According to latest reports, Bitcoin and Ethereum ETFs saw massive inflows for the week, with Bitcoin ETFs garnering around $2.34 billion in net inflows from US spot-ETF products, while Ethereum ETFs bounced back with about $638 million.

These numbers are big, but market watchers have also noticed that they are consistent, with this being the third week in a row that Bitcoin ETFs have seen net inflows without outflows. As macro expectations, especially around US interest rate cuts improve, investor demand for regulated exposure remains high.

ETF Fund Flows Last Week

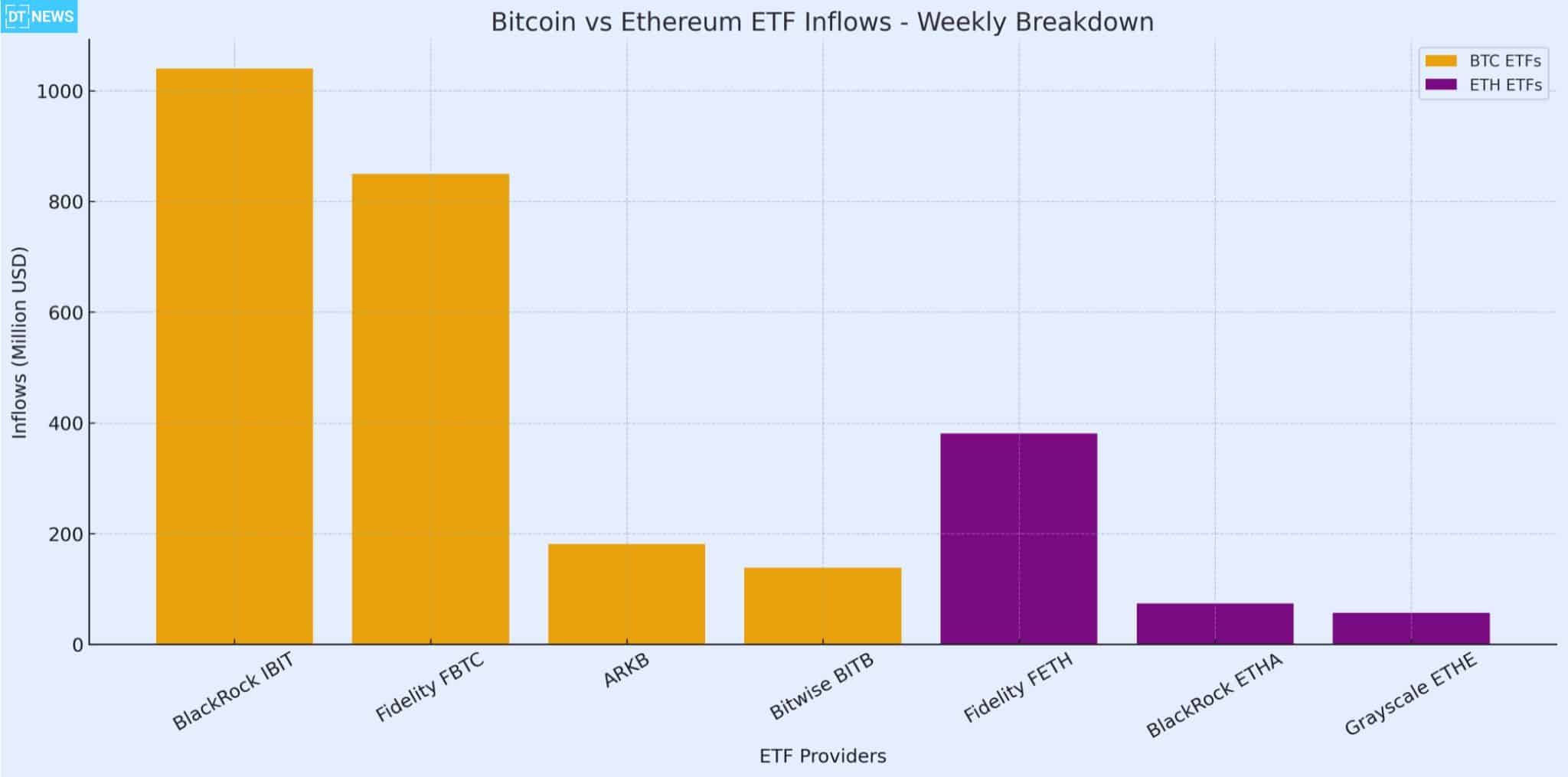

Based on available data, in the just-concluded week, Bitcoin spot ETFs saw $2.34B in net inflows. Top contributors were BlackRock’s IBIT with $1.04B, Fidelity’s FBTC with $849.56M, ARK’s ARKB with $181.62M and Bitwise’s BITB with $138.54M.

