This article was first published on Deythere.

- What the $40B in Volume Really Means

- The Redemption Wave: Big Outflows from IBIT

- Price Decline Fits with Stressed ETFs

- Why This Looks Like Institutional Capitulation

- Effects on the Wider Bitcoin Economy

- Conclusion

- Glossary

- Frequently Asked Questions About Spot Bitcoin ETF Flows

- Does the $40B volume equal institutions buying?

- Does this mean Bitcoin is in a long term bear market?

- Can ETFs exchange shares for Bitcoin?

- IBIT is the only ETF under stress?

- What would the effect be if institutions totally exited via ETFs?

- References

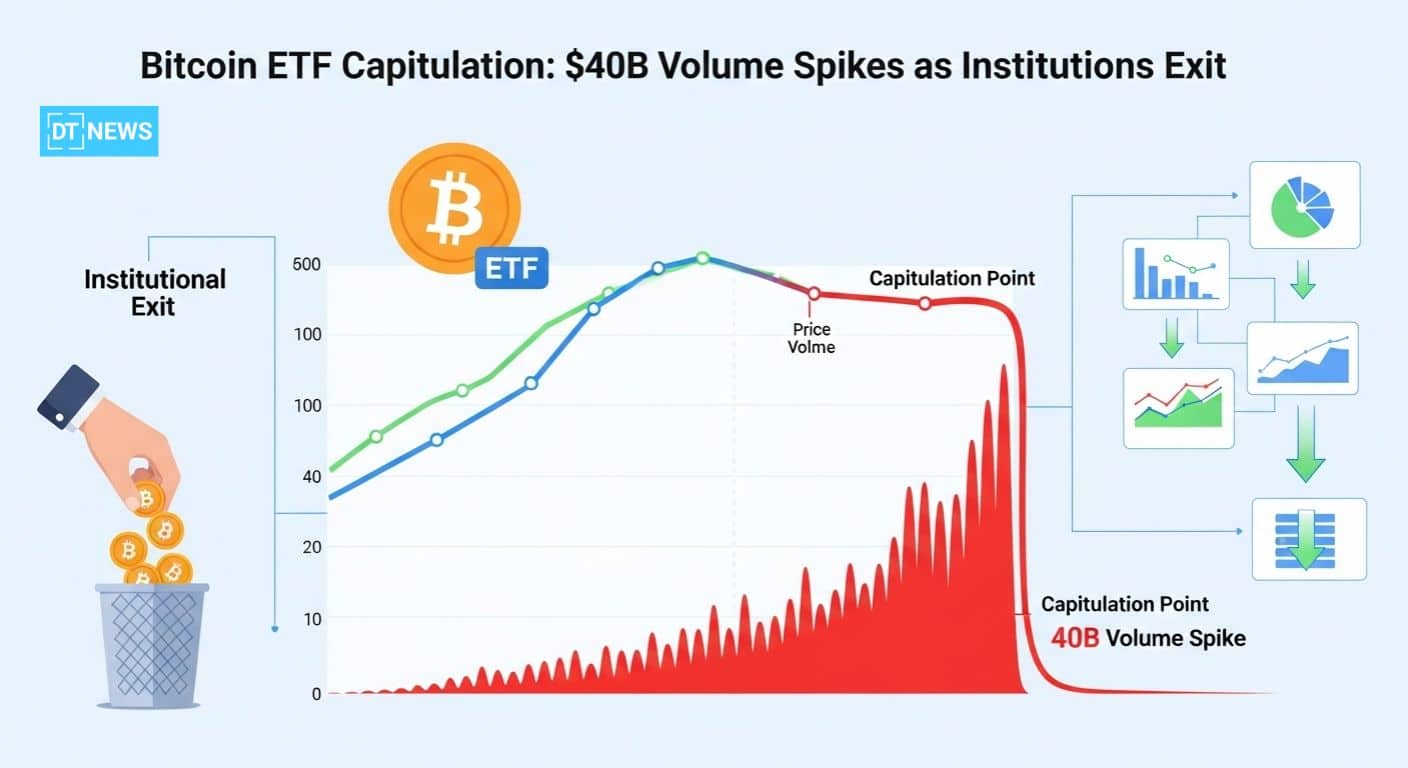

One of the most notable rotation changes within the crypto space is currently happening in U.S. spot Bitcoin ETFs.

In just a week, these funds traded a record $40.32 billion and much of that came via BlackRock’s IBIT fund, which accounted for $27.79 billion on its own.

This spike in activity, along with huge redemptions and a steep decline in the price of Bitcoin, is a clear sign that institutions are capitulating, abandoning positions en masse after an epic run-up earlier this year.

What the $40B in Volume Really Means

The aggregate volume across the 11 U.S.-listed spot Bitcoin ETFs totaled $40.32 billion in one week, CoinDesk reported. BlackRock’s IBIT ETF had an eye-popping $27.79 billion of that, or nearly 70% of it. Meanwhile, in one day, IBIT alone conducted $8 billion of that volume.

High volume like this usually indicates that serious repositioning is taking place and not just by retail traders.

