This article was first published on Deythere.

- Backpack Exchange Funding Talks and Valuation

- Tokenization Tools and Tokenomics Strategy

- Regulatory Expansion and European Operations

- Conclusion

- Glossary

- Frequently Asked Questions About Backpack Exchange Funding

- What is Backpack Exchange funding goal?

- Who founded Backpack Exchange?

- What regulatory licenses does Backpack have?

- How is Backpack planning to allocate tokens?

- References

Backpack Exchange, a crypto trading platform created by former FTX and Alameda Research staff, is in advanced discussions to raise $50 million at a valuation of $1 billion as investors regain confidence in regulated crypto infrastructure and tokenization services.

If successful, such funding would help Backpack’s ranks among the new class of crypto firms after the collapse of FTX.

Backpack Exchange Funding Talks and Valuation

Backpack Exchange is looking to raise a fresh funding round of about $50 million at an approximately $1 billion pre-money valuation, according to reports. Industry discussions say that final fees could be higher still, but formal terms and parties have not been publicly reported.

The founders have crafted the pitch to hammer on durability and long-term value creation as core selling points by aligning internal incentives and token mechanics with external, long-anticipated goals such as possible public market access or strategic partnerships instead of early token liquidity events among insiders.

According to Backpack co-founder Armani Ferrante, the agreement works in such a way that other team members and early contributors are not seeing value until the company crosses certain major equity goals like through an IPO or its equivalent exit event.

