Bitcoin ATH has once again captured global attention, this time, thanks to Japan’s new Prime Minister Sanae Takaichi, whose revival of Abenomics sent shockwaves through both currency and crypto markets. As the yen tumbled to multi-month lows, Bitcoin rocketed past ¥18.8 million, marking a new all-time high in Japanese yen terms.

During her first press briefing, Takaichi announced plans to restore coordinated monetary and fiscal stimulus, saying that “Japan must combine strong policy support with wage-led growth.” Her pro-stimulus message immediately triggered a sharp selloff in the yen and renewed investor appetite for digital assets like Bitcoin.

Abenomics Revival Sparks Bitcoin ATH Momentum

Takaichi’s agenda revives the hallmark economic framework pioneered by late former Prime Minister Shinzo Abe, a blend of aggressive government spending, structural reforms, and ultra-loose monetary policy. The shift has already made waves across global markets.

The yen slid beyond ¥150 per dollar, a level unseen since early 2024. That currency weakness magnified Bitcoin’s value when measured in yen, lifting it to its Bitcoin ATH. As one Tokyo-based trader put it on X, “Every time the yen dips, Bitcoin finds another gear. It’s become Japan’s hedge against its own policy.”

Japan’s retail investors, many of whom flocked to Bitcoin during the 2017 bull run, are re-emerging with fresh enthusiasm. Trading volumes on Japanese exchanges spiked as the yen’s fall made Bitcoin appear even more attractive as a store of value.