Here, the scale, speed and concentration of buying on IBIT suggest institutions are either aggressively taking profits or getting flat with their Bitcoin exposure.

The Redemption Wave: Big Outflows from IBIT

From earlier reports, while trading surged, redemptions followed. IBIT previously saw a single-day record outflow of $523.2 million. That’s its biggest one-day redemption since the ETF began trading in January 2024.

On a monthly basis, the redemptions are even more eye-catching. As can be seen in investor flow data, IBIT issued $1.26 billion in net outflows so far this month, also the worst monthly performance on record.

The size and pace of these redemptions indicate that some institutions are not only cutting their exposure but also shying away from Bitcoin ETF bets altogether.

Price Decline Fits with Stressed ETFs

These ETF flows are occurring when the price of Bitcoin has been declining more and more. Reports show that $BTC had tumbled about 23% in the month and it had fallen to as low as $80,000 on certain exchanges.

This downtrend is a margin call on leveraged players and putting many ETF holders underwater especially when the average cost basis of people who bought was over $90K, according to Bianco Research.

It’s not just IBIT that has been getting hammered with redemptions, also a long list of other spot ETFs which indicates more of a general institutional change in view toward exposure to Bitcoin.

On top of that, the price of bearish options (puts) has been climbing, another sign that some investors are preparing for more downside rather than a quick comeback.

Why This Looks Like Institutional Capitulation

“Capitulation” occurs when a large number of investors all give up on their positions at the same time, often causing an avalanche of exits.

In this case, a range of factors tend to indicate institutional surrender:

Unusual ETF activity suggests big players are ramping down exposure.

Treasury Note and massive IBIT redemptions signal that some of the largest backers are cashing in.

The timing coincides with loss realization: the majority of ETF holders are underwater as $BTC stands for now because their average buying entry is higher than $90 000.

Increased options activity, especially in bearish hedges, shows that institutions might be preparing for further weakness.

All of this implies that at least part of the capital “wave” seen in ETFs this year was not long-term treasury-style exposure but likely more tactical and now that momentum is reversed, institutions are quickly taking risk off.

Effects on the Wider Bitcoin Economy

The potential outcome if institutional ETF holders are actually capitulating is enormous. Without that demand cushion, Bitcoin might be vulnerable to more price volatility especially if ETF inflows disappear entirely.

This may cause a re-calibration of the role that ETF market plays in supporting Bitcoin. Rather than being a stable demand driver, perhaps it will swing more violently in line with price.

On the other hand, capitulation tends to occur before a bottom as big holders sell out and only the true believers are left.

Should selling pressure find a floor, institutional investors might also see renewed opportunity at lower levels or end up re-allocating funds into other structured crypto products.

In all, the flow in IBIT which controls ETF volume, introduces a risk for future flow dynamics. If BlackRock’s ETF goes from being a net buyer to a net seller, the spillover effects for Bitcoin could be huge.

Conclusion

The U.S. spot Bitcoin ETFs record of $40.32 billion weekly volume, overwhelmingly driven by BlackRock’s IBIT, alongside record outflows, is tough to read as anything but institutional capitulation.

The timing coincides with a sharp fall in prices, leaving many investors underwater.

This fall may be more than just a temporary pullback, it could be a possible sign of more changes in how institutions view risk in Bitcoin.

If so, the aftermath could redraw the ETF path and determine a new era for the market.

Glossary

Bitcoin ETF Capitulation: A scenario whereby large institutional ETF investors sell-off their positions in droves, often following a period of leveraged or speculative risk exposure.

Spot Bitcoin ETF: An ETF that holds Bitcoin itself, enabling investors to obtain price exposure without owning the asset.

Redemption: The system by which investors in ETFs sell shares, thereby causing the ETF to either sell holdings or deliver underlying assets.

Outflow: Net cash leaving an ETF, which reflects investor selling.

Put Option: A financial contract that gives the holder the right to sell an asset at a predetermined price, usually used as a hedge.

Cost Basis: The average purchase price of shares held by investors, which determines whether they are in the money or out on redemptions.

Frequently Asked Questions About Spot Bitcoin ETF Flows

Does the $40B volume equal institutions buying?

Not all the time; high volume can also be attributed to large sell orders or withdrawals. And, in this case, it just so happens that there is very large selling.

Does this mean Bitcoin is in a long term bear market?

Possibly, but not guaranteed. It’s the point when institutions throw in the towel, and it can mean more decline or serve as a kind of structural bottom if new demand emerges.

Can ETFs exchange shares for Bitcoin?

Yes. Spot Bitcoin ETFs actually have $BTC in its possession. Redeemers may need to either sell $BTC or deliver it to redeeming investors, depending on the ETF’s arrangement.

IBIT is the only ETF under stress?

IBIT is the biggest and most important, so its redemptions matter and have more impact. But additional spot Bitcoin ETFs are also experiencing outflows, which indicates a widening trend in risk-off sentiment.

What would the effect be if institutions totally exited via ETFs?

If institutions see an exodus, the demand for ETFs could fall off a cliff. That could push up volatility, erode bid support and prompt re-evaluation of Bitcoin’s place in institutional portfolios.