According to sources, more investors are turning to Bitcoin ETFs digital gold narrative as a safer choice in uncertain markets. Big institutions are putting money into these funds, showing they trust $BTC more.

- Why are Bitcoin ETFs attracting strong inflows again?

- How Big Investors Are Shaping Bitcoin’s “Digital Gold” Story?

- What role do price movements play in reinforcing confidence?

- Are macroeconomic conditions boosting the ETF boom?

- How are banks and infrastructure supporting the trend?

- Conclusion

- Glossary

- FAQs for Bitcoin ETFs Digital Gold Narrative 2025

Bitcoin ETFs recorded $332.7 million in inflows on September 2, 2025, sharply offsetting $135 million outflows from Ethereum ETFs, highlighting Bitcoin’s growing safe-haven status.

Experts say Bitcoin is now seen as more than a speculative crypto, acting like digital gold in global investment strategies.

Why are Bitcoin ETFs attracting strong inflows again?

After a few weeks of ups and downs, Bitcoin ETFs are seeing a clear recovery. New money is flowing in, replacing past losses and boosting investor confidence.

Traders say this growing demand strengthens the Bitcoin ETFs digital gold narrative, with $BTC now seen as a safer option during uncertain times rather than just a risky investment. ETF researchers note that wealth managers and advisers now hold most of these funds.

Bitcoin ETFs are now being used by more than just retail investors and are becoming part of everyday financial planning. These regulated funds make it simple and safe for traditional investors to own $BTC.

Also read: Q2 Sees $33.6B Institutional Surge Into Bitcoin ETFs

How Big Investors Are Shaping Bitcoin’s “Digital Gold” Story?

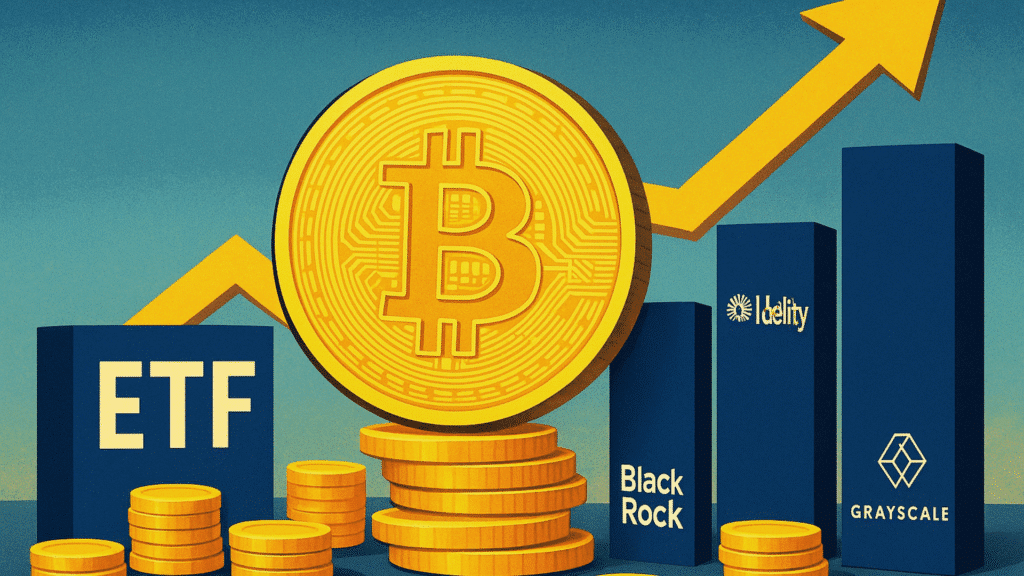

Big investors are helping boost the Bitcoin ETFs digital gold narrative. Bitcoin ETFs drew $332.7 million recently, surpassing rival cryptocurrencies and highlighting Bitcoin’s growing appeal.

Most of the money went to Fidelity’s Wise Origin Bitcoin Fund with 132.7 million dollars and BlackRock’s iShares Bitcoin Trust with 72.8 million dollars, reversing the losses from August and showing renewed confidence from institutional investors. Big companies like BlackRock, Fidelity, and Grayscale are leading the way, investing millions and giving $BTC products more credibility.

Analysts at Bloomberg Intelligence say that institutions have been steadily increasing their Bitcoin ETF holdings, focusing on long-term protection rather than quick gains. Pension funds and advisory firms are putting Bitcoin into their portfolios to help protect against market swings.

