Bitcoin’s bounce off the $93K range has got the whole crypto market buzzing, with key altcoins like Ether, Solana and Dogecoin holding support. As the $100K threshold looms, traders are watching Bitcoin’s price action and selective altcoin patterns for short term rallies.

- Bitcoin (BTC): Bulls eyeing Psychological Resistance

- ETH: Bulls Defend $1,900 as Network Fundamentals Improve

- XRP: Pinned in a Range, But Whales are Accumulating

- BNB: Network Strength Supports Bullish Setup Above $576

- Solana (SOL): Bulls Hold Key Support, Eye $200

- Dogecoin (DOGE): Neutral Pattern With Breakout

- Cardano (ADA): Range Bound $0.58-$0.75

- SUI: Bullish Setup Targets $5

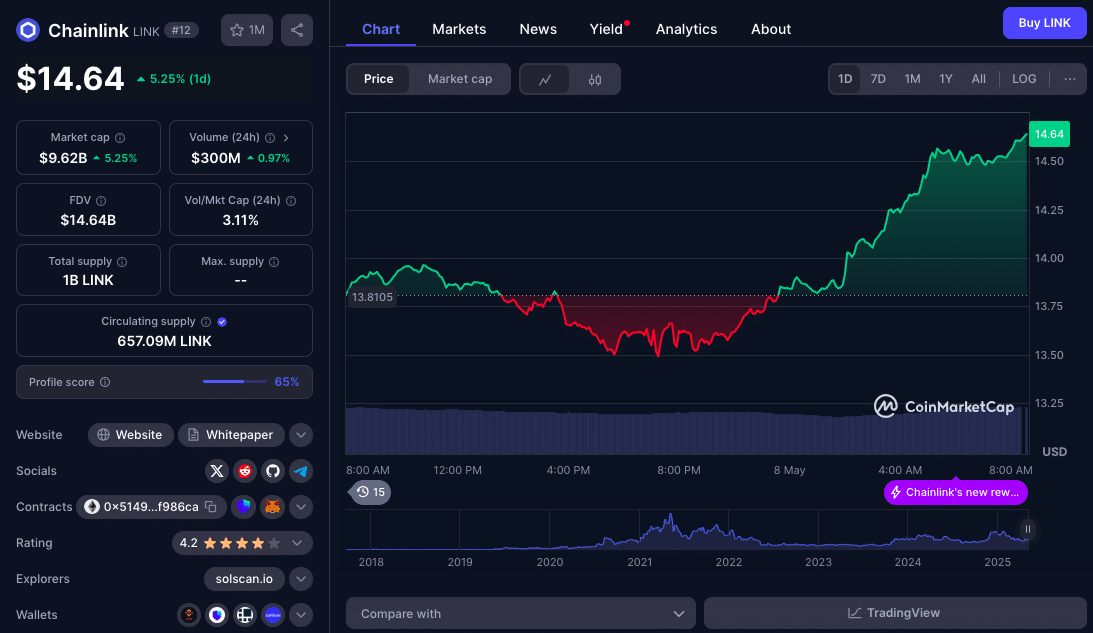

- Chainlink (LINK): Decision Point $13.99

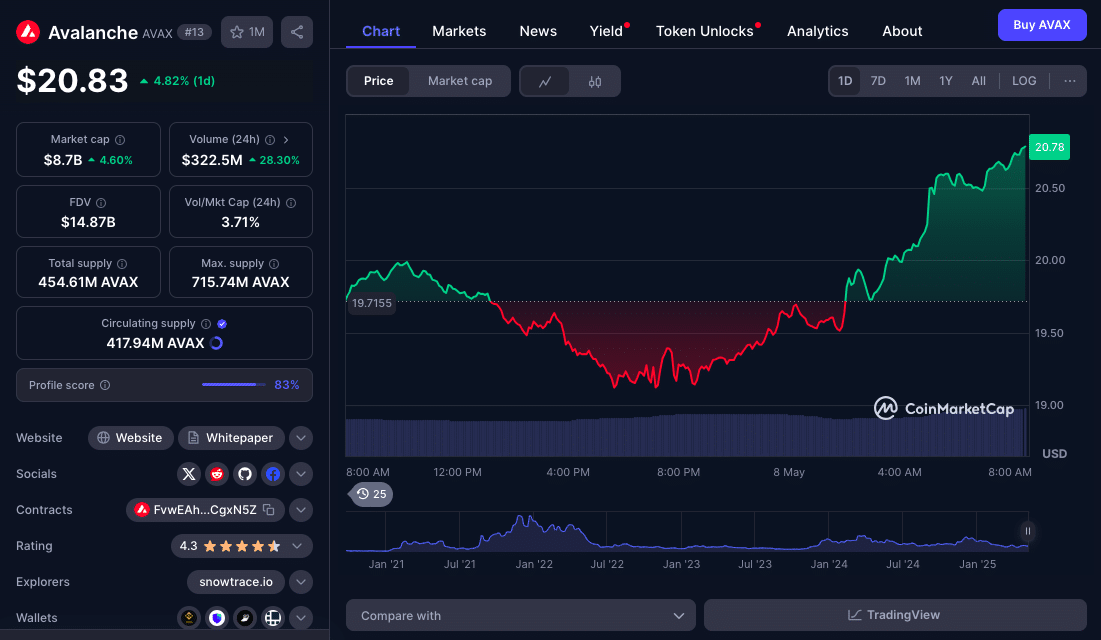

- Avalanche (AVAX): Range Bound With Bearish Risk

- Conclusion: Momentum Building, But Key Levels Must Hold

