This article was first published on Deythere.

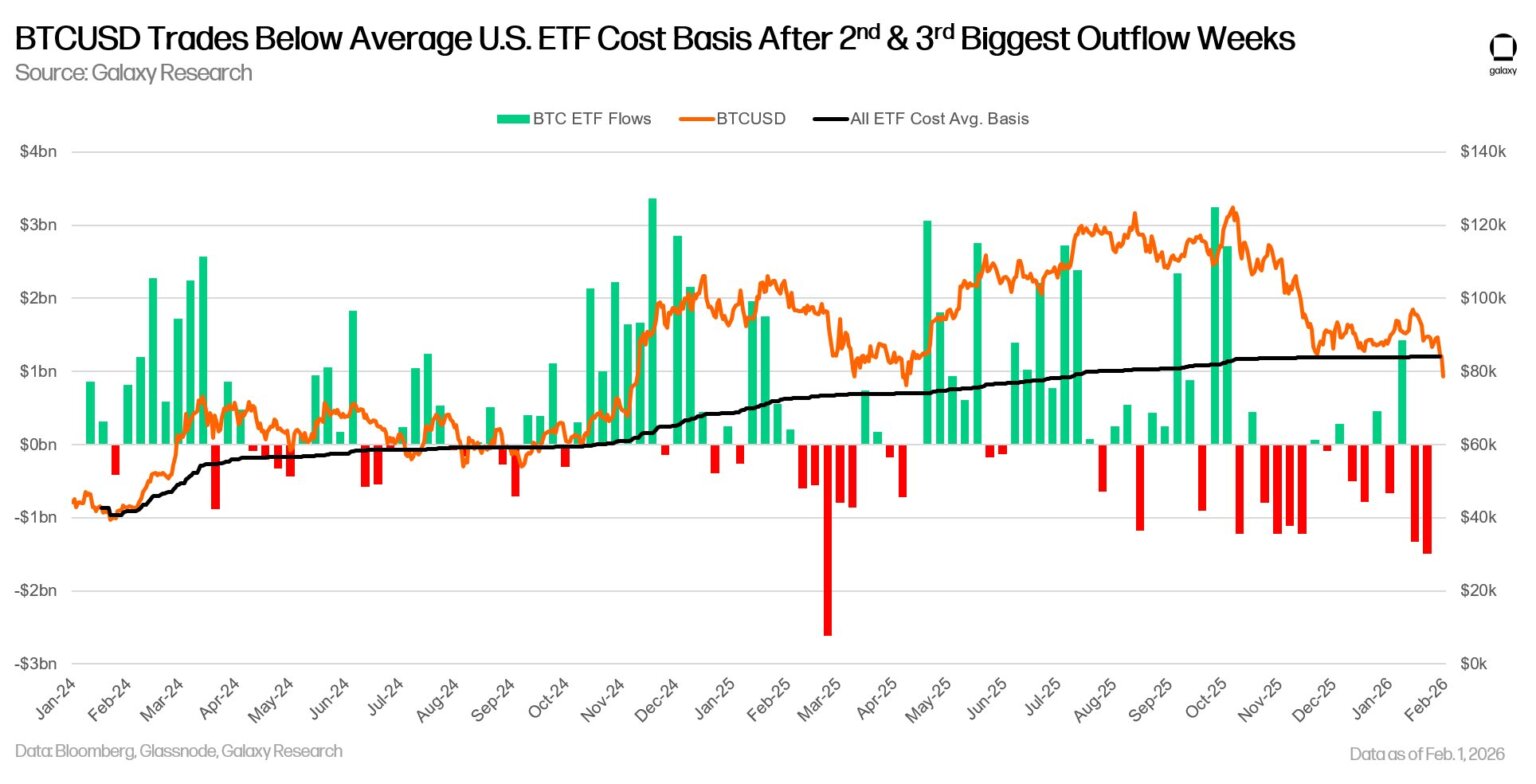

There has been a change in the dynamics of Bitcoin exchange-traded funds (ETF) in early 2026. For a long period of time, net inflows helped fuel price rallies, however, Bitcoin ETF outflows have now become dominant, contributing to unrealized losses for many holders and adding selling pressure on price.

Spot Bitcoin ETFs that once sucked up billions of dollars are seeing redemptions, while the average entry price for those funds has climbed higher than where the market currently trades, leaving many ETF holders “underwater” on their positions.

This transition has also accompanied the slide of Bitcoin below important price levels causing more fear to creep into the market space.

Bitcoin Below ETF Cost Basis, Creating Paper Losses

The price of Bitcoin dipped to the mid-$70,000s over the weekend into early February 2026 before stabilizing around the high-$70,000s. That drop hold implications for holders of US spot Bitcoin ETFs. Bitcoin is currently trading below the average cost basis of the 11 spot Bitcoin ETFs, which purchased a lot of their coins at approximately $90,200, data from Galaxy Digital’s head of research Alex Thorn shows.

That price level leaves most ETF investors nursing unrealized losses totaling about $7 billion combined. When a large number of ETF buyers discover that their average purchase is above market price, it can result in trading behavior that actually increases selling pressure rather than a stable accumulation.

