This article was first published on Deythere.

- Plan C’s Core Argument: Rejecting Historical “Playbooks”

- Macro Indicators: PMI, Business Cycles and Divergence

- Distribution Bands and What They Mean for Bitcoin Prices

- Gold, Liquidity and the “Safe-Haven” Signal

- The Three 2026 Regimes to Watch

- Conclusion

- Glossary

- Frequently Asked Questions About Plan C Bitcoin Cycle Warning

- What is Plan C’s Bitcoin cycle warning?

- What is the Bitcoin Quantile Model?

- Why the ISM PMI for Bitcoin?

- What does Bitcoin-gold ratio indicate?

- Do previous Bitcoin cycles even matter?

- References

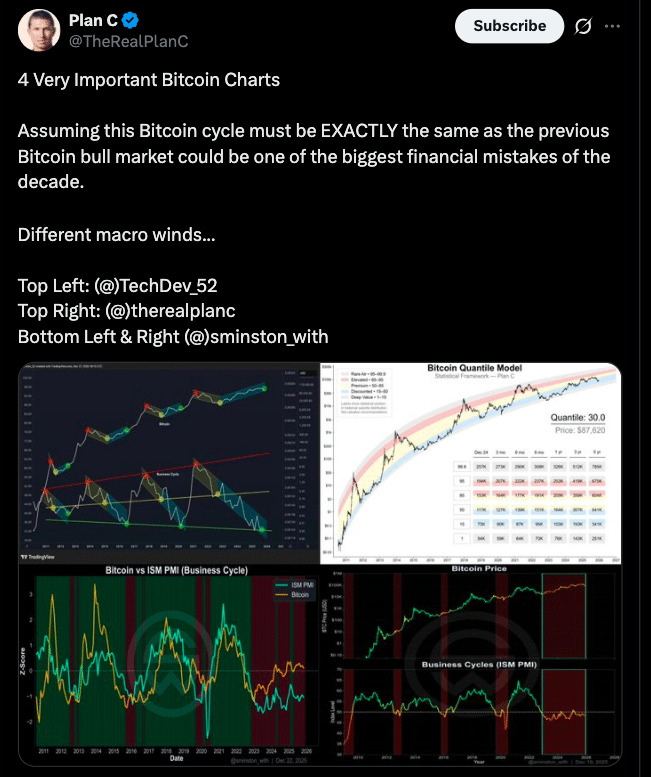

As 2025 winds down, one of the leading Bitcoin analysts is taking issue with a popular thesis in the cryptocurrency markets. The Bitcoin cycle warning comes from Plan C, the pseudonymous creator of the Bitcoin Quantile Model, who says that presuming this market cycle will repeat previous bull runs could be “one of the biggest financial errors” of the decade.

This caution is based on a combination of macro data, fragile business cycle signals, and Bitcoin’s existing price action in relation to historical distributions.

The analysis notes that the larger macro divergence, such as U.S. manufacturing weakening and gold’s own surge, could alter Bitcoin’s path into 2026.

Plan C’s Core Argument: Rejecting Historical “Playbooks”

Plan C’s most recent charts point to the average trader and investor ceasing reliance on analogies from previous Bitcoin cycles.

According to the analyst, Bitcoin trading near $87,661, consistent with recent price data showing Bitcoin around the mid-$87,000 level as year-end approaches, offers no guarantee of a repeat performance of patterns witnessed in earlier phases including fast-paced rallies or predictable timing setups from prior bull markets.

Plan C was quoted saying “Assuming this Bitcoin cycle must be EXACTLY the same as the previous Bitcoin bull market could be one of the biggest financial mistakes of the decade.”

The following quotation sums up the point, that historical repetition is not a foregone conclusion and it is possibly an invalid assumption to make for market participants.

Macro Indicators: PMI, Business Cycles and Divergence

Central to the Bitcoin cycle warning are conditions where Bitcoin’s relative strength isn’t syncing up with traditional business-cycle indicators. In Plan C’s dataset, the U.S. ISM Manufacturing PMI ,which is a highly-tracked measure of economic activity, read 48.2 for November, coming in as indicating contraction in manufacturing.

This sub-50 reading signals general economic weakness, with the next print set to come out in early January 2026.

Plan C’s charts suggest Bitcoin is holding up as the PMI trend eases, reinforcing a decoupling from real economy indicators. That would imply Bitcoin’s strength now may be more about liquidity and money-market positioning than widespread economic growth.

If business activity still does not recover while Bitcoin remains at elevated prices, it is possible the market is behaving less like a momentum-driven asset and more like a liquidity-sensitive one than following previous growth cycles.

Commentators observing ISM PMI correlations with Bitcoin have noted that weak and disappointing PMI data have, however, previously coincided with prolonged macro headwinds, or stretching out cycle tops, altering recovery timelines.

One interpretation of this data is that low PMI values could signal elongated cycles where traditional patterns become less predictive.

Distribution Bands and What They Mean for Bitcoin Prices

The Quantile Model doesn’t make any certain price targets but more so identifies distribution waypoints that act as quantifiable boundaries. Using Bitcoin’s roughly $87,661 level as a reference, the model’s quantile bands outline where price could fall relative to historical distribution across different time horizons.

