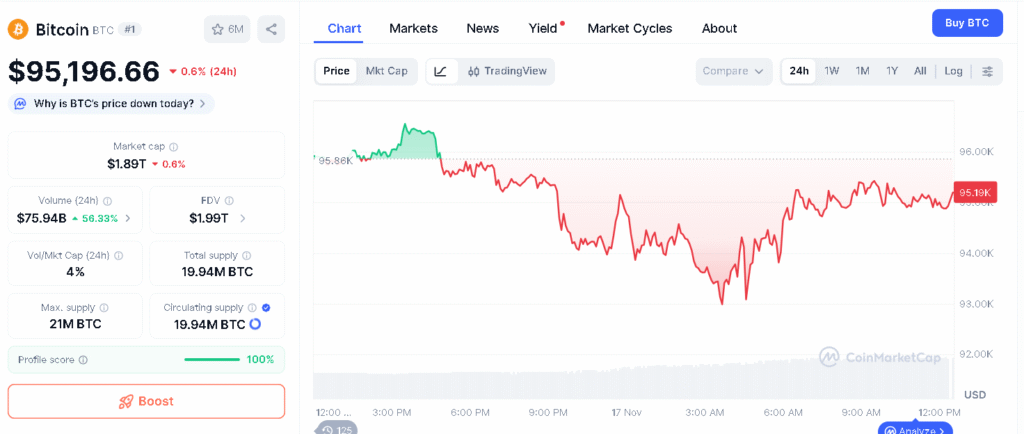

Updated on 17th November 2025

- What Defines a Bitcoin ETF and Why Is It Central to Market Sentiment Today?

- Why Did Nearly $867 Million Exit the Market in a Single Day

- Did Derivatives and Profit Taking Amplify the Pressure?

- Is Capital Truly Leaving Crypto, or Moving Somewhere Else?

- Do These Redemptions Indicate a Structural Problem With Bitcoin ETFs?

- Conclusion

- Glossary

- Frequently Asked Questions About Bitcoin ETF Outflows

Bitcoin ETF outflows hit $866.7 million on Nov. 13, the second largest one day exit since these funds went live in the United States. The timing was rough, because Bitcoin slipped under $100,000 on the same day and shook confidence across the market.

People close to the trading desks say they are still figuring out whether this was panic selling or simply money being pulled back. Bitcoin is now trading around $95,369.86, as the economic outlook continues to shift.

What Defines a Bitcoin ETF and Why Is It Central to Market Sentiment Today?

A Bitcoin ETF is a regulated fund that follows the real market price of Bitcoin. It lets people invest without needing to buy or store the cryptocurrency themselves. Since these ETFs began trading in the United States in January 2024, they have made it much easier for large firms to enter the crypto market.

The setup takes away the usual problems of handling Bitcoin directly and has become a common way for traditional investors to get exposure to the asset. Because these ETFs carry so much weight in the market, their flow changes give a clear picture of what big investors are doing.

A strategist in Chicago said that watching Bitcoin ETF outflows gives a better sense of where major money is moving than looking at activity on regular crypto exchanges.

Why Did Nearly $867 Million Exit the Market in a Single Day

The Nov. 13 outflow of $866.7 million pushed past the Aug. 1 total of $812.3 million and is now the second-largest daily exit after the $1.1 billion recorded on Feb. 25. Grayscale’s Bitcoin Mini Trust saw the biggest withdrawals at about $318 million, with BlackRock’s IBIT close behind at $257 million.

Funds from Fidelity and Bitwise also reported steady outflows across the remaining U S spot ETF lineup. Bitcoin fell under $100,000 around the same time, and that shift pulled more sellers into the market. In the days around the outflows, the coin was seen near $95,369.86, a level last touched in early May.

The wider trend shows three weeks of steady risk reduction, with almost $2.6 billion leaving Bitcoin ETFs over that period. Analysts say the selling was driven by the end of the U S government shutdown and a shift in expectations for what the Federal Reserve might do next.

