Updated on 20th November 2025

The Bitcoin crash alert is showing signs it might drop further. Investors and traders are keeping a close eye on prices where the market could slow down.

Many analysts are tracking $BTC closely to see how it behaves next. Past patterns and areas where lots of trades happen suggest the coming weeks could be challenging for those holding positions.

What Makes Bitcoin Important During a Bear Market?

Bitcoin (BTC) is the global first and most famous cryptocurrency. The idea was implemented in 2009. While traditional money is still controlled by a central authority, Bitcoin is working on a decentralized network and, therefore, it is not controlled by any central authority like a government or a bank.

Knowing the operation of Bitcoin would be very helpful, especially in the case of a Bitcoin crash alert, as the price can vary dramatically and cause you to lose money in a very short time.

Why Has Bitcoin Dropped From $126,000 to $92,000?

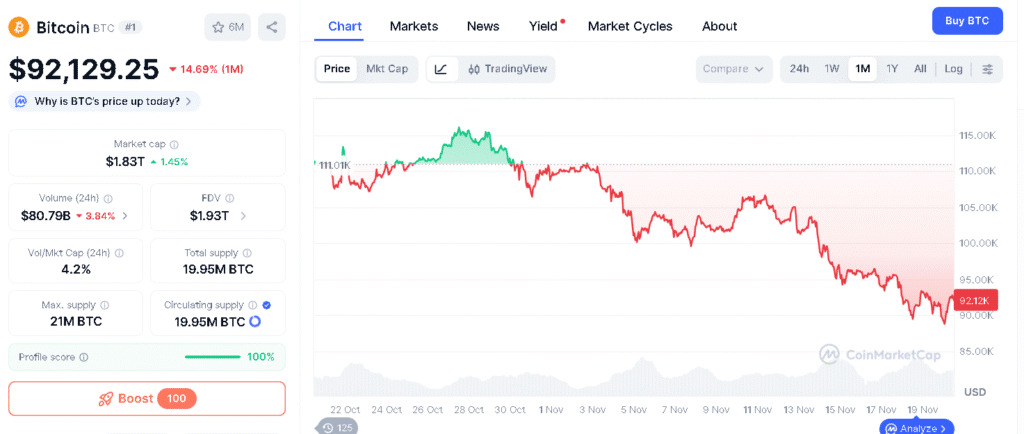

$BTC spent several months moving around its record high of $126,000, holding that strength from May through October. Things changed quickly in mid October when a tariff shock sent the market tumbling. The first heavy pullback took the price straight to $106,400.

After that hit, $BTC moved back and forth between $106,400 and $112,000 as traders waited to see if the market could steady itself. The quiet period ended quickly. When $BTC fell below $113,000, selling increased fast and drove the price under $100,000.

It was the moment many traders realized the market had lost its footing. Many traders say this kind of move shows how Bitcoin travels from one liquidity pocket to the next. These pockets act like brief floors or ceilings, guiding price action during heavy trading periods.

What Are the Key Levels to Watch in This Bear Market?

Analysts now see $85,000 as the next likely stop in the current Bitcoin crash alert. This level has been important in past trading, which is why many big and small investors pay attention to it. The drop toward $85,000 looks fairly open, so the price could reach it if selling continues.

If $BTC falls below that, traders will start watching the $77,000 to $74,000 area, which has acted as strong support in earlier downturns. Many traders point to $73,400 as a possible bottom for this cycle because past highs and strong buying interest meet around that level.

It is seen as an important spot for long term holders who want the market to stabilize during the Bitcoin crash alert. If $BTC drops under that level, the next important area is near $49,800. This zone is the lowest support in the current setup and would show that the market is under heavy pressure.

| Metric | Value / Range |

|---|---|

| High Range | ~$126,000 |

| First Major Pullback | $106,400 |

| Trading Range After Pullback | $106,400 and $112,000 |

| Major Breakdown Level | ~$113,000 |

| Next Key Support Level | $85,000 |

| Secondary Support Range | $74,000 and $77,000 |

| Possible Bear Market Bottom | ~$73,400 |

| Lowest Major Support | ~$49,800 |

| Current Price (approximate) | $92,144 |

How Do Traders Interpret These Price Movements?

For short term traders, each liquidity shelf acts like a point where they need to decide their next move in the Bitcoin crash alert. $BTC’s recent swings between the low $90,000s and the high $80,000s are pulling in traders who want to take profits and others who are trying to escape losing positions.

Analysts note that earlier market cycles often show similar patterns, where each drop falls into the next pocket of liquidity. They explain that this steady rhythm is why Bitcoin keeps moving lower in clear, measured steps in the Bitcoin crash alert.

A veteran crypto trader noted that the drop under $110,000 looked more like a sharp fall than a slow decline. If Bitcoin keeps following its usual trading patterns, $85,000 could be the next place where the market settles before moving lower. Many traders expect that level to act as a pause in the downtrend.

Long term holders may also see any move toward $73,000 as a buying chance because past support and strong interest have gathered in that area. CoinMarketCap charts show Bitcoin is trading near $92,144.33, which is roughly 15% lower than its price one month ago.

Could Bitcoin Reach $73K?

While no prediction is guaranteed, market patterns hint that the Bitcoin crash alert might find a bottom near $73,400. This number is not a sure outcome but a guide based on past price behavior and liquidity trends. $BTC has followed similar ranges many times over the last 18 months in the Bitcoin crash alert.

This helps traders understand the market’s direction a bit better instead of trying to guess every move. The move toward $73,000 could still bring short lifts toward $97,000 or $100,000, giving traders some room to adjust their positions.

Experts say price swings are still strong in the Bitcoin crash alert, so managing risk matters a lot. Traders who stay calm and avoid reacting too fast have a better chance of dealing with the current conditions.

Conclusion

The Bitcoin crash alertt is putting both active traders and long term investors to the test. With important levels sitting at $85,000, the $77,000 to $74,000 range, and maybe even $73,400, these areas reveal how the market is holding up under stress.

The way $BTC moves through these levels also shows what traders are thinking and how liquidity changes as the price shifts. While the final bottom is never certain, knowing these zones helps investors make better choices and manage their risk.

One analyst explained that Bitcoin does not move without order, but follows a kind of liquidity staircase that traders can watch to stay prepared. Investors should face the current market with patience and discipline. It is important to see how $BTC moves through these well known price areas before making any major decisions.

Glossary

Selling Pressure: When lots of traders sell at once, causing the price to drop.

Liquidity Pocket: A price area where many buy and sell orders happen, often making a temporary support or resistance zone.

Market Cycle: A pattern where prices go up, down, then up again over time.

Pullback: A small drop in price after a big rise or steady period.

Bear Market: When prices keep falling and most people expect the decline to continue.

Frequently Asked Questions About Bitcoin Bear Market

Why do $85K and $73K matter for Bitcoin?

It matters as Bitcoin bounced up from these spots before. They show strong buyer interest.

Why is Bitcoin falling from recent highs?

It’s dropping because important price supports broke. This made more people sell.

Could Bitcoin go down to $49,800?

Yes, if the key supports fail again and selling picks up, it could drop there.

How do traders use past price moves?

They watch where Bitcoin slowed or turned before to guess where it might stop next.

Why does Bitcoin fall in steps?

Each drop lands in a “liquidity pocket,” where buyers step in, making the fall slow and steady.