This happened even as Bitcoin has been consolidating. On the Ethereum side, ETFs ended the outflows streak and saw $638M in inflows. Top inflows were Fidelity’s FETH with $381.28M, BlackRock’s ETHA with $74.13M and Grayscale’s ETHE with $56.87M.

Overall, the flows show institutional appetite and confidence in the structures of both Bitcoin and Ethereum ETF products.

Macroeconomic and Regulatory Factors

Several external factors are driving the Bitcoin and Ethereum ETFs flows. There is growing market expectation of multiple US Federal Reserve rate cuts before year-end, which is bullish for risk assets. Institutions, therefore, see the current Bitcoin price consolidation as an opportunity.

Q4 is traditionally strong for $BTC. Regulatory clarity and the legitimacy of spot ETFs are attracting capital. Ethereum’s inflows may be a reversal of outflows, perhaps driven by improved sentiment around ETH staking, protocol updates and use-case expansion.

Investors are also looking for regulated products to gain exposure, especially with macro headwinds.

Technical and Price Market Context

While flows are strong, price action for both is mixed. Bitcoin has been trading sideways around $114,000-$116,500. Despite big inflows, that range has been tough to break. Ethereum is also consolidating; it’s up a bit this week but still constrained by resistance and uncertainty.

Volatility is high. Technicals like RSI show Ethereum is trying to regain momentum after weak weeks. For these flow trends to translate into price moves, markets need to hold current support and break through resistance with conviction.

What it Means for Bitcoin and Ethereum Going Forward

The consistent big inflows into Bitcoin and Ethereum ETFs mean a few things. First, institutions are committing to regulated crypto exposure which should reduce volatility over the long term. Second, spot ETF inflows are bridging the gap between demand from investors who want regulated, transparent products.

Third, if macro conditions remain favorable, such as rate cuts, low inflation, and economic stability, these ETFs could be the foundation for buyers at these price levels. If macro shocks happen or resistance doesn’t break, there’s risk the inflow momentum stalls or reverses.

Also read: BlackRock’s ETHA Drives Ethereum ETF Inflows Toward $10B Milestone

Conclusion

Based on the latest research, Bitcoin and Ethereum ETFs are seeing institutional demand as $2.34B went into Bitcoin and $638M into Ethereum last week. This is during consolidation, resistance and macro optimism around rate cuts.

Prices aren’t trending up yet but the flows are a sign of confidence. If resistance breaks and regulatory clarity continues, these ETFs could be the drivers of gains. Investors are advised to watch how support holds and inflow velocity changes to see if the recent momentum is sustainable.

For in-depth analysis and the latest trends in the crypto space, our platform offers expert content regularly.

Summary

Bitcoin and Ethereum ETFs saw big inflows last week with $2.34B into Bitcoin funds and $638M into Ethereum. BlackRock, Fidelity, Bitwise, and ARK, among others, were the big contributors. Macro drivers like rate cut expectations and institutional preference for regulated exposure are supporting these flows during sideways price action.

Glossary

ETF (Exchange-Traded Fund) – A regulated investment fund traded on stock exchanges that holds underlying assets like Bitcoin or Ethereum.

Spot ETF – An ETF that holds the actual cryptocurrency rather than derivatives or futures.

Net Inflows – The total amount of new capital flowing into a fund minus withdrawals during the same period.

Resistance Level – A price range where selling pressure tends to prevent further upward movement.

Support Level – A price zone where buying pressure tends to prevent further decline.

FAQs about Bitcoin and Ethereum ETFs

What caused $2.34B into Bitcoin ETFs?

Big inflows were led by funds like BlackRock’s IBIT and Fidelity’s FBTC as institutional investors sought regulated exposure during favorable macro conditions.

Why did Ethereum ETFs rebound with $638M inflows?

After a period of outflows, investors went back into ETH ETFs likely due to improved sentiment around Ethereum’s fundamentals and renewed interest in regulated exposure.

Will ETF inflow lead to price up for BTC/ETH?

Inflows show demand but prices need to break resistance and hold technical strength. Macro risks and profit taking can offset gains.

Are these inflows sustainable?

They are if macro conditions remain favorable and regulatory risks don’t increase. But rate policy changes or geopolitical stress can kill the trend.