According to sources, Bitcoin all-time high momentum has grown as $BTC crossed $124,000 for the first time, hitting a new record in early Asian trading. The rise came from supportive U.S. policies, expectations of Federal Reserve rate cuts, and strong interest from institutions.

- What factors pushed Bitcoin to this record level?

- How significant is the role of institutional inflows?

- What do the technical indicators reveal?

- How does market sentiment reflect this rally?

- How should traders plan with the Bitcoin all-time high in sight?

- Conclusion

- FAQs

- 1. What is new Bitcoin all-time high in 2025?

- 2. What triggered Bitcoin’s latest rally?

- 3. Which political moves boosted Bitcoin?

- 4. What does the RSI indicate?

- 5. What is the current market sentiment?

- 6. Which ETFs lead in Bitcoin holdings?

- Glossary

- Sources

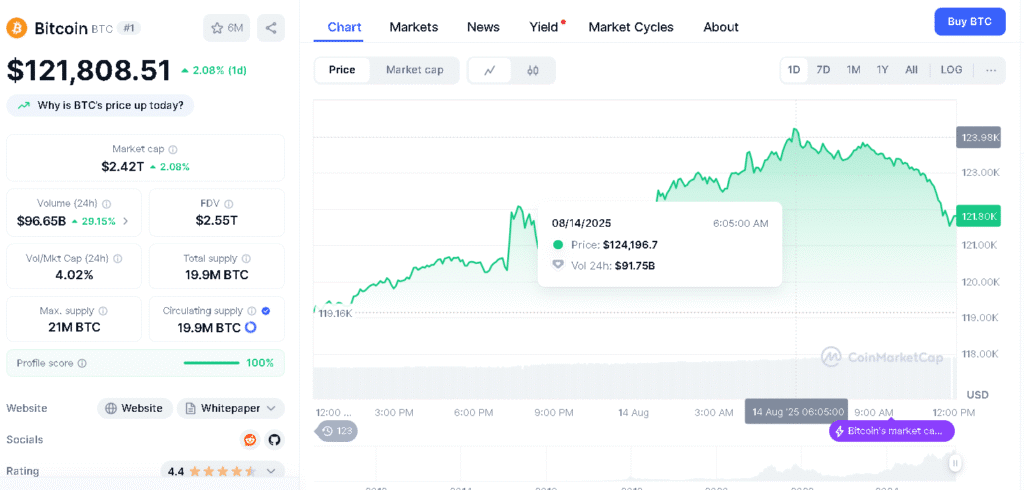

Data shows $BTC briefly reached $124,500 before pulling back slightly, beating its July peak and showing how regulatory changes are helping the cryptocurrency grow.

What factors pushed Bitcoin to this record level?

Bitcoin has reached a new milestone due to a positive economic outlook and supportive political moves. Analysts say the expected U.S. interest rate cuts are helping boost risk assets like $BTC.

The Trump administration’s pro-crypto steps, including easing rules for banks working with crypto companies, have increased investor confidence.

Samer Hasn, senior market analyst at XS.com, said that the cryptocurrency market is experiencing very strong fundamentals and noted that Bitcoin is becoming more accepted in mainstream finance.

How significant is the role of institutional inflows?

Institutional involvement is a key factor behind the current Bitcoin rally. Spot Bitcoin ETFs saw $86.91 million in net inflows, bringing total inflows to $54.76 billion.

BlackRock’s iShares Bitcoin Trust and Fidelity’s FBTC hold the largest assets, showing ongoing confidence from professional investors.

