This article was first published on Deythere.

Bitcoin ETF outflows are quietly reshaping the institutional story around digital assets, and the pace of selling has become impossible to ignore. What once looked like a triumphant bridge between crypto and Wall Street now faces a prolonged stress test that could redefine confidence ahead of the next halving cycle.

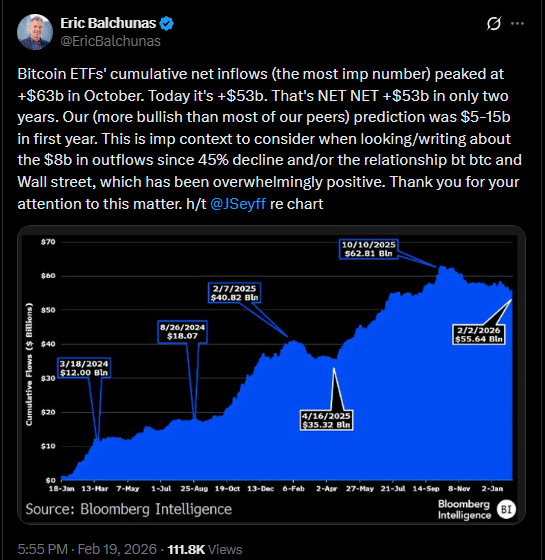

According to the source, cumulative net inflows into US spot products peaked near $63 billion in October and now stand around $53 billion after roughly $8.66 billion in withdrawals. That headline figure masks a deeper shift. Bitcoin ETF outflows have occurred on 55 of the past 89 trading days, revealing steady pressure rather than a one-off exit.

When the Math Tells a Different Story

The scale of Bitcoin ETF outflows becomes clearer when broken into daily rhythm. Spread across 89 sessions, the $8.66 billion drawdown equals about $90 million leaving per trading day. That number drives the entire concern about sustainability.

Total assets under management across the Bitcoin ETF complex sit near $98.33 billion. If Bitcoin ETF outflows continue at the same daily pace, simple arithmetic projects about 1,011 trading days before assets theoretically approach zero, which places the timeline nears early 2030. While markets rarely move in straight lines, the projection highlights how steady redemptions compound over time.

The pressure extends beyond assets under management. Divide the remaining $53 billion in cumulative inflows by the same $90 million run rate and the result suggests that cumulative net inflows could hit zero in roughly 590 trading days, landing just after the next halving in mid-2028.

The 2028 Halving Meets Institutional Reality

The next Bitcoin halving is expected around April 2028, roughly 558 trading days away. If Bitcoin ETF outflows persist without meaningful inflows, assets under management could shrink to nearly $44 billion by that point. At a mid-$60,000 Bitcoin price, as reflected on CoinMarketCap, that would translate to roughly 662,000 BTC still held inside ETF structures.

Such a reduction would reshape the supply landscape entering a historically bullish phase. Bitcoin ETF outflows therefore intersect directly with halving expectations, creating a tug of war between supply tightening and institutional retreat.

A prominent ETF analyst recently remarked in a widely cited interview that cumulative inflows remain “shockingly large,” noting that much of the capital has stayed despite volatility. That observation tempers alarm but does not dismiss the trend.

Liquidity Clusters at the Top as Risk Appetite Fades

A closer look at fund distribution shows how capital concentrates during uncertainty. IBIT commands about $57.01 billion, while FBTC and GBTC manage roughly $13.94 billion and $12.58 billion respectively. BITB and ARKB hold $5.79 billion and $5.36 billion, while smaller products such as HODL, EZBC, BTCO, BTCW, and BRRR trail below $1.5 billion.

This concentration suggests investors favor scale and liquidity when risk appetite cools. At the same time, futures exposure on a major US derivatives exchange has fallen nearly two-thirds from late 2024 highs to around $8 billion, reinforcing the broader theme of reduced institutional leverage.

Another signal has emerged in price spreads. Coinbase, a primary US venue, has traded at a discount to Binance, a pattern often associated with domestic selling pressure. As one financial outlet recently noted while covering fund flows, capital has rotated toward bonds during periods of rate uncertainty, underscoring how macro forces influence crypto allocations.

Bitcoin ETF Outflows as a Public Scoreboard

Bitcoin ETF outflows now function as a public scoreboard for institutional conviction. When the number rises, headlines celebrate adoption. When it falls, skepticism grows louder. The transparency of ETF data means that sentiment updates daily, sometimes amplifying volatility.

Despite recent Bitcoin ETF outflows, cumulative inflows remain firmly positive, and total assets still approach $100 billion. That foundation matters because it shows institutional participation has not vanished. Yet sustained redemptions would alter the narrative that Bitcoin has secured a permanent foothold inside traditional portfolios.

Conclusion

Bitcoin ETF outflows present a rare moment where arithmetic and psychology collide. The $90 million daily pace, the 1,011-day projection toward 2030, and the halving stress test frame the debate with clarity rather than emotion. Markets evolve, and institutional demand can return as conditions shift.

For now, Bitcoin ETF outflows offer a measurable lens into Wall Street’s appetite for risk, reminding investors that conviction often moves in cycles. Whether this period marks consolidation or deeper erosion will depend on whether inflows reappear before time runs out.

Glossary of Key Terms

Bitcoin ETF

An exchange-traded fund that tracks Bitcoin’s price and trades on traditional stock exchanges.

Bitcoin ETF Outflows

Net investor withdrawals that reduce the assets held inside these funds.

Assets Under Management

The total market value of investments controlled by a fund.

Bitcoin Halving

A programmed event that cuts Bitcoin mining rewards in half, reducing new supply.

Institutional Investors

Large financial entities such as asset managers, hedge funds, and pension funds.

FAQs About Bitcoin ETF Outflows

Why are Bitcoin ETF outflows important for investors?

They reveal institutional sentiment and can signal shifts in broader market risk appetite.

Could Bitcoin ETF outflows really drain funds by 2030?

If the current pace continued without interruption, projections suggest depletion around that timeframe.

How do Bitcoin ETF outflows affect Bitcoin’s price?

Redemptions may increase selling pressure because funds must adjust underlying holdings.

Will Bitcoin ETF outflows reverse before the halving?

Historical cycles suggest sentiment can shift quickly, especially if macro conditions improve.