Bakkt Holdings has filed a $1 billion shelf offering with the U.S. Securities and Exchange Commission (SEC). This strategic financial maneuver may position Bakkt to become a significant player in the digital asset treasury game, as it explores buying Bitcoin and other cryptocurrencies as part of its treasury management.

This Bakkt $1B shelf offering is a calculated move that aligns with a growing trend of corporations diversifying their balance sheets with crypto holdings, reinforcing the company’s broader ambition to evolve into a pure-play digital asset infrastructure provider.

What Is a Shelf Offering?

A shelf offering allows a company to register a large amount of securities upfront and sell them gradually over time, depending on market conditions. Bakkt’s $1 billion shelf registration includes common stock, preferred stock, debt securities, and warrants, giving the company flexibility in raising capital as needed.

This method is particularly advantageous during volatile markets—something the crypto industry knows all too well. The flexibility of the shelf offering enables Bakkt to raise funds efficiently when opportunities for expansion, acquisition, or crypto investment arise.

Plans to Buy Bitcoin

According to its SEC filing, Bakkt may use part of the funds raised to buy Bitcoin or other digital assets. Although no purchases have been made yet, the company has signaled that its investment policy now allows treasury allocation into crypto. This reflects a strategic pivot, as Bakkt looks to transform into a high-growth crypto-native enterprise.

With Bitcoin’s institutional adoption on the rise and ETFs driving mainstream exposure, Bakkt’s move is well-timed. Co-CEO Akshay Naheta emphasized that digital assets are increasingly viewed as long-term stores of value, and the company is exploring global jurisdictions to support this transformation.

Risk Factors and Financial Caution

While the headline-grabbing figure of $1 billion is eye-catching, the filing also comes with regulatory and financial caveats. Bakkt’s disclosure outlines potential risks, including regulatory uncertainties (particularly regarding whether digital assets are deemed securities), limited access to traditional banking, and its own history of operating losses.

These factors highlight that while the Bakkt $1B shelf offering signals bullish intent, it’s also a calculated bet amid growing scrutiny in the U.S. crypto regulatory landscape.

