This article was first published on Deythere.

Bitcoin clawed its way back toward the mid-$70,000s after a sharp drop that briefly pushed it below $73,000, levels not seen since late 2024. The rebound brought relief across the board, with ether and several large-cap tokens bouncing too, yet the tone underneath this move stays cautious. Price can recover faster than confidence, and right now confidence is the scarce asset.

One reason is simple: the market has been trading like it is looking for footing, not launching a fresh trend. Bitcoin was reported trading above $78,000 at points during the rebound, but it also ran into resistance that has capped upside since early February. That pattern matters because it often creates a choppy range where short-term traders thrive and long-term buyers hesitate.

Total Crypto Market Cap Rises, Then Meets a Ceiling

The broader market followed Bitcoin higher. Total crypto market capitalization increased about 1.7% over 24 hours to roughly $2.65 trillion, but the rebound has repeatedly lost momentum around the $2.65 trillion to $2.68 trillion zone. That range is acting like a low ceiling. Until price can push through it with conviction, rallies can feel more like a reset than a restart.

Leadership also tells a story. BNB was cited as a rebound leader, while Dogecoin caught a lift after another round of attention from Elon Musk. When meme energy and exchange-linked tokens lead, it can signal risk appetite returning, but it can also hint that investors are hunting for quick upside rather than building long-term positions.

