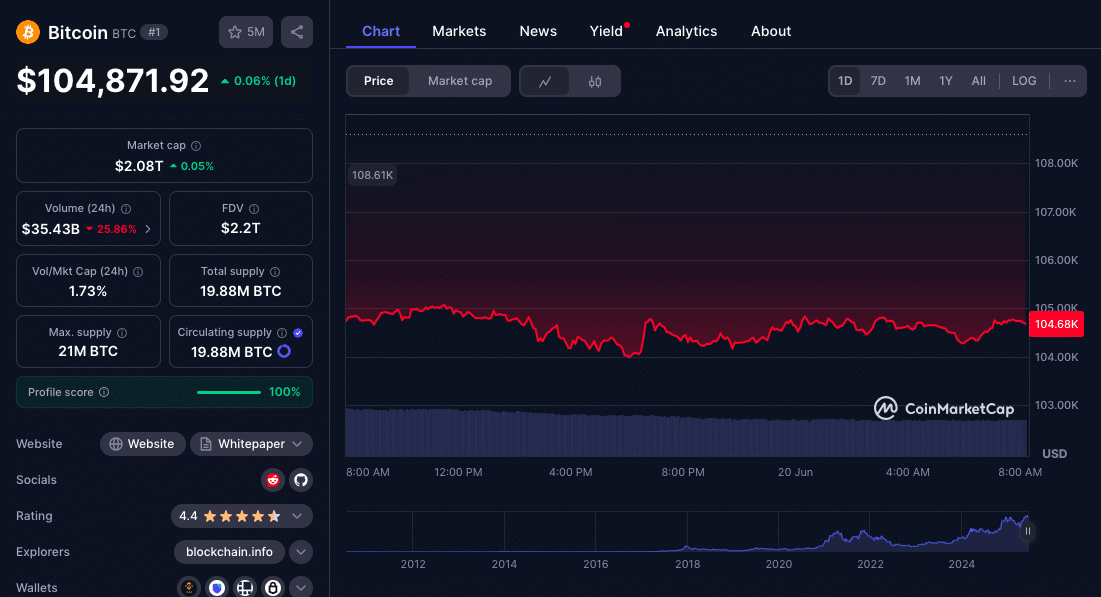

Bitcoin is currently holding around $104k – $105k but behind the scenes, a big concern is brewing. According to a new report from CryptoQuant, the market may be entering one of the weakest Bitcoin demand phases in years; and that means a correction to $92,000 or even $81,000. As institutions accumulate and retail participation declines, analysts are now split on whether Bitcoin is coiling for a breakout or a downturn.

- Bitcoin ETF Inflows Plummet, Market Disarray Brewing

- Institutional Inflows vs Retail Exodus: A Market in Transition

- Bitcoin Coiled or Cracking? Market Bets Split Ahead of June Close

- Technical Levels to Watch as Bitcoin Tests Market Patience

- Conclusion: Can Bitcoin Weather the Shift in Demand Dynamics

- FAQ

- What does the CryptoQuant report say about Bitcoin demand?

- Why are retail investors exiting the Bitcoin market?

- Are institutional investors still bullish on Bitcoin?

- What’s the technical Bitcoin price prediction?

- How do geopolitics affect Bitcoin?

