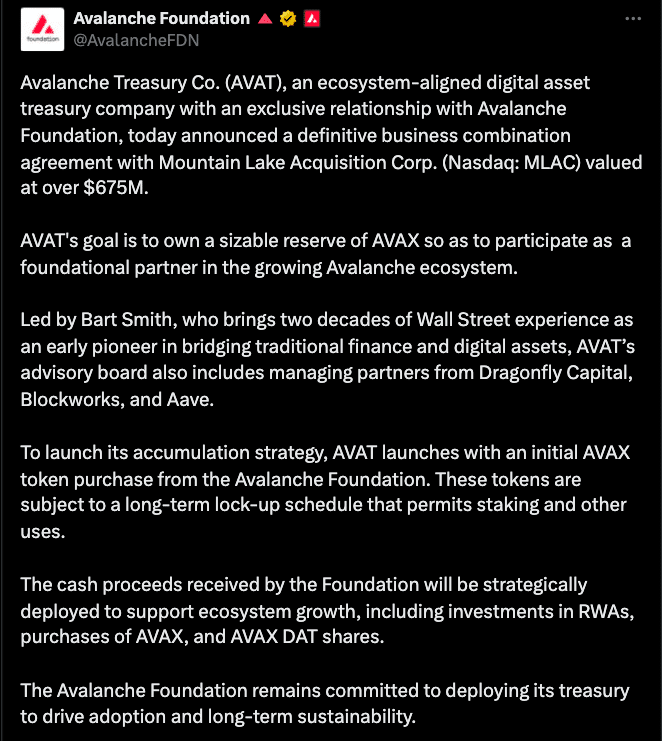

Following the latest Industry reports, Avalanche Treasury Co. (AVAT) has announced a big deal with Mountain Lake Acquisition Corp. valued at over $675 million to create a public vehicle to accumulate AVAX and be a bridge for institutions into the Avalanche ecosystem.

The deal includes around $460 million in initial treasury assets, a discounted $200 million AVAX token purchase and an 18-month priority window on Avalanche Foundation token sales. This merged entity will list on Nasdaq in Q1 2026 and be the leading public AVAX treasury vehicle.

Deal Structure and Initial Treasury Setup

The core of the AVAX treasury vehicle is the merger between AVAT and Mountain Lake Acquisition Corp. (MLAC), a SPAC, for about $675 million. AVAT is bringing around $460 million in treasury assets already secured through private placement.

In addition to the capital base, AVAT has locked in a discounted purchase of $200 million in AVAX tokens through an exclusive agreement with the Avalanche Foundation. This gives the vehicle a head start in building its token holdings.

The merger is expected to list on Nasdaq in early 2026, subject to regulatory and shareholder approvals. The combined entity will aim to build a $1 billion+ AVAX treasury over time through further acquisitions and ecosystem support.

A notable financial structure element is the entry valuation: AVAT is offering a 0.77× multiple of net asset value (mNAV), effectively a 23% discount to buying AVAX directly or through ETFs. The discount is to attract institutional investors who want exposure to AVAX but prefer regulated public vehicles.

Also read: $250 AVAX by 2029? Standard Chartered Forecasts Huge Surge for Avalanche

Motivations and Role in the Ecosystem

The AVAX treasury vehicle is a response to growing demand from institutions for regulated access to blockchain ecosystems without holding tokens or managing complex custody. Many institutions find token ownership cumbersome in terms of compliance, custody and integration.

AVAT is designed to bridge that gap. CEO Bart Smith said the vehicle is “launching as an active, strategic partner within the Avalanche network” .

The structure also gives AVAT priority access to future $AVAX sales through the Avalanche Foundation for 18 months, making it even more privileged. From the ecosystem perspective, AVAT will invest beyond token accumulation. It will deploy capital to support protocol development, validator infrastructure, tokenized real-world assets and enterprise blockchain projects.

Backed by leading crypto firms such as Dragonfly, VanEck, Galaxy Digital, Pantera, Kraken, CoinFund, and others, AVAT has credibility.

Market Reaction, AVAX Price Impact

The AVAX treasury vehicle announcement had an immediate market impact. $AVAX prices went up to about $31.32 intraday before cooling off. The token was up 2% after the announcement.

Analysts say AVAT’s accumulation targets, preferential purchase rights and institutional packaging will reduce circulating supply over time.

Ecosystem metrics are positive. Avalanche’s decentralized exchange volume is up; TVL has more than doubled this year from $1.3B to $2.3B.

Also read: Avalanche (AVAX) Price Prediction – Is a Major Breakout Coming?

Conclusion

Based on the latest research; the AVAT-MLAC merger is expected to help institutionalize AVAX exposure via a public AVAX treasury vehicle. By combining discounted token purchases, initial assets, preferential rights and ecosystem alignment, AVAT is trying to differentiate itself from passive holders.

For in-depth analysis and the latest trends in the crypto space, our platform offers expert content regularly.

Summary

Avalanche Treasury Co. is merging via SPAC to become a public AVAX treasury vehicle, with $460M in assets and a $200M discounted token purchase, aiming for $1B holdings and a Nasdaq listing in 2026. The structure offers institutional exposure.

Glossary

mNAV (Multiple of Net Asset Value) – A ratio of share price to underlying asset value.

SPAC (Special Purpose Acquisition Company) – A shell company that merges with an operating business and takes it public.

Treasury vehicle – An entity that holds and manages a large reserve of tokens or assets.

Discounted purchase – Buying tokens or assets at below market price via privileged rights.

Ecosystem investment – Capital deployed to support projects, infrastructure or development in the network.

Validator infrastructure – Nodes and software validating blockchain transactions and securing the network.

Frequently Asked Questions About AVAX Treasury Merger

What does the AVAX treasury vehicle do?

Merges with SPAC, lists on Nasdaq and builds $1B AVAX treasury while investing in the Avalanche ecosystem.

Why is the 0.77× mNAV discount important?

It offers 23% cheaper entry compared to direct token purchase or ETF.

Does AVAT just buy AVAX?

No. The plan is to deploy capital into validator support, protocol investments, enterprise use and tokenized assets.

When will the company go public?

Merger expected to close in early 2026, listing in Q1 pending regulatory and shareholder approval.