Bitcoin has blown past its previous records to reach a new all-time high above $111,000 and it seems institutional dominance is here to stay. The latest Bitcoin all-time high, driven by a steady stream of capital from public companies, asset managers and ETFs, has put Bitcoin in uncharted territory while rebranding it from a speculative asset to a macroeconomic hedge.

- Institutional Demand Outpaces Retail Hype

- Treasury Strategies Put Bitcoin into Corporate Finance

- JPMorgan’s Quiet Spin Signals TradFi Shift

- Derivatives Market Shows Bullish Sentiment

- Resilience in Global Macro Uncertainty

- Conclusion: A New Institutional Era

- FAQs

- Why did Bitcoin reach a new all-time high?

- Who is buying Bitcoin now?

- How did ETFs contribute to the recent rally?

- Has JPMorgan Chase adopted Bitcoin?

- Can Bitcoin’s all-time high go even higher this year?

- Glossary

Institutional Demand Outpaces Retail Hype

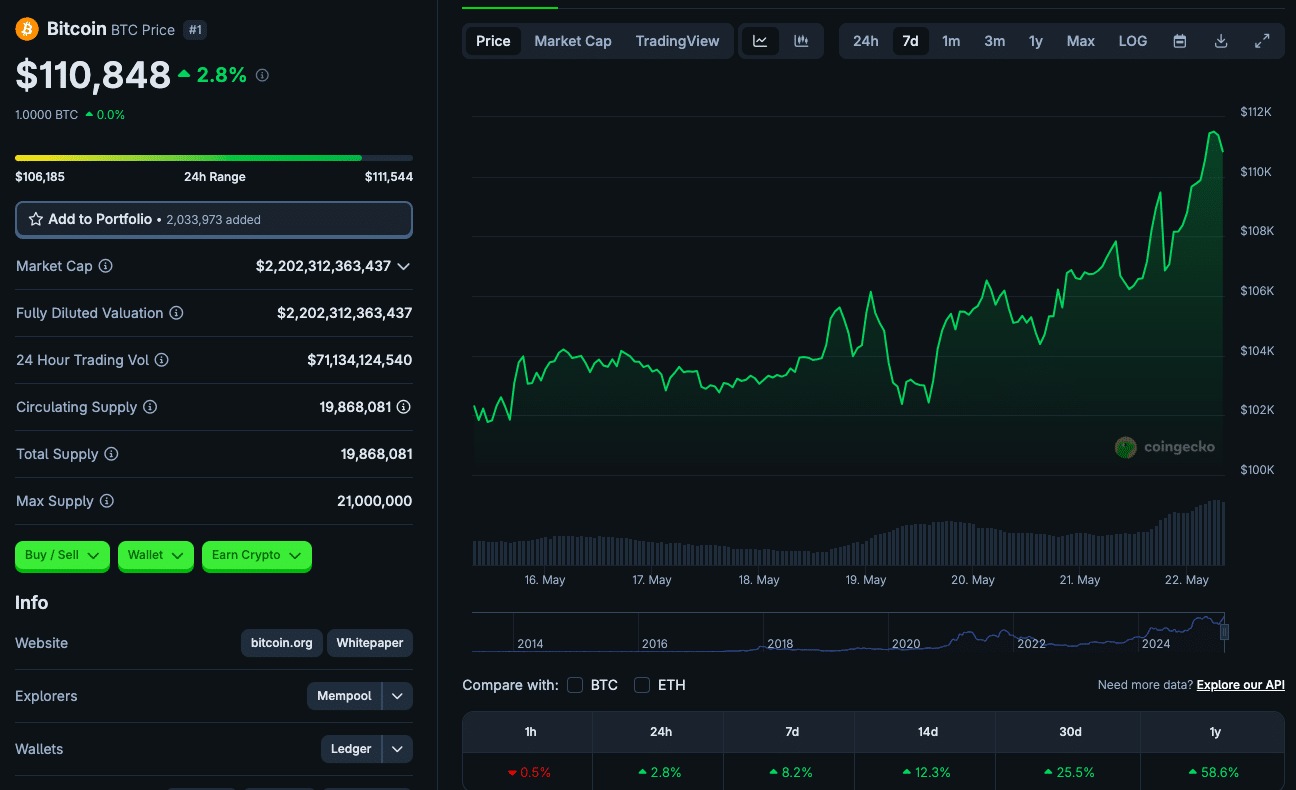

This morning, Bitcoin hit $111,878 according to CoinGecko, lifting the total crypto market cap by 1.7%. However, as at the time of this publication, BTC stands at $110,848. Unlike previous cycles driven by retail traders and hype, this is a deeper market shift led by big financial players. Jeff Mei, COO of BTSE, told CoinDesk

“We think institutions are driving Bitcoin’s rally. This will continue as more companies go public and ETF inflows remain strong.”