Bitcoin price is still the main topic of discussion as the flagship cryptocurrency is flirting with $100K and bulls are also targeting . Institutional flows are strong with BlackRock’s Bitcoin ETF has seen inflows for over 2 weeks now and has reached $4.7 billion, according to ETF Store President Nate Geraci.

Santiment data shows whale wallets (10-10,000 BTC) have added over 81,000 BTC in the last 6 weeks, supporting the upward pressure. Bitfinex analysts say Bitcoin needs to hold above $95K to confirm the trend reversal. A breakout could take us to $107K.

But how are major altcoins like Ether, Solana and Chainlink aligning with this momentum?

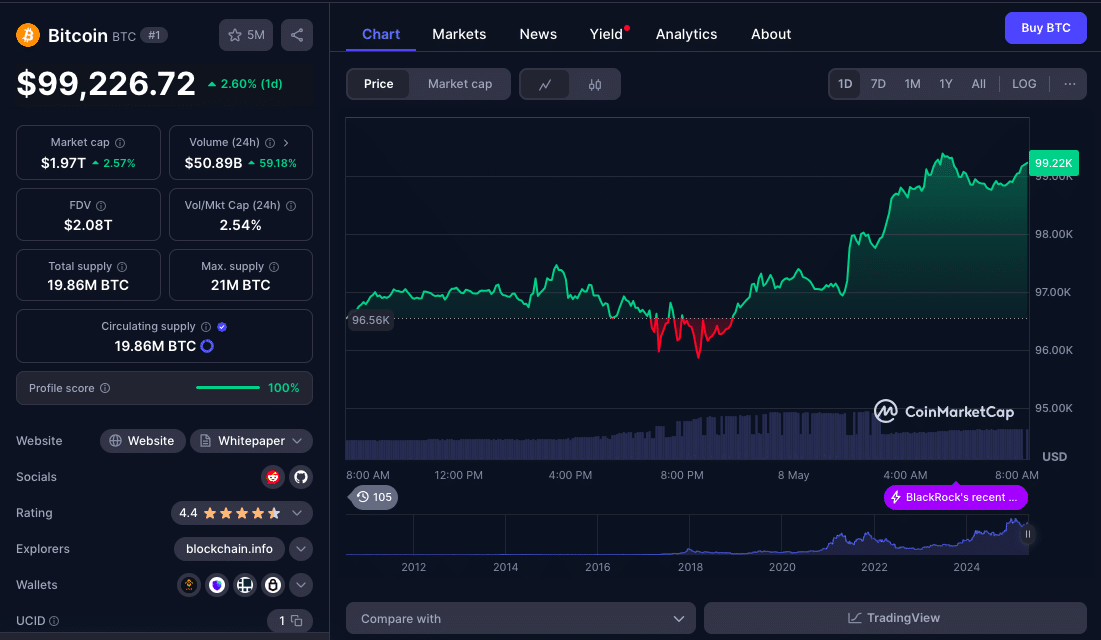

Bitcoin (BTC): Bulls eyeing Psychological Resistance

Bitcoin is currently inching so close to $100k at $99,226. A clean break here could clear the way to $100K. Price bounced off the 20-day EMA ($93,091) on May 6, reinforcing the bullish sentiment. Analysts say failure to hold above $95K could lead to a correction to the 550-day SMA ($87,441).

