The debate over US fiscal policy has reached new heights as reports appeared that the US may embrace Bitcoin and gold as instruments to manage its massive $35 trillion debt.

While contentious, the concept indicates a growing recognition that old tactics may no longer be enough. Analysts, politicians, and investors are now debating if gold revaluation and Bitcoin reserves will reshape the future of US monetary stability.

A Debt Crisis and Unconventional Solutions

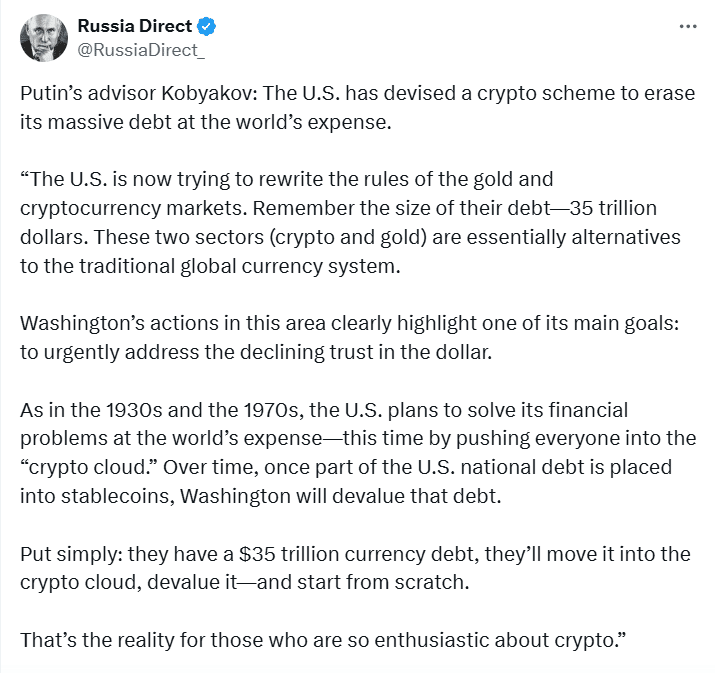

The United States’ national debt has swelled into a monumental burden, spurring debate about unusual solutions. A top advisor advised that Washington explore incorporating Bitcoin and gold into fiscal policy as a strategy to decrease obligations and hedge inflation.

The assertion included the possible use of stablecoin conversions to restructure debt, thereby authoring a new chapter in the country’s financial playbook.

One remark on X summed up the urgency: “The United States cannot outgrow or out-tax its way out of a $35 trillion problem.” It needs to reconsider reserves.” This view reflects larger fears that conventional approaches like greater taxes and expenditure cuts may no longer be sufficient.

Bitcoin and Gold: Reserve Assets

According to reports, officials and financial strategists are discussing the prospect of revaluing America’s massive gold reserves. Currently, those reserves are reported at outdated book values, but a change in accounting might reveal hundreds of billions in hidden assets.

By diverting that wealth into Bitcoin accumulation, the United States may potentially create a modernized dual reserve of Bitcoin and Gold that combines digital innovation with conventional stability.

Political momentum looks to be developing behind this story. Proposals for a national Bitcoin reserve have gained ground in Washington, backed by experts who see the commodity as “digital gold” with long-term inflation-hedging potential.

Advocates claim that, in the digital era, Bitcoin might serve as a strategic buffer in the same way that oil, gold, and foreign currency reserves have.

Investor Strategies mirror the debate

Beyond politics, markets are already responding to fears about fiscal instability. Legendary hedge fund investor Ray Dalio has warned that the United States faces a “financial heart attack” if debt continues to rise.

His method entails diversifying among inflation-resistant assets, with a focus on Bitcoin and gold. “Every investor needs exposure to assets that governments cannot print endlessly,” Dalio said, emphasizing why institutional portfolios are turning toward these safe-haven strategies.

At the same time, Bitcoin’s performance has bolstered its credibility. Bitcoin has risen by more than 300% in the last year, but gold has retained its reputation as a reliable store of wealth. The combined narrative of Bitcoin and Gold as rival hedges is influencing investment strategy while also sparking debate about how governments may utilize these assets.

Skepticism and Risk

Despite the curiosity, cynicism is rampant. Critics worry that such a move might disrupt global financial institutions and have unexpected repercussions. Economists say that connecting debt management to volatile assets such as Bitcoin poses significant dangers.

Furthermore, concerns about legality, transparency, and international reputation cast doubt on the practicality of using Bitcoin and gold as official debt relief mechanisms.

Nonetheless, the discourse is broadening. The notion that America may shift to Bitcoin and Gold follows a worldwide trend in which conventional and digital assets are increasingly seen as inextricably linked. Even if these tactics are hypothetical, they underscore the importance of investigating alternative solutions to a looming catastrophe.

Conclusion

The allegation that the United States may turn to Bitcoin and Gold to reduce its $35 trillion debt has generated one of the decade’s most interesting financial arguments.

Advocates see innovation, security, and the opportunity to rebuild budgetary underpinnings, while others warn of instability and unpredictability. What is obvious is that Bitcoin and gold have evolved into more than just rival safe havens; they are now at the center of the global debate about the future of finance and national debt.

FAQs for Bitcoin and Gold as Assets

Q1: Why are Bitcoin and Gold being linked to U.S. debt solutions?

They are considered inflation hedges and reserve assets that cannot be manipulated like fiat currency.

Q2: What is meant by gold revaluation?

It refers to updating the book value of gold reserves to reflect modern market prices, potentially unlocking hidden wealth.

Q3: Could Bitcoin realistically serve as a national reserve asset?

Yes, proponents argue Bitcoin’s scarcity and global acceptance make it suitable, though volatility remains a concern.

Q4: What are the risks of using Bitcoin and Gold for debt relief?

Risks include volatility, legal complexities, and potential disruption to global markets.

Glossary

National Debt: The total amount of money owed by a country’s government, in this case the U.S. at $35 trillion.

Stablecoin Conversion: The idea of restructuring debt into blockchain-based stable assets.

Gold Revaluation: Adjusting the recorded value of gold reserves to reflect real market prices.

Reserve Asset: A currency, commodity, or asset held by governments to support stability and financial obligations.

Inflation Hedge: An asset that protects against the declining purchasing power of fiat currency.