May has seen $3.6 billion in net ETF demand, proving that regulated products are driving price discovery at levels never seen before. Spot Bitcoin ETFs, which launched earlier in 2024, are the magnet for institutional capital. BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund have been leading trading volumes and AUM growth.

Treasury Strategies Put Bitcoin into Corporate Finance

Several public companies are now using Bitcoin as a treasury reserve asset, further reducing supply in an already tight market. Following MicroStrategy’s playbook, newer entrants like Semler Scientific and Metaplanet have recently disclosed multi-million-dollar Bitcoin purchases as part of their balance sheet strategy.

Semler Scientific reportedly bought 581 BTC for $40 million in May and declared Bitcoin as its “primary treasury reserve asset” according to its SEC filing. Japan’s Metaplanet mirrored this strategy, buying 117 BTC, citing long term inflation and currency debasement concerns. This is happening in an environment of low trust in fiat and rising demand for decentralized assets.

JPMorgan’s Quiet Spin Signals TradFi Shift

A quiet but noteworthy signal emerged this week when JPMorgan Chase, the largest bank in the U.S., started offering Bitcoin to select clients. JPMorgan has always been cautious on crypto but this reported move suggests they are rethinking their stance in response to client demand and competitor momentum. Ryan Lee, Chief Analyst at Bitget Research, told CoinDesk

“As the largest bank in the U.S., this adds a new level of legitimacy to Bitcoin, and other traditional financial institutions will likely follow to not get left behind.”

This could be the start of more TradFi participation as Bitcoin is no longer seen as a volatile asset but a scarce digital commodity like gold.

Derivatives Market Shows Bullish Sentiment

Options traders are doubling down on the up.side According to Deribit, open interest in Bitcoin call options for $110,000, $120,000 and even $300,000 expiring in June has gone up. This is telling us that smart money is expecting more upside in the short term and potentially another leg of price discovery before summer ends.

It should be noted that the options market is showing a huge imbalance of bullish vs bearish bets. With implied volatility still contained despite the price rise, many are interpreting this as institutional accumulation rather than a blow off top.

Resilience in Global Macro Uncertainty

Bitcoin is breaking out despite traditional macro headwinds that would normally crush risk assets. Rising bond yields, inflation fears have not deterred investors from Bitcoin.

QCP Capital in their Thursday note described Bitcoin’s behavior as “remarkably resilient” and said another FOMO driven rally is possible.

“A breakout to new highs could trigger a fresh wave of FOMO, drag in sidelined retail capital and push prices even higher” they wrote.

Another factor is the US regulatory environment. The SEC approving spot Bitcoin ETFs and the bipartisan support for digital asset regulation in Congress has created a more stable framework for institutions to get in. This clarity is giving traditional asset managers the confidence to scale their Bitcoin exposure for the first time.

Conclusion: A New Institutional Era

Bitcoin all-time high of $111,878 is an exemplary pattern. With ETF flows, corporate treasuries and traditional banks on board, Bitcoin is no longer a macro asset up for debate. While short term volatility is possible, the institutional participation foundation suggests Bitcoin’s long term trajectory is just getting started.

FAQs

Why did Bitcoin reach a new all-time high?

Bitcoin reached a new all-time high of $111,878 due to institutional inflows, ETF demand, corporate treasury buying and traditional financial institutions getting in.

Who is buying Bitcoin now?

Publicly listed companies like MicroStrategy, Semler Scientific and Metaplanet and ETF issuers like BlackRock and Fidelity are among the institutions getting in.

How did ETFs contribute to the recent rally?

Spot Bitcoin ETFs brought regulated exposure to Bitcoin and attracted billions of institutional capital. May alone saw $3.6 billion in net ETF inflows and helped push the asset into price discovery.

Has JPMorgan Chase adopted Bitcoin?

While not announced in a press release, multiple reports say JPMorgan is offering Bitcoin to select clients. Institutional acceptance is growing.

Can Bitcoin’s all-time high go even higher this year?

Options data and institutional positioning says yes. Open interest in high strike call options is pointing to more upside through summer.

Glossary

Bitcoin All-Time High: The highest price of Bitcoin ever.

ETF (Exchange-Traded Fund): A fund that trades on an exchange and holds Bitcoin.

Treasury Reserve Asset: An asset held by companies to keep capital and hedge inflation.

Options Trading: A way to bet on the future price of an asset.

TradFi: Short for “traditional finance,” means old school banking and investing.

![BitTorrent [New]](https://s2.coinmarketcap.com/static/img/coins/64x64/16086.png)