This article was first published on Deythere.

- How Polymarket’s New Contracts Work

- Early Trading Indicators: Interest in Volatility

- Why It Matters for Traders and Markets

- Volatility Trading vs. Traditional Derivative Products

- Conclusion

- Glossary

- Frequently Asked Questions About Crypto Volatility Markets

- What are the latest crypto volatility markets?

- How are volatility prediction contracts compared to price bets?

- How did the indices of volatility of these markets come about?

- Do these markets require advanced trading knowledge?

- Can the retail trader even access these markets?

- References

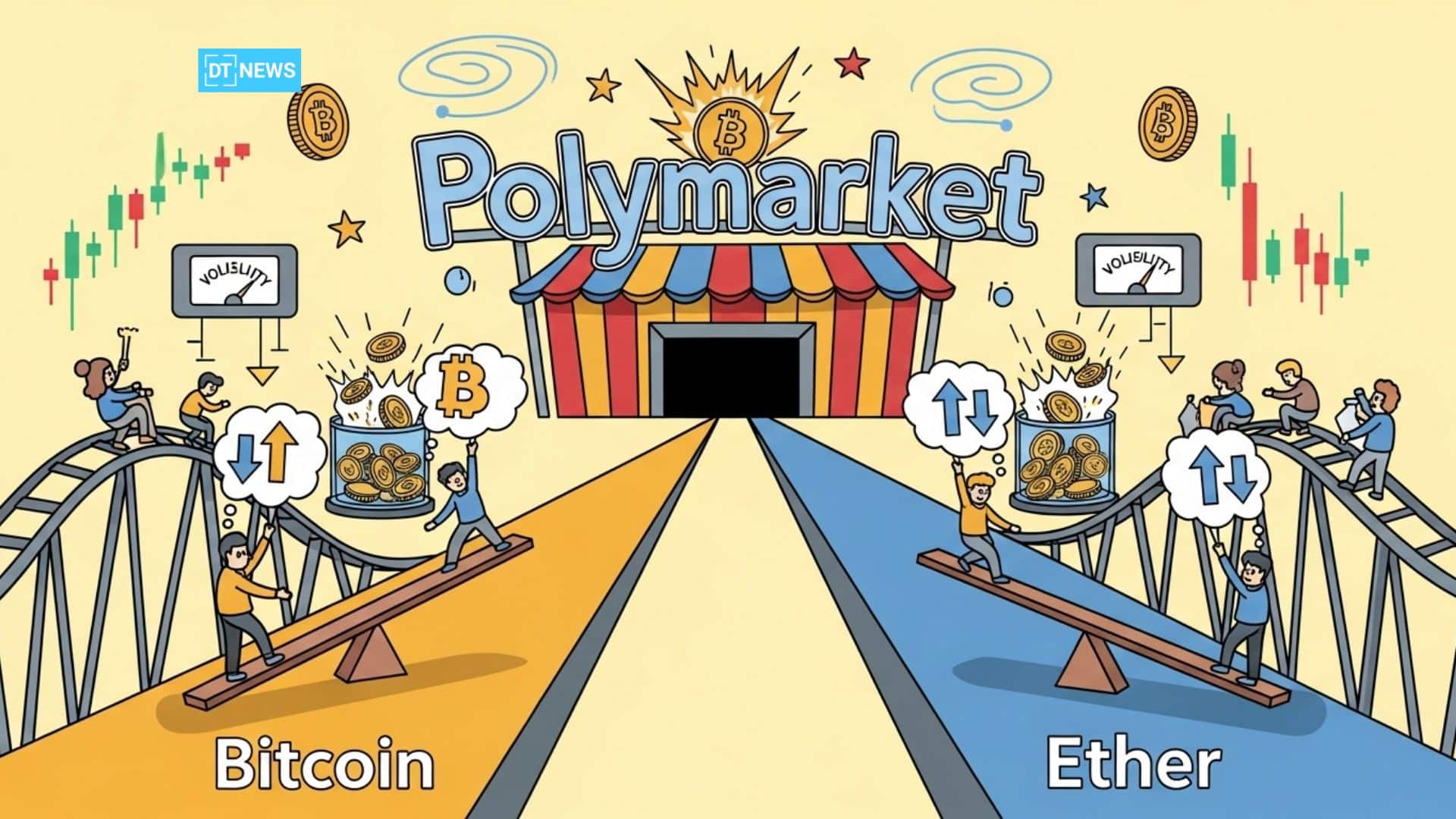

Polymarket just introduced new contracts based on a 30-day implied volatility for Bitcoin and Ether using Volmex’s rapidly adopted BVIV and EVIV indices. These contracts allow participants to bet directly on how much market prices will swing this year; a new, creative way to track and trade crypto volatility without going through complex derivatives or institutional set-ups.

How Polymarket’s New Contracts Work

Polymarket’s new product is built on 30-day implied volatility indices for Bitcoin and Ether developed by Volmex Labs. Implied volatility is the level at which traders expect prices of an index or security to swing over a future period, in this case, the next 30 days.

Until now, access to simplicity around crypto implied volatility was mostly available only for professional traders through options and futures.

Two prediction contracts were created on Polymarket tied to the Bitcoin Volmex Implied Volatility (BVIV) index, and Ethereum Volmex Implied Volatility (EVIV) index respectively. Traders can purchase the “Yes” or “No” shares on whether either one will reach or surpass barrier levels before Dec. 31, 2026.