These bands show a picture of how far price would have to travel in order for Bitcoin’s historical position to change.

Over the next three months, the lower quantile band sits around $80K, the median band at about $127K. Upper bands increased to $164,000 and $207,000 for high quartiles.

Over a horizon of a year, the mean and median distribution bands converge at around $164K, predicting an upper range over 200K. These numbers show that the price of Bitcoin could travel quite a bit, without violating expectations on the historic distribution.

A different panel to Plan C’s yokes Bitcoin and the business-cycle index into z-scores to confirm that Bitcoin’s outperformance hasn’t been matched by material economic expansion which could upset traditional market rhythm.

Gold, Liquidity and the “Safe-Haven” Signal

Another wrinkle to the Bitcoin cycle warning is what’s happening between Bitcoin and gold, long seen as the standard for safe-haven assets.

Spot gold reached around $4,458 an ounce at late 2025, near all-time highs. This high price of gold is such that a single Bitcoin now equals almost 19.7 ounces of gold, a number frequently cited as the “gold-Bitcoin ratio” and is used to assess Bitcoin’s strength against traditional hard assets.

Some new numbers also indicate that Bitcoin’s percentage of gold value is low, consistent with the overall picture where investors favoured traditional stores of value in 2025 market conditions.

One financial report noted that the Bitcoin-to-gold ratio is at lows not visited since early-2024, indicating continued relative underperformance on Bitcoin and preference for safe haven assets in gold.

A stable or increasing BTC-gold ratio would denote Bitcoin is becoming stronger than gold, even as the price of gold remains firm.

Conversely, if the ratio keeps breaking down, more capital for precious metals would then flow, affecting how outperformance is defined for portfolios that include both Bitcoin and traditional hard assets.

The Three 2026 Regimes to Watch

It should be noted that Plan C’s analysis does not predict specific price levels, but three potential scenarios in 6-12 months based on PMI, BTC-gold ratio dynamics and liquidity:

For one, a reflation rally may converge on recovering PMI figures and a tighter BTC-gold ratio to push Bitcoin toward median quantile bands. In such a case, macro adversity eases and risk assets take another leg up in line with recovery.

Another outcome could be an easing into a weakness regime, which might continue if PMI stays under 50, while future liquidity is bullish on asset prices. Here, Bitcoin can sustain significantly more value than business-cycle circumstances even without strong economic expansion.

Finally, under a more severe contraction scenario, such as an increase in demand for hard assets (gold in particular), pushing flows away from risk assets, this would leave Bitcoin more vulnerable to de-risking and breakdowns towards lower quantile bands over shorter time frames.

These notional paths are a reminder that clinging too closely to the playbooks of previous cycles may send traders and investors up the wrong path as the market heads into 2026.

Conclusion

The Plan C Bitcoin cycle warning defies a dominant culture that the current price action in Bitcoin is set to play out similarly to previous bull markets.

Employing a statistical Quantile Model and based on macro indicators such as the ISM PMI and BTC-gold ratio, Plan C charts today’s Bitcoin price in the region around the 30th quantile of its historical distribution, that is to say at levels below the median, even though absolute dollar terms are high. Such a “labelling of parallel cycles” would be incorrect and misleading.

Rather, the future of Bitcoin in early 2026 may rest more on the extent to which manufacturing activity recovers, how loose or tight conditions become, and also stabilization of the BTC-gold relationship.

In 2026, as traders and market-watchers take note of these structural traits, a better understanding of Bitcoin’s role in larger economic cycles, instead of an expectation that the past must rhyme, is expected to be seen.

Glossary

Bitcoin Quantile Model: A statistical methodology that provides Bitcoin’s price in historical distribution bands and not give out any specific points.

Quantile Bands: Quantiles of historical distributions; essentially, where current prices fall in the realm of past data at select horizons (e.g., 15th, 50th quantiles).

ISM Manufacturing PMI: An important measure of U.S. manufacturing conditions; readings below 50 signals contraction.

BTC-Gold Ratio: Indicates the price of Bitcoin in terms of Gold; a metric used to gauge relative strength between both assets.

Z-Score: A statistical indication representing a number of standard deviations from the mean.

Frequently Asked Questions About Plan C Bitcoin Cycle Warning

What is Plan C’s Bitcoin cycle warning?

The warning is that assuming this Bitcoin market cycle will exactly mirror previous ones could be “one of the biggest financial mistakes of the decade,” according to Plan C’s analysis of macro divergence and statistical distributions.

What is the Bitcoin Quantile Model?

This is a Plan C model that puts BTC price into a historical context, and it transforms everything to quantile bands to look at the relative position of price instead of a fixed price forecast.

Why the ISM PMI for Bitcoin?

The PMI is a reflection of economic activity, and soft prints have often coincided with a drawn-out macro cycle that can impact risk sentiment and asset prices.

What does Bitcoin-gold ratio indicate?

The BTC to gold ratio is the metric that sees how strong Bitcoin is compared to gold. A rising ratio signals Bitcoin’s outperformance to gold and vice versa.

Do previous Bitcoin cycles even matter?

Prior cycles serve as valuable indicator, but should not be taken as certainty.

References

CryptoSlate

StatMuse

The Economic Times

Yahoo Finance

MEXC