Bitcoin bear market conditions are now being guided more by measurable market signals than by panic selling. The current phase shows Bitcoin adjusting after a sharp decline, with the asset trading near $71,263.31, reflecting about a 41% pullback from the early October 2025 peak region, when prices moved above $126,000. Despite the visible price weakness, large investors have not abandoned the market, making this downturn more structured and complex than earlier cycles.

- What does the Bitcoin bear market mean in today’s cycle?

- How do long-term averages confirm the current regime?

- What are derivatives markets signaling about risk appetite?

- Why did broader markets deepen pressure on Bitcoin?

- Why do demand and liquidity remain under pressure?

- How are institutions behaving despite bearish labels?

- Is the current downturn affecting assets evenly?

- Conclusion

- Glossary

- Frequently Asked Questions About Bitcoin Bear Market 2026

Julio Moreno, head of research at CryptoQuant, said Bitcoin is operating within a bear regime that could continue through the third quarter of 2026. He described the phase as a shift in market structure rather than a breakdown, emphasizing that institutional participants continue to manage exposure even as broader market conditions remain under pressure.

What does the Bitcoin bear market mean in today’s cycle?

The Bitcoin bear market is increasingly seen as a phase of slower growth rather than a rush for the exits. The U.S. Securities and Exchange Commission generally treats a market as bearish when prices fall by around 20% and stay lower for several months. Bitcoin moved past that level well before now.

However, many crypto researchers and institutional analysts consider this measure less useful for digital assets. Sharp price moves are common in crypto and do not always mean the market has entered a long-term downturn. Because of this, analysts place more weight on a wider set of signals, including price trends, how investors are positioned, and overall liquidity conditions.

How do long-term averages confirm the current regime?

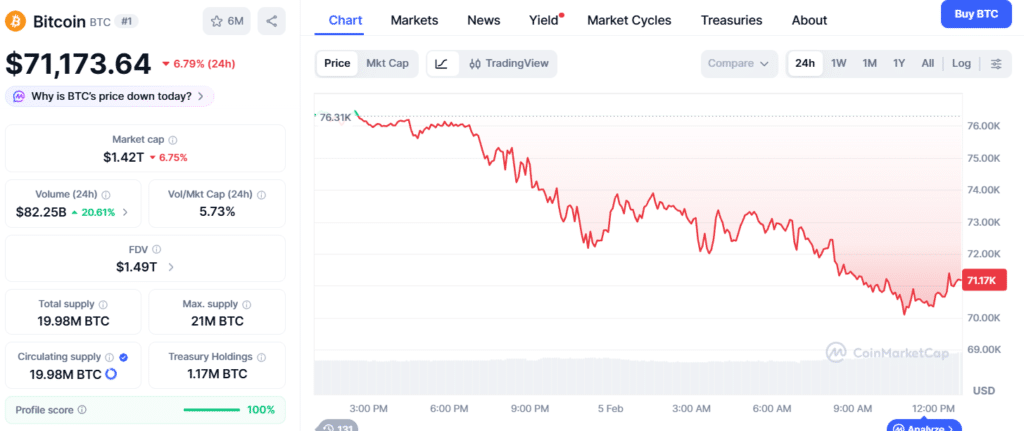

One of the strongest signs of the Bitcoin bear market can be seen in its price setup. Bitcoin is trading near $71,263.31, reflecting a 6.8% decline over the past 24 hours and a 19.34% drop over the last week. The asset also remains below both its 200-day and 365-day moving averages, with the longer-term 365-day level near $101,448, showing that the broader trend has not yet turned positive.

CryptoQuant’s Bull Score Index, which combines several on-chain health indicators, is currently at 20 out of 100. The firm classifies this reading as extreme bear territory, highlighting ongoing weakness across network activity, investor behavior, and capital flows.

What are derivatives markets signaling about risk appetite?

Derivatives data highlight how market participants are handling the Bitcoin bear market with caution. Recent Glassnode Week On-Chain reports show a clear shift toward protecting against losses, with options markets maintaining a steady bearish tilt. Instead of chasing gains, traders are willing to pay higher costs to guard against further price drops.

Dealer gamma has also moved below zero, a setup that makes the market more sensitive to downward moves. Analysts view this behavior as a sign of careful risk control rather than a loss of long-term confidence in Bitcoin.