What separates these contracts from traditional price markets is that the payouts are based on volatility spikes, not on price direction. That means a participant betting on the Bitcoin contract isn’t really betting on whether BTC moves up or down but rather if 30-day expected volatility will trade at the chosen level at any point in 2026.

For a “Yes” trade to win, a one-minute candle on the BVIV index must touch or exceed that level at any point over the life of the contract; if not, it settles “No.”

Early Trading Indicators: Interest in Volatility

Early market moves indicate traders foresee big price swings of both Bitcoin and Ether this year. The Polymarket Bitcoin volatility contract prices a roughly 35% implied chance that BVIV will double to 80% (from present levels) during 2026.

A similar view is expressed by the Ethereum volatility contract, which has an EVIV that could increase towards 90% from its current level. Implied volatility readings are generally higher when traders anticipate large price swings.

Those pricing levels are important because they represent viewing volatility itself, not directional price wagers. It’s not whether BTC hits a price at its peak or ETH catches onto some valuation; it’s traders betting on how choppy the market will be in the months ahead.

Therefore, by packaging it into a minimalist binary contract structure otherwise known as a “Yes/No” market, this standardizes what was once considered an institutional-only volatility futures and complex option strategies.

Why It Matters for Traders and Markets

Traditional volatility trading as seen on Wall Street with products such as the VIX index, has long enabled traders to hedge or bet on market fear and turbulence.

In crypto, implied volatility has been more difficult for normal traders to access directly without sophisticated option strategies. With Polymarket’s launch, volatility speculation is now easy to join, thus opening up participation.

Cole Kennelly, the founder and chief executive of Volmex Labs said;

“Polymarket, the world’s largest prediction market, launching contracts on Volmex’s BVIV and EVIV indices is a major milestone for Volmex and crypto derivatives broadly”. He explained that this approach brings “institutional-grade BTC and ETH volatility benchmarks into the simple, intuitive prediction market format, making it easier for traders and investors to express views on crypto implied volatility.”

This matters because volatility pricing is a main input flavor in numerous models to price trades and manage risk. When the market is expecting bigger swings in the future, that can affect everything from options pricing to demand for liquidity and hedging.

Volatility Trading vs. Traditional Derivative Products

Before firms such as Polymarket entered the volatility space, most exposure to market volatility involved multiple options strategies or futures. Volmex also made its volatility based indices in the past available to centralized exchanges such as BFX Derivatives, where BVIV and EVIV perpetual futures provide leverage on market volatility for professional traders.

Now that prediction markets have binary volatility contracts, retail traders are now able to put basic capital towards sentiments on volatility in the markets without having to establish accounts or develop derivative knowledge.

This may also play a role in how volatility impacts spot price moves, as implied volatility often serves as a measure for trader sentiment: high levels of implied volatility can sometimes be a sign of fear or uncertainty, while lows can indicate complacency.

The growth of such a market points to broader trends in crypto, a growing sophistication when it comes to financial products; deeper integration between traditional reference points, decentralized tools for managing finances and more retail users being able to get at complex financial data.

Conclusion

Polymarket and Volmex indices introduction of crypto volatility markets is a positive move in the maturation of digital asset trading.

By allowing simple bets on Bitcoin and Ether implied volatility, Polymarket has standardized the space that was formerly limited to elite institutional traders.

The early pricing indicates that traders are expecting big market swings over the course of this year, not only in prices but in the uncertainty that factors into volatility measures.

As the year ticks on, these markets will be monitored for their trading action and what they reveal about sentiment toward crypto risk and price dynamics in 2026.

Glossary

Crypto volatility markets: These are trading or prediction platforms where participants can bet on the amount of price movement (or “volatility”) a crypto asset will have over a certain period in time.

Implied volatility: a measure based on options prices that shows how much traders expect an asset’s price to fluctuate in the future.

Prediction markets: Sites where traders can vote or bet on the result of future events, typically with binary outcomes.

BVIV: Bitcoin Volmex Implied Volatility Index, a measure of 30-day expected price volatility in Bitcoin.

EVIV: Ethereum Volmex Implied Volatility Index, which gauges anticipated 30-day price turbulence of Ether.

Frequently Asked Questions About Crypto Volatility Markets

What are the latest crypto volatility markets?

The latest crypto volatility markets are prediction contracts on Polymarket linked to Volmex’s 30-day implied volatility indices for Bitcoin and Ether. Traders and investors can wager on whether volatility will hit certain levels through 2026.

How are volatility prediction contracts compared to price bets?

Volatility prediction contracts pay out based on how much price movement is anticipated than predicting if Bitcoin or Ether will be higher/lower than a certain price.

How did the indices of volatility of these markets come about?

The BVIV and EVIV indices, which gauge 30-day implied volatility for Bitcoin and Ether, were developed by Volmex Labs and now support a range of financial instruments like these prediction markets.

Do these markets require advanced trading knowledge?

No. Polymarket’s binary contracts are intended to make trading volatility simple for all, including new users who can simply understand a decision that is yes/no.

Can the retail trader even access these markets?

Yes. These markets are live for anyone who has access to Polymarket and they let retail traders take a view on future crypto volatility without getting into a complex derivatives setup.