After a short-lived recovery, Bitcoin (BTC) has once again turned lower, hovering near $107,600, while altcoins like AVAX and ADA suffer intraday losses approaching 5%. As investors brace for the G7 Summit and a new wave of economic data from both the U.S. and Europe, today’s ETF flows and macro commentary may offer critical clues.

Market Sentiment: Central Banks, Inflation, and Geopolitics

The day began with a string of statements from European Central Bank (ECB) officials. Any dovish commentary highlighting economic slowdown could spark temporary optimism in risk markets, including crypto. However, later in the day, markets will digest the U.S. Producer Price Index (PPI) report, expected to come in at 2.6% YoY, up from the previous 2.4%.

Such a jump in inflation could serve as a negative lead indicator for upcoming Personal Consumption Expenditures (PCE) data, likely fueling risk-off sentiment as U.S. markets open. This puts crypto, particularly Bitcoin, under short-term pressure.

Looking ahead, the G7 Summit (June 15–17) may bring further volatility. While tariff resolution with China has improved optimism, renewed negotiations between the U.S. and other trade partners could influence sentiment if positive headlines emerge. According to Dey There, markets are now positioned in a highly reactive stance—sensitive to both policy and geopolitical signals.

BTC Price Watch: Below $107,800 Is a Caution Flag

Technically speaking, Bitcoin’s failure to close above $107,800 raises concerns about deeper retracement potential. If this level continues to act as resistance, altcoins could face additional downside pressure. Meanwhile, reports of unconfirmed activity in the Middle East and vague U.S. government briefings on regional tensions may stir either anxiety or relief—both of which are capable of swinging crypto prices in the short term.

ETF Inflows: Bitcoin and Ethereum Tell a Different Story

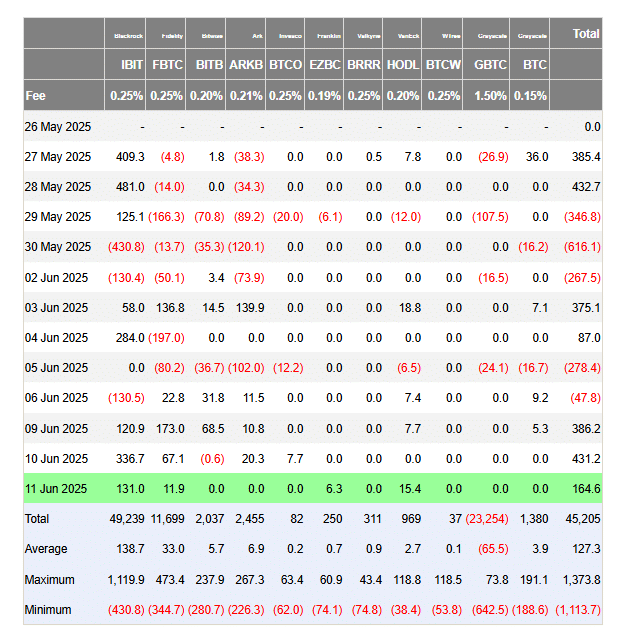

Despite short-term price weakness, ETF flows remain robust, especially in Bitcoin ETFs. Since June 5, net inflows have shown steady momentum, with yesterday alone seeing $164.6 million in net BTC ETF inflows, thanks to a positive CPI print and Trump’s remarks confirming the China trade breakthrough.

So far this week, BTC ETFs are nearing $1 billion in net inflows, showing clear institutional confidence. However, rising geopolitical tension could lead to short-term outflows if fear spikes.

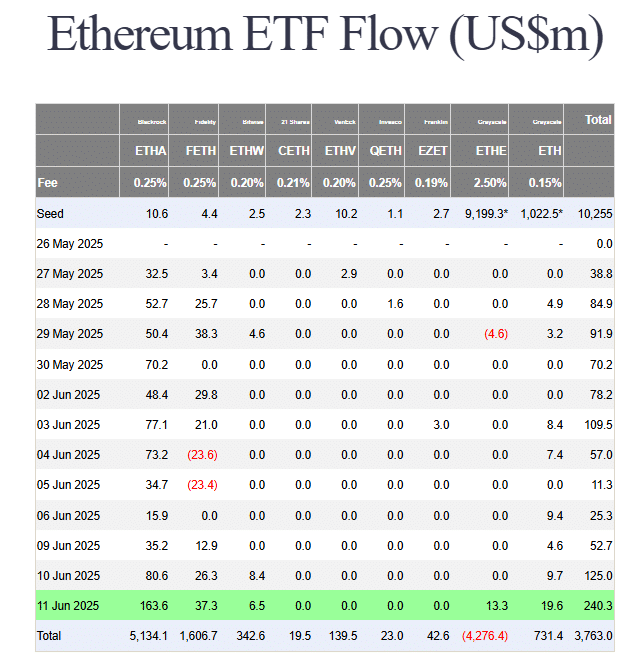

Meanwhile, Ethereum ETFs are experiencing a surge. With ETH recently trading above $2,766.59, ETF channels recorded $240 million in net inflows in a single day. The majority of these flows came from BlackRock clients, underscoring deep institutional support not just for Bitcoin but Ethereum as well.

Summary Outlook

Despite short-term downside risks linked to inflation and geopolitics, ETF data suggests that long-term institutional conviction remains strong. For investors assessing near-term volatility versus long-term potential, Dey There recommends closely monitoring ETF trends alongside global economic developments.