According to Bloomberg ETF analyst Eric Balchunas, spot Bitcoin ETFs could surpass gold ETFs in AUM in 3-5 years. This growing institutional confidence is good for the medium-term Bitcoin price prediction.

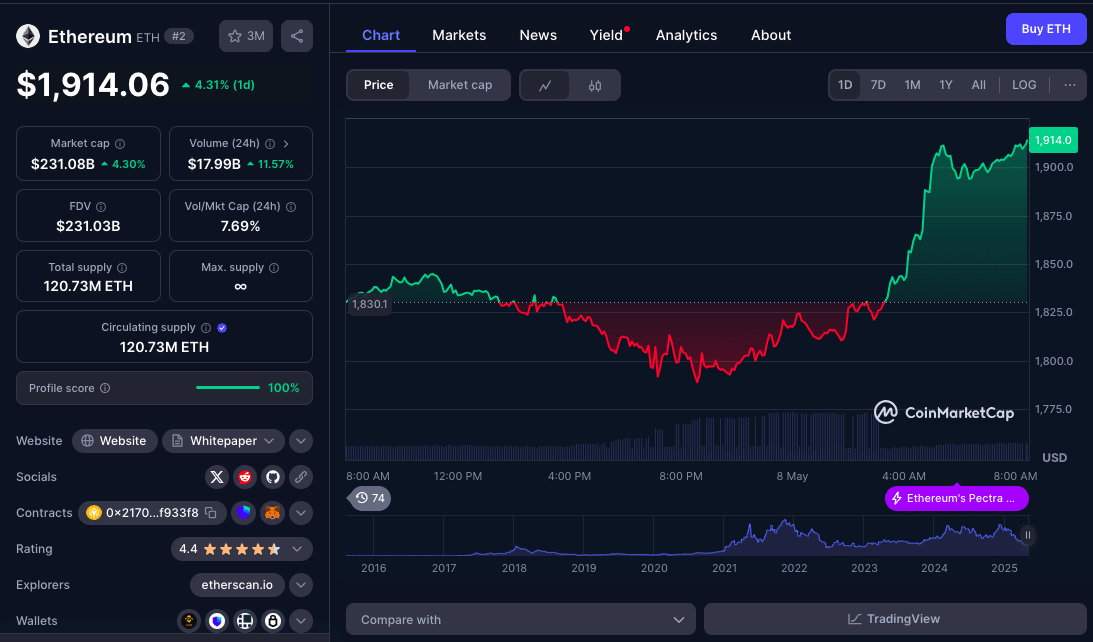

ETH: Bulls Defend $1,900 as Network Fundamentals Improve

Ether is holding support and the bulls are trying to break above the current $1,914. A close above this level could take us to $2,111 with only minor resistance at $1,957.

The 20 day and 50 day moving averages are flattening, showing indecision. A break below $1,537 could trigger selling and $1,368 is the final line of defense.The immediate resistance is at $1,873. After the May 7 Pectra upgrade, Ethereum’s base layer fees have decreased significantly which should help user engagement over time. According to Noam Hurwitz, Head of Engineering at Alchemy, blob fees on Ethereum are at their lowest levels ever, thanks to the recent rollup support improvements.

ETH’s short term price action is dull but fundamentals are improving. DefiLlama data shows Ethereum still leads in TVL with $53.7 billion. Solana and Tron are chipping away at its dominance by outperforming in DApp usage and stablecoin activity respectively.

