Gold closed 2025 like an asset that institutions reach for when the goal is stability, not excitement. Prices marked 53 new all-time highs, and total annual demand by value reached $555 billion, powered by strong investment buying through physically backed funds. Bitcoin has exchange-traded access, but January 2026 delivered a blunt signal: Bitcoin ETF outflows, not fresh allocation, set the tone.

That split reveals how large portfolios classify Bitcoin in practice. When volatility spikes, many managers treat Bitcoin as a high-beta position that can be trimmed quickly, while gold is treated as strategic ballast.

Why gold looks like allocation

The fund numbers read like slow, methodical reweighting. Global gold ETF holdings increased by 801 tonnes in 2025 to a record 4,025 tonnes, and assets under management climbed to about $559 billion. In the United States, backed gold ETFs added 437 tonnes, lifting holdings to 2,019 tonnes worth roughly $280 billion. Those flows resemble policy, not a quick trade.

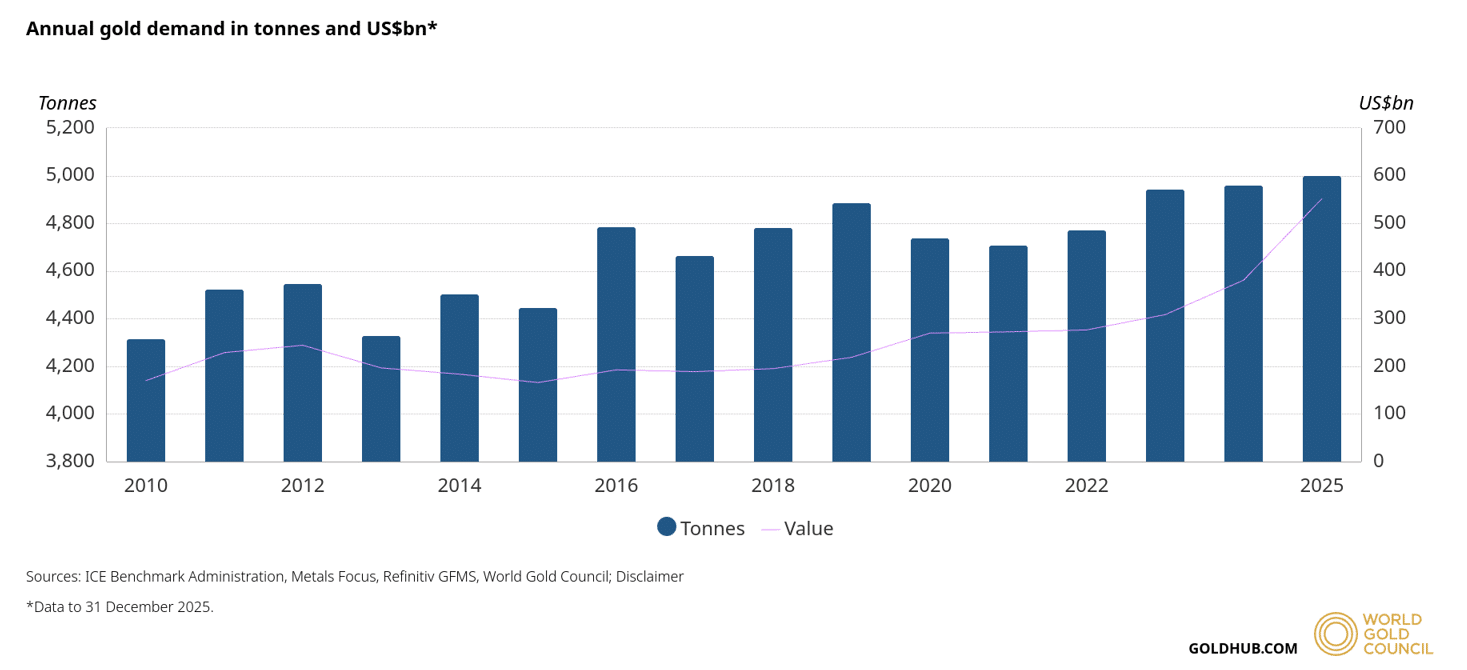

The same full-year data notes total gold demand including over-the-counter activity topped 5,000 tonnes for the first time, and the record price run helped push the value tally to $555 billion. When buyers pay up in size, they are usually buying certainty rather than trying to time a dip.