Pankaj Balani, CEO of Delta Exchange, said that institutional support “helps maintain the uptrend” and reduces reliance on retail traders, unlike past rallies. This strong backing is one reason the Bitcoin all-time high is seen as more stable than earlier peaks.

| Metrics | Key Value |

| Bitcoin New All Time High | $124,457.12 |

| Date Of New All-Time High | Aug 14, 2025 |

| Price Change Year-to-Date | +33.22% |

| Market Cap | $2.42T |

| Institutional Inflows | $237 million |

| Factors Driving Price Surge | Fed rate cut hopes, regulatory clarity, |

| Near-Term Price Target | $145,000 |

| Long-Term Price Target | $185,000 |

What do the technical indicators reveal?

Market indicators suggest that Bitcoin’s upward drive is still strong, with no clear warning signs of overheating. The RSI reading is in a bullish zone but still under the overbought mark. The MACD shows a clear gap above its signal line, pointing to sustained buying interest.

$BTC is positioned well above its key moving averages, the 7-day SMA at $119,728.23 and the 200-day SMA at $100,077.71, confirming that the broader trend remains positive.

On the chart, resistance is set at $124,474.00, with traders eyeing the round-number target of $125,000 and beyond. Meanwhile, support is found at $111,920.00, with a deeper floor near $105,100.19.

How does market sentiment reflect this rally?

Investor mood stays in the “Greed” range, with the Fear & Greed Index rising from a week earlier. This positive outlook is fueled by steady ETF inflows, clearer regulations, and more companies holding Bitcoin as part of their reserves.

Ben Kurland, CEO of DYOR, called the situation “a perfect storm” created by easing inflation, strong institutional demand, and supportive regulatory moves.

The ongoing push toward the Bitcoin all-time high keeps traders watchful, as high sentiment levels can also bring sharper market swings.

How should traders plan with the Bitcoin all-time high in sight?

For short-term traders, Bitcoin being close to resistance means they should be careful. Risk-takers might aim for a breakout above $124,474.00, while cautious investors may choose to buy slowly over time.

Since it’s near the Bitcoin all-time high, big price swings are likely. The daily ATR of $2,704.44 can help manage risks, and spot trading volume on Binance is still strong at about $3 billion.

Conclusion

Based on the latest research, Bitcoin all-time high levels have been driven by a mix of heavy institutional buying, favourable policy moves, and strong chart signals.

Pushing past $124,000 is a record in itself, but seasoned traders warn that excitement should be matched with smart risk management.

In the near term, the market will show whether Bitcoin settles into a steady range or aims for the next big milestone. Either way, this latest rally cements Bitcoin’s role as the clear leader in the crypto world.

Summary

The Bitcoin all-time high for 2025 hit $124,500, driven by optimism over possible U.S. Federal Reserve rate cuts, friendlier crypto regulations, and strong buying from big investors.

Spot Bitcoin ETFs brought in huge inflows, with BlackRock and Fidelity taking the lead, helping keep the rally steady and less volatile. Technical signals show steady buying with Bitcoin trading well above key moving averages.

Market sentiment sits in the “Greed” zone, but experts advise caution near resistance levels. The surge cements Bitcoin’s position as the dominant force in the cryptocurrency market.

Stay updated on every Bitcoin all-time high 2025 price move and expert analysis only on our platform.

FAQs

1. What is new Bitcoin all-time high in 2025?

$124,500 in early Asian trading.

2. What triggered Bitcoin’s latest rally?

Fed rate cut hopes and supportive U.S. policies.

3. Which political moves boosted Bitcoin?

The Trump administration is easing rules for banks working with crypto firms.

4. What does the RSI indicate?

Bullish, but not overbought.

5. What is the current market sentiment?

In the “Greed” zone

6. Which ETFs lead in Bitcoin holdings?

BlackRock’s iShares Bitcoin Trust and Fidelity’s FBTC.

Glossary

Fed Rate Cut- Reduction in U.S. interest rates by the Federal Reserve.

ATR- Average True Range is a measure of market volatility.

Fear & Greed Index- Gauge of market sentiment from extreme fear to extreme greed.

MACD- Indicator showing buying or selling momentum.

RSI- A tool showing if Bitcoin is overbought or oversold.