For ETH to confirm a bullish reversal, a daily close above $1,950 is key. Support is firm at $1,800 and secondary demand zones at $1,537

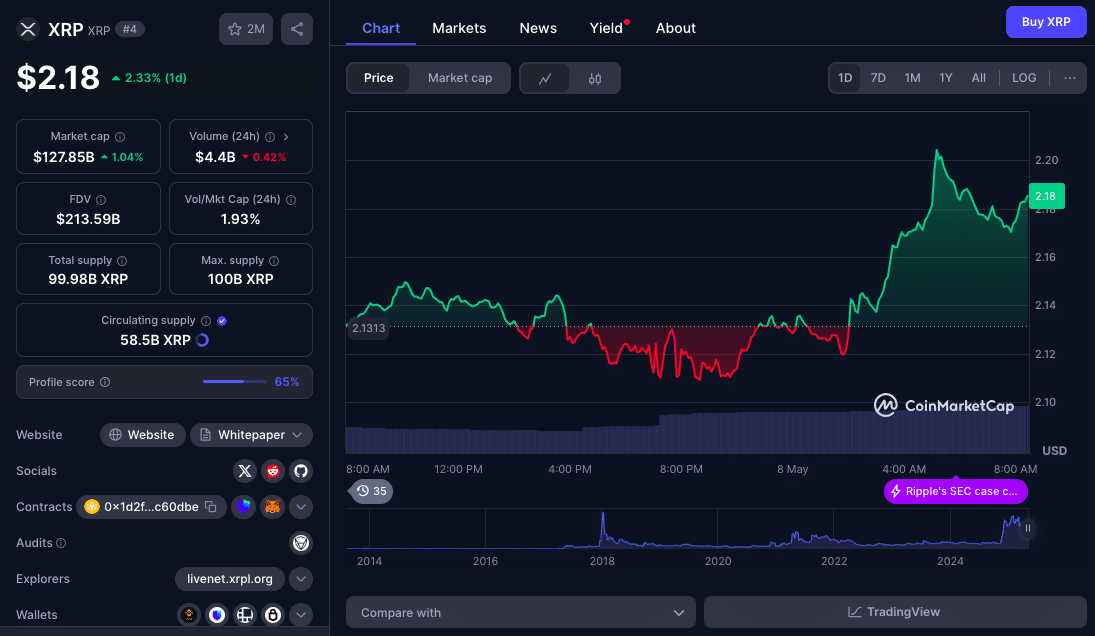

XRP: Pinned in a Range, But Whales are Accumulating

XRP’s dip below the moving averages didn’t spark more selling, and the price is holding above $2. XRP has been range-bound for the past three weeks, bouncing between $2 and $2.60. The RSI is neutral, with no strong momentum from bulls or bears. But on-chain data from Santiment shows that large XRP wallets (over 10 million) have added over 80 million XRP since mid-April. This quiet accumulation phase might be a sign of a shift in sentiment, especially as the regulatory noise around Ripple dies down.

From a technical standpoint a break above $2.60 would confirm the bullish reversal, targeting $3.10 and potentially $3.47. A failure to hold the $2 zone would be a warning sign, potentially leading to a retest of the $1.72 and $1.61 support cluster.