With money conditions tightening, many investors moved toward cash, bonds and gold, while cutting back on riskier assets. A macro analyst in New York said the market reaction was driven more by forced selling than fear. Once Bitcoin slipped under $100,000, leveraged positions began to break down and ETF redemptions increased quickly.

Did Derivatives and Profit Taking Amplify the Pressure?

Activity in the derivatives market made the drop even sharper. The jump toward $126,000 in October had left many futures traders heavily positioned on the long side. When the price slipped under $100,000, close to $190 million in Bitcoin long positions were wiped out, along with more than $300 million across the wider crypto market.

Those forced liquidations triggered risk limits at several institutions and led to another wave of ETF withdrawals. Profit-taking added to the move as well. Early ETF holders were sitting on gains of more than 100% by late October, and the change in the broader economic outlook, along with weaker equity markets, pushed many of them to close out some positions.

That activity fed into another round of Bitcoin ETF outflows and added to the cautious mood already spreading through the market.

Is Capital Truly Leaving Crypto, or Moving Somewhere Else?

Some of the movement in the market was driven by rotation rather than investors walking away entirely. The launch of the first U S spot XRP ETF on Nov. 13 drew about $250 million in new money, and Solana ETFs picked up smaller amounts.

Ethereum funds, however, saw money leave the market alongside Bitcoin. Even with some money shifting into other products, the size of the Bitcoin ETF outflows was far beyond what a normal rotation could explain. The amount was too large to be viewed as routine repositioning.

A digital asset fund manager said the move reflected broader risk management rather than a shift from one token to another. This blend of rotation and defensive selling has left traders unsure whether Bitcoin’s drop is a short term washout or the start of a wider rethink of risk.

Do These Redemptions Indicate a Structural Problem With Bitcoin ETFs?

They do not. Even with the heavy withdrawals, the ETF structure worked the way it was designed to work. Authorized participants handled redemptions smoothly, with no signs of stress or liquidity issues.

Total assets under management are still above $80 billion, and the $2.6 billion pulled over the past three weeks amounts to about 3% of total holdings, which is in line with past risk off periods. ETF researchers say the recent conditions show that the structure is now mature.

According to one analyst, this pattern is normal during periods of pressure, and Bitcoin ETF outflows are tied to the broader macro adjustment rather than any problem with the products. Bitcoin’s slide into the $95,000 area now marks a drop of about 25% from its October peak and puts the market at a key technical point. How this level behaves is likely to guide the next wave of ETF activity.

Conclusion

Bitcoin ETF outflows now give the most direct read on how big investors are handling this market. The ETF setup is working as it should, and the recent exits are tied to the broader economic backdrop, not a loss of trust in Bitcoin or in the funds.

What comes next mostly hinges on how Bitcoin holds around its support levels and on whether investors feel ready to take on risk again. For now, Bitcoin ETF outflows make it clear that sentiment can turn very quickly when policy talk changes, money becomes tighter, and leveraged trades start to unwind.

Glossary

Redemptions: When investors take their money out of an ETF.

Macro Conditions: Big economic factors that influence the whole market.

Forced Selling: When traders must sell because their positions can’t stay open.

Risk Reduction: When investors move money from risky assets to safer ones.

Outflows: When money leaves an ETF as investors pull back.

Frequently Asked Questions About Bitcoin ETF Outflows

Why did $867 million leave Bitcoin ETFs in one day?

$867 million left Bitcoin ETFs because investors became afraid as Bitcoin dropped below $100,000.

Which funds saw the biggest outflows?

The funds including Grayscale’s Bitcoin Mini Trust and BlackRock’s IBIT saw the biggest outflows on that day.

Why are investors reducing risk now?

They are reducing risk because the economy feels unsure and money is tighter.

Did the United States government’s situation affect the market?

Yes, the end of the government shutdown changed investor expectations and added pressure.

What happened to Bitcoin ETFs in the last three weeks?

About 2.6 billion dollars left Bitcoin ETFs as people moved their money to safer places.

Sources