Bitcoin ATH and the Currency Divergence

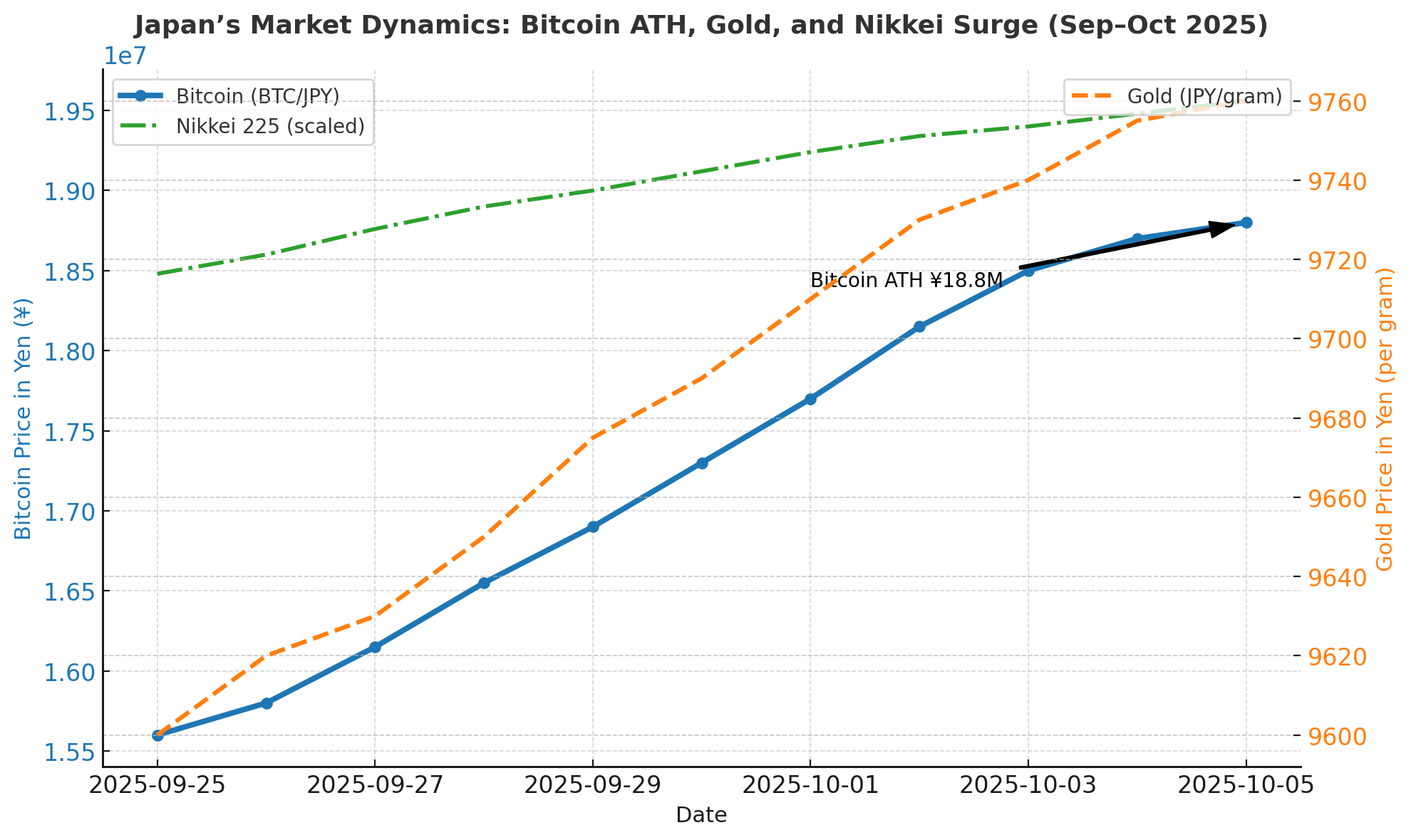

Even though Bitcoin’s price in U.S. dollars steadied near $124,000, the yen’s rapid depreciation exaggerated its local gains. Analysts point out that this divergence between BTC/JPY and BTC/USD highlights the currency effect driving the Bitcoin ATH phenomenon.

Market strategist Katsuya Ishida explained, “The yen’s decline isn’t just about Japan, it’s about liquidity. As long as Japan prints more money, risk assets, especially Bitcoin, will thrive.”

This pattern is being mirrored across Asia, where other regional currencies like the won and yuan are facing similar pressures amid renewed capital inflows into digital assets.

Global Reactions and Economic Ripple

The broader financial landscape echoed Japan’s excitement. The Nikkei 225 surged above 48,000 points, reflecting investor optimism over the return of fiscal expansion. Meanwhile, gold also hit a new high, showing that both traditional and digital safe havens are benefiting from Japan’s policy pivot.

However, some economists caution that the Abenomics revival could reignite inflation and balloon Japan’s already massive public debt, now over 250% of GDP. Yet for Bitcoin believers, that’s precisely the appeal.

“Bitcoin ATH levels are not just market records, they’re proof that fiat currencies are losing credibility,” said analyst Nic Carter, emphasizing that such macro shifts always funnel value toward decentralized alternatives.

Can Bitcoin Sustain Its ATH in Japan?

For now, the path forward depends on how far Takaichi’s government pushes stimulus without triggering intervention from the Bank of Japan. If the yen continues to weaken, more investors are expected to shift funds into Bitcoin and gold as hedges against monetary dilution.

With fiscal easing on the horizon and political stability backing it, analysts believe Bitcoin ATH in Japan could soon be mirrored globally. If Japan’s liquidity-driven policies inspire similar moves elsewhere, Bitcoin’s ascent may extend well beyond the yen markets.

Conclusion

The Bitcoin ATH against the yen is more than a chart milestone, it’s a reflection of Japan’s economic reset under Sanae Takaichi. Her return to fiscal expansion and dovish monetary policy has reshaped investor sentiment, reinforcing Bitcoin’s reputation as a global hedge against inflation.

As Abenomics 2.0 unfolds, Bitcoin could remain one of the biggest beneficiaries of Japan’s bold economic experiment.

Frequently Asked Questions

1. Why did Bitcoin reach a record high in Japan?

Bitcoin ATH came as Japan’s new pro-stimulus policies weakened the yen, driving investors to seek protection in crypto assets.

2. How does Abenomics influence crypto markets?

Abenomics encourages government spending and easy money, which weakens the yen and increases Bitcoin’s appeal as a hedge.

3. Is this rise limited to Japan?

Not entirely. The impact could ripple globally if other nations mirror Japan’s liquidity-driven approach to boost growth.

4. What’s next for Bitcoin’s price?

If the yen remains weak and fiscal easing continues, Bitcoin could push beyond ¥20 million in Japan and new highs globally.

Glossary

Abenomics: Japan’s economic revival plan combining monetary easing, fiscal stimulus, and reforms to drive growth.

Bitcoin ATH: The highest price Bitcoin has achieved in a specific currency or market.

Yen Depreciation: The fall in the yen’s value against other currencies, making assets like Bitcoin appear stronger.

Fiscal Stimulus: Increased government spending aimed at boosting economic activity.

Inflation Hedge: An investment that protects purchasing power during periods of rising prices, such as Bitcoin.

Liquidity Expansion: A policy that increases the money supply, often benefiting risk assets like crypto.

For advertising inquiries, please email . [email protected] or Telegram