Tokenization Tools and Tokenomics Strategy

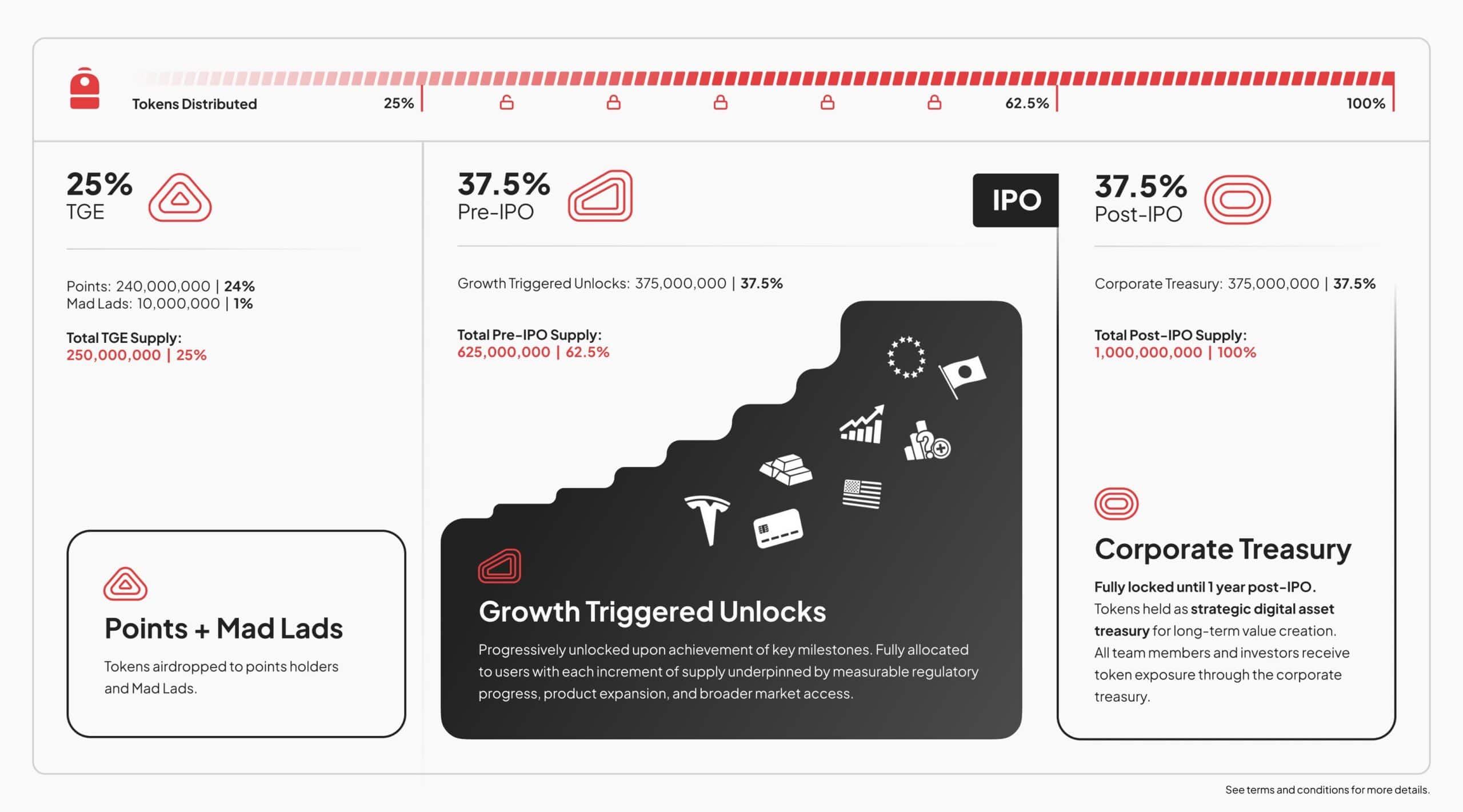

Backpack Exchange has also developed a comprehensive tokenization and tokenomics structure for supporting its product ecosystem and value network. The prospective utility token is intended to supply 1 billion units, with distribution tied to specific achievements and a business incentive alignment perspective instead of free market speculation.

With this in mind, 25% of the token supply will be unlocked at TGE, and 240 million assigned to airdrop all Backpack Points participants, while an additional 1 million is set aside for holders of the project’s Mad Lads NFT collection.

Remaining portions of the offering will be released over time in connection with product launches, expansion into new regions and achievement of equity related goals, resulting in reduction of upfront dilution while promoting sustained growth.

Regulatory Expansion and European Operations

Backpack’s plans go beyond fundraising and tokenomics. The company has also taken over FTX EU, which is the European division of the collapsed FTX exchange in an arrangement approved by the FTX court bankruptcy and European regulators such as Cyprus Securities and Exchange Commission (CySEC).

Included in the acquisition was FTX EU’s MiFID II license, which will allow Backpack to offer regulated crypto and derivatives services throughout the European Union.

Backpack CEO Armani Ferrante stated that by securing a regulatory foothold in Europe through the MiFID II rulebook, it represents a commitment to bringing transparent, secure and regulated crypto trading to an underserved market.

The plan also includes the return of customer funds through the FTX EU bankruptcy process, a very important step in restoring trust with a community that was heavily affected by the fall of the original Exchange.

The firm has also obtained a Virtual Asset Service Provider (VASP) license in Dubai that permits global capabilities, spot and derivatives trading with regulated compliance in the Middle East and other markets.

The platform launched a private beta of its Unified Prediction Portfolio, a native prediction market aimed at aggregating different markets into one single trading interface, in early 2026, according to the exchange’s CEO.

Conclusion

Backpack Exchange funding effort to secure $50 million at a $1 billion valuation, as well as its tokenization and regulatory expansion plans is another sign of how 2026 is proving to be the era of defining growth and investor appeal.

With a focus on regulated operations, such as the purchase of FTX EU’s MiFID II license, innovative tokenomics that promote long-term incentivization and new product initiatives like prediction markets; Backpack plans to connect traditional capital markets with DeFi.

The company’s transparency and singular focus on sustainable growth might just make it stand out from previous exchange launches, although the fundraising terms for the company have not fully been determined.

Glossary

Token Generation Event (TGE): a type of planned release in which the creator (developer/project founder) releases a new cryptocurrency token to users and investors according to predetermined rules set within the protocol’s code base.

MiFID II license: a regulatory license that permits financial services firms to provide their services throughout the EU on the basis of consistent regulation and investor protections.

VASP license: the abbreviation for Virtual Asset Service Provider regulatory certification that allows crypto businesses to receive a legal status in a certain jurisdiction like Dubai.

Prediction markets: platforms where users can trade on the outcome of future events, frequently through tokenized positions or contracts.

Frequently Asked Questions About Backpack Exchange Funding

What is Backpack Exchange funding goal?

Backpack is in talks to raise around $50m at a valuation of close to $1 billion, although terms are not yet final and have yet to be made public.

Who founded Backpack Exchange?

The exchange was established by former FTX and Alameda Research employees, its CEO being Armani Ferrante and other early web3 veterans.

What regulatory licenses does Backpack have?

Backpack Dubai holds a VASP license and has recently acquired the MiFID II licensed entity behind FTX EU, allowing for operations in Europe.

How is Backpack planning to allocate tokens?

Backpack’s tokenomics plans to allocate 25% of total token supply being released at the TGE with allocations for points holders, NFT holders and more metrics related to its platform success.