The Fund-Flow Signal Is Still Risk-Off

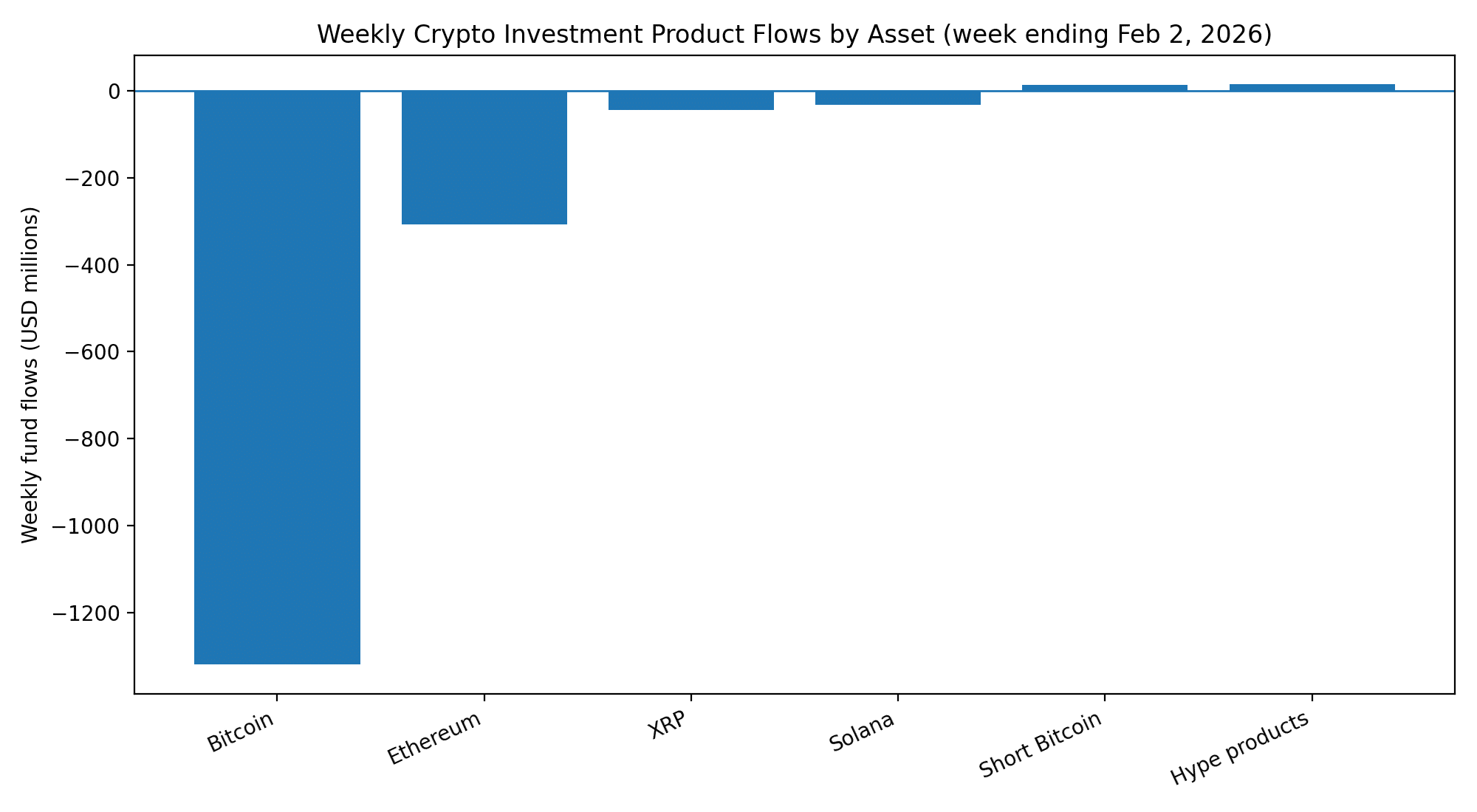

The strongest argument for caution is not on the chart. It is in capital flows. A weekly fund-flows report from a major digital-asset manager showed $1.7 billion in outflows, flipping year-to-date flows to a net outflow of $1 billion and cutting assets under management by about $73 billion since the October 2025 peak.

The withdrawals were broad across major assets: roughly $1.32 billion out of bitcoin products and $308 million out of ether products, with additional outflows from XRP and Solana. That kind of steady exit flow can act like sand in the gears. Even if spot prices bounce, a market that is bleeding investment-product demand often struggles to sustain upside.

Key Indicators Traders Are Watching Now

From a price-analysis standpoint, the mid-$70,000 area is the first real battleground. A recent market report described a possible “value zone” in the mid-$70,000s, and bitcoin was noted changing hands above $76,000 after the dip. If buyers defend that band, it can set up a higher low and stabilize sentiment. If it fails, the market risks revisiting the recent low and dragging majors with it.

The options market adds a second layer. Analysts noted signs that options traders are starting to position for a local bottom, even as on-chain signals indicate long-term holders have slipped into unrealized losses, a setup associated with an “extremely bearish” phase in prior cycles. In plain terms, the market is doing two things at once: searching for a floor while still behaving defensively.

Conclusion

Bitcoin’s rebound toward $76,000 has improved the mood, but it has not repaired the foundation. Heavy outflows, resistance near key levels, and defensive positioning suggest this rally can fade as quickly as it appeared. The next durable move will likely require more than a bounce. It will require steady demand, cleaner liquidity, and a market that stops selling every recovery.

Frequently Asked Questions

Why are traders skeptical even after Bitcoin bounced back?

Because fund flows remain negative and the broader market has struggled to push beyond resistance zones. That combination often limits follow-through on rebounds.

What level matters most in the short term?

The mid-$70,000 area is a key support band after the recent dip below $73,000. A firm hold can stabilize price action, while another break can reopen downside risk.

Why do outflows matter for price?

Large, persistent outflows signal investors are reducing exposure, which can weaken demand during rallies and make rebounds more fragile.

Glossary of Key Terms

Market Capitalization: The total value of the circulating supply of crypto assets.

Outflows: Net withdrawals from investment products such as ETPs or funds, often reflecting risk-off positioning.

Assets Under Management (AUM): The total value managed in investment products, which can rise or fall with price and flows.

Options Market: A derivatives market where traders buy or sell contracts to hedge risk or speculate on price direction.

Unrealized Loss: A paper loss on holdings that have not been sold, based on current price versus acquisition cost.

Liquidity: How easily an asset can be bought or sold without moving price sharply; low liquidity can amplify swings.

References