ETF Flows Change: From Inflows to Outflows

The longer trend of Bitcoin ETF outflows has been forming for months. US-listed spot Bitcoin ETFs have seen several billion dollars in net outflows between late 2025 and early 2026, according to market flow trackers. It is the longest period of net outflows since the products started trading in 2024.

In January 2026, flows were positive and negative as some funds saw outflows while others had negligible inflows. But in early February, the negative flows hardened, with several funds experiencing withdrawals that outweighed new capital.

There have been stretches in which overall net flows across the ETF complex have gone negative for several days a time; a far cry from the strong inflows in 2024 and 2025 that had helped support Bitcoin’s price momentum.

This change in capital flow dynamics points to the fact that investors are repositioning or reducing exposure, instead of continuing to accumulate positions, which can create mechanical price pressure when redemptions require ETF issuers to sell Bitcoin to meet cash requirements.

Market Conditions and Price Action

So far, Bitcoin is trading at the high ends of $70,000s after a slip down to roughly $74,600, its lowest price level in nine months. Leveraged liquidations have also added to price volatility as derivatives traders knot out positions.

Some analysts note that when prices remain below where institutional ETF holders purchased, it can discourage fresh capital entry.

When those structural buyers reverse through net outflows, that can change the demand-supply dynamics. That balance is important, as it’s now becoming clear that ETF holdings constitute a huge portion of Bitcoin’s available supply with estimates range around 1.29 million BTC worth over $115 billion held by about 12 U.S. spot Bitcoin ETFs.

With Strategy’s corporate treasury, the ETF holdings are 10% of all Bitcoin. Yet their openings are so different. Strategy has been purchasing Bitcoin since 2020, at an average price of $76,020; however is now holding an unrealized profit of $1.17 billion, going down from holding as high as over $30 billion last October.

This becomes even more powerful as Bitcoin’s price is mingling with macroeconomic circumstances such as risk-off on international markets or reallocation of investor portfolios.

Why Bitcoin ETF Outflows May Matter to the Market

The change happening with Bitcoin ETF outflows has turned buyers who previously were consistently infusing fresh capital into Bitcoin through ETFs to holders who now are contending with redemptions or deciding to rebalance.

Because ETFs store vast amounts of Bitcoin and are structured to replicate how much investors want exposure, their flows are meaningfully correlated with price moves.

During periods of net inflows, funds have a tendency to keep the price floor from sinking by taking coins off the market. When outflows dominate, issuers might have to sell Bitcoin for liquidity, pushing downward price pressure.

The combined effect of ETF outflows and a price that sits below many holders’ entry points can reinforce market caution.

Investors with unrealized losses sometimes hesitate or scale back future contributions, and that can reduce demand even when the macro environment changes.

Recent data indicate that U.S. Bitcoin ETFs’ assets under management have shrunk from former highs, as a result of both price pressure and actual investor capital exiting these products.

Conclusion

Bitcoin ETF outflows have taken the place of constant inflows that formerly functioned as a push for rallies and higher prices.

With Bitcoin trading below where many ETF holders made their purchases, unrealized losses now approach $7 billion and redemption behavior is creating supply-demand shaped market conditions.

This is really indicating that ETF flows are mostly a measure of sentiment rather than demand.

With consecutive negative flow sessions and large holdings now underwater, Bitcoin’s price behavior in this month has moved toward cautious repositioning instead of aggressive accumulation.

As capital rotates and ETF participation wanes, the market will be looking to see if flows start to bottom, turn negative or worsen. Whatever happens will likely determine Bitcoin’s price dynamics in the weeks ahead.

Glossary

Bitcoin ETF outflows: when more money is leaving Bitcoin ETPs than entering in the form of redemptions. This is counter to inflows, where there is net input of money.

Average cost basis: the average purchase price or entry point at which investors, meaning ETF holders, acquired their assets. When the market price dips below this amount, those holders are said to be “underwater” on their positions.

Spot Bitcoin ETFs: are funds that actually hold real Bitcoin, rather than derivatives, that track the price of the asset for those who want to gain exposure without holding private keys.

Redemptions: happen when investors sell shares in an ETF back to the fund, requiring the fund to give them a cash payment or sell assets to cover it.

Total assets under management (AUM): the aggregate market value of assets an investment company manages on behalf of investors.

Frequently Asked Questions About Bitcoin ETF Outflows

What are Bitcoin ETF outflows?

Bitcoin ETF outflows happen when investors cash out their shares of Bitcoin exchange-traded funds, resulting in a net outflow of capital from those funds.

Why should Bitcoin price affect ETF flows?

ETFs don’t really own actual Bitcoin; when they take in coins from inflows, they can diminish supply and boost price. When outflows happen, selling can amplify supply pressure.

Are the average holders of ETFs losing their funds right now?

Yes. Research reveals the average U.S. Bitcoin ETF entry price is below current market levels, meaning many players are stuck underwater in a loss-making position.

How much Bitcoin do spot ETFs have?

U.S. spot Bitcoin ETFs collectively hold around 1.29 million BTC, which is a big portion of the circulating supply.

Do flows determine price all the time?

Flows in and out of ETFs are an indicator of how people feel and can impact supply and demand particularly when they are large.

References

TodayOnChain

Cryptonews

Trading News

CoinCentral

The Coin Republic