- Glossary

Bitcoin ETF Inflows Plummet, Market Disarray Brewing

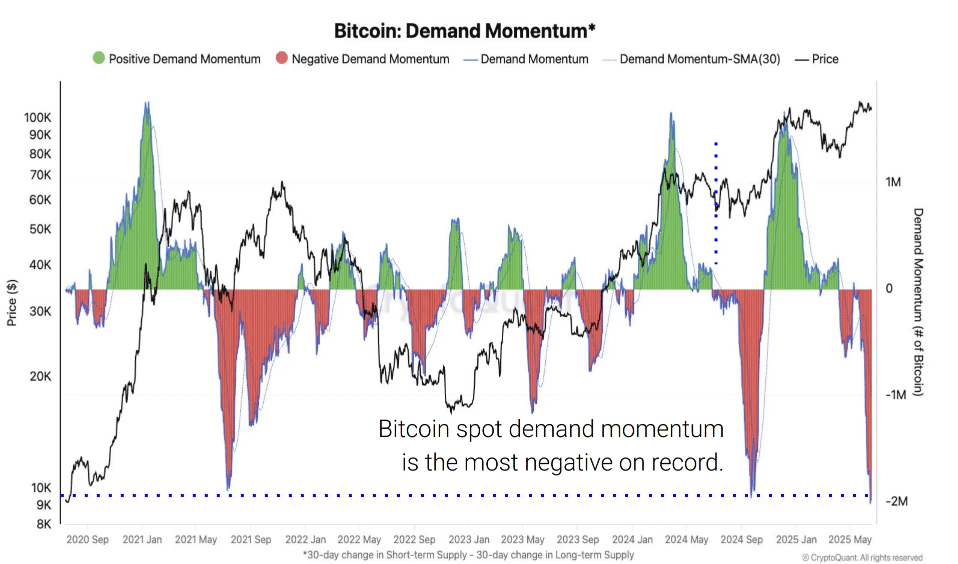

In its June 19 analysis, CryptoQuant flagged an “alarming” drop in several on-chain demand metrics. Most notably, Bitcoin ETF inflows have plummeted 60% since April and whale accumulation has halved. The firm’s demand momentum tracker has also hit a notable low and that means even institutional enthusiasm is slowing. Some traders think Bitcoin’s stability is just masking deeper structural issues.

However, Glassnode sees the stagnation differently. Instead of panic they see a “cooling” of retail hype and a maturation of the market. While transaction volume is down, Glassnode points out that high value transfers are still consistent hence, larger investors are still active and possibly positioning for the long term.

Institutional Inflows vs Retail Exodus: A Market in Transition

This divergence is visible across multiple data sets. Santiment reports that in the last 10 days, 231 new wallets with 10+ BTC have emerged. In contrast, smaller wallets (0.001-10 BTC) have declined by over 37,000. In past times, this pattern of retail exodus and whale accumulation has preceded price reversals.

But caution remains. As CryptoQuant analyst Julio Moreno said

“When ETF flows and retail interest both fall, we lose the demand engine that typically powers bullish moves. It doesn’t matter if whales are buying, if no one else joins, the momentum stalls.”

Meanwhile derivatives markets are outpacing spot activity with Flowdesk pointing out a 16:1 ratio. That means traders are positioning with more caution and sophistication and possibly anticipating a big move but unsure of direction.

Bitcoin Coiled or Cracking? Market Bets Split Ahead of June Close

The markets are also reflecting this uncertainty. On Polymarket, traders are split 49/51 between Bitcoin ending June below $90,000 or above $120,000. The indecision is due to the complexity of the macro environment. Global tensions (U.S. military action against Iran and the Fed’s hawkish tone on inflation) are causing market paralysis across crypto and traditional assets.

The geopolitical risk premium is real. Bitcoin is being pulled in two directions. On one hand a safe haven narrative; on the other a high risk asset during macro stress.

Officials have reported that Semler Scientific, one of the few public companies buying Bitcoin, isn’t backing down. They just announced plans to increase their BTC holdings from 4,449 to 105,000 by 2027. However, their own stock is also down 40% YTD.

Technical Levels to Watch as Bitcoin Tests Market Patience

From a technical perspective, Bitcoin has immediate resistance at $105,150. If bulls can’t push through, the structure will give way especially if demand is thin. Support is at $101,000 and then more decisively at $92,000; the level CryptoQuant is calling the critical downside target. Below that, $81,000 is the next major psychological level.

But many say a flash crash is unlikely unless ETF outflows and macro factors get worse fast. Sone experts have said what is being seen may be less of a collapse and more of a recalibration. The market is evolving, and volatility is moving away from retail to institutional desks.

Conclusion: Can Bitcoin Weather the Shift in Demand Dynamics

As the market recalibrates, the central question remains will institutional accumulation offset the retail collapse? With the Bitcoin demand collapse looming over the next move, all eyes are on the interplay between spot volumes, ETF flows and macro signals.

The next few weeks will tell if Bitcoin is just pausing or preparing to break lower.

FAQ

What does the CryptoQuant report say about Bitcoin demand?

CryptoQuant’s latest report shows a severe decline in ETF flows and whale accumulation with their demand momentum tracker at an all time low, raising concerns of a price crash to $92,000.

Why are retail investors exiting the Bitcoin market?

On-chain data shows small wallet holders have decreased significantly likely due to macro uncertainty, high volatility and weakening short term confidence.

Are institutional investors still bullish on Bitcoin?

Despite retail pullback, large holders and ETFs are still accumulating with companies like Semler Scientific planning to buy massive amounts of BTC over the next few years.

What’s the technical Bitcoin price prediction?

If Bitcoin loses the $104,000–$105,000 range, analysts say it could drop to $92,000 or $81,000. But some think a breakout is still possible if liquidity returns.

How do geopolitics affect Bitcoin?

Geopolitical risks create uncertainty in the global markets. Bitcoin can sometimes be a safe haven but has recently been mixed depending on broader sentiment and institutional flows.

Glossary

ETF Flows – Capital moving into or out of exchange-traded funds.

Whale Accumulation – When big wallets add more.

MACD – Technical indicator to measure momentum and trend reversals.

Demand Momentum Tracker – CryptoQuant’s proprietary index to measure buyer demand across on-chain and market data.

Coiled Market – Market is quiet before a big move up or down.