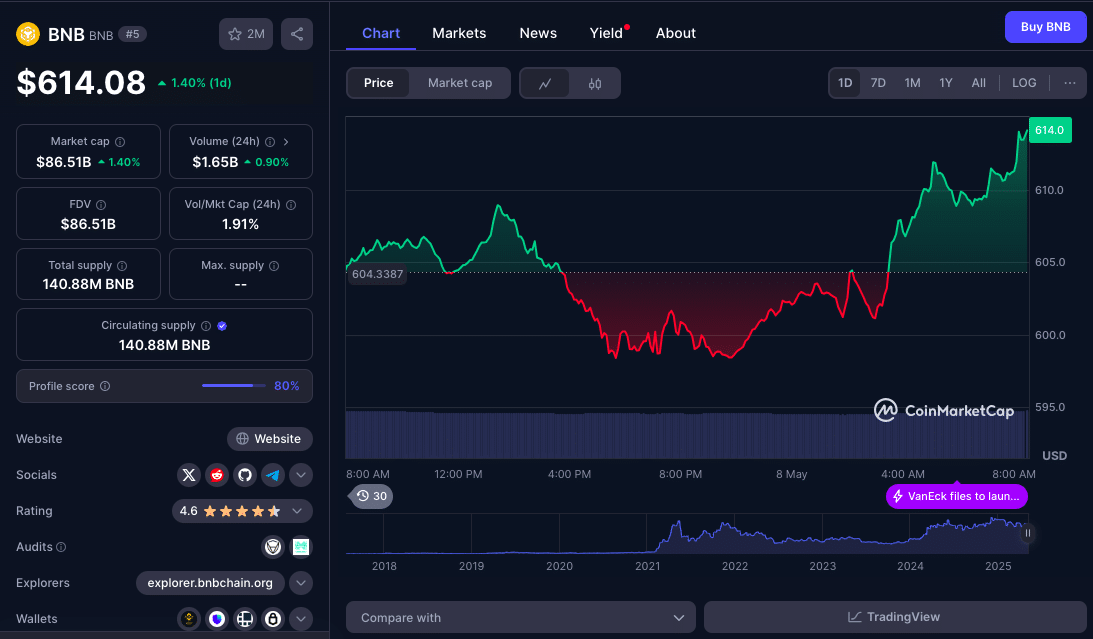

BNB: Network Strength Supports Bullish Setup Above $576

BNB is holding above $576 with growing transactions on the BNB Chain. BscScan reportedly shows daily transactions are around 3.7 million despite the broader market uncertainty. BNB’s deflationary tokenomics (quarterly burns) provide long-term support for the price, with the last burn in April removing over 2.1 million BNB from the circulation.

From a technical standpoint BNB is at $615, buyers are looking to break above $644. This level capped the price in April and is a psychological barrier. A break above would expose $680 and $728. But traders should watch on-chain flows. A sharp drop in user activity or a regulatory trigger affecting Binance could take BNB below $576, and then $520 or even $500, a strong support zone.

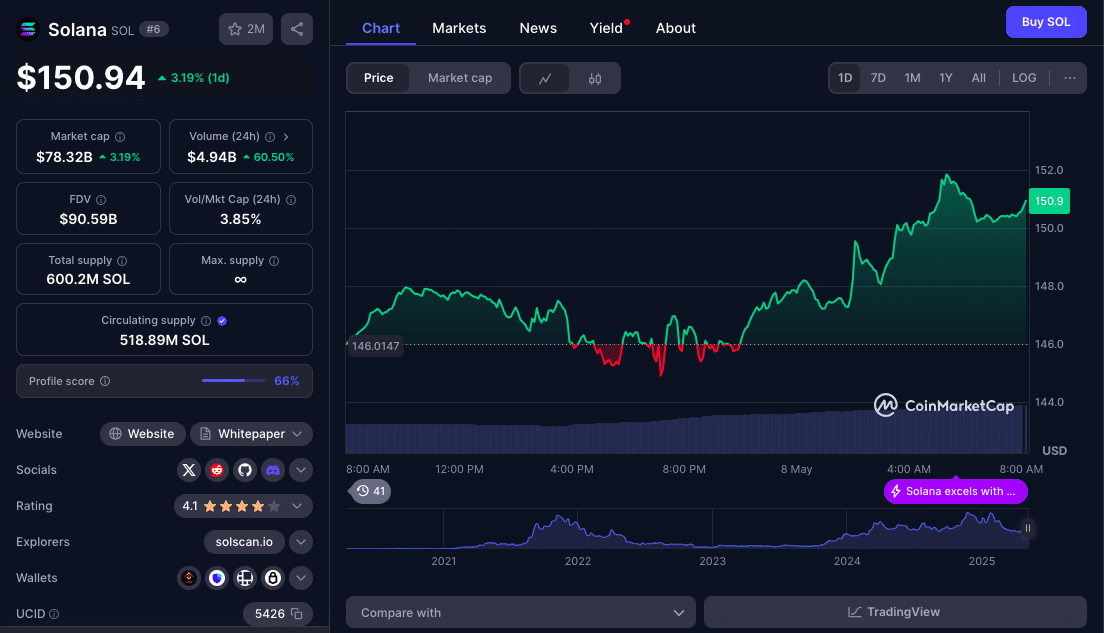

Solana (SOL): Bulls Hold Key Support, Eye $200

Solana is seeing a surge in user activity, especially in decentralized trading and NFT marketplaces. According to Messari, Solana processed over 45 million non-vote transactions in the last week—way more than most layer-1s. NFT collections like Mad Lads and Tensorians are still hot on Magic Eden, keeping Solana relevant.