Why did broader markets deepen pressure on Bitcoin?

Bitcoin’s recent decline moved in step with sharp losses across global markets. Asian technology stocks fell heavily, while silver recorded a historic drop of as much as 17%. The move followed disappointing earnings reports from major U.S. technology companies, including Alphabet and Qualcomm, which weakened overall risk sentiment.

This alignment shows that Bitcoin continues to behave like a high-beta risk asset rather than a defensive one during periods of stress. For the Bitcoin bear market, this matters because macro uncertainty often forces investors to reduce exposure to speculative assets.

As equities and commodities sold off at the same time, liquidity was pulled out of the crypto market, adding pressure to Bitcoin’s price. The shift in sentiment was also reflected in the Fear and Greed Index, which fell into Extreme Fear territory with a reading of 11, signaling broad investor caution rather than isolated crypto-specific weakness.

Why do demand and liquidity remain under pressure?

Demand-related indicators are adding pressure to the Bitcoin bear market outlook. CoinShares estimates that large holders have sold close to $29 billion worth of Bitcoin since October, reducing support from long-term investors. At the same time, digital asset exchange-traded products have seen roughly $440 million in outflows so far this year.

Analysis from CryptoQuant and MarketWatch points to a mix of soft demand and shrinking stablecoin liquidity. In past cycles, this type of environment has usually been linked to longer-lasting bearish phases rather than short-term pullbacks.

How are institutions behaving despite bearish labels?

Institutional activity adds an important layer to the Bitcoin bear market narrative. A global investor survey carried out by Coinbase Institutional and Glassnode between Dec. 10, 2025, and Jan. 12, 2026, found that 26% of institutions now say the market is in a bear phase, a sharp rise from 2% in the previous survey.

Despite this shift in outlook, behavior has remained steady. About 62% of institutions said they have held or increased their net long positions since October, while 70% continue to view Bitcoin undervalued. Matt Hougan of Bitwise has pointed out this contrast, explaining that institutions are more comfortable labeling the environment as bearish while still keeping long-term positions in place.

Is the current downturn affecting assets evenly?

The current phase is often described as K-shaped. Bitcoin continues to show relative strength compared with the rest of the market, while many other crypto assets have suffered deeper losses. Coinbase and Glassnode have pointed to this gap using dominance data and signs of defensive positioning among investors.

This split indicates that the Bitcoin bear market is not affecting all assets in the same way. Capital appears to be staying concentrated in Bitcoin, even as risk appetite for the broader crypto market remains limited, supporting the view that resilience is selective rather than widespread.

Conclusion

Bitcoin bear market conditions are likely to continue until clear structural signals begin to turn. Analysts are watching three main factors. Bitcoin needs to move back above its long-term moving averages and hold there. Institutional flows must shift firmly into positive territory. Options markets also need to calm as demand for downside protection eases.

Julio Moreno has outlined scenarios where Bitcoin could drift toward $70,000 over the next three to six months, with a possible test of $56,000 in the second half of 2026 if demand fails to recover. CoinShares, however, expects a more uneven three-to-six-month phase marked by sideways price action, followed by better conditions as selling pressure from large holders fades.

The key change is that market structure now carries more weight than timing. This phase is expected to end not because of a set calendar cycle, but when price trends, demand strength, and risk appetite begin to move in the same direction again.

Glossary

Bitcoin Bear Market: A period when Bitcoin prices are falling or staying weak.

Moving Average: A long-term price level that shows market direction.

Options Hedging: A way to protect against further price drops.

Bull Score Index: A CryptoQuant measure of Bitcoin’s market health.

K-Shaped Market: A market where Bitcoin performs better than other coins.

Frequently Asked Questions About Bitcoin Bear Market 2026

Why do analysts say Bitcoin bear market now?

Analysts say Bitcoin is in a bear market because prices are down and key market signals are still negative.

How much has Bitcoin fallen from its peak?

Bitcoin has fallen about 41% from its peak price above $126,000.

What do moving averages say about Bitcoin’s trend?

Bitcoin trading below long-term moving averages shows the overall trend is still bearish.

Why are demand and liquidity still weak?

Demand and liquidity are weak because large holders have sold Bitcoin and capital inflows remain low.

Why are institutions still holding Bitcoin?

Institutions are still holding Bitcoin because many believe it is undervalued for the long term.