The U.S. Bank has restarted Bitcoin custody services with NYDIG, helping institutions feel more secure. Along with other developments, this shows how the Bitcoin ETFs digital gold narrative is gaining strength and why $BTC is seen as a dependable asset in uncertain markets.

| ETF Name | Inflows (USD million) |

| Fidelity Wise Origin Bitcoin Fund (FBTC) | 132.7 |

| BlackRock iShares Bitcoin Trust (IBIT) | 72.8 |

| Grayscale Bitcoin Trust (GBTC) | Positive modest inflow |

| Other issuers (Bitwise, VanEck, Ark, Invesco) | Moderate positive inflows |

| Total Bitcoin ETF Inflows | 332.7 |

| Ethereum ETF Outflows | -135.3 |

What role do price movements play in reinforcing confidence?

The performance of $BTC in September reflected the strong ETF inflows. After falling in late summer, Bitcoin bounced back above important technical levels in early September.

Traders took Bitcoin’s rebound as a good sign, especially since ETF demand was also rising. Gold prices also went up, and $BTC moved back to $111,000.

Experts say this is another sign of the Bitcoin ETFs digital gold narrative, showing that Bitcoin is acting more like a traditional safe-haven. Younger investors favour Bitcoin for its easy transfer and digital features, while older investors continue to prefer physical gold priced above $3,500 per ounce

Are macroeconomic conditions boosting the ETF boom?

Economic changes are affecting how people invest. Many investors are watching the Federal Reserve’s September meeting because interest rates might change. The chance of lower rates has pushed more money into cryptocurrencies and other assets that carry some risk.

Geoffrey Kendrick from Standard Chartered said that if rates drop more than expected, Bitcoin could rise. This could lead to more people buying ETFs, showing the Bitcoin ETFs digital gold narrative in action as a way to protect money from inflation and currency changes.

This interest is not just in the U.S. Investors in Europe and Asia are also using Bitcoin ETFs to safeguard their investments. The trend shows that the Bitcoin ETFs digital gold narrative is spreading across the globe.

Also read: $389M Floods into Bitcoin ETFs But Why Is BTC Still Stuck?

How are banks and infrastructure supporting the trend?

Secure custody has played a big role in boosting confidence. U.S. Bank recently brought back its Bitcoin custody services with NYDIG. This matters because big investors usually want safe storage before putting large amounts into digital assets.

Experts say this helps bring Wall Street closer to crypto. With custody and ETFs in place, institutions feel safer to invest. This makes demand for ETFs grow and strengthens the Bitcoin ETFs digital gold narrative. Overall, better infrastructure is making it easier for big investors to support $BTC.

Conclusion

The Bitcoin ETFs digital gold narrative shows that Bitcoin is no longer just for a few investors but is now widely accepted. Big institutions, safer investment options, and good economic conditions have helped more people invest in it.

Even though challenges remain, steady investment and stable prices show that Bitcoin’s reputation is growing stronger. The Bitcoin ETFs digital gold narrative is more than just a saying and is becoming a reality.

Investors are treating $BTC as a hedge, regulators are giving clearer guidance, and banks are creating the infrastructure to support long-term growth. As economic uncertainty continues worldwide, Bitcoin’s role as a digital version of gold is likely to get stronger, changing how modern portfolios handle risk and security.

Summary

Bitcoin ETFs digital gold narrative 2025 is gaining strong traction as $332.7 million flowed into Bitcoin ETFs, showing growing trust from investors. Major companies like Fidelity and BlackRock led the inflows, reversing August losses and boosting confidence.

Experts say Bitcoin is being viewed more as a safe-haven, similar to digital gold. Younger investors prefer its digital features, while older investors still favour physical gold. At the same time, more institutions are investing, custody services are safer, and economic conditions are favourable, all helping this trend grow globally.

Stay updated on Bitcoin ETFs Digital Gold Narrative 2025, and track $BTC’s rise as a top safe-haven asset only on our platform

Glossary

Safe-Haven Asset: An investment considered low-risk during market uncertainty.

Wealth Managers: Professionals managing investment portfolios for clients.

Custody Services: Secure storage for digital assets provided by banks or institutions.

Technical Levels: Key price points that indicate support or resistance in Bitcoin trading.

Macro Conditions: Economic factors, like interest rates or inflation, affecting Bitcoin investment.

Regulated Funds: Financial products overseen by authorities to ensure investor safety.

FAQs for Bitcoin ETFs Digital Gold Narrative 2025

1. Why is Bitcoin called “digital gold” in 2025?

As investors see it as a safe-haven asset even in market uncertainty.

2. How much money flowed into Bitcoin ETFs recently?

Recently $332.7 million flowed.

3. Are big companies investing in Bitcoin ETFs?

Yes, firms like BlackRock, Fidelity, and Grayscale are leading.

4. Why are investors buying Bitcoin ETFs?

They see Bitcoin as a safer option in uncertain markets.

5. Who owns most Bitcoin ETFs now?

Wealth managers, pension funds, and advisory firms.

6. Did Bitcoin prices respond to ETF inflows?

Yes, $BTC bounced back above key levels to around $111,000.