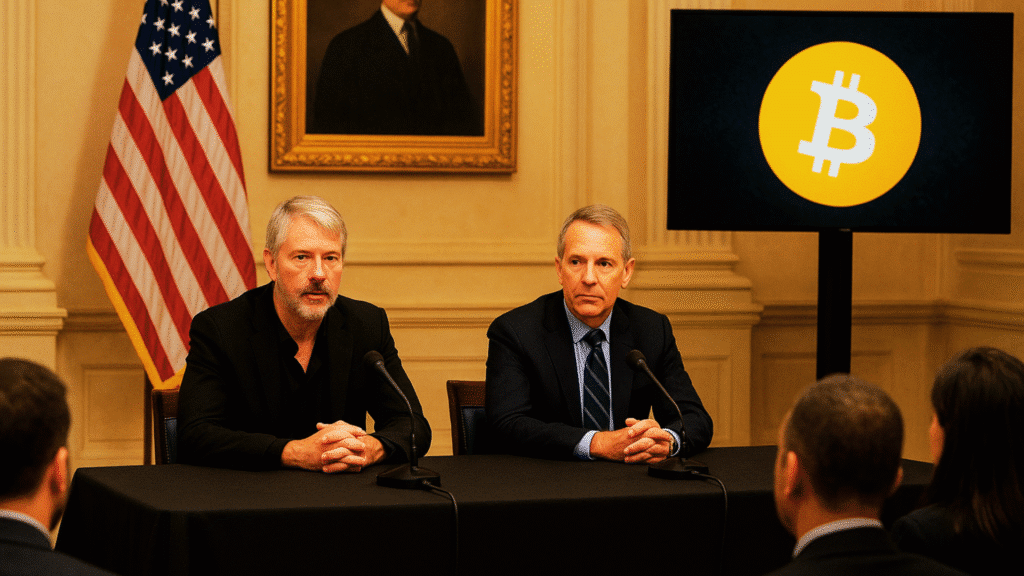

According to sources, the BITCOIN Act is set to take center stage on Capitol Hill this week. Michael Saylor, Marathon Digital CEO Fred Thiel, and other top executives will join lawmakers to discuss the proposal.

The roundtable will be led by Senator Cynthia Lummis and Representative Nick Begich. Its goal is to push forward a bill that would make Bitcoin a strategic reserve asset for the United States.

How Does the BITCOIN Act Aim to Shape U.S. Crypto Policy?

The BITCOIN Act, brought back in March by Sen. Lummis, suggests that the U.S. government should buy 1 million $BTC within five years. Lawmakers behind the bill say this can be done through “budget-neutral strategies.”

Supporters think it would create a permanent digital reserve, similar to America’s gold holdings, and help make the U.S. economy stronger. Crypto supporters see the bill as an important step to fix Bitcoin’s place in U.S. policy. Saylor often says that Bitcoin is more than just technology and that it is a strategic asset.

Also read: Bitcoin Slow Grind Narrative Gains Traction as PlanC Outlines Path to $1 Million

Who will attend the Capitol Hill roundtable?

Michael Saylor, Fred Thiel, and Cardano founder Charles Hoskinson are among the names set to join the Capitol Hill session. Senior leaders from Bitdeer, Riot Platforms, and Cleanspark will also take part, giving the talks wider industry backing.

The push is meant to show lawmakers that the BITCOIN Act is about national security and economic strength, not party lines. Charles Hoskinson confirmed on X that he would be in Washington for the meeting.

How does this connect to Trump’s executive order?

Earlier this year, former President Donald Trump signed an order that kept Bitcoin taken in criminal or civil cases in a permanent government fund instead of selling it. The BITCOIN Act takes this further by calling for planned accumulation of Bitcoin rather than relying only on seized assets.

Analysts note that if the plan goes through, it would be the first time the U.S. government purposely builds a Bitcoin reserve as a strategic asset. Hailey Miller from the Digital Power Network said it is about making sure the country does not fall behind in the digital age.

What challenges does the legislation face?

Crypto leaders are very supportive, but the BITCOIN Act currently has only Republican backing. So far, only Republicans support the BITCOIN Act, and backing from both parties will be needed for it to pass.

Lawmakers have not scheduled hearings with the House Financial Services Committee or the Senate Banking Committee, so it’s unclear when the bill will move forward. Groups like the Digital Chamber and the Digital Power Network are sharing briefing papers to present the BITCOIN Act as a chance for bipartisan support.

Also read: Michael Saylor Hints at Another Massive Bitcoin Buy After $1B Raise

How does this affect the broader crypto market?

Traders and analysts say investors are closely watching the BITCOIN Act. Market interest reflects both institutional attention and hopes for clearer regulations.

Many believe that if the U.S. commits to a Bitcoin reserve, confidence in the asset could rise significantly. Tom Lee of Fundstrat, also attending the roundtable, added that creating a Bitcoin reserve would put the U.S. in a leadership position, much like its gold strategy did in the past.

Conclusion

The future of the BITCOIN Act will depend on whether lawmakers can come together to treat Bitcoin as a reserve asset. Supporters say it could strengthen the country’s financial security in a digital economy. Critics, however, caution about market volatility and political challenges.

Recent analysis shows the BITCOIN Act could become a key moment for U.S. crypto policy. If support grows, the bill may change how Washington sees Bitcoin as not just an investment but also a strategic national asset

Summary

The BITCOIN Act is gaining attention as crypto leaders, including Michael Saylor and Fred Thiel, meet lawmakers on Capitol Hill. The bill, reintroduced by Senator Cynthia Lummis, proposes the U.S. acquire one million $BTC over five years as a strategic reserve.

Supporters say the BITCOIN Act could make the country’s financial system stronger and help the economy. At the moment, mostly Republicans support it, but advocates are trying to get both parties on board. If the bill passes, it could change the way the U.S. treats Bitcoin as a key national asset

Stay updated on the BITCOIN Act and see if 1M BTC could change US market policy or not, only on our platform

Glossary

BITCOIN Act – A proposal for the US to buy 1 million Bitcoin as a national reserve.

Budget-Neutral Strategy – A funding method that avoids adding new costs to taxpayers.

Strategic Reserve Asset – A long-term government holding like gold, used for stability.

Capitol Hill Roundtable – A policy meeting in Washington where lawmakers and leaders debate proposals.

Seized Bitcoin – BTC taken by the government in criminal or civil cases.

FAQs for BITCOIN Act.

1. Who supports the BITCOIN Act?

The Industry leaders named Michael Saylor and Fred Thiel.

2. What does the BITCOIN Act call for?

Buying 1 million Bitcoin.

3. Who hosts the Capitol Hill roundtable on the BITCOIN Act?

Cynthia Lummis and Nick Begich.

4. Which industry leaders are attending the roundtable?

Executives from Cardano, CleanSpark, Bitdeer, Riot Platforms, and others.

5. What is the goal of the meeting?

To build bipartisan backing.

6. Why do supporters want the Act?

For US economic security.