crash shows how quickly liquidity problems can cause big price swings, even when overall market conditions are good. Powell’s comments suggested favorable economic conditions, but the whale’s large sale showed that Bitcoin can still be affected by a few big holders.

Ethereum’s strength shows that investors are spreading their money across different crypto assets, yet Bitcoin still sets the tone for the market. Traders and regulators will be watching closely to see if this event was just a short-term shock or a sign of deeper risks in the crypto market.

Summary

The Bitcoin Flash Crash occurred when a whale sold 24,000 $BTC, wiping out gains from Powell’s dovish comments. The sudden sell pushed $BTC from $114,666 to $112,546, showing weak market liquidity. Traders stayed careful, and options data showed a bearish mood.

Ethereum went over $4,900 for a short time, showing that some money moved to other networks. Experts said the event revealed risks from big holders but added that long-term factors, like institutional adoption, still keep the market strong. The market now watches for deeper vulnerabilities.

Stay ahead of the Bitcoin flash crash with expert insights and price predictions only on our platform.

FAQ on Bitcoin Flash Crash

1. What triggered the Bitcoin Flash Crash?

A whale sold 24,000 $BTC, sparking the sudden crash.

2. Where did the whale move the Bitcoin before selling?

The whale sent the BTC to Hyperunite and began large sales.

3. How did options traders react to the flash crash?

Options traders bought more puts than calls, showing caution.

4. What concerns did experts raise after the crash?

Experts warned about market risks from sudden whale activity.

5. What is the long-term outlook after the crash?

Analysts remain optimistic, citing adoption and economic policies.

Glossary

Bitcoin Flash Crash – A rapid Bitcoin price drop triggered by massive sell orders.

Risk Reversal – Options trade measure showing market bias toward fear or optimism.

Hyperunite – Exchange used by the whale to offload 24,000 BTC.

Put Options – Derivatives giving protection against falling crypto prices.

Jackson Hole Speech – Powell’s comments hinting at rate cuts that briefly boosted Bitcoin