Bitcoin ETF outflows and the risk-on reality

In Bitcoin, the ETF tape is more twitchy as US spot products recorded net redemptions of more than $1.9 billion in January 2026, a clear stretch of Bitcoin ETF outflows that lined up with softer risk appetite across markets. It does not mean Bitcoin is broken. It means the marginal holder inside the ETF wrapper is sensitive to drawdowns, volatility limits, and rebalancing rules.

Many ETF buyers run models that cap volatility and maximum loss, so a sharp move can force selling even if the manager still believes in the long-term thesis. In that setup, Bitcoin ETF outflows can act like a volume knob on short-term price pressure.

The ETF base is still meaningful

As of February 9, 2026, spot Bitcoin ETFs held about 1.41 million BTC valued near $100 billion, roughly 6% of the fixed supply. That is enough to influence liquidity at the margin, because ETF shares are easy to trade and easy to rebalance, which is why Bitcoin ETF outflows can look abrupt.

Gold sits inside risk models as a reserve asset, so it rarely needs a new narrative to justify a hold. Bitcoin is still earning that role, and its investor mix remains more momentum-driven. Until that shifts, Bitcoin ETF outflows can flare up when macro volatility forces managers to reduce exposure.

Crypto indicators that explain the gap

Liquidity conditions often decide whether Bitcoin trades like protection or like beta. When markets de-risk, investors sell what is liquid first, and ETFs are built for liquidity, so Bitcoin ETF outflows tend to appear alongside wider de-risking.

Correlation is another tell. When Bitcoin moves with growth equities, it behaves less like an insurance asset and more like a risk sleeve. Volatility is the third indicator. Gold typically swings less, making it easier for balanced funds to hold, while Bitcoin’s larger moves can force position sizing down.

On-chain supply adds nuance. A large share of Bitcoin supply sits with long-term holders who rarely transact, so Bitcoin ETF outflows can coexist with a longer-term tightening backdrop.

Why small rotations still matter

Gold ETF assets near $559 billion create a useful thought experiment. Even a small shift in allocation could translate into billions of dollars of demand for Bitcoin, large enough to matter relative to new supply, and the same plumbing that enables exits can also enable fast re-entry.

Conclusion

Gold’s 2025 surge looked like a classic safety bid backed by record fund demand. Bitcoin’s early 2026 ETF picture looks more tactical, with Bitcoin ETF outflows reminding the market that many portfolios still treat Bitcoin as a volatile risk position. For now, Bitcoin ETF outflows remain one of the cleanest indicators of that positioning.

Frequently Asked Questions

What do Bitcoin ETF outflows usually signal?

They usually signal short-term de-risking, rebalancing, or volatility control rather than a permanent rejection of Bitcoin.

Why did gold attract so much ETF demand in 2025?

The data shows heavy investment buying and a broad safe-haven bid as prices set repeated records.

Can Bitcoin become a hedge asset?

It can, but it needs to show lower correlation during stress and attract longer-horizon holders.

Do Bitcoin ETFs control the whole market?

They influence liquidity and sentiment, but price discovery still spans global spot markets and derivatives.

Glossary of key terms

Bitcoin ETF: An exchange-traded fund that provides Bitcoin price exposure without direct custody.

Net outflows: The capital leaving a fund after inflows are subtracted.

Assets under management: The market value a fund manages.

Volatility: The size of price swings, often used to size portfolio risk.

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or legal advice. Digital assets are volatile, and readers should do independent research and consult qualified professionals before making decisions.

Sources