Market Impact and Related Moves

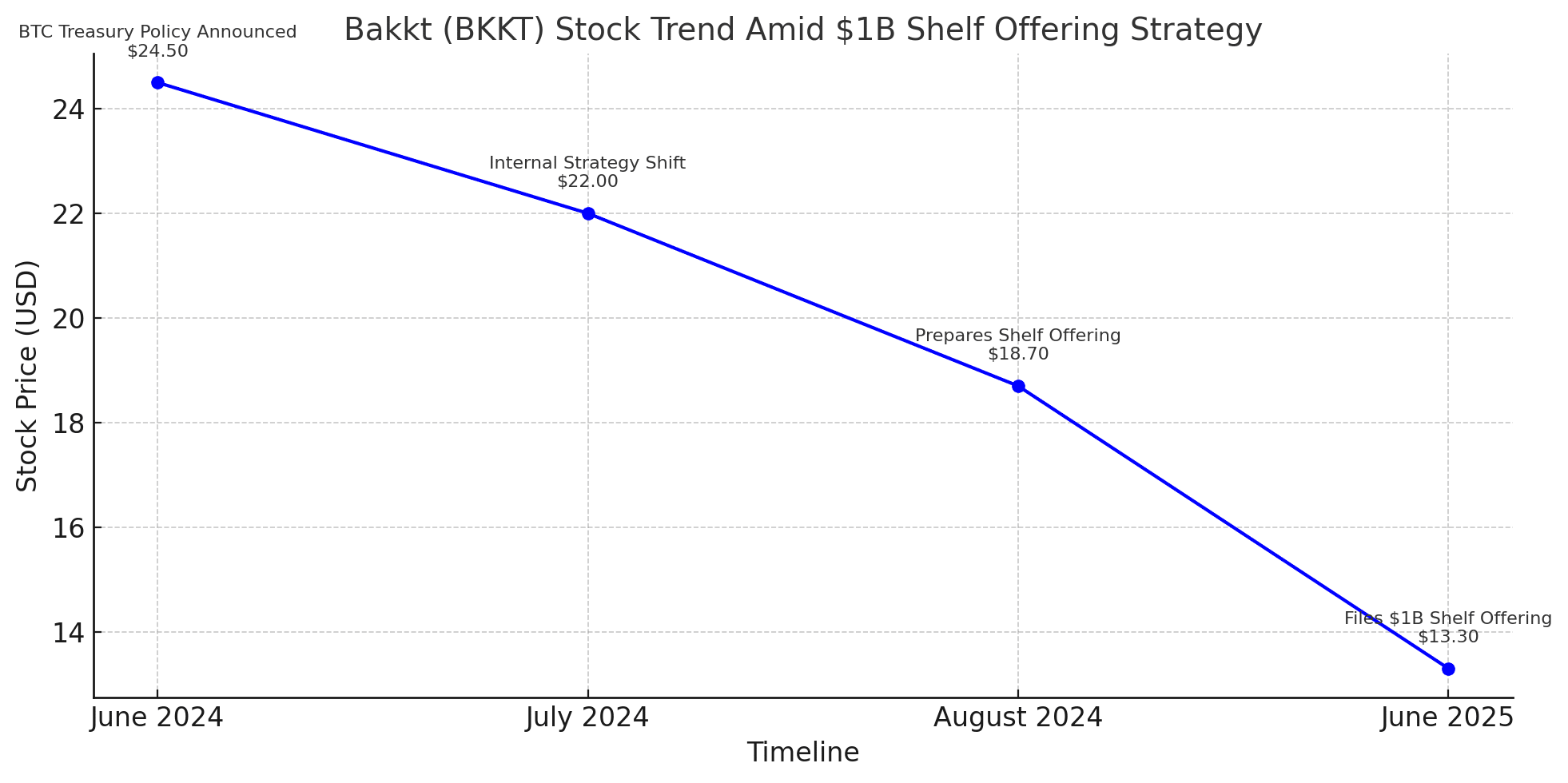

Following the announcement, Bakkt’s stock (NYSE: BKKT) saw a modest bump, trading at $13.33, though it remains down roughly 46% year-to-date. Still, investors and analysts are paying attention, especially given the increasing number of companies emulating similar treasury strategies.

Notably, Trump Media & Technology Group recently filed to raise $2.5 billion to establish a Bitcoin treasury, aiming to rival corporate holders like MicroStrategy. Industry sources suggest acquisition talks may be ongoing between Trump Media and Bakkt, signaling a potential consolidation play that could reshape crypto corporate holdings.

Final Thoughts

The Bakkt $1B shelf offering is more than a financial registration, it’s a signal. It tells the market that Bakkt sees crypto, especially Bitcoin, as integral to the future of corporate finance. In a year where digital assets are slowly reclaiming global interest and legitimacy, Bakkt’s bold strategy may set the tone for a new wave of institutional crypto adoption.

As regulatory environments continue to evolve, and as more companies follow suit, the impact of this Bakkt $1B shelf offering may ripple far beyond Wall Street, reshaping the future of digital finance.

FAQs

Q1: What is the Bakkt $1B shelf offering?

It’s a financial registration allowing Bakkt to issue up to $1 billion in various securities to fund business operations, including potential Bitcoin purchases.

Q2: Is Bakkt planning to buy Bitcoin?

Yes, the company’s updated investment policy allows it to allocate capital to Bitcoin and other digital assets, although no purchases have been made yet.

Q3: Why did Bakkt file this offering now?

To raise flexible capital in a volatile market and support its pivot to a more crypto-native infrastructure model.

Q4: What risks are involved?

Regulatory uncertainty, classification of assets, limited banking access, and a history of financial losses are among the highlighted risks.

Q5: How does this relate to other firms like Trump Media?

Trump Media is pursuing a similar strategy with a $2.5B fundraise for Bitcoin holdings, possibly indicating a trend of corporate crypto treasuries.

Glossary of Key Terms

Shelf Offering: A registration method that allows companies to issue securities over time instead of all at once.

Treasury Management: Strategy involving how companies manage and allocate financial assets, including crypto.

Digital Asset: Any asset that is issued and transferred using blockchain technology.

Bitcoin Treasury: Bitcoin held by companies as part of their long-term financial reserves.

Warrants: Financial instruments that give holders the right to purchase company shares at a specific price before expiration.

Pure-Play Crypto Company: A company that focuses solely on crypto products or services.