SOL is testing $153. If bulls break above with volume, then $180 and $200 is more likely.

The bigger picture is a price channel between $110 and $260, with bulls in control of the middle. Note that SOL has bounced off its 50-day SMA at $133 multiple times, that’s a healthy demand zone. Analysts from CryptoQuant also note that SOL exchange inflows are declining, that means long-term holders are not selling, that’s a bullish sign. Failure to clear $153 in the next few sessions could see the pair retest the 50 day SMA at $133.

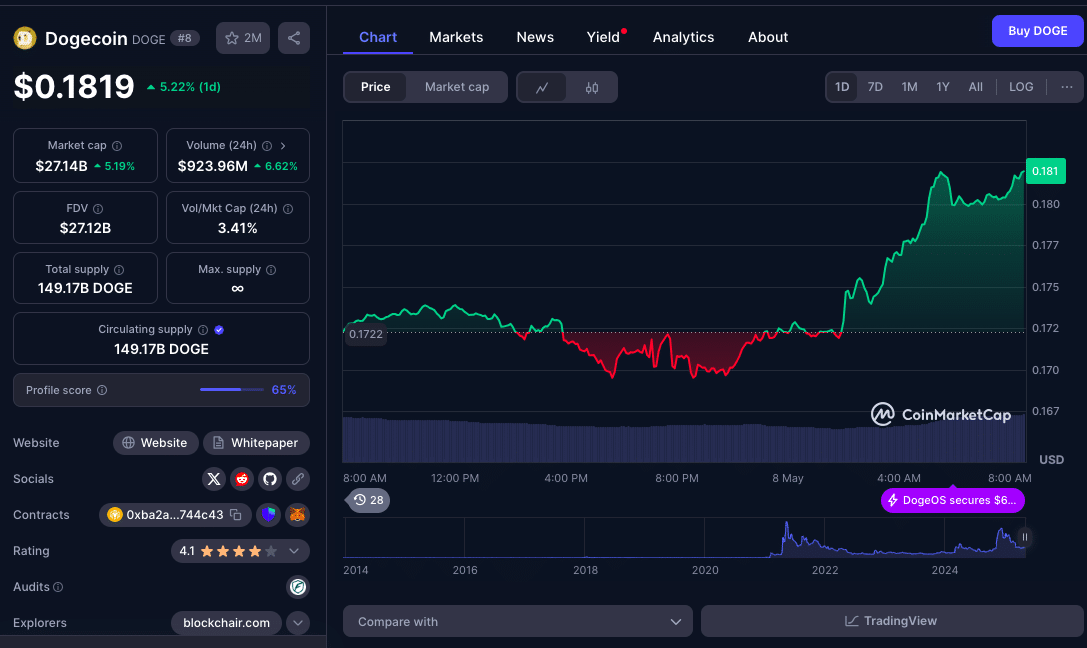

Dogecoin (DOGE): Neutral Pattern With Breakout

Dogecoin is hovering around its moving averages, neither bulls nor bears in control. DOGE is consolidating between $0.16 and $0.21. Despite not having institutional support like BTC or ETH, DOGE has high social volume and search trends, driven by retail traders and Elon Musk hype. According to LunarCrush, DOGE is one of the top-5 most talked about cryptocurrencies on social media even during sideways movement.

$0.21 is a key area, a daily close above this level would be a breakout from the 3-month triangle and could take DOGE to $0.25 and $0.28. Analysts say 62% of current DOGE holders are in profit, that reduces immediate selling pressure. But if price drops below $0.16, then watch out for $0.14 and $0.12, the 200-day moving average. Memecoin volatility is high, so traders are to be careful here.

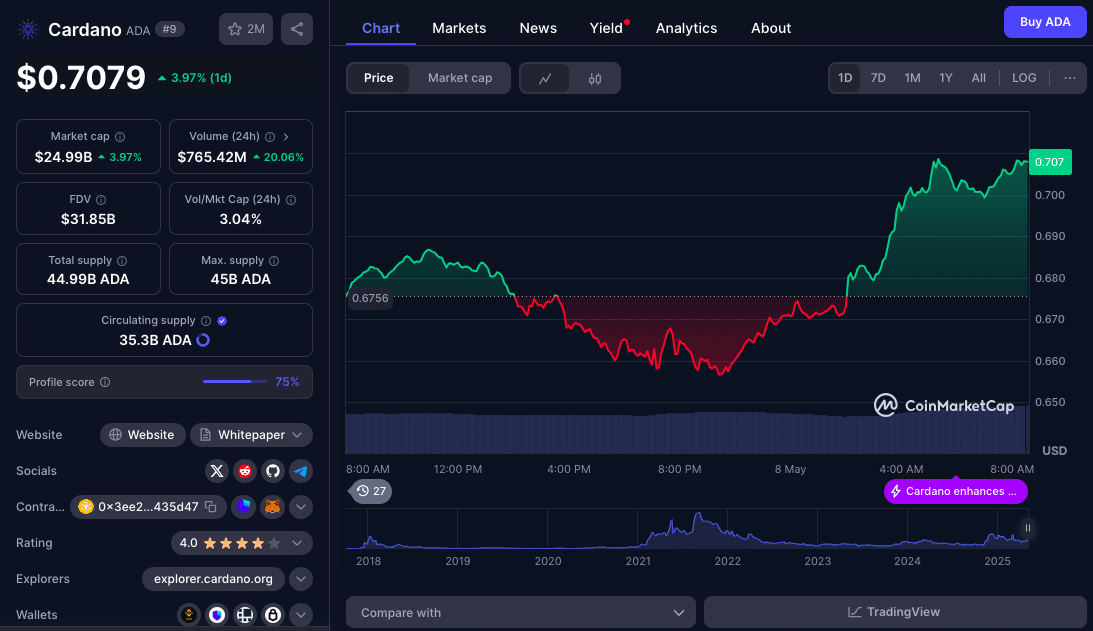

Cardano (ADA): Range Bound $0.58-$0.75

Cardano is stuck between $0.58 and $0.75 but on-chain metrics are looking good. According to Santiment, wallet activity on the Cardano network has increased by 16% in the last 2 weeks driven by growth in DeFi platforms like Minswap and Indigo Protocol. Total value locked (TVL) on Cardano is at $438 million, the highest since early 2023.

Price is stuck in a tight range, $0.75 is a strong resistance. A break above this would be the start of a new leg to $0.83 and possibly $0.96. But Cardano’s 20-day and 50-day EMAs are flat, so short term consolidation is expected. If price drops below $0.58, it might test $0.54 and $0.50. Watch DApp growth and TVL for any breakout move.

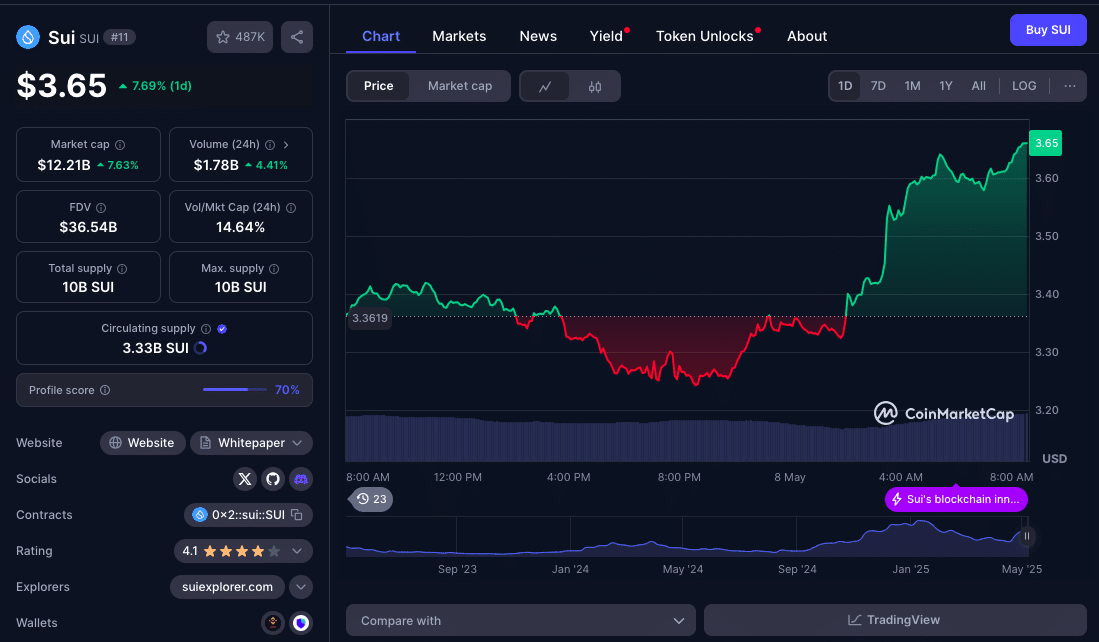

SUI: Bullish Setup Targets $5

SUI has bounced back strongly from the 20-day EMA at $3.14 as developers gain confidence in the chain. Token Terminal shows 23% increase in daily active developers and consistent smart contract deployment. This is bullish for SUI as it’s one of the most active layer-1s.

Price is hovering around at $3.60 to $3.80, the next level is $3.90. A break above that could lead to $4.25 and eventually $5. But 50-day SMA at $3.29 is the key support; a break below that would expose $2.86 and $2.61. SUI’s growing ecosystem participation and DApp support is medium term bullish.

Chainlink (LINK): Decision Point $13.99

LINK is currently at $14.64, no strong bounce. Chainlink is stuck near 50-day SMA at $13.66 with no clear trend. But fundamentally the network is gaining traction. According to Chainlink’s latest update, total value secured by oracles is over $20 billion driven by DeFi projects on Ethereum, Arbitrum and Avalanche.

LINK staking v0.2 is attracting more participants, 26 million LINK is staked. This is tightening supply and potentially increasing price support. If bulls can close above 20-day EMA at $13.99, LINK could test $15.50 and then $17.20. Failure to hold $13.66 would open up room for a deeper correction to $11.68. As long as Chainlink has on-chain activity growth and user engagement, the trend is bullish.

Avalanche (AVAX): Range Bound With Bearish Risk

Avalanche is stuck between $18.50 and $23.50 but network metrics are recovering. According to DefiLlama, TVL is at $776 million driven by recent liquidity incentives and the continued expansion of Avalanche subnets which now support over 100 independent blockchain instances.AVAX is below 50-day SMA but bulls are holding.

A break above $23.50 could lead to $28.78 and then $31.73. Below $18.50 could be $15.27. Avalanche Foundation’s new GameFi program could bring more demand in coming months. Technicals say AVAX is at a decision point, volume will be key to direction.

Conclusion: Momentum Building, But Key Levels Must Hold

With Bitcoin price prediction at the top of the charts and near $100K, traders are getting more and more bullish. Altcoins are not left out as they are riding heavily on the current wave.

Whale accumulation, ETF inflows, and chart strength suggest more upside, but only if the key support zones hold. Altcoins are reflecting this with several set to rally short term if the macro triggers like the FOMC minutes don’t mess with the flow.

FAQs

What’s the Bitcoin price prediction for May 2025?

Bitcoin is going to break out above ‘$100,000 with $95,000 as support. If that holds, we could see $107,000.

Why is $95,000 important?

According to Bitfinex, $95K is a structural level. Above it confirms the trend; below it could lead to a deeper correction.

Which altcoins are looking good right now?

Solana, Ether, and SUI are showing strong signals with room to run if the current resistance is cleared.

Are institutions still buying Bitcoin?

Yes. BlackRock’s Bitcoin ETF has had 16 days of inflows in a row, $4.7 billion total.

What if Bitcoin can’t hold $95,000?

If it can’t hold $95K we could see a pullback to $87,000-$90,000.

Glossary

Support/Resistance levels – The price levels on a chart where an asset finds demand (support) or selling pressure (resistance).

EMA/SMA – Exponential and Simple Moving Averages used to smooth out the price and identify momentum shifts.

RSI – Relative Strength Index, an indicator to measure if an asset is overbought or oversold.

Whale wallets – Large crypto wallets controlled by institutions or early investors that can move the market.

References

Disclaimer: This article is for educational purposes only and not’ financial advice. Cryptocurrency